The shampoo market in China: trends and opportunities for new entrants | Daxue Consulting

The prospects of the shampoo market in China are booming

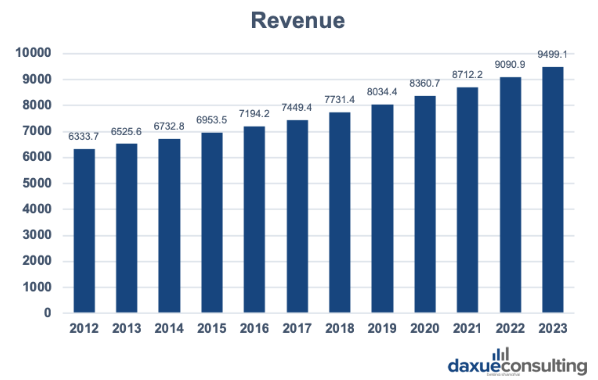

Shampoo, as a daily consumer product, has one of the highest penetration rates of personal care products in China. Most Chinese people wash their hair every 2-3 days and buy a shampoo and hair-care products every few months. The size of the shampoo market in China is 30 million RMB and the hair-care market in China is 20 million RMB. According Statista, revenue in the hair-care market in China amounts to US$8034.4m in 2019. The shampoo market in China is expected to continue to grow annually by 4.3% (CAGR 2019-2023).

As can be seen from the graph, the hair-care market in China maintains a steady growth trend.

Market segmentation of China’s shampoo market: Main players & products

Nowadays, the market competition of shampoo and hair-care products in China is extremely fierce. There are around 4000 brands and more than 2000 manufacturers engaging in the production of shampoo and hair-care products in China. Among all these brands, the brands P&G and Unilever take a market share of about 75%, both players entered China in the ’80s and ’90s.

P&G

Procter & Gamble (P&G) owns star brands such as Head & Shoulders, Rejoice, OLAY, etc. It is one of the largest consumer goods companies around the world. P&G in China was the first to crack the Chinese shampoo market, and it has remained in the Chinese shampoo market for 30 years. P&G has occupied large-scale, low-cost channels to meet the needs of most consumers and become one of the most recognized global brands in China.

In terms of its shampoo products, Head & Shoulders (海飞丝) is ‘the world’s number one shampoo’. It is a brand famous for its anti-dandruff shampoo for being the best-seller in China over the past decade. Other shampoo brands that belong to P&G including Rejoice for soft hair; Pantene for healthy and shinning hair; VS Sassoon for moisturizing; and Clairol for natural-looking hair.

For six consecutive years, P&G in China has become the market leader in fast-moving consumer goods industry. The reason is that the company launched a series of new and complex shampoo products in China, while increasing the availability of products and using social media and e-commerce platforms.

However, at the beginning of 2019, P&G announced its second-quarter earnings for the 2019 fiscal year. The financial report showed that P&G revenue in the second quarter was US$17.4 billion, compared with US$17.395 billion in the same period last year, which means that the growth was very low at 0.28%. In the first six months of 2019, P&G revenue was $34.28 billion, compared with $34.48 billion in the same period last year. P&G’s growth seem to be almost stagnant.

P&G in China, to some extent, was caught in the problem of brand popularity and aging. However, its market share in the shampoo market in China is still unmatched by other brands. In order to cope with the aging of brands, it began to reduce the brand matrix in 2016 focusing on high-end. In terms of marketing, P&G in China has increased advertising investment in various channels to enhance brand exposure.

Unilever

According to Unilever,

“On any given day, 2.5 billion people use Unilever products to feel good, look good and get more out of life – giving us a unique opportunity to build a brighter future.”

Unilever is a British-Dutch multinational consumer goods company. Unilever in China is one of the biggest FMCG firms. Its products include foods, beverages, cleaning agents and personal care products. Lux (力士) is the most famous brand of Unilever in China. The range of products includes beauty soaps, shower gels, bath additives, hair shampoos and conditioners. Today, Lux is the market leader in several countries including Pakistan, Brazil, India, Thailand and South Africa. Dove (多芬) products are manufactured in Argentina, Australia, Brazil, Canada, Germany, India, Indonesia, Ireland, the Netherlands, Thailand, Turkey and the United States. Their products are sold in more than 35 countries and are marketed towards both women and men. Sunsilk (夏士莲) is Unilever’s leading hair care brand. Its shampoos and hair-care products are sold in 69 countries worldwide.

Multi-functional shampoo and hair-care products in China

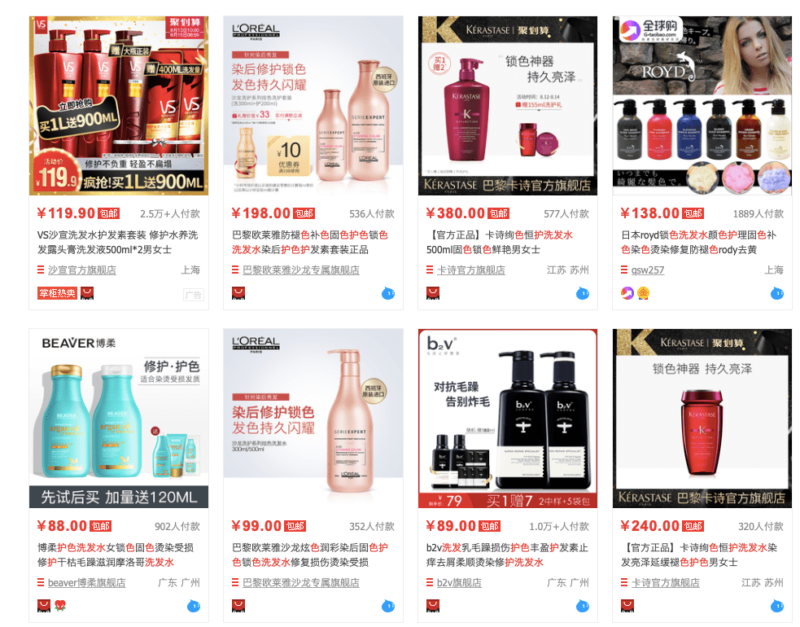

In the Chinese shampoo market, sales of anti-dandruff oil products accounted for the highest proportion of shampoo sales, followed by nourishing hydration products; sales of anti-hair loss products increased the fastest. With the increase of work and life pressure, the problem of hair loss is a concern of consumers. In addition, more young Chinese women are dying their hair frequently, which has led to a series of color enhancing product lines for shampoo and hair-care products in China. For example, color vive shampoos that protect the hair color and hair-care products for repairing permed hair. In this regard, shampoos and hair-care products from L’Oréal seem to be favored by young Chinese consumers.

From the consumption structure of shampoo products, the proportion of sales of medium and high-end products continues to grow, and the younger generation of 23-28 years old are the main consumers. The younger generation has higher requirements for the quality of the products and drives the consumption upgrade of the shampoo market in China. In terms of brand selection, 45% of consumers choose to buy familiar brands, 45% of consumers will try a new brand, and 10% of consumers do not have a fixed brand. At the same time, Chinese consumers are more influenced by word-of-mouth than brand message.

In addition, up to 70% of consumers will choose three shampoo brands to rotate, and consumers who choose to fix a single brand account for a relatively low proportion, indicating that consumers in the Chinese shampoo market are not loyal to shampoo brands, which gives opportunity to new market entrants.

What are the opportunities for foreign companies in China’s shampoo market?

Healthy concepts and exquisite packaging

In recent years, silicon-free shampoo, which is not harmful to hair, has become the focus of many young consumers. Some consumers do their research on social platforms to find out whether the ingredients are healthy or not. Different consumers will choose various functional shampoos, but overall, healthy shampoos with beautiful packaging will be more popular with consumers. On Xiaohongshu, “silicone free” and “high appearance level” (高颜值) shampoos are the hottest search terms and top headlines. Other concerns include shampoo fragrance, product endorsers and brand reputation. Coupled with the fact that still many Chinese consumers buy shampoo at supermarkets, a beautiful appearance can attract the eyes of consumers.

How to choose the right distribution channel for your shampoo brand in China

The Chinese shampoo market’s preferred distribution channel remains primarily brick-and-mortar. Consumers tend to go to stores to choose their hair care products, because viewing the packaging is crucial to them. Besides, hair-care products are distributed in supermarkets, department stores and the Internet. Nearly a third of the industry’s sales are through physical channels.

Nevertheless, for foreign brands that entering the Chinese shampoo market for the first time, offline retail is probably not the first choice. Firstly, Chinese consumers who buy shampoo in supermarkets rarely choose the brand they see for the first time. Young consumers, in particular, are more likely to have decided which brand of shampoo they want before they shopping in the supermarket. This is not good for a new foreign brand.

Compared to sale in offline shops, the digital channel seems more suitable for undertaking a first commercialization in the shampoo market in China. Starting with e-commerce and social platforms is faster and relatively low-cost. It is a common means for brands to release new products by letting KOLs conduct product trials and pass on the experience on to customers. It is always best to reach your customers through word of mouth. Of course, these are for middle-end and high-end products. For low-end and cheaper products, it is more effective to attract consumers in second-tier and third-tier cities with price through offline stores.

Let the new China Paradigm have positive economic leverage on your business

Listen in China Paradigm in iTunes

![[Podcast] China Paradigm 38: How to start a dream driven elderly care business in China](../wp-content/uploads/2019/05/China-podcast-Elderly-care-business-China-150x150.jpg)