Chocolate market in China

Chocolate market in China

China is the next great frontier for Chocolate market

China’s transformation from an isolated economy to a global economic powerhouse has turned hundreds of millions Chinese of its 1.3 billion people into eager consumers of everything from candy to cars. Thirty years ago, most Chinese had never eaten a piece of chocolate; gradually chocolate and its culture as an exotic food product has already been accepted by most Chinese and their taste for chocolate was ready to be shaped by whichever company entered the country with a winning combination of quality, marketing savvy, and manufacturing and distribution acumen.

According to the market research data from Association of Chinese Chocolate Manufacturer, Chinese consumes 70 grams of chocolate per capita every year. This data is dwarfed by 2 kilos that of Japan and Korea, needless to say 7 kilos of one European. Having become one of the world’s lowest consumers of Chocolate, yet the situation is changing fast. Market researches show chocolate sales in China have surged dramatically, opening new opportunities for chocolatiers – and contributing to a rise in global cocoa prices. Its 30% annual growth and its large population have attracted chocolate marketers from all corners of the world. Now the China market has already become the engine for the global chocolate market.

For chocolate companies, China was the next great frontier—a market of almost limitless potential to be unlocked through a battle between the world’s leading chocolate companies for the hearts, minds, taste buds, and ultimately the wallets of China’s consumers.

Competitive landscape of Chocolate market in China

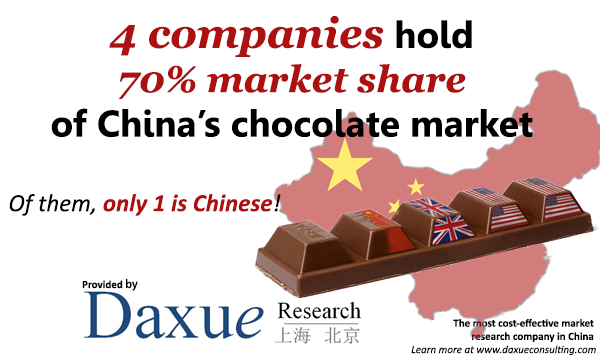

So far, the top 20 chocolate makers have already presented in the market. In a common supermarket in Shanghai, you can easily find chocolate of over 70 brands. Most of them are foreign brands.About 90% of the market is occupied by foreign brands. The big four (biggest four companies in China chocolate market: Dove, Ferrero, Cadbury and Leconte) have taken over 70% of the market. Only Leconte is a local brand. Among the three foreign brands, only Dove has taken one-third of the market. And these four brands have held the high class market. Then following brands such as UHA, Meiji and Lindt & Sprüngli take medium-to-high class chocolate market and the rest of the market is taken by local companies.

Foreign success in China’s Chocolate market

First of all, taste. In China, taste definitely plays the top role for consumers to choose in the chocolate market. We often see advertisement slogans of big foreign brands promoting their products by depicting mellow pictures of “Sweet-smelling milk as silk tasting” or “melt in mouth, a lasting flavor”.

Second, branding. Imported chocolates are often linked as premium food product because of its decent look and packaging. And a big part of imported chocolates purchased in China are for gifts or ceremonial use like wedding candy or during special festivals like western or Chinese Valentines’ Day. Therefore premium brand is one of the considering factors when purchasing chocolates. Plus, imported chocolates also enjoy a fame of high class ingredients. With the growing concern for health and food safety, consumers are becoming more careful about the ingredients of chocolates and imported chocolate are trusted for containing more coco or milk.

Mass media makes a big impact on foreign brands’ success in China’s chocolate market, such as the use of Social Networking Service, creating chocolate websites and community management to promote their products as well as advocate chocolate culture.

China’s multitier economy demands complex product stratification: various products at a range of prices that meet the needs of different consumers. Companies such as Mars, which offers a wide range of products, are best positioned to compete across China’s multitier markets. Mars can meet the needs of China’s multitier market through selectively distributing its products according to consumers’ stage of chocolate development—their taste for and ability to buy the product. For example, Mars can sell smaller Dove chocolate bars as an introductory offering for emerging consumers in second-tier cities and high-priced Dove boxed chocolates in cities, such as Shanghai, with more sophisticated consumers.

Opportunities for smaller companies in China’s chocolate market

Although the top five players account for 70% of the market, the rest is extremely fragmented. Most consumers are highly price conscious and buy cheap products, although Chinese consumers are embracing many of the trends in value-added chocolate that have been driving growth in the chocolate market in North America and Europe such as functional ingredients demand as consumers have become more health conscious, and the rise of single serve package. However, despite the health concern, the primary market is still children according to market research in China.

Furthermore, foreign chocolate companies should understand their limitations in China. It is unrealistic for multinational corporations with higher operating costs to compete with local companies on price. In addition, many foreign companies in China are at a disadvantage when locally procuring commodities such as milk and sugar, since local companies often receive more favorable pricing. With higher built-in operating costs, multinational corporations that attempt to compete with local companies on price may jeopardize their sustainability through loss of long-term profitability.

More market research in China – Market of chocolate in China – Daxue Consulting

Source:

- http://www.foodnavigator-asia.com/Markets/Opportunities-for-smaller-companies-in-Chinese-chocolate-market

- http://marketingtochina.com/imported-chocolate-market-in-china/

- http://www.euromonitor.com/chocolate-confectionery-in-china/report

- http://www.chinabusinessreview.com/chocolate-fortunes/

![[Podcast] China paradigm episode #9: How to successfully run a restaurant in China](../wp-content/uploads/2018/11/Bonnefoy-Youtube-Cover-1-150x150.jpg)