PayPal officially entered China’ online payment market | daxue consulting

On September 30, 2019, the state-owned People’s Bank of China approved PayPal’s acquisition of the majority stake of GoPay (国付宝 Guofubao) – a company running third-party payment platform in China. PayPal acquired 70% of GoPay’s equity interest through its China-based subsidiary, MeiYinBao Information Technology (Shanghai) Co., Ltd. (美银宝信息技术上海有限公司), and became the actual controller of GoPay China. As a result, PayPal successfully entered China’s online payment market.

PayPal is a NASDAQ-listed world-leading third-party payment company, which supports more than 100 currency transactions worldwide. PayPal has more than 286 million active payment accounts in more than 200 countries and regions around the world. Although PayPal has been cooperating with local Chinese companies, it was not able to enter Chinese Market officially until recently.

PayPal overcome the legal restrictions in mainland China

What has held PayPal back from entering China for so long? The previous difficulty lay in the restriction of Chinese financial policies. Local payments cannot be made in mainland China, which means that Chinese consumers cannot use PayPal to pay domestic merchants. But now, the door has opened for PayPal China. According to GoPay, the company is licensed by the People’s Bank of China to operate online payment and mobile payment service. GoPay also has the fund payment business license in China as well as the cross-border RMB payment business license. Through the acquisition, PayPal China is now able to overcome the legal restrictions in mainland China.

“We look forward to partnering with China’s financial institutions and technology platforms, providing a more comprehensive set of payment solutions to businesses and consumers, both in China and globally,” PayPal CEO Dan Schulman said in a statement on LinkedIn.

China’s online payment market

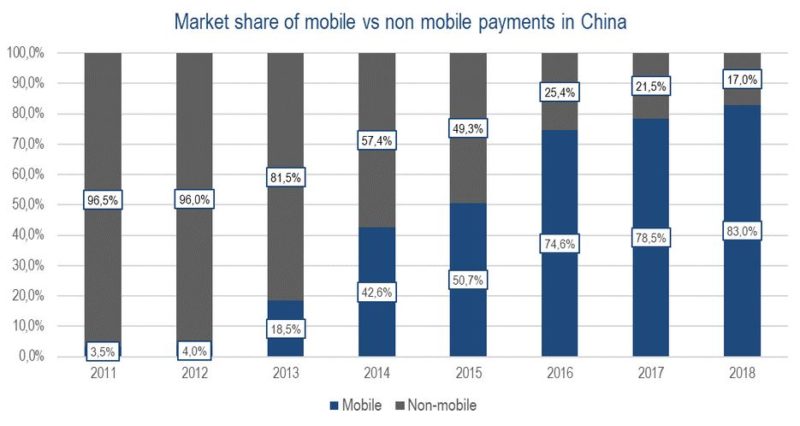

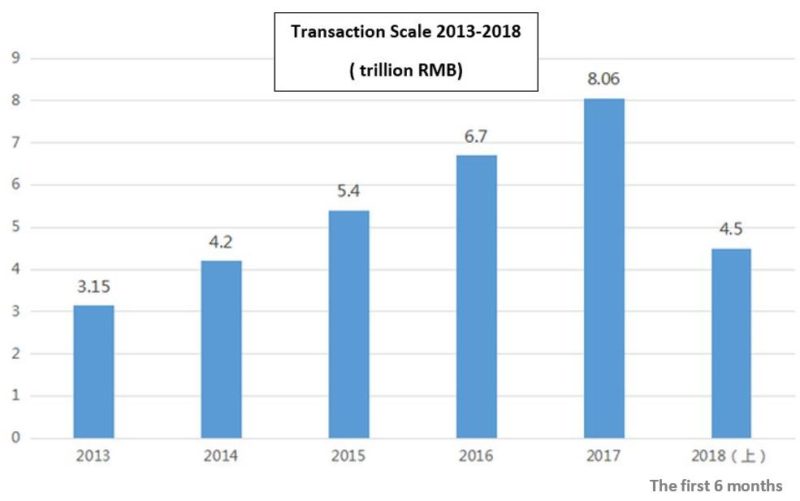

China’s online payment market is substantial, with total transaction values more than doubling to 2,126.3 trillion yuan (roughly USD$200 trillion) in 2018 compared to five years previous. That is due to, firstly, the rapid growing of e-commerce among Chinese consumers; Secondly, the higher and higher internet and smart phone penetration in China. The convenience of online shopping and strong awareness of technology among Chinese consumers are boosting not only the development of online retailing, but also China’s mobile payment market.

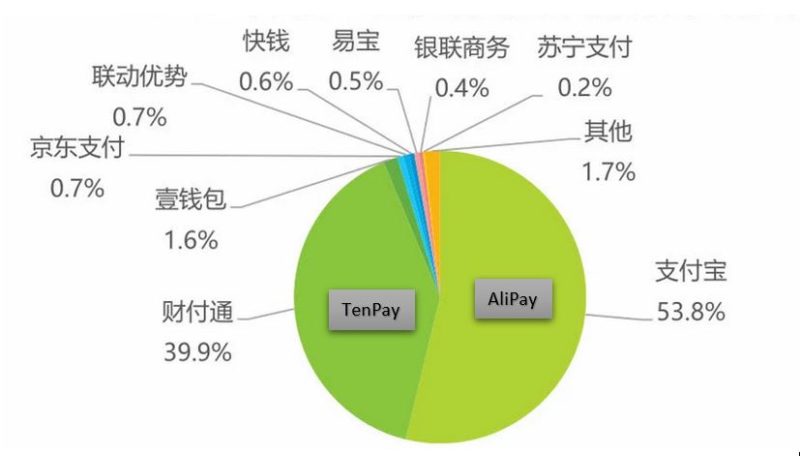

Yet, it seems difficult for PayPal China to compete with the domestic players on the local market as a third-party payment platform in China. The chart below shows China’s third-party payment market share in the first quarter of 2019. As it can be seen: the market is dominated by Alipay owned by e-commerce giant Alibaba and TenPay owned by Tencent. These two companies account for more than 90% of the total market.

China’s mobile payment market

China’s mobile payment market projected to grow 21.8% to $96.73 trillion. Furthermore, the number of active mobile payment users is expected to double by 2023. Within the fast-growing online payment industry, mobile payment shares a higher and higher proportion. Whether it is a 5 RMB (less than 1 USD) purchase at a market or a huge haul in the mall, most Chinese consumers are comfortable to pay with their mobile phones. According to PwC’s Global Consumer Insight Survey 2019, 86% of China’s population will make use of mobile payments in 2019, for the highest mobile payments penetration rate of any country in the world.

China’s mobile payment market has been growing with a tremendous speed thanks the fast development of FinTech in China. The ubiquitous QR Codes make the mobile payment extremely fast and convenient for the consumers. There are two ways to pay via QR Codes in China:

First, the customer scans the seller’s QR code, which is very often printed and visible at the places such as the checkout, restaurant tables or even product itself. Second, the customer shows the QR code displayed on his/her smartphone to the seller for scanning.

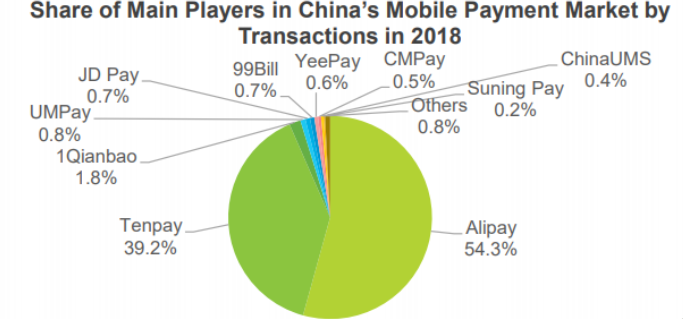

PayPal China will have to face the same two huge competitors – Alibaba and Tencent – on China’s mobile payment market. Alipay and TenPay together make up 92% of the mobile payment market by transactions in 2018. Tencent had only a 15.9% market share by 2015 and was able to reach almost 40% of the total market share in the last year.

TenPay (incl. WeChat Pay and QQ Wallet)

Although Alipay toped the market share by transactions, TenPay had the biggest market share by penetration rate in China, with 84,3% in 2018. Tencent owns WeChat – the most popular social media App in China and has developed the most used mobile payment solution in China: WeChat Pay.

WeChat pay transaction fees of 0.1% start at withdrawals over 10,000 RMB as well as overseas transactions such as in case of cross border commerce. The app currently supports 9 currencies, yet cross-border transactions can still be complicated. To be able to become more powerful on China’s payment market, WeChat has recently partnered with Adyen, an international payment technology company to facilitate access to China for foreign companies.

Alipay

Alipay is developed by Alibaba, owner of China’s leading online shopping website – Taobao. Alipay is the only online payment system used on Taobao. Considering low trust in China’s online payment market, they introduced escrow (the payment is made by the buyer before the product is shipped and the payment is released when the product is received) and immediate payment (used to pay for hotel room bookings, flight bookings or other items with no physical delivery) to solve the trust issue.

There is no setup fee for Chinese companies, they only need to pay 0.7-1.2% transaction fees. Foreign companies needs to pay USD 1,000 to set up on this third-party payment platform in China. Transaction fees are btw. 2.5% to 3.0% depending on the annual transaction volume.

PayPal’s possible breakthrough in China: cross-border e-commerce and overseas travel

For PayPal China, it seems difficult to compete with the local players on both China’s online payment market as a third-party payment platform in China as well as on China’s mobile payment market. PayPal China’s breakthrough may lie on cross-border payments such as cross-border e-commerce and payments made across the sea (travel).

China’s cross-border e-commerce market saw 8.8 trillion RMB transactions in 2018, over 20% of which are import e-commerce sales. The top platforms are Tmall Global and NetEase Kaola. Alipay dominates these online shopping platforms. 25-34 years-old are the largest user segment making up 48%. Furthermore, cross-border online shoppers are highly educated with high incomes. It is worth mentioning that it is also more and more common for these wealthy Chinese millennials to shop directly from platforms out of China (such as Amazon.com) or online flagship stores across the sea. The reason is cheaper price or better quality, sometimes also due to the unavailability of certain products within China. In this case, a PayPal account can be much more useful for Chinese consumers.

The purchasing power of Chinese consumers during travel can also not be underestimated. Data from the International Association of Tour Managers shows that overseas travel spending by Chinese tourists reached USD 261.1 billion in 2016, an increase of 4.5% year-on-year ranking first worldwide. According to the Outbound Chinese Tourism and Consumption Trends: 2017 Survey, jointly issued by Nielsen and Alipay, during their most recent overseas trip, 65% of Chinese tourists paid for their expenses via mobile payment, while a mere 11% of their non-Chinese counterparts used mobile payment. Although more and more countries are offering Alipay and WeChat Pay at their airports and shopping malls to encourage Chinese tourists to spend more, it remains a small portion. On the other hand, PayPal has a much better chance on the payment market providing Chinese consumers with a quick, easy and safe payment solution outside of China.

Author: Chencen Zhu

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes

![[Podcast] China paradigm #25: How to connect an overseas store to 900 million Chinese consumers using mobile payment](../wp-content/uploads/2019/04/China-marketing-podcast-25-150x150.jpg)