Beauty and Personal Care in South China

Trends and potential for personal care in South China

The last a few years experienced a substantial growth in value sales for beauty and personal care products in China, and especially in the South of the country. According to consulting firms, the main driving force was the vigorous development of the economy as a whole. With more disposable income, consumers can buy more products beside primary needs. An important fact about consumers in South China is that, they have been developing brand awareness, and they are having more sophisticated demands. Market players in this industry responded to this trend by subdividing their products to satisfy the need of different consumer groups.

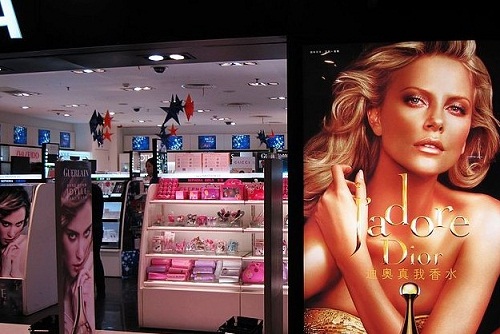

Despite the fact that skin care is a fairly mature product category, it still saw big development in south China. In particular, anti-agers show good performance. Although the main consumers are females aged over 30, there are more and more young females who are paying attention to their beauty and begin to use anti-agers early. Another important trend is the appearance of sets. At special time spots like Christmas and the New Year, some famous brands like Estée Lauder, Clinique and Dior launched special sales where products are sold in the forms of sets. In addition, male consumers are no longer concerning their basic needs such as shaving, bathing and shower products. They are buying oil control products and deodorants. With an average relatively high education level, male consumers are highly brand sensitive.

Also, consumers are being more and more aware of cross infection prevention. Thus liquid soaps acquired huge increase in sales volume, with brands like Blue Moon, Kaimi, Walch and Dettol having greatly increased their sales in south China.

Prospects of South China

The consumer need in south China has been becoming more and more sophisticated. Thus market players are trying to divide the market at large, and they have been developing new multifunctional products to cater to people’s needs. Consumers’ concern for product safety has been a driving force for producers to use more organic or ‘green’ ingredients instead of chemical ingredients. The brands that had already used some organic materials benefit a lot, like Shanghai Jahwa United’s Herborist skin care.

Large department stores, supermarkets and hypermarkets have remained the major retailing channels for years, and it has been predicted that this trend will continue into the following a few years. Since south China is a relatively more developed region than inland, Internet retailing has much market potential. Many key marker players, having realized the importance of this channel, have established their online shops using B2C websites such as Tmall and 360buy, or their own official websites.