Chocolate market in China

The chocolate market in China consists of all chocolate-based products, including but not limited to boxed chocolate, chocolate candy bars, and chocolate flavors. Supermarkets and grocery stores are the two main retail channels of chocolate products in China. Online retail and specialty retail have both displayed strong growth as the distribution channels of chocolate products due to the rapid development of e-commerce and improved quality of life in major cities in China. Moreover, the extensive market expansion of premium retail brands and grocery chains as well as the penetration of food delivery applications in lower-tier cities have increased the supply of chocolate confectionery and provided easier access to consumers.

Why Dove is the chocolate champion of China

Mars was one of the first chocolate companies to enter China in the 1980’s. Despite Nestle entering the market six years earlier, Mars still had a head start on producing Chocolate in China, setting up factory as early as 1993. Mars first sponsored the 1990 Asian Games in Beijing promoting M&M’s. However, M&M’s were perceived as children’s treats and not fit for adults. So Mars next launched its Dove Chocolate bar in China, a huge success which became the number one chocolate bar in China. In its early years, Mars had a variety of products which could be positioned in cities according to consumer’s familiarity with Chocolate, meaning cheaper products in lower-tier cities with a wider variety in cities like Shanghai. Dove now uses romantic ads to position itself as the ambassador of love, which is convenient in a culture that expresses love through gift giving.

[Source: Alibaba, Chinese Dove Chocolate gift boxes]

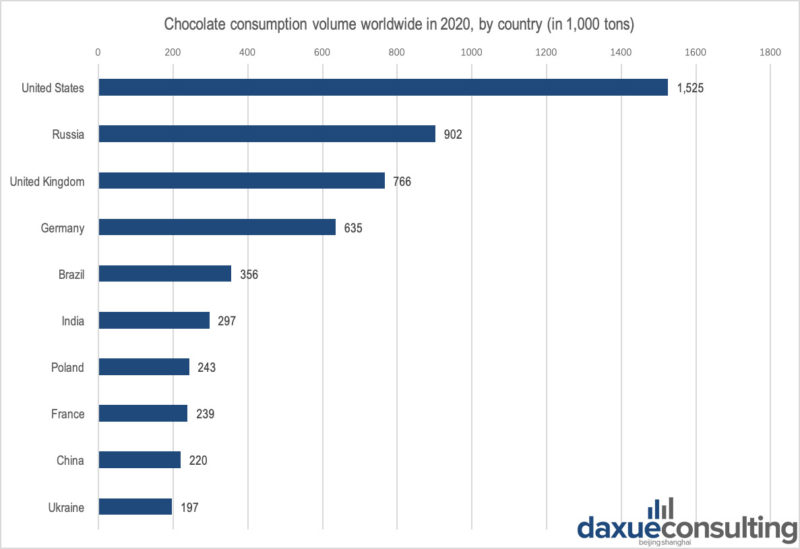

Chocolate consumption in China is much smaller than the rest of the world

The retail sale of chocolate in China does not perform as well as that of the western countries. According to Statista, the chocolate consumption volume in China only ranked ninth globally. Which is surprisingly low given the huge population in China. This is attributed to the fact that the per capita chocolate consumption in China is minimal, with only 0.1 kilograms being consumed per capita in 2017, which is an extremely tiny scale compared with Japan with a number of 1.2 kilos. A majority of Chinese have not made a habit of consuming chocolate. However it is becoming a trend in tier-1 cities, and the rest of the country is soon to follow. At the same time, despite having low chocolate consumption overall, due to the high population, China is the world’s second-largest sugar and chocolate market after the US.

[Source: Euromonitor “Chocolate consumption in China is minimal given its huge population”]

Chocolate market in China has developed steadily and is in its mature stage

The retail selling price (RSP) represents the market value of chocolate products. It’s shown that sales of chocolate confectionery grew steadily up to 2014, and the market has plateaued out during the five years through 2018. The average unit price of chocolate confectionery increases by 5% in 2019. However, demand and prices are negatively correlated. Thus, the market volume continues to drop in 2019, while market value sees 4% current value growth in 2019. It’s projected that the chocolate market in China will see a 1% current value CAGR at constant 2019 prices.

Changes in consumer behaviors are influential factors

The Chinese market is dynamic as changes in consumer behaviors are constantly evolving. Increased health-awareness and indulgence among younger consumers are proving influential in China’s chocolate market. At the same time, consumers are worried about excessive sugar intake and weight gain. That’s why we have seen many candy and chocolate companies introduce sugar-free or low calories products and increasingly more customers are turning to dark chocolate.

Moreover, younger consumers are fascinated by experience while making purchase decisions. It is said that these days, young consumers are more willing to pay for experience than products. This is exemplified by emerging brands such as Heytea (喜茶) and Hema (盒马鲜生) that gained popularity among the youth, for they create pleasurable indulgence experience in stores at affordable prices. In order to meet the demand of consumers, a synergistic effect of product innovation and experiential marketing is of importance for the chocolate market in China.

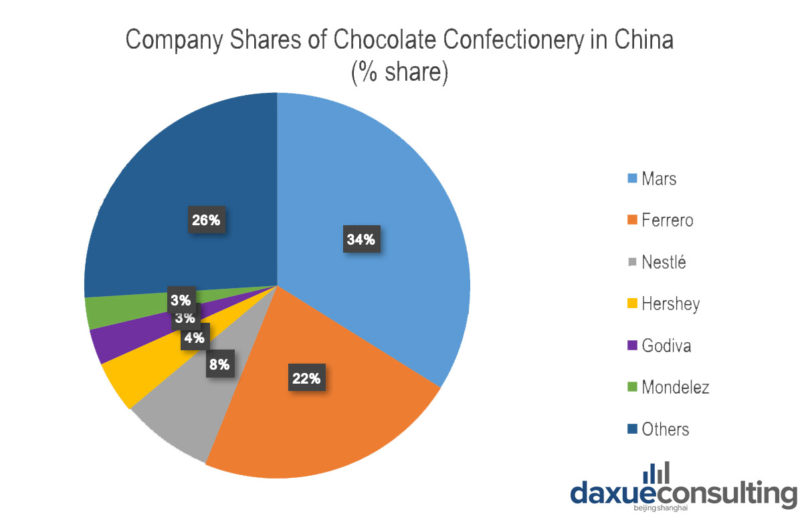

The leading chocolate brands in China are all foreign

In China, most of the leading chocolate brands in the market come from foreign countries. This is due to the limited cocoa output, the main raw material for chocolate manufacturing, as well as the popularity of Western and international food in China. Moreover, Chinese consumers generally perceive imported chocolate as premium ones. They are mostly American, as we can see, there are Mars and Hershey’s. There are also Swedish brands like Nestle and Lindt. There are no famous Chinese chocolate brands, but the little one is in partnership with big famous brands.

[Source: Statista “Chocolate market in China is dominated by foreign brands”]

Mars Group dominates China’s chocolate market, possessing brands M&M, Dove, and Snickers. This privately-owned firm expands its market all over China, Dove, in particular, has a strong market presence as it consistently lines the impulse section of Chinese convenience stores. However, Mars’ market share is shrinking due to the competition with some imported brands such as Ferrero Rocher which targets young consumers in first-tier cities and grows very fast.

Mars Group retains the lead in China’s chocolate market

Mars Group entered China in the 1970s and began selling their sweets through distribution channels in 1983. Its brands, Dove, M&M’s and Snickers are worth 1 billion US dollars each just in China and have high brand awareness among the Chinese consumers. As the largest sponsor of the 11th Asian Games, M&M had the advantage to act as one of the most popular candy brands in China. Thanks to their thorough market research and strategy, positioning and advertisement, these chocolate brands gradually interiorize, as DOVE is the symbol of love and happiness, Snickers advertises itself as the best snack for instant energy. Different flavors, mature distribution channels, and meticulous marketing segmentation, Mars has absolutely established its status in the market, with a 34% value share.

Mars’ brands Dove, M&M’s and Snickers worth 1 billion US dollar each just in China and have high brand awareness among the Chinese consumers.

Mars and Alibaba’s partnership

Furthermore, in 2016 Mars Group has made a partnership with Alibaba Group. Thanks to this partnership, Mars will benefit from its website Taobao used by 500 million people every month in 2018 and its platform Tmall, the second-largest e-commerce business in the world. The marketing services, media properties, mobile reach, big data and consumer insights of Alibaba will also considerably help Mars group to reach Chinese consumers and to be more efficient in China’s market chocolate.

For the prices, they are affordable so people can buy it easily. It’s not a premium chocolate brand as you can see its products in every store for a cheap price.

Ferrero Rocher moving from premium to affordable

In 1994, Ferrero Rocher started to sell its first products in China. It has implanted a subsidiary in 2007 and was well established at this time. Ferrero Rocher positioned itself as a premium chocolate brand in China. Due to its premium status, it is a popular choice to gift to friends and family, especially during the lunar new year. Additionally, 15% of Ferrero Rocher’s China sales can be attributed to weddings. For the price, with a box of 16 chocolates, it’s approximately 48RMB, which is down from the 60-90RMB price it held a few years ago. Ferrero Rocher is entering the mainstream chocolate market in China, which could be for the better.

Nestlé, early China entrant

Nestlé’s first sales point was in Shanghai in 1908. Today, China has become the second largest market for Nestle thanks to constant adaptation and major innovation. It has around 53,000 employees just in China and has 34 factories. Nestle has made several partnerships with famous Chinese brands such as Totole, Yinly, and Hsu Fu Chi. More than 90% of its products sales in China are also produced there.

E-commerce has strongly increased during the last years in China. One of the major difficulties of companies is to be enough innovative to follow the new trends. Consequently, Nestlé has opened a special department which consists of developing e-commerce in China. We can say that Nestle has shown its adaptability face to evolution.

Hershey’s, a global leader with less market share in China

Hershey’s really started to implant itself in China when it bought 80% of Shanghai Golden Monkey in December 2013. Unfortunately, once acquired, the company sales started to decline and Hershey’s had to sell the Golden Monkey. Meanwhile, Hershey’s was not doing well either. In 2017, its sales fell by 17.3%. According to Mintel, Hershey’s lost its market share in 2016 because of the lack of innovation. They didn’t know how to adapt themselves with the e-commerce prospering. Hershey’s had 8.5% chocolate market share before 2016 and then dropped to 8.2%.

How Chinese consume chocolate

Women aged 15 to 39, in particular, working women, are the main target customer for chocolate as the demand for convenience food from this consumer group increases. Besides, children aged 5 to 14 years are also the major consumers of chocolate products, for children’s increasing pocket money supports higher demand for chocolate. This is proved by the finding that chocolate with toys was the fastest-growing category in China’s chocolate market in 2019 due to its specific targeting of children. If children become chocolate consumers, they are more likely to continue consuming it into adulthood, which is promising for the chocolate market in China.

Special sweet for special occasions

Chocolate is used for gifts or events but not consumed daily like in the west. In China, like in the west for Valentine’s Day, chocolate is perceived as a gift of love. During this period in China, 5 of the 10 top items sold online are chocolates, according to Alibaba. Chinese people are not into original or individual gifts. They prefer to choose quality and well-known brands that can be trusted. For example, last year, Dove partnered with leading technology company Xiaomi to co-create a Valentine’s Day campaign. The campaign leveraged Xiaomi’s AI technology while enhancing Dove’s position as the ‘ambassador of love’ in China’s chocolate market. The gifting ritual is not exclusive among lovers. Although Chinese consumers have not made a habit of consuming chocolate daily, they often give chocolate as gifts. No wonder boxed assortments are popular among Chinese consumers.

Prospects of the chocolate market in China: Demand for differentiation marketing strategy

As the market is getting saturated, the future of chocolate market in China demands brands to have a differentiated strategy to create distinctive ‘consumption moments’. For instance, Mars-owned chocolate brand Snickers markets the brand as the best snack to defeat hunger. Mondelez’s Milka brand entered the chocolate with toys category and co-branded with Oreo to produce chocolate with Oreo crumbs. Godiva benefited from the trend towards premiumization and set up stores in China to highlight the indulgent experience.

With all these brands striving for innovation and creativity in product and marketing, chocolate brands aiming to gain a competitive advantage in China have to understand their customers and constantly adapt to market dynamics. This can be achieved through the creation of new products and marketing strategy.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes