J-beauty and K-beauty in China: Key players in Chinese cosmetics market

Market overview of J-beauty and K-beauty in China

In the Chinese cosmetic’s market, there is strong influence from the neighboring countries Korea and Japan. Known as K-beauty and J-beauty, East Asian fashion from Korean and Japan has successfully penetrated China’s beauty industry, which is the second largest beauty industry in the world. According to Euromonitor, China’s beauty industry it is expected to be worth US$62 billion by 2020. While several large western brands like Dior, Chanel and Estee Lauder maintain an oligopoly market in China, Korean brands like Innisfree and Whoo, and Japanese brands are still gaining market share. According to L2 Digital IQ Index Rankings, Japanese brand SK 2 is ranked 6th, and Korean brands like Innisfree and Laneige ranked within the top 7. In 2017, among $2.6 million exported Japanese beauty products, Hong Kong and China accounted for nearly $1.5 billion, according to the Ministry of Finance. At the same time, South Korean cosmetics exports to China reached US$151 million in January in 2018.

Consumer perceptions of J-beauty and K-beauty in China

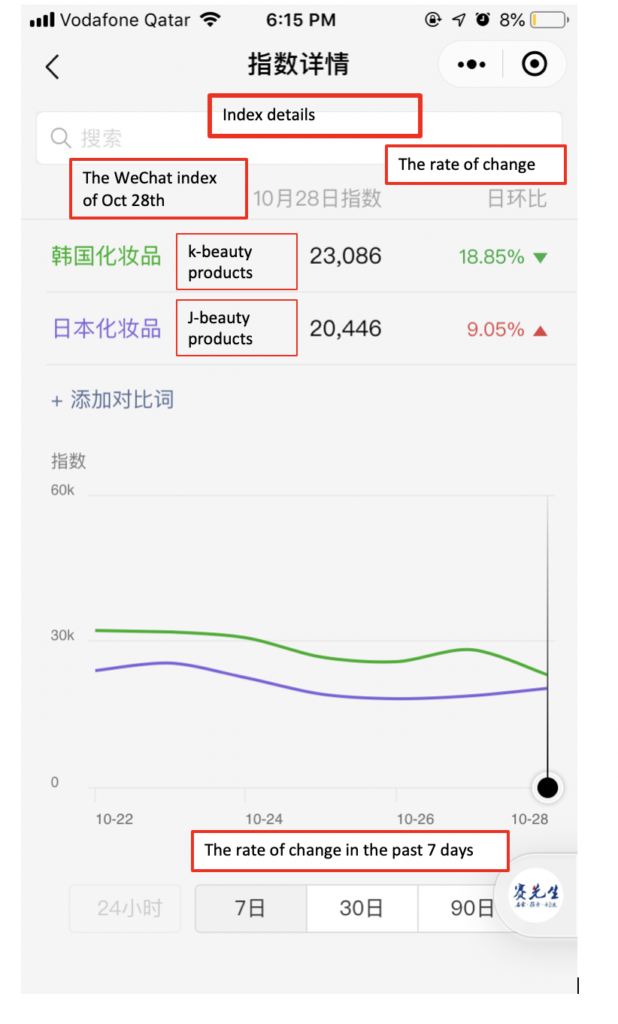

[Source: WeChat “The WeChat index of Korean cosmetics and Japanese cosmetics in China. K-beauty is only slightly more searched than J-beauty in China”]

K-beauty entered the Chinese market early with the influence of K-dramas and K-pop, part of Hallyu in China (Hallyu refers to the Korean wave, or the explosive popularity of K-pop in China). However, J-beauty became more popular in recent years, gradually outscoring the market share of K-beauty in China.

Why is J-beauty currently out-competing K-beauty in China?

Over the past five years, South Korean beauty and cosmetics exports to China had an average growth of 66 percent. However, in 2018, k-beauty exports to China only increased by 20 percent. Why the sharp drop in K-beauty in China?

Recent current events have affected China-Korea economic relations and ultimately the k-beauty market in China. As tourism to Korea is one of the drivers of the China’s k-beauty market, the popularity of K-beauty in China is subject to changes tourism to Korea. Korean brands were first hurt by the MERS outbreak in Korea in 2015, which resulted in sudden decline of Chinese tourists to Korea. This could have been a short term incident, as MERS was rather quickly put out by nationwide efforts in Korea.

However, something else came between China and Korea. THAAD, or Terminal High Altitude Area Defense, which is an American anti-ballistic missile defense system. The governments of South Korea and US agreed to deploy THAAD in Korea to defend the country from North Korea’s missiles.

Chinese government demanded that THAAD should not be installed in Korea, as it would spy on China. From 2016, when THAAD deployment in Korea was decided, to 2017 when THAAD was actually installed, Korean companies that were doing business with China had to scale down their Chinese operation quite dramatically. The damage to Korean firms’ business related to China from THAAD (and MERS) has not been fully recovered yet.

Also, Japanese brands are usually associated with “high quality” “high-tech”. Chinese consumers care about having youthful skin, and believe Japanese products are more effective. Last year, Japanese cosmetics conglomerate Shiseido’s sales in China made up 17.4 per cent of its overall sales, an increase from 14.4 per cent the year before. Besides that, Chinese consumers’ needs and tastes are also getting diversified with China’s growing economy and thriving C-beauty industry

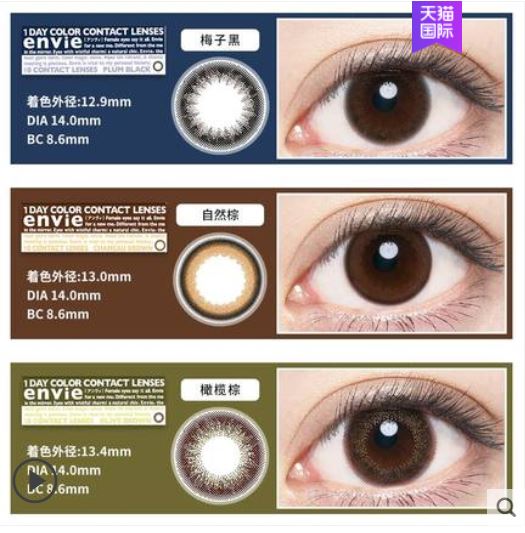

[Source: Tmall ‘Colored contact lenses are a common product of J-beauty in China’]

College students and young women are the main group of Chinese consumers for Japanese and Korean cosmetics in China

“Young women aged 18 to 29 are the main target consumers for the growing interest in Korean products in countries in East Asia like China and Singapore”, says Yvonne Lum, VP of consumer insights at Nielsen Hong Kong. Compared to big western brands like Dior and Chanel, the J-beauty and K-beauty market in China have a larger following among college students and young women who have lower purchase power and are relatively more influenced by social media campaigns and Korean and Japanese culture.

Relatively speaking, the K-beauty and J-beauty markets have more budget-friendly and accessible brands with delicate and adorable product designs for Chinese customers. For example, one of the most famous Korean brands in China, Etude House, which is a brand under AmorePacific, has a fun and playful vibe that is targeted at young trendy women. Their lipsticks usually have youthful and fashionable designs and the price of those lipsticks are set between 4 dollars and 10 dollars. Since entering the Chinese beauty market in 2013, Etude House has penetrated in 25 cities with 58 shops with offline stores. Thus, you can easily buy products in a mall even in a tier-2 or 3 city. Considering there is no competitors from western brands with affordable price and easy accessibility which are available in China, K-beauty and J-beauty brands are popular among young women in China.

Drivers of the Japanese and Korean cosmetics markets in China

[Source: Unsplash ‘The common beauty standards of pale skin and an innocent look in K-beauty and J-beauty in China’]

The East Asia region has similar beauty standards

As Japan, Korea and China are located in the same region and share similar cultures and beauty standards, K-beauty and J-beauty products attract Chinese consumers in terms of the function and product positioning. In general, East Asian beauty standards prefers a “cute” image. Specifically, the conformity and collectivism in East Asian beauty standards defines white and flawless skin, a thin body shape, and double eyelids, as beautiful figure. Compared to western makeups which focus more on naturalism and individualism, Korean and Japanese products better satisfy the needs of Chinese consumers.

More accessible, Multiple online & offline purchase channels

[Source: Tmall “Innisfree’s online official shop”]

J-beauty and K-beauty products are easily accessible in China. First, people can easily purchase those brands through online and offline platforms. For example, Tmall, a sub platform from Alibaba, launched a Korean pavilion to provide a one stop shop for genuine Korean products and related information in 2015. Besides that, Tmall launched 1000 international brand stores this year including Korean brands like Innisfree and Japanese brands like cosme. Besides that, surrogate shoppers (daigou in Chinese) is also popular in China for purchasing Japanese and Korean products. They buy up stocks overseas and sell them through social media or e commerce sites in China.

Travelling to Japan and Korean is also an option for some Chinese consumers. Chinese consumers do a lot of shopping during travelling in duty-free shops at airports and drug stores and Ginza in Japan. Similarly, tourists who visit Korea also enjoy shopping there a lot in cities like Seoul and Jeju. The popularity of Korea as a travel destination — particularly among the growing Chinese middle-class — has also helped brands like Innisfree and It’s Skin, says Julien Lapka, managing director of brand consultancy Flamingo Shanghai.

The penetration of Korean and Japanese culture among Chinese

The Korean culture export in China is closely related with the trend of K-beauty cosmetics popularity. Specifically, K-pop culture, k-dramas and TV shows incite people’s interest in K-beauty in China.

Co-authors: Jiayi Shen from daxue consulting and Hyokon Zhiang from Innomove

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes