Government regulation of the cosmetics industry in China| Daxue Consulting

Cosmetic products include:

- Skincare products

- Shampoos and hair-care products

- Make-up products

- Products for children

- Sunscreen

- Anti-aging products

- Sports cosmetics

- Cosmeceuticals (products that combine cosmetic and pharmaceutical features, such as spot lightening cream, acne treatment lotion, and acne ointment.)

The cosmetics industry in China in 2019

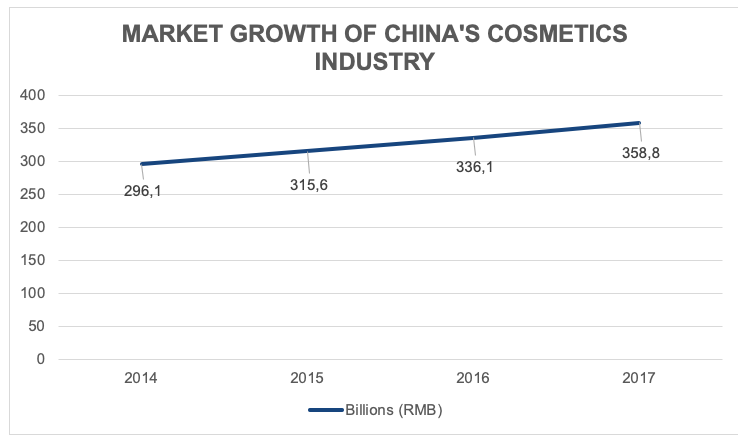

China has recently overtaken Japan to become the largest cosmetics market worldwide. In 2018 the cosmetics market in China was worth over USD 26 billion. The cosmetics industry in China is high growth, expanding 21% since 2014.

[Source: Daxue Consulting, “Market size of cosmetics industry in China”]

Growth of the cosmetics industry in China is driven by rising disposable incomes and an increase in beauty consciousness. The huge demand has attracted many enterprises to the cosmetics industry in China, consequently creating intense competition between brands. Among the top 10 cosmetics players in China, 7 are international brands. Collectively, the international cosmetics brand hold a 61.5% share of the cosmetics market in China. Despite the relatively higher prices of international cosmetics, Chinese consumers are drawn to international brands because of brand name recognition and perceived effectiveness of the product. However, international and domestic cosmetics brands alike are subject to strict government regulation.

Regulation of the Chinese cosmetic industry

The Chinese government first began regulating cosmetics products in 1990 and has since released dozens of laws and ordinances relating to the cosmetics market in China. When lawmaking, regulators attempt to prioritize consumer safety without constraining innovation. According to June 2018 data from the CFDA, the number of enterprises qualified to produce cosmetics in China is 3,880.

Supervision and regulation of cosmetic hygiene are handled by the China Food and Drug Administration (CFDA). The General Administration of Quality Supervision, Inspection, and Quarantine of the People’s Republic of China (AQSIQ) is in charge of hygiene license release and supervision. The State Administration of Industry and Commerce (SAIC) supervises advertising, falsification, and protection of consumer rights in relation to cosmetics products. All authorities responsible for cosmetics regulation are clustered under the administrative umbrella of the State Administration for Market Regulation (SMRA).

The most important regulation that governs cosmetics production and company operations in China is the Regulations on Hygiene Supervision of Cosmetics, which was last updated in August 2018.

Licenses and certificates required to sell cosmetics in China

Before cosmetic products can be manufactured in or imported to China for the first time, companies must conduct their own safety assessment. The assessment must be carried out by a responsible person in charge of safety and quality, who has at least five years’ experience working in cosmetics manufacturing or quality management and has specialist knowledge in medicine, pharmacy, chemistry, toxicology, chemicals, and biology.

After the safety assessment, manufacturers can obtain an application for a Hygiene License of Imported Cosmetics from the Chinese Hygiene Administration Department. Upon receipt of the application, the Hygiene Administration Department will inspect the products in question with their own cosmetics safety panel.

CONTACT US NOW TO ANSWER YOUR QUESTIONS ABOUT BUSINESS IN CHINA

The inspection process is much more extensive for cosmetics deemed as “special use.” Special use cosmetic products are legally defined as: 1) hair dyes; 2) hair perm products; 3) spot removal and skin whiteners; 4) sunscreens, and 5) other products which claim a new function.

Cosmetic products that pass the inspection will be issued an Approval Document for Hygiene License of Imported Cosmetics. Approval documents are valid for four years.

All cosmetics sold in China are classified and filed by digital codes. The 8-digit code consists of four parts:

- The function of the cosmetic product (g. hair dye, hydration, etc.)

25 possible categories of function

- The body part of the product is to be applied to (g. hair, skin, eyes, etc.)

26 categories of a body part

- The form of the cosmetic product (g. cream, powder, etc.)

17 categories of form

- The target population for the product (g. general population, pregnant women, etc.)

6 categories of the target population

For example, the digital code for a children’s sunscreen would be 09-03-01-04. These codes help the CFDA track the filing, registration, administration, and statistics of cosmetics.

Mandatory animal testing for cosmetics in China

Cosmetics companies that sell in China have historically been required by law to test their products on animals. However, recent regulation has marked a movement away from compulsory animal testing.

In March 2019 the Gansu Province National Medical Products Association announced that post-market animal testing would no longer be mandatory on cosmetic products. However, pre-market animal testing was still required.

In April 2019 China’s National Medical Products Administration (NMPA)approved nine non-animal-based test methods that could be accepted as sufficient cosmetic testing. From January 2020 these methods will be the preferred toxicological tests for the registration and pre-market approval of cosmetic ingredients.

These regulations are significant steps forward for the cruelty-free cosmetics movement, but until animal testing is completely banned in China activists will continue to lobby the government for regulation changes.

Ingredients requirements in Chinese cosmetic industry

The Hygienic Standard for Cosmetics in 2007 banned over 1200 chemicals in cosmetics and restricted the use of 73 chemicals, 56 preservatives, 156 colorants, 28 sunblock agents, and 93 dyes. Before cosmetic companies can apply for hygiene licenses or record-keeping certificates, they must ensure that their formulas meet these hygienic standards.

Cosmetics containing new ingredients not listed on the Inventory of Existing Cosmetic Ingredients in China (IECIC) must register to be filed with the CFDA. New ingredients that are high-risk must be approved by the CFDA. After registration, the applicant must regularly report to CFDA any safety issues related to the new ingredients. If a new ingredient causes safety concerns during a three-year period, then the CFDA will revoke its filing or registration. If three years pass without incident, then the new ingredient is included in the catalog of ingredients accepted for use in cosmetics production in China.

Packaging and labeling requirements for cosmetics in China

According to China’s 2008 Regulations on the Administration of Cosmetics Labelling, a complete list of ingredients must be shown all cosmetic product labels. The ingredients must be listed in standard Chinese. The provisions also regulate the formatting of cosmetics labels and content allowed or prohibited to be stated in the labels.

According to China’s 2010 Naming Requirements for Cosmetics, the name of a cosmetic product should be concise and easily understandable. It must not intentionally mislead or deceive consumers.

The Cosmetics Naming Guidelines list expressions prohibited in cosmetic product names. Banned expressions include: ‘special effect,’ ‘total effect,’ ‘powerful effect,’ ‘miraculous effect,’ ‘super effect,’ ‘extraordinary,’ ‘skin renewing,’ or ‘wrinkle removing.’ Also banned are expressions that falsely claim a product is ‘absolutely natural.’

Product names must not explicitly or implicitly indicate a false medical effect by using expressions such as ‘anti-bacterial’, ‘bacteria-inhibiting’, ‘bacteria-removing’, ‘detoxifying’, ‘anti-allergic’, ‘scar-removing’, ‘hair-growing’, ‘hair-regenerating’, ‘fat-reducing’, ‘fat-dissolving’, ‘body-slimming’, ‘face-slimming’, and ‘leg-slimming.’

Names of celebrities in the medical field, such as Bian Que, Hua Tuo, Zhang Zhongjing and Li Shizhen are not allowed to be used in product names.

If a cosmetics label does claim any specific function or efficacy, this must be supported by sufficient scientific evidence including research data, assessment reports, and relevant studies. Manufacturers must disclose a summary of this scientific evidence on their websites.

Requirements for international companies looking to import cosmetics to China

Importers must follow the same CFDA rules as domestic companies: a safety inspection, license application, and another inspection.

Upon arrival at a Chinese port of entry, importers must provide:

- Approved hygiene licenses and certificates

- Safety assessment data on materials with potential safety risks

- Certification allowing production and sale in the country of origin

- Certificate of origin

- Digital code

- Sample of the Chinese label and foreign label

- Information on product quantity and weight.

Imported cosmetics are subject to import tariffs. Different cosmetic products in China are tariffed at different rates.

| Cosmetic Product | Import Tariff Rate in China |

| Skincare | 1% |

| Makeup | 5% |

| Shampoos and hair products | 3% |

| Nail polish | 5% |

| Perfume | 3% |

| Other | 3% |

Source: Customs Import and Export Tariff of the People’s Republic of China 2018

Penalties against cosmetics manufacturers in breach of CFDA regulations

The CFDA has many weapons in the arsenal to penalize problematic cosmetics manufacturers. The CFDA can issue safety warnings to the public, order mandatory product recalls, seize harmful cosmetics and ingredients, and close down production or distribution sites. Manufacturers and distributors with bad records are subject to stricter supervision and frequent surprise inspections.

Chinese cosmetics manufacturers that do not meet mandatory standards have their products and earnings confiscated. In addition, they can also face confiscation of raw materials, packing materials, manufacture tools and equipment; a fine between 2-10 times the value of the relevant product; and revocation of cosmetics licenses. Individual leaders of the cosmetics manufacturing companies can also be held personally liable, with fines between RMB 10,000 and 50,000 and temporary bans from working in the cosmetics market in China.

Although penalties are harsh, the Regulations on Hygiene Supervision of Cosmetics clearly define what is considered a violation and provide guidance on the application of different penalties depending on the severity of actions.

Distributor obligations to enforce cosmetic regulations in China

E-commerce platforms, offline operators, and salons that sell cosmetics products are responsible for ensuring regulatory compliance of the cosmetics products they sell. Stores and e-commerce platforms must check all licenses, registrations, and qualifications of cosmetics retailers that operate on their sites. Platforms and operators that fail to carry out checks on their cosmetics sellers are subject to fines up to RMB 100,000.

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions