Surging Rates of Diabetes in China Make it the World’s Biggest Market

At Daxue Consulting, we have helped many clients in the healthcare and insurance sectors realize their goals of improving their business performance in China. It is through our research for these clients that we found, and are concerned by, the public health issues that are currently plaguing China. Since 2010, China has become home to some of highest rates of diabetes cases and diabetes-related deaths in the world. According to the International Diabetes Federation’s (IDF) Diabetes Atlas, the number of Chinese diabetes cases has increased to around 110 million in 2015, which accounts for 11% of the total adult population in China. With the largest number of diabetes cases in the world (and growing), China now also has one of the biggest markets for its treatment. As a result of the rapidly expanding diabetes crisis, China’s need for medical investment and development is growing in response.

Almost 11% of all adults aged 18 years or older live with diabetes in China.

The prevalence of diabetes in China has risen from less than 1% in 1980 to 11% of Chinese adults in 2015. The number of diabetes cases will rise to 154 million in 2040 according to the estimates of IDF. This situation may get even worse considering that most Chinese patients do not know they are diabetic. The diagnosis rate in China is around 39%, which is lower than in countries like America and Japan where over half of patients are diagnosed, according to the Centers for Disease Control of China (China CDC) in 2013. According to the Wall Street Journal, most prediabetic patients in China only discover their condition after having microinfarction (minor stroke). Delayed detection problems like these have led to over a million diabetes-related deaths in 2015. In China, only 13% of patients’ blood glucose levels have been deemed appropriate or controlled after receiving long-term treatment. “Half of the patients stopped the use of insulin within three months, and only one-third of them stick to the treatment after a year,” said Luo Tianhong (骆天红), head of medical affairs of Sanofi China (赛诺菲).

The lower rate of diagnosis and the lack of appropriate treatment lead to more diabetic complications, which then increase the expenditure of both patients and the Chinese government. 13% of the national healthcare expenditures in China are directly caused by diabetes annually. A recent survey by the R&D-based Pharmaceutical Association Committee (RDPAC, a non-profit organization made up of 38 member companies with pharmaceutical R&D capability) shows that the cost for complications accounts for 80% of the total expenditures. By 2040, the related cost of diabetes will increase to 72 billion in China, according to IDF estimates.

Additionally, to solve the increasing need of treatment for diabetes in China, the Chinese government has allowed foreign firms to establish autonomously-owned hospitals in China. The move indicates there will be a large market for foreign enterprises that provide diabetes-related products in the future.

Diabetes market distribution in China: widespread variation in diabetes prevalence and detection rates across China

China has a vast geographical and socioeconomic span, which leads to disparate rates of diabetes prevalence as well as detection methods across China. An article published by Journal of the American Medical Association (JAMA) in 2013 shows that Chinese diabetes prevalence increase from southwest to northeast. There is a clear uptrend from 8% in the northeast to 13% in the north. As for each province, there is a downtrend from 13% in urban areas to 9% in rural areas. The differences in prevalence across the provinces reveal which areas require the most attention.

The detection rate reduces from 40% in the north to 16% in the southwest, from 41% in the urban areas to 21% in rural areas, which is reflected by the socioeconomic levels of those areas, as income and education rates are relatively lower in the southwest. In connection with these lower rates, rural areas in China have less access to the quality treatment facilities and tools found more commonly in urban areas. When compounded with higher costs for these resources, getting treatment in rural provinces becomes much more difficult. In this case, northeast China’s lack of medical infrastructure will provide ample opportunity for diabetes treatment services and care.

Emerging market for diabetes in China: Business opportunities in four main industries

Chinese diabetes food market is ripe for the taking

Over 90% of China’s diabetes cases are type 2 diabetes, with the leading causes being obesity and lifestyle factors, such as lack of exercise, high-calorie intake, and sedentary jobs. Proactive lifestyle changes, particularly implementing healthier diets, can be difficult to adopt for type 2 patients, as most of them are over 40 and have set habits. Instead, this may require specialized food substitutions, such as fat-free evaporated milk, to satisfy daily health requirements while cutting down on caloric food. Since the Chinese diabetes food market is underdeveloped compared to its western counterparts, foreign firms are in a unique position to fill the unserved market.

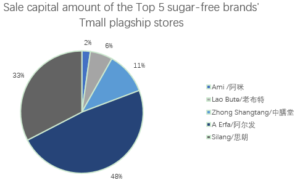

A glance at the shopping guide search engine Manmanbuy (慢慢买) reveals that the top 10 food brands are all Chinese domestics. As of May 25, 2017, Tmall’s online stores’ total sales from the top 5 brands yielded approximately 1.35 million RMB in a one month period. 48% of those sales came from “Aerfa food flagship store” (阿尔发食品旗舰店). From here, their best sellers provide some insight into the higher demand products. Among all the store’s product lines, sugar-free cookies and milk powder were top performers.

Aerfa dominates in Tmall sales, boasting almost half of the segment share.

Chinese consumers’ preference for Aerfa food flagship store is also a testament to their increasing inclination towards “professional” brands. In contrast to most other domestic brands, Aerfa has a separate product catalog for anti-diabetic food, which conveys a high-quality and consumer-conscious culture that has grown popular in China.

With younger diabetes patients in China, whose numbers’ are steadily growing, this consumer orientation is especially common. China’s new generation is often defined by their preference for global goods, and therefore more readily consume western brands that cater to them. International brands with this “professional” brand image can expect high demand for their products in China.

Further openings in the market for diabetes in China

In 2017, standard health insurance provided by the Chinese Government covers 95% of the Chinese population, according to the People’s Daily. The Chinese government’s new medical insurance directory includes more diabetes drugs than ever before in the national reimbursable medicine list. The new policy includes the entire Category A and select Category B products, which allows more products from foreign companies to be accessed by patients. The China Food and Drug Administration (CFDA) also plans to enable digital filings for new drug applications in 2017. And while China’s regulatory regime is still evolving, these reforms are expected to help speed the entry of new drugs into the Chinese market, from both foreign and domestic sources.

As diabetes is still an incurable disease, the cost of treatment is a major concern for most patients. In China, the monthly average income of a diabetes patient is between 2,000 and 4,000 RMB, according to a recent investigation published by the Beijing Diabetes Prevention Association (北京糖尿病防治协会) in 2015. Although the revamped medical insurance directory has lessened the financial burden on diabetes patients, it is still imperative that foreign pharmaceutical enterprises still consider the price of their treatments.

Urgent need for diabetes Apps in China

Despite having the largest number citizens with diabetes, China still lacks some of the critical resources and infrastructure in healthcare. China’s National Health and Family Planning Commission recently released its 2015 statistical bulletin, which revealed the number of registered doctors per thousand people is 2.21 in 2015, a rate well below those of developed nations. For example, in comparison, the number of registered doctors per thousand people in Austria was 5.1 in 2014.

For those suffering from a chronic disease, diabetes patients need a comprehensive and continuous treatment plan to prevent severe complications. Proper individualized treatments should include diet control, a regular exercise schedule, blood glucose monitoring, diabetes education and hypoglycemic agent application. Though thorough treatment plans are an essential approach to controlling the disease, the steep costs associated with full treatments make them nearly unattainable for most Chinese patients.

However, there may yet be a way to reconcile some of the costs and treatment for diabetes in China. High smartphone usage and hospital-supported apps make it possible for patients to help manage their diabetes through their phones. For example, the Tianjin Medical University’s metabolic disease hospital(天津医科大学代谢病医院)has coordinated with the app “Tang Yisheng” (糖医生), which aims to supervise diabetes patients after they are discharged. Liming Chen (陈莉明), director of Tianjin medical university’s metabolic disease hospital, said: “it improves the efficiency of patient management by reducing the time consumed for registration.”

Although the diabetes apps like Tang Yisheng are still imperfect solutions, the Chinese government still expects mobile applications to improve the awareness and treatment of chronic diseases like diabetes. In 2015, the government issued “Guiding Opinions of the General Office of the State Council on Propelling the Building of a Hierarchical Diagnosis and Treatment System” which emphasizes the improvement of chronic disease management through the internet.

New trend for Chinese diabetes insurance market

The Chinese insurance company DateBao (大特保) launched“Tuitanggu”(退堂鼓) on November 2015 for diabetic complications. Photo source: Datebao’s website.

In recent years, insurance firms have begun seeking to partner with smartphone apps for new diabetes patients. The cooperation between them has proven mutually beneficial thus far. The insurance companies have used the mobile health platform’s database to conduct big data analysis and refine their risk control models. Simultaneously, the app developers have derived revenue through the apps themselves. The services provided by the apps have also helped the patients understand and control their disease, which reduces the business risk of the insurance companies and the costly spending on treatment and medicine. Future app ventures may come from third-party sources that aim to turn a profit in the market, but are less constrained by partnership agreements and capital requirements.

Some top insurance companies in China, including Datebao (大特保), Munich Re(慕尼黑再保险公司)and China Taiping(中国太平), have all cooperated with the top mobile apps like “ZhangshangTangyi”(掌上糖医), “Utang”(U糖), and “XuetangGaoguan”(血糖高管).

The app XuetangGaoguan (血糖高管) monitors the sugar intake of users and generates customized menus accordingly. Photo Source: XuetangGaoguan’s website.

The CEO of Datebao, Zhou Lei(周磊), said that the cooperation with those diabetes apps helps them pinpoint their target clients, which increases the efficiency of their advertising. He stated that ‘‘focusing on single disease insurance like diabetes is less costly and more effective. To achieve this, collaborating with relevant apps is the most ideal approach.” Some of the biggest draws of the apps are the professional medical services they provide, which include both full and part-time medical staff, as well as secure user data storage. Those critical services make the insurance more attractive for diabetes patients, and reduce overall costs for the insurance company.

Overall, the development of the insurance market for diabetes in China centers on the cooperation with diabetes apps, at least for the foreseeable future. Foreign firms hoping to penetrate the Chinese diabetes insurance market must consider integrating with Chinese apps, for if not, they risk losing the established infrastructure and massive data platforms that they offer.

Daxue’s expertise: Market assessment and distribution network analysis

As chronic diseases like diabetes are on the rise in China, so is the opportunity to address the glaring public health issues. Recently, we partnered with a client who is an Asian semi-governmental organization focusing on technology transfer and business promotion. Given China’s promising medical and healthcare device market, our client aimed to assist companies from its country to further integrate them into the Chinese market. Therefore, the client hired Daxue Consulting to conduct market analyses of both Eastern and Central& Western China, and to explore the different distribution channels in the respective regions. Daxue Consulting conducted extensive desk research, a series of on-site checks, and many in-depth interviews (agents, distributors, procurement managers) in the two regions in order to assess and identify the best distribution options for the medical and healthcare device companies.

Find out more about our healthcare related projects by contacting our senior project managers by email at dx@daxueconsulting.com.