What companies must know about China’s FinTech scene | Daxue Consulting

FinTech is short for “financial technology” and refers to the application of technology within the financial services industry. This advanced and innovative combination unveils a remarkable breakthrough in modern technology. FinTech currently serves as the critical foundation to build differentiated customer experiences via personalization, quick response, relevance, and seamless delivery.

There are two types of FinTech firms: technology-centered and financial-service-oriented firms. Both of the FinTech types are earning a customer-centric reputation by bridging the gap between what financial services firms currently offer versus customers’ wishes. They are improving customer journeys by merging financial services seamlessly with daily activities to make banking and other financial services invisible and frictionless through a more customer experience-based approach (such as real-time updates), innovative business models (such as P2P lending), customized solutions, and optimal and transparent pricing.

FinTech in China

In effect, China, unlike Japan and the US, has leapfrogged from cash to mobile payments, bypassing the payment cards system. While undergoing this significant period globally, FinTech remains mysterious to most people. We summarize the basic concepts about FinTech and explain how it will likely develop in the future, as well as how international companies can leverage it in China.

Contact us for any question on the Chinese market

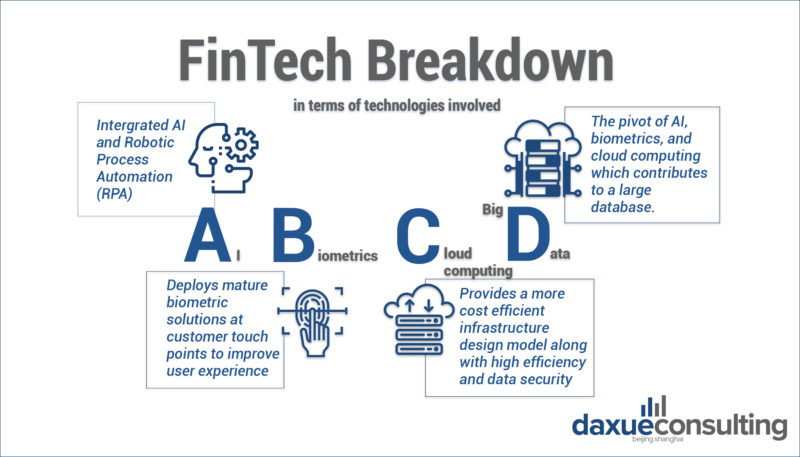

The breakdown of FinTech in terms of technologies involved in it

According to Mrs. Kan, Executive Director and Alternate CEO of China CITIC Bank International (CNCBI), the technology within FinTech can be categorized as ‘ABCD’ which are Artificial Intelligence (AI), Biometrics, Cloud and (Big) Data.

[Source: Daxue Consulting]

“Integrating AI and Robotic Process Automation (RPA) technology into our business enable the bank to save time and money by automating high volume and repetitive tasks such as account opening, anti-money laundering (AML) checking and user acceptance testing,” she suggests. Toumi RA (Robot Advisor), a FinTech company in China, aims to leverage robot to process large amounts of information quickly. Hu Jinhui, CTO of the company, points out that even sophisticated employees will pale in data collection and analysis compared with robots.

In traditional banking, customer authentication relies on the physical presence of the customer at a branch, a signature on paper or the input of a password. Whereas, in the digital world, the deployment of sophisticated biometrics solutions at customer touch points, such as via mobile banking, can improve the user experience. Upon registration, customers will be able to access their banking applications without having to memorize and input various login IDs and passwords.

Cloud computing offers the possibility of a more cost-effective infrastructure design model and allows people access to the same kinds of applications through the internet, leading to high efficiency, low cost and data security. It has taken only a few years for the concept of cloud computing in China to transform from research to practice. Fortunately, for China, its internet companies, like Tencent caught the trend immediately.

Big data serves as the pivot of the three technologies mentioned above, which contributes to an extensive database that includes all the customer-related information necessary for detailed and personalized analysis. In China, where access to secondary data is difficult due to lack of transparency, Big Data offers excellent opportunities to get an infinite amount of data to understand consumers better and predict their behavior. Thanks to this, Chinese companies will be closer than ever to their customers. To give an idea of the gigantism of Big Data, the state-owned Industrial and Commercial Bank of China (ICBC, 中国工商银行) alone had amassed 4.9 petabytes (or 4,900 terabytes that equal to 4,900,000 gigabytes) of data in March 2014. The Big Data in China is expected to grow by more than 60% in the years coming and reach total revenue of 46.29 billion yuan in 2019.

Also, blockchain gained much popularity in the past four years as the technology behind cryptocurrency. Digital currency has many benefits, including reducing the costs associated with the issuing and circulation of bank notes; improving the efficiency and transparency of economic transactions; preventing financial crimes such as money laundering and tax evasion; promoting financial inclusion. Combining shared databases and cryptography, blockchain technology allows multiple parties to have simultaneous access to a constantly updated digital ledger that cannot be altered. Blockchain has far from cooled down by increasing restricted regulations; on the contrary, many experts within the industry expect it to be widely used more rationally. Every international company knows sending global payments to China is costly and time-consuming. To solve the problem, Remitsy uses the blockchain technology and conversions in Bitcoin, with fees as low as 1% and speeds as quick as six hours.

Know-how of FinTech

FinTech firms are now penetrating nearly every financial services segment, driving innovation and disruption. Subsegment focus areas of FinTech include digital payments (PayTech), fully digital insurance (InsurTech), banking (BankTech), wealth management services (WealthTech), and the creation of marketplaces for selling financial products.

BankTech refers to retail banking technology startups focused on lending, cross-border transfers, and money management. PayTech focuses on the payment space and is used by firms such as Alibaba and Tencent. WealthTech firms are to online/mobile wealth or investment management firms such as Lufux, Ant Finance, and Betterment. InsurTech refers to the use of technology and innovation to make the insurance industry more efficient and customer-centric, typical Chinese firms including Ping An Insurance, Taikang Insurance Group, and Sunshine Insurance Group.

What is the FinTech status quo in China and what is the motivation driving it?

[Source: Goldman Sachs Global FinTech Survey China summary in 2017]

The mobile payment scene in modern China

In 2018, mobile payment saw vigorous volume growth, up 7.4 percent at the first half of the year, reaching 566 million people according to a report on the country’s internet development by the China Internet Network Information Center (CNNIC). In addition, the percentage of Chinese internet users using online financial services rose from 16.7 percent to 21 percent in the first half of 2018. Overall, 788 million Chinese used mobile phones to surf the internet in the first half of 2018, making up 98.3 percent of the total internet users.

[Source: Daxue Consulting]

Competition for market share has propelled innovations that connect online payments with face-to-face retail transactions. QR codes, a type of matrix barcode, have been vital in facilitating the offline-to-online interaction and are widely used in China’s retail businesses, from street food vendors to Starbucks, from subway tickets to taxis, and even street performers. QR codes can be used for both the buyer and seller, for example, a shopkeeper can display a code that customers scan with their mobile phone to initiate a payment, or a customer’s WeChat or Alipay account can generate a unique, transaction-specific code that a retailer scans to complete a transaction. In either case, the mobile phone serves as both the credit card and the wallet. Money transfer between parties is also as simple as sending a text message.

Two ways of QR codes applications [Source: Daxue Consulting]

In popular destinations such as Hong Kong, Thailand, Japan, and Korea, WeChat Pay and Alipay are aggressively expanding their reach by forming local partnerships with places frequently explored by tourists, including airport duty-free shops, scenic spots, shopping malls, and restaurants.

An average Chinese consumer has 3.6 debit cards, but only 1 out of 3 has a credit card. The low credit card penetration but extremely high debit card penetration set a unique stage for digital payment to grow. Also, the low penetration of credit cards meant there was a massive, untapped pool of consumers needing credit, paving the way for FinTech in the credit space. As merchants were onboarded rapidly due to the low fixed cost of adoption and incentive pricing by Tencent and Alibaba, it became possible to use digital cash in Alipay or Wechat Pay accounts to buy almost anything. That’s the reason, we believe, why mobile payment has become more prosperous in China than in anywhere another country else in the world. China was a late mover in terms of digitization and mobile penetration but leapfrogged into being a global leader.

As for the scene of mobile and online payments, we identify B2C (Business to Consumer), C2C (Consumer to Consumer) and B2B (Business to Business) as the three main payment channels in China based on nature of the transaction. However, the fact is that it will be hard for third-party payment companies to make meaningful direct profits from payment processing unless they have other channels for monetization within their ecosystem.

CONTACT US NOW TO ANSWER YOUR QUESTIONS ABOUT BUSINESS IN CHINA

The unique attributes of the Chinese digital landscape propel a cashless trend in the country

China’s FinTech miracle lies in the country’s unique technology ecosystem: a tech-savvy population, an underdeveloped banking industry, and an initially relaxed regulatory environment. Perhaps most significant of all, more than 95 percent of China’s internet users—or 772 million people—access the web via a mobile device, according to CNNIC. All the above, the unique environment cultivates Chinese users’ to be heavily reliant on mobile payment, which in turn drives the development of online lending and its adoption.

China has become the global leader in online lending, accounting for three-quarters of the worldwide market. The majority of China’s online lending is peer-to-peer (P2P). Online lending platforms connect potential borrowers with lenders who are seeking returns higher than bank-offered interest rates. Among online lending platforms, there are multi-functions players such as Meituan Dianping which expands its business to mobile payment and online lending. It is evident in the industry that mobile payment can rarely bring much profit, but many market players regard mobile payment as a gateway to drive traffic into their closed-loop ecosystems and then, reap benefits from online lending services. The same logic why Baidu, spent 900 million RMB to initiate the sponsorship with CCTV Spring festival gala in 2019 to promote Du Xiaoman Financial.

Small and medium-sized enterprises (SMEs) are behind the momentum for online lending services in China

According to the World Bank’s 2012 Enterprise Survey, Chinese SMEs received less than 25 percent of the loans extended by Chinese banks even though SMEs accounted for over 60 percent of China’s GDP and 80 percent of urban employment. This discrepancy in bank lending was attributed to the lack of qualified collateral and credit histories among SMEs.

FinTech firms, noticing the surplus of underserved individuals and SMEs, stepped in to fill the void. FinTech can play a significant role in helping close the gap between the financing needs of private enterprises and banking products at the time when banks might become more reluctant to address this issue amid downward pressure, according to experts and officials.

Historically, the traditional banks in China focused more on serving the state-owned enterprises (SOEs), leaving the financial needs of consumers and SME’s overlooked.

As China’s economy enters the ‘new normal,’ a mostly investment-and-SOE-led economy is no longer sustainable, and thus, consumption and SME growth are becoming more pivotal drivers. With that macro backdrop, the government and regulators have explicitly expressed support for financial innovation and internet finance since 2013 and imposed far less regulatory constraints initially.

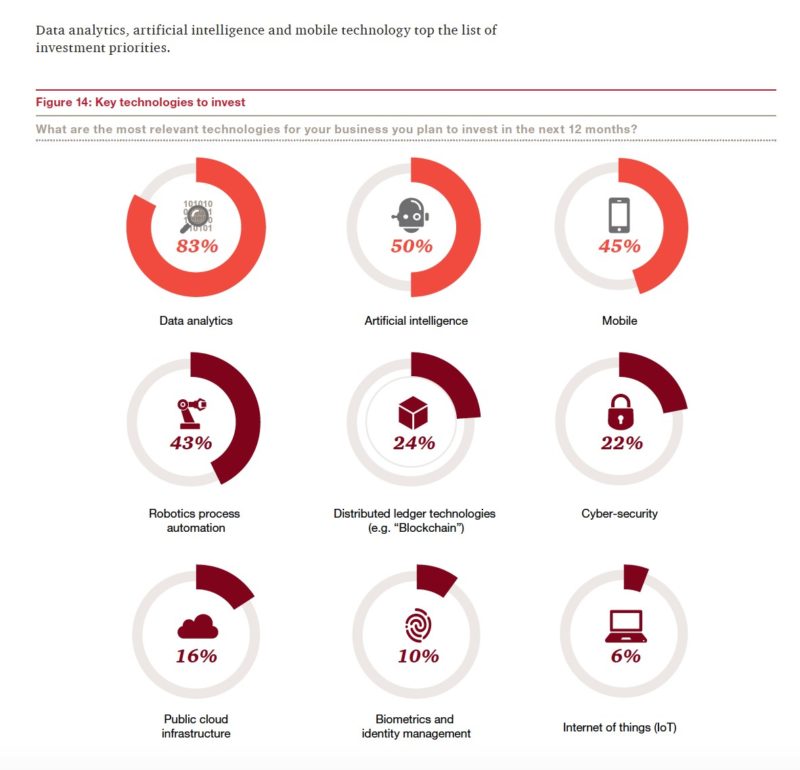

Ant Financial (an Alibaba affiliate) applies AI technologies to its lending business and explores blockchain technologies to build a more transparent platform. The FinTech firm provides small loans to effectively support the fragmented credit demands of China’s massive population of SMEs and individual entrepreneurs who find it difficult to obtain loans under the traditional banking system, to help them to grow and innovate. Based on big data and internet technologies, Alipay has been able to offer its 310 loan services to rural consumers and small business owners without collateral guarantees. It takes three minutes to make an online application, one second for a lending assessment, and zero manual intervention in the whole process (Hence the name ‘3-1-0’ lending). Not only FinTech firms strive to grab a slice of this lucrative pie, but also Chinese traditional financial institutions are concentrating on adapting legacy systems to data analytics and mobile technology, to catch up with the advancement of the industry. According to PWC, data analytics, artificial intelligence, and mobile technology top the financial institutions’ list of investment priorities.

What are the most relevant technologies for the business to plan to invest? [Source: PWC]

Investment on emerging technologies centered on customer service

Emerging technologies, heavily leveraged by FinTech and BigTech firms have created a paradigm shift in customer experience that eliminates multiple pain points across the customer’s life cycle. According to the survey of PWC, China’s financial institutions are planning to pour 32 percent of investment on the technology – more than double the level of their global peers. However, the customer should be the focal point of their corporate strategy instead of clear laboratory focus. The rationale is that advanced technology tends to be easily replicated or even adapted by imitators. Whereas customer retention contributes to a promising prospect, which is a lasting cash cow for the company. Therefore, alignment with customer goals, the creation of the trust, and delivery of digital, agile, and efficient processes are catalysts for success.

Design-based thinking and simple-to-follow user-interfaces are making the customer journey quick, convenient, and seamless, while insights driven through data-focused technologies are ensuring relevant, personalized offerings.

Through innovative use of technologies, FinTech firms are delivering low-cost personalized products and are having a significant impact on raising customer expectations while also increasing pressure on traditional firms.

How are regulations affecting the FinTech industry in China?

Regulating the FinTech industry is a dynamic balancing act and regulations may constantly evolve through trial and error. Due to the nascent nature of the business model and the public-private collaboration, it is difficult to anticipate future policy directions. Thus, we believe it is essential to track the development of how a few early initiatives unfolded, as it could have broad implications for regulating the rest of the FinTech industry. According to the report of Goldman Sachs, here are some significant regulations imposed by the Chinese government from 2016.

2016: Chinese government laid out a comprehensive policy framework for regulating the internet finance industry across all verticals, namely lending, insurance, crowdfunding, payments, fund distribution, consumer finance.

March 2017: Established centralized clearing house (Wanglian) for all third-party payments, enabling regulatory oversight on fund flows, which were previously circumvented by FinTech players. What is unique here and very different from most of China’s infrastructure is the involvement of private capital (Ant Financial and Tencent each own 9.61% of Wanglian).

May 2017: Central bank set up a FinTech committee to act as overall coordinator of all FinTech efforts and policies.

Overwhelmingly, the most significant factor that limits the mass application of financial technologies is regulation. Regulation in this sense can either be classified as lack of regulation clarity or over-regulation of technological development.

Regtech (short for ‘Regulation and Technology’), coming along with FinTech, is gaining momentum globally. RegTechs is the innovative application of technology and new business concepts to the challenges firms face in managing regulatory risk and compliance. It aims to mobile adoption of big data, AI, cloud computing and other technology to improve cross-industry/ cross-market risks identification/prevention. In addition to the technology-driven developments in its retail banking business, CNCBI sees RegTech present numerous solutions which can simplify processes and reduce costs. In the field of commercial and corporate banking, new developments in blockchain applications, and account opening and account management processes, also promise new opportunities.

Contact us for any question on the Chinese market

What is the future of FinTech in China?

Disruptors and competitive landscape

40% of the retail consumption today in China is done via third-party payments. Alipay and WeChat Pay now dominate the space with 84% market share, but sizeable players from other industries are joining the race. They are planning to develop the locked-up system facilitating their ecosystems, and thus fierce competition in the sector would last in the expected future.

Future monetization, concealed in their own ecosystems, will likely come from targeted advertising, consumer financing, and wealth management.

However, it’s proper to have a glance at the payment field, probably unveiling the steepest competition. We expect fee competition to intensify and wait to see more M&As in the payment space, as players in adjacent industries scramble for payment licenses to close their loop, and banks themselves catch up in innovation.

Fee competition: With the introduction of Wanglian, the already fierce fee competition will likely get more intense, when more banks and UnionPay join the battleground. Part of the current fee charged on offline merchants can be as low as 0.38% from many payment companies, while the 0.6% official guideline.

M&A: Due to owing the license itself is still valuable, many cash-rich players from other industries are looking to close their loop. Among the suitors, there are not only traditional industry magnates who seek to keep their competitive advantages in the digital age but also rising tech stars in the online-to-offline service industry. Therefore, the demand for a payment license continues to increase, especially from tech start-ups with early success. They either want to close the loop with their supply chains, or are incentivized to expand onto the adjacent growth area to boost their respective valuations. In either case, the fact leads to new, significant, private entrants not likely being ruled out of the current landscape or ecosystem.

China FinTech ecosystem is the high level of integration, both with offline businesses and along the entire finance supply chain, Alibaba, Tencent, JD, Baidu, for instance.

We believe the conglomerate structure and the ‘integration’ mindset will continue to shape how Chinese business leaders think about their overall strategies, or how they evaluate the specific business lines return – always in a context of the whole ecosystem, and rarely by individual lines. This probably explains why companies invest heavily in the payment businesses, although the profit profile is rather unattractive.

Utilizing FinTech in B2B models

B2B tends to move very slowly given the significant time and cost required to change the technology infrastructure. Plus the adoption of electronic payments (such as bank transfers) was much higher, to begin within the B2B area. We could see a significant shift in the long run, especially in international B2B payments. But for now, most disclosure on payment company TPV (冠捷科技) includes only B2B payments related to e-commerce, and the growth has been relatively slow.

After Alibaba, Pony Ma, the chairman of Tencent, has shifted the corporate strategy onto serving the upper side of the value chain – suppliers. Utilizing FinTech in B2B model, he ensures the next explosive growth in the prospected China’s business lies in big, medium or small companies, given that Chinese consumers have been well educated.

Daxue Consulting insights: Behavior-based customer analysis

AI seems already to have the capability to gather, analyze and anticipate human behaviors in most cases. For example, they can move from the traditional segmenting of customers by geographic location and demographic factors, such as gender, age, occupation, and financial parameters. A more sophisticated segmentation method, psychographics, helps banks define them based on their personalities, lifestyles and social classes; thus providing a better understanding.

Behavioral segmentation extends this subtler differentiation further, for example, distinguishing between those customers in a specific segment whose preference is still to use cash for payments and those who opt for debit and credit cards. Appropriate marketing campaigns can then be devised for each section.

As a core engine of Alibaba’s financial affiliate Ant Financial, the world’s largest third-party payments platform, AI has been used widely in the company’s businesses, including intelligent customer service, transaction risk control, marketing, virtual damage assessment for car insurance, loan approval and anti-fraud processes.

Besides, AI could effectively improve the construction of the social credit system which is now pursued by the Chinese government. Government officials are willing to further stabilize the society via advanced technology. Fan Yifei, deputy governor of the People’s Bank of China, said on the Fintech and Construction of a Social Credit System Forum that with the innovations in technology he is confident that China’s social credit system will be a success. However, innovative development and risk prevention are fundamentally intertwined and to meet the demands of people for a better life and for the system to be successful, both must be considered in equal measure.

While it is now widely accepted that the effective collection and utilization of data is becoming crucial to future business success, sophisticated and systematic analysis of data helps us to formulate new insights about customers, thereby driving new products and services. It also facilitates us to adjust our risk appetite and enhance our fraud monitoring capabilities.

How can foreign companies harness FinTech to gain a competitive edge in China?

For international companies operating in China, there is undoubtedly the ability to leverage FinTech to gain a competitive edge – if they are dynamic enough to navigate the Chinese market. The Chinese FinTech industry is developing at a breakneck pace – primarily driven by massive central & private investment, a STEM-heavy pool of talent and favorable regulation. “China has focused on promoting widespread adoption of key emerging (primarily applied) technologies, which inherently drives development and consumption within the technology sector,” observed by Stephen Hopkins, the former Director of Strategy at Clipper Coin Capital, an expert in the FinTech area. Firms then have access to capital, a skilled workforce, governmental support, and the world’s 2nd largest economy – which means that carving a niche in the market is plausibly attainable for firms with marketable products that solve real market problems. Hopkins suggests that depending on the nature of the firm, they could then use their technology or product to disrupt the traditional financial industry (with the goal of reaching economies of scale or being acquired) or leverage their success in the Chinese market to attract foreign institutional partners seeking to expand into the Chinese market.

In this early stage, the ROI for implementing FinTech solutions varies greatly amongst organizations. For large financial conglomerates (banks, brokerages & insurance agencies), FinTech is seen as more of an insurance policy that future-proofs their operations while also providing incremental value for preexisting products & services. Large banks see FinTech as an industry disruptor, but through strategic acquisitions of startups, they can either incorporate or kill technologies that could disrupt their core operations. While for SMEs, FinTech is everything – it’s how they differentiate themselves from competitors and make money. Most FinTech companies nowadays would likely consider themselves more “tech” than “fin,” with the technology simply being applied to the financial services industry.

The challenges in the Chinese market that await FinTech applications

The possible danger is that FinTech may upset business models that serve the greater good without providing viable alternatives. In response to the growing competition they face from technology startups, traditional banks may take more risks to cling to a shrinking market share. And the rush to overhaul business models, or to adopt unfamiliar and rapidly evolving technologies, may weaken internal processes, creating another source of potential loss. While financial institutions and FinTech companies are willing to increase partnerships, challenges need to be addressed. IT compatibility and differences in business models top the list among certain risks.

More broadly, the rapid rollout of new technologies gives lower-skill workers little time to adapt, and may ultimately cost some of them their jobs. Individuals might gain as consumers but lose as employees. Smart investment systems in Wall Street have caused unemployment in some big firms and, this issue expects to expand worldwide shortly. The balance of these two effects will differ across segments of society, potentially leading to greater economic inequality.

When there is a danger, there is a possibility for the human being to progress, and that’s how history evolves all the time. The dawn of FinTech, on the one hand, brings challenges for traditional financial institutions; on the other hand, unveils the precious timing for banks to revolutionize their business models. Pains are deemed as upside, though it will take some time to adapt to the new era. As for the unemployment, it’s trickier to tackle it since the stereotype in people’s mind needs to change to catch up with the upcoming trend. Don’t settle, to quote Steve Jobs, quite relevant to this situation. Except for employees continually learning, the governments need to take account for taking care of their people, to maintain society stable in the long term.

Foreign opportunities in China’s FinTech scene

In conclusion, FinTech must play a vital role in the future business world. In China, FinTech is still a blue ocean, and hence, foreign companies may leverage the already-existed-broadly-adoption mobile payment among Chinese people; and also, international players should emphasize on technology which is expected to create synergy in the financial scenes, such as more transparent and efficient transactions, further acknowledgment of domestic companies as well as local customers, etc. As we stated before, BankTech, PayTech, InsurTech, WealthTech, and Regtech are all different yet interrelated dimensions for foreign corporations to consider.

Related Reading:

Author: Will Qian

Daxue Consulting helps you get the best of the Chinese market

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.

![[Podcast] China paradigm #25: How to connect an overseas store to 900 million Chinese consumers using mobile payment](../wp-content/uploads/2019/04/China-marketing-podcast-25-150x150.jpg)