Market Study: Cheese Market in China

Overview of Cheese Market in China

Traditionally, there was barely a market for cheese in the past in the past, but the tastes of Chinese consumers are changing fast and cheese is becoming one of the most popular foods among China’s large cities.

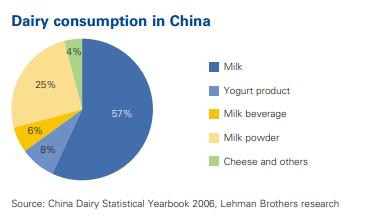

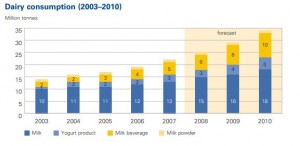

This burgeoning growing has been supported by the increasing health awareness and nutritional value of dairy products among Chinese consumers. The figure from a market research report shows a steady rise indairy consumption in China from 2003 to 2010. By 2006, Cheese has occupied 4 percent of whole dairy market in the traditionally dairy-less market.

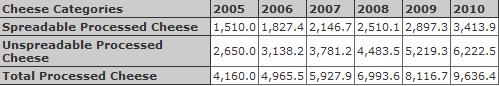

The total processed cheese retail volume in China increased from 4160.0 tons in 2005 to 9636.4 tons in 2010. The source of cheese in China is split in half between domestic production and importation from abroad. New Zealand and Australia are two nations that ranked in Top 2 among Chinese imports from 2005 to 2007. Cheese imports from other foreign countries is also growing significantly. The U.S. Dairy Export Council says that cheese imports to China grew 47 percent in 2010. In addition, data from CNIEL, a French dairy Ccuncil, shows that China imported 30,000 tons cheese from abroad in 2011. In the past few years, the annual growth of cheese importation to China has been growing steadily at 24 percent. During the period from 2009 to 2011, cheese produced in France tripled its sales from 400 tons to 800 tons.

Market Sizes of Processed Cheese in China – Retail Volume in Tonnes

Key Players in China: Mengniu, Yili, Bright Dairy & Food

Before 2006, the top 4 domestic dairy companies in China, Mengniu, Yili, Sanlu, and Bright Dairy & Food Co, dominated China’s dairy market. However, since the Sanlu milk contamination scandal and a series of other milk-quality-related incidents, the situation and structure of the dairy market in China has been gradually changed. After the scandal-hit Sanlu dairy company, it merged and was taken over by Sanyuan Group, a state-owned dairy firm, with revenues of 616.5 million yuan (US$90 million).

In 2010, Bright Dairy and Food Co. held a 52% share of the retail cheese market in 2010. This was followed by Fonterra Commercial Trading, a New Zealand company that is one of the top 10 largest global dairy companies, with a 18.5% market share. For other foreign cheese brands in China, they can usually be found in various retail markets, such as Anchor from New Zealand, President from France, Coeur de Lion from UK, La Vache qui rit from France, Hochland from Deutschland, Arla Castello from Denmark, and so on. Besides, some foreign companies, for instance Danone, Bongrain, Fonterra and Nestle, have already invested in domestic dairy companies or formed joint- ventures in China.

Opportunities & challenges in China’s cheese market (market analysis)

The demand of consumers for cheese is driven by several factors. First, Chinese shoppers seek high quality products with big brands in order to get safe, organic, and healthy food. Second, the lifestyle of Chinese people has changed a lot; especially for young children and those living in urban area. Children play a big role in driving the demand in food expenditure as they account for more than 50% of total household spending in urban cities in China.

However, the food scandals that broke during the past several years in China alerted Chinese people to pay much more attention to what they eat and drink. Food quality and safety are top priorities for Chinese consumers when making a decision about what products to buy for their kids. Marketing towards safe food for kids is an important aspect for foreign companies to consider when forming their strategy in China to enter this promising cheese market.

Daxue China Consultant (market study in China)

Sources:

Credit Photo: Agriculture and Agri-Food Canada