China business development: Chocolate market in China

China business development: Chocolate market in China

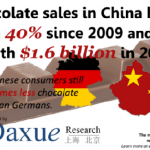

While being one of the largest sugar producers, China is gradually becoming an active chocolate consumer. Chocolate popularity is growing every year with a rate of 40% of growth of sales. It is evident that many foreign producers have been entering the market and now account for more than 50% of market share. It is explained by tastes and preferences of Chinese consumers, which choose to buy high-quality foreign chocolate. Our focus is on chocolate market in China and its business development in China.

Chocolate foreign brands are by far the leaders of the industry, while domestic producers still need time to catch up

According to the Association of Chinese Chocolate Manufacturer, annual per capita consumption of chocolate in China is only 70 grams, what means that chocolate is not available to the majority of population, but consumed mainly by middle class. This might be the result of foreign brands, saturating chocolate market in China. It is good news as long as China is growing annually at 9% rate and, as a result, its middle class is rapidly shrinking. Moreover, 70 grams, consumed annually by one person, multiplied by 1.3 billion population gives a considerable demand. This demand has a huge potential to grow further thus reaching the level of European consumption.

Main players in chocolate market in China

As it was mention above, the major players in the market are mainly European including Dove, Ferrero, Cadbury, which control 70% of chocolate market along with local chocolate maker Leconte. UHA, Meiji and Lindt & Sprüngli are the other outstanding market players, which offer high-quality chocolate for middle class. The rest of the market is shared between local producers, which offer less expensive chocolate products. However, it is observable that consumers prefer to buy European chocolate because of its high quality and taste. As long as the majority of consumers are middle class, which can afford more expensive chocolate, local Chinese chocolate makers do not account for considerable market share. Chocolate market is occupied by foreign chocolate companies by 90%, what make difficult for Chinese local companies to compete with foreign producers. As the recent survey shows, over 50% of correspondents choose to buy European chocolate while taste is the first criteria in choosing a chocolate. Surprisingly, the price stands on the third place when it comes to choose a chocolate brand, what party explain such a high demand for foreign chocolate, and such a low demand for domestic producers. Brand is also a more important criteria than price for chocolate lovers in China; it takes the second place after the quality.

To conclude, chocolate market in China is developing fast while being saturated and dominated by major European producers. This trend is explained by Chinese chocolate lovers, who put quality as the main factor and price as the least important factor. Moreover, the main consumers of chocolate are middle class, for whom price of chocolate is not a big deal. Evidently, quality and taste of foreign chocolate is more loved by consumers than quality and taste of local chocolate. However, with a big number of foreign producers in the market domestic chocolate makers are learning about quality and taste loved by consumers, what makes them more competitive in the future.

For further information:

http://marketingtochina.com/imported-chocolate-market-in-china/

http://daxueconsulting.com/market-of-chocolate-in-china