Prospects behind the Great Wall: Who are Chinese business and trade partners? | Daxue Consulting

We believe that these infographics vividly and clearly reveal the potential of the Chinese market, the purchasing power of the Chinese, as well as insistent market trends; whereas this article is a guide in existing key business relationships between China and other countries. Are you ready to know what country has become a true business and trade partner for China in 2018 and which one plans to become such in 2019?

Trade relations between Australia and China

[Source: Daxue Consulting]

The 5th round of tax reduction starts from the first day in 2019 leading to over 96% of total Australian products, approximately 5000 kinds of goods exported to China are free of tariff. Amid this round of tax reduction, wine, salmon, lobster, oyster, and honey will get free trade to China. In the meantime, all products from China traded to Australia are expected to be zero tax. In 2017, Australian beef accounted for 16.66% of China’s total beef imports. Seafood from Australia soared over four times than the previous year in terms of exports to China.

China is at the top list of tourism expenditure during the period from Feb.2107 to Feb.2018, valued $11.3 billion, up 26.5% year-on-year growth, occupying 52% of Australian earnings from international tourists. Averagely, each Chinese tourist spends ten days in Australia with 8,472 AUD expenditure.

In 2017, there are 800,000 students from abroad going to Australia to study. Chinese students account for 38% of the total population, climbing 18.1% over the previous year.

Trade relations between East Asia and China

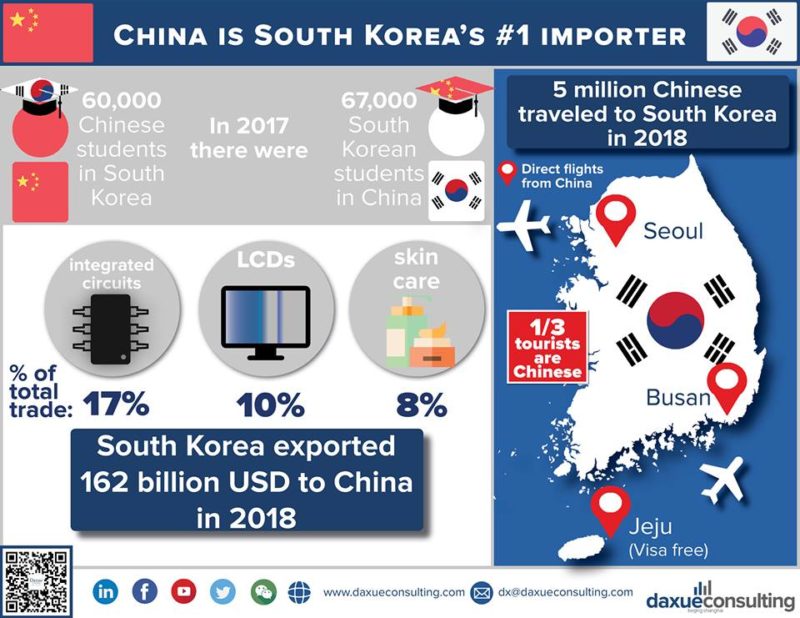

South Korea’s business avenues to China: China is South Korea’s #1 Importer

[Source: Daxue Consulting]

Integrated circuits are the top bilateral trade product between China and South Korea, regarding both import and export volume. China is South Korea’s first largest cosmetics and beauty export destination. Beauty and cosmetics trade volume from South Korea to China surged a 23.1% growth in 2017, up to 13 billion RMB. Amore Pacific and LG Household & HealthCare among other beauty companies account for the top two trade share to China, 30.26% and 29.35% respectively. Also, free trade agreement plays a vital role in bilateral trade. Zero-tariff products have covered 50% of bilateral trade volume.

Cities in China such as Tianjin, Dalian, Yantai, Weihai have regular routes both for passengers and cargo to Incheon, Busan in South Korea. In 2018, over 5 million Chinese people traveled to South Korea, up 14.5% to 630,000 people from 2017. China takes a third of total foreign visitors, at the top list of South Korea’s visitors.

Trade relations between Europe and China

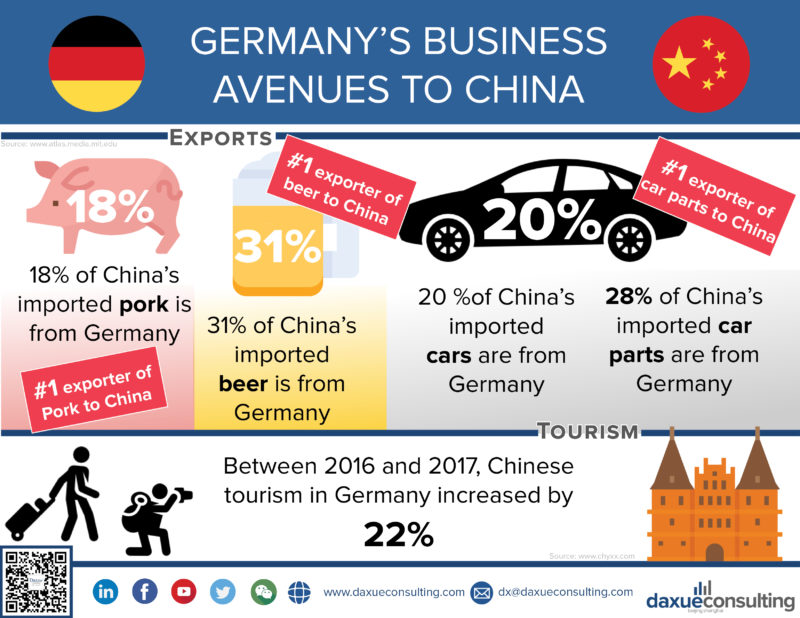

Germany’s business avenues to China: Germany is an exporter of many goods to China

[Source: Daxue Consulting]

Commenting on the preferences of the Chinese in beer, we turn to Yan Yuze, who is the owner of a local beer in the northeastern Chinese city of Shenyang – one of the largest Chinese markets for beer. He told to CGTN that many of his customers have been ordering German beer during this year’s soccer season.

What is important for car business is that China will steeply cut import tariffs for automobiles and car parts, opening up greater access to the world’s largest auto market amid an easing of trade tensions with the United States. China’s tariff move will be a major boost to overseas carmakers, especially helping premium brands such as Germany’s BMW, electric car maker Tesla and Daimler AG’s Mercedes-Benz close a price gap on local rivals.

Chinese become more and more global choosing tourism as one of the favorite activities. Chinese tourists are very interested in the different attractions that Germany can offer. In German cities, the Chinese are an important source of revenue for retailers. According to a survey conducted on the commercial behavior of Chinese tourists, in Munich, they spend an average of 513 euros (558 dollars) per day.

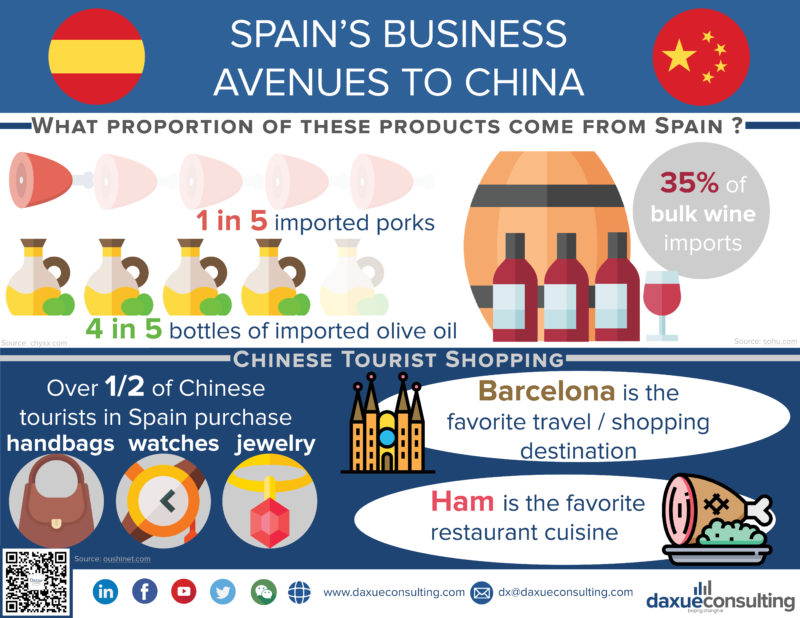

Spain’s business avenues to China: Chinese feelings for Spain

[Source: Daxue Consulting]

Another pride of the Spaniards and the fact that Spain strengthened its position in 2017 as the main supplier of pork to China, ahead of Germany, Canada, and the US.

Mediterranean products are becoming more and more popular in China as the Belt and Road initiative continues to go underway. At the beginning of 2017, Spain accounted for 81% of the total olive oil imports to China, leading far ahead of Italy (13%), Greece (2%).

Spain is the second most popular tourist destination in the world, only after France. It attracted about 82 million visitors in 2017, 700,000 of them from China, a number which the United Nations World Tourism Organization (UNWTO) estimates will rise to about 1 million by 2020.

Trade relations between North America and China

Mexico’s business avenues to China: Peace or war

[Source: Daxue Consulting]

As Dezan Shira and Associates claim Mexico continues to seek to improve its participation in the Chinese market to achieve more balanced trade, despite the fact that approximately 70 percent of Mexico’s imports from China are intermediate or capital goods, which are used or repurposed for re-export.

Beer, one of Mexico’s main export products to China, grew 35.5% to US$38.59 million.

Vladimir Kocerha, economic and commercial counselor of Peru in Shanghai, said the avocado trade had benefited from China’s cuts in import tariffs and continuous increases in imports of Latin American fruit.

China imported 8,800 tonnes, 16,700 tonnes, and 6,700 tonnes of the nutritious-rich fruit from Mexico, Chile and Peru, respectively last year.

Trade relations between South America and China

Brazil’s business avenues to China: Chinese business investment

[Source: Daxue Consulting]

“We’re definitely going global,” said Didi Chuxing president Jean Liu in one interview. And the company is moving fast towards that direction, each partner or region at a time. Didi invested in Brazil through investment in local ride-hailing leader 99. The investment builds upon the deep existing partnership between DiDi and 99 to further accelerate market growth in Latin America and bring more transportation choices to the region’s citizens.

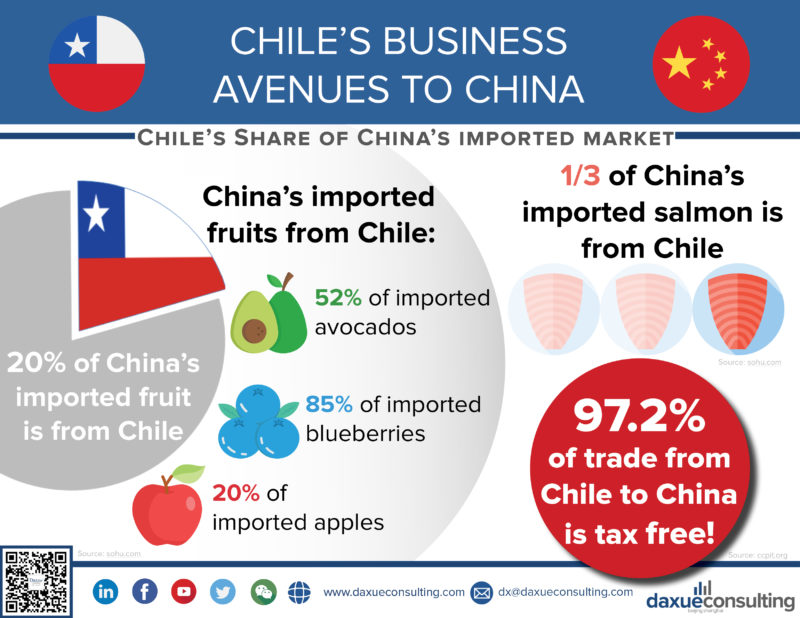

Chile’s business avenues to China: Chinese trade partner

[Source: Daxue Consulting]

According to President of the Association of Fruit Exporters of Chile AG (ASOEX), Ronald Bown Fernández, Chilean fruit exports during the recently completed 2017-2018 campaign reached a total of 2,781,092 tons. This entailed an increase of 6.7% compared to the 2016-2017 season. He said: “This increase has been achieved thanks to the record volumes of cherries and blueberries shipped, mainly in Asia and China”.

In conversation with Produce Report at FHC China 2016, Juan Enrique Lazo, General Manager of the Chilean Hass Avocado Committee, described the success, present and future, of Chilean avocados in China. “Chile will supply 60 percent of China’s avocado market this November, and the majority of avocados one finds in Chinese supermarkets and fruit stores these days originate from Chile.”

Talking about the upcoming plans, Chile will join China´s Belt and Road initiative, Foreign Minister Roberto Ampuero said, in a move to deepen economic and political cooperation with the Asian powerhouse. Ampuero emphasized that joining China´s global infrastructure initiative would make Chile more attractive to Chinese investors and position the Andean nation as the “landing point for investments in Latin America.”

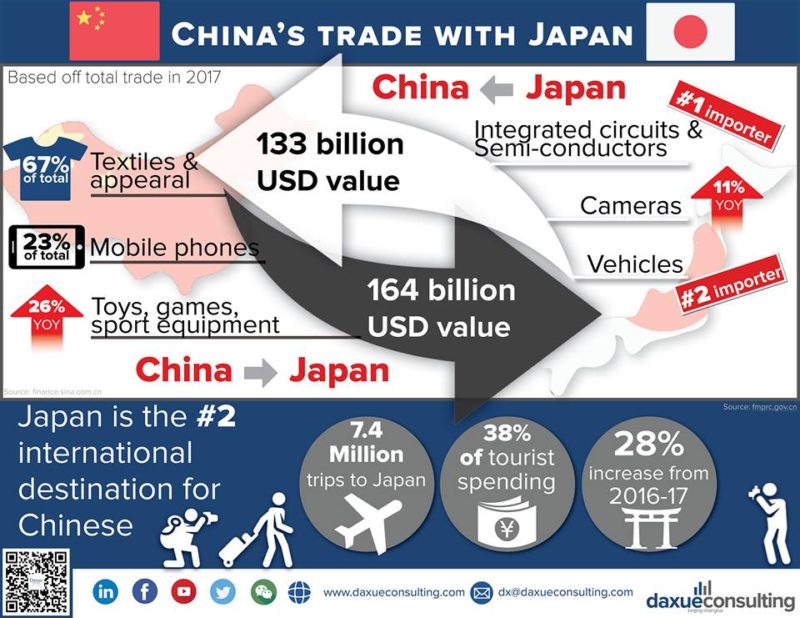

Trade relations between Japan and China

[Source: Daxue Consulting]

In 2017, China’s importation of electric-mechanical products and parts from Japan rose 4.5% to $4.22 billion, accounting for 25.6% of the total imports. China is Japan’s second largest foreign automobile markets. In 2017, sales by Japanese carmakers Toyota, Nissan, Honda and Mazda in the Chinese market all hit record highs. Nissan reported a 12% rise in sales to more than 1.52 million units last year, while Honda sold more than 1.44 million cars, up 15.5 percent year on year.

Tourists from China’s mainland made more than 7.3 million trips to Japan in 2017, up 28% from 2016. Tourists from Japan traveling to China boosts 3% in 2017 from 2016 up to 2.68 million visits.

In 2018, the population of Chinese students studying in Japan had surpassed 100,000, achieving 40% of overall overseas students in Japan.

Daxue Consulting helps you get the best of the Chinese market

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.