Automotive industry in China: How carmakers compete for first place

Auto industry in China.

China has been the world’s largest automotive market for years. That is why carmakers around the world are fighting to sell their cars to Chinese consumers. However, in a market mainly dominated by Chinese brands (42%), what are the trends and growth drivers that international carmakers can follow?

The automotive sector is one of the top pillar industries for China’s economy and a major employer. In 2019, for example, the automotive sector contributed 9.6% of the total retail sales of consumer goods. The sector also accounted for around 10% of total employment in China.

COVID-19 impact on the automotive industry in China: decline in sales

COVID-19 placed significant burdens on the automotive industry in China. Hubei Province where the outbreak started, accounting for about 9% of the country’s auto production. Wuhan, Hubei, as one of the key development cities of the country’s six major automobile industrial clusters, not only gathers many vehicle manufacturers, but also has more than 500 automobile parts enterprises.

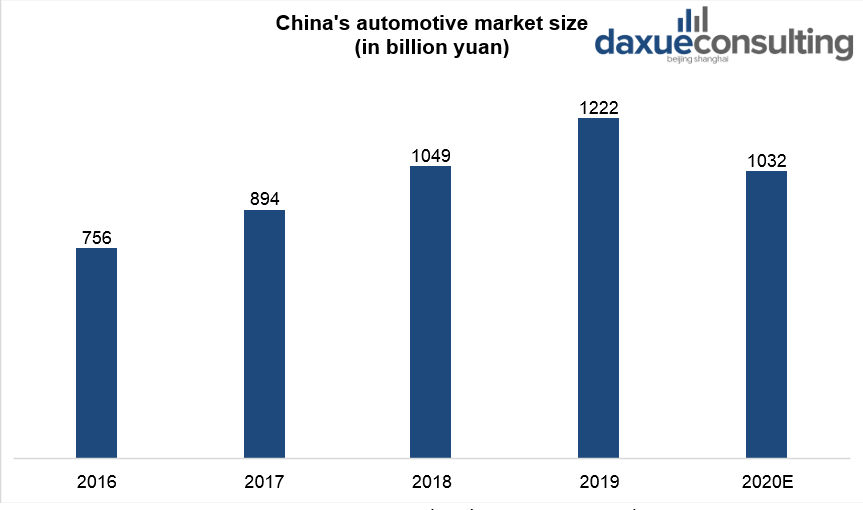

The auto industry is especially facing major challenges both on supply and demand side—new passenger car sales in the Chinese market slumped by over 80 percent in February 2020. Forecast shows that China’s automotive market will decline 15.5% in 2020.

Data Source: Statista, PwC, China’s auto market size

China’s first quarter vehicle sales saw the biggest impact. According to the China Association of Automobile Manufacturers, sales of passenger cars declined 42.4% year over year during that period. SAIC, one of China’s largest manufacturers, reported a 44.9% percent drop year to date in April. Its SAIC-Volkswagen and SAIC-General Motors joint ventures, dropped 50.4% and 47.7% year over year in retail sales from January to April respectively.

Government policies to help the automotive industry in China

To stimulate the automotive market, government launched some policies. 10 cities released incentive schemes. For instance, Guangzhou announced a subsidy of 10,000 RMB for New Energy Vehicles sold between March and December. Additionally, a State-level subsidy to New Energy Vehicles was extended until 2022.

Epidemic highlighted imbalance of car brands in the Chinese market

The epidemic has exacerbated the imbalance between the various car brands. From January to March 2020, the total sales volume of the top ten enterprise groups was 3.295 million units. It had a year-on-year decrease of 41.7%, which was 0.7 percentage points lower than the industry decline. It accounts for 89.7% of total car sales, which is 1.1 percentage points higher than the same period last year. This shows that under the impact of the epidemic, the market share of small brands has shrunk even more.

A phenomenon worth noting is that compared with last month, the sales of major foreign brands also showed a rapid growth, of which the growth rate of Korean brands is particularly significant.

COVID-19 boosted electric cars market

China’s reaction to the crisis shows a commitment to new technologies, signaling how the crisis could build resiliencies moving forward. The real opportunity after COVID-19 lies in the shift from internal combustion engines to cleaner, electric vehicles in China. China is set to keep its long-term strategic goals for automobile electrification and meet climate change goals set by the Paris Agreement.

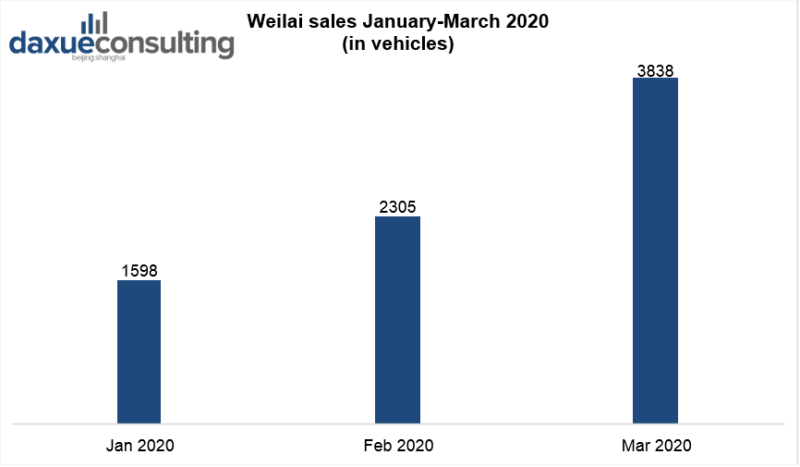

In March 2020, the production and sales of electric vehicles were also significantly better than that of the previous month. The growth rate was rapid and the year-on-year decline was narrower than that in February. For example, electric car maker Wei Lai released the delivery data for March 2020. The delivery volume reached 1533 units, an increase of 11.7% year-on-year and an increase of 116.8% month-on-month.

The auto industry in China slowly rebounds back

On February 2020, due to China’s recovery from the coronavirus outbreak, car companies ushered in the first wave of resumption of work. They include Geely Automobile, Great Wall Motor, Changan Automobile, Xiaopeng Automobile, Weilai Automobile, Tesla Shanghai Super Factory and so on. The outbreak of the epidemic has also made car companies pay more attention to the online car sales model. Many brands have launched online car purchase activities during the epidemic, thereby stimulating consumers’ desire to consume.

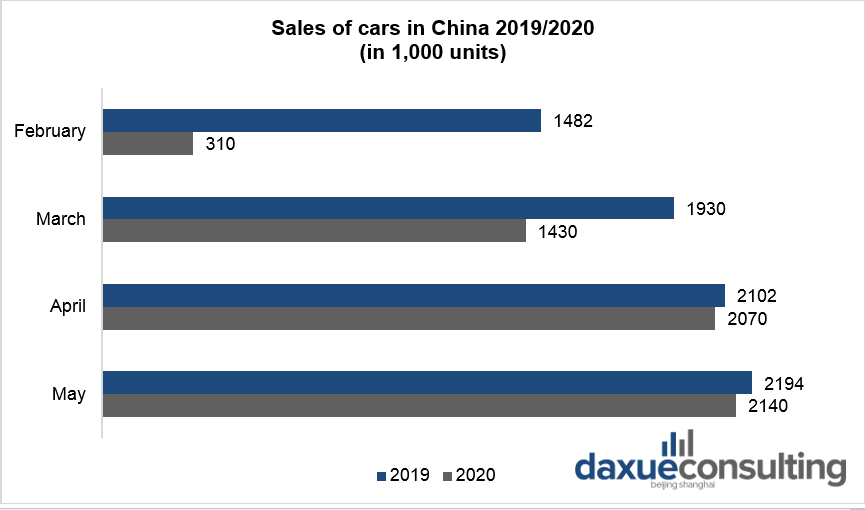

In March 2020, as the industry’s orderly resumption of production, the monthly production and sales volume rebounded significantly, but still did not reach sales level of 2019.

Data Source: China Association of Automobile Manufacturers (CAAM), China car sales 2019/2020

Retail sales of light passenger vehicles also surged ahead in March, as reported by the China Passenger Car Association. Year over year, March 2020 sales were still below 2019 levels, but 26%, not the 80% drop seen in February. Sales in April 2020 have begun to catch up with just a 2% drop year over year.

Automotive brands show signs of recovery

From the perspective of different brands, Changan Automobile sales reached 119,000 in April 2020, an increase of 32% year-on-year, ranking first. In April, the company achieved sales of 105,400 units, an increase of 44% month-on-month and 2% year-on-year. Great Wall Motor sold a total of 81,000 new cars in April, an increase of 35% month-on-month.

Chery Automobile increased by 15% month-on-month in April 2020, but continued to show negative growth year-on-year.

Volkswagen’s China terminal sales in April 2020 were 16.57 units, an increase of 9.9% year-on-year and an increase of 41% month-on-month.

Weilai (also known as NIO) delivered 1,533 vehicles in March 2020, an increase of 117% QoQ.

Data Source: China Automobile Association, Weilai sales January-March 2020

Therefore, key automotive brands show the signs of recovery, however this process will take time.

In 2020, mainstream automakers supposed to have many new models launched on the market. However, due to the impact of the coronavirus epidemic, it is difficult to carry out offline listing activities such as test drive, auto show, and press conference.

Data Source: China Automobile Center, Summary of originally planned models to be launched in the first quarter of 2020

Chinese auto industry still has big potential

Despite the significant impact of COVID-19 on China’s automotive industry, the market potential is still quite huge. China is still expected to become the largest vehicle market with around 260 million units in operation. At 173 units per person now, there is room in China for more light passenger vehicle purchases.

However, after COVID-19, the market will definitely not simply snap back to where it was before the pandemic. According to a forecast from IHS Markit , light vehicle sales will decline 15.5% in China for 2020.

Why 2018 was a turning point for car manufacturers in China?

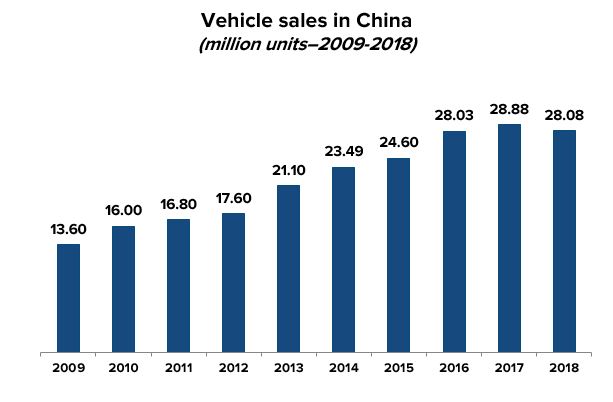

For the first time in twenty years, sales in the automotive industry in China are declining

In 2018, for the first time in 20 years, China saw its new car sales decline by 2.8%. In 2017, 28.88 million cars were sold in China compared to only 28.08 million in 2018.

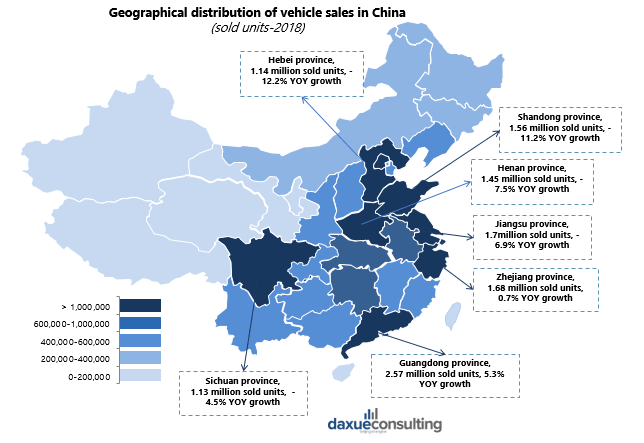

Sales in most provinces of the China declined in 2018 except Guangdong, which saw an increase of 5.3% compared to last year, which can easily be explained by the rapid development of the local economy (Guangdong has had the highest GDP for 29 years in China).

Despite this decline, China remains the world’s largest automotive market, accounting for about 30% of total global car sales in 2018. Compared to the 28 million cars sold in China in 2018, only 5.2 million cars were sold in Japan, 16.5 million in Europe and 17 million in the United States in 2018.

But then what explains this decline in car sales in China?

Contact us for any question on the Chinese marketAlternatives to cars are increasingly successful in China

One of the main reasons for the decline in car sales in China in 2018 is that there are many relevant alternatives. Chinese car shoppers are increasingly value minded and open to the alternatives to buying new cars. Moreover, the younger generation of Chinese is increasingly sensitive to environmental issues and tend to consider more environmentally friendly options.

In recent years, car-hailing apps have been gaining popularity in China. By the end of 2018, there were more than 100 car-hailing platforms in China, and the total number of car-hailing app users has exceeded 330 million.

This is the success of car sharing apps such as Didi Chuxing or bicycle sharing apps such as Mobike, which have seen their number of users increase in recent years:

Didi Chuxing

Didi is now one of the main alternatives to owning cars in China.

The business model of this Chinese transportation network company can be compared to Uber’s model. The cost of fares is very low and the simplicity of the service, easily ordering a fare on the app, make China gradually becoming the largest ride-hailing market in the world, with a value of US$30 billion.

In 2018, Didi held more than 80% of China’s ridesharing market.

Mobike

Mobike, a fully station-less bicycle sharing company in China, also offers a great alternative to private cars in China, especially in big cities.

Bikes are often used to connect to buses and subway stations, what we can call intermodality. For example, in Shanghai, approximately 1 in 5 users take bikes to make subway and bus connections (Mobike, 2018).

Thus China has now become the leading country both in terms of ride sharing and bike sharing in 2018, and this can be bad news for car manufacturers in China.

Second-hand car market shows growth in China

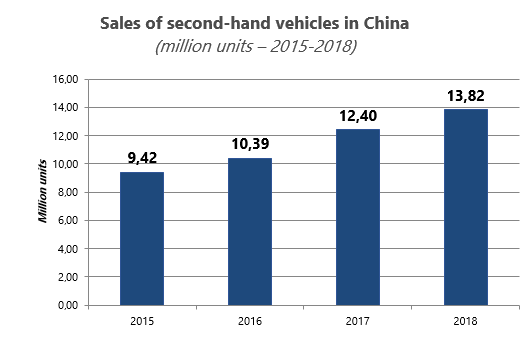

The Chinese craze for used cars is also an essential reason for the decline in car sales in China in 2018.

In 2018, second-hand car sales in China rise with a growth of 11.5%. Sales are even expected to reach over 20 million in 2019.

As consumers prioritize value for money, they become more price conscious and lose confidence with spending. Online marketplaces for second-hand cars, like Renrenche (人人车), Uxin (优信) or Guazi (瓜子), are also developing fast and allow customers to find the best price quickly without having to visit multiple brick and mortar shops.

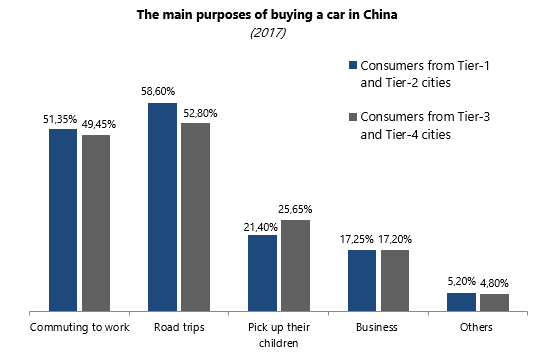

Despite this, consumers continue to buy private cars in China, whether for practical reasons or for pleasure. According to the graph below, 58% of them buy a car to travel comfortably on holidays. Driving has been a very popular way of travel (average 300km) in China. In Tier-3 and Tier-4 cities, the school bus hasn’t been very popular, so many parents also need safe and convenient transportation for their children.

New-energy vehicles in China have become very trendy

Electric cars sales are increasing

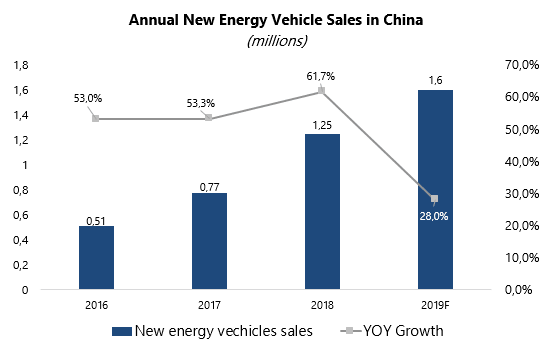

Electric or hybrid cars have been very successful in recent years in China, thanks in particular to the support of the Chinese government but also because buying an electric vehicle avoids the cost of purchasing a license plate, which is a considerable saving.

In 2018, the sales of new energy vehicles in China consistently grew reaching 1,25 million units sold.

Buyers of new energy cars in China are mostly urban and young: 40% of China’s electric car sales in 2018 came from 6 large Chinese cities which are Beijing, Shanghai, Shenzhen, Tianjin, Hangzhou, and Guangzhou because of the awareness of the pollution problems inherent to combustion vehicles and the gasoline-car restrictions that have been implemented in these cities. Most of them are also the first person in their family ever to own a car.

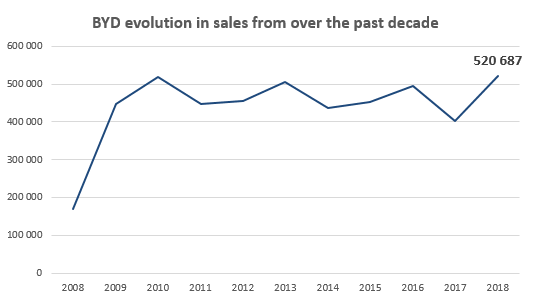

China’s biggest electric carmaker: BYD

BYD Company Limited was China’s top-selling electronic car manufacturer in China in 2018. Created in Shenzen in 2003, the brand launched its first electric car model, the E6, in 2011.

In 2018 BYD sold a total of 520,687 cars in China including 247,811 electric vehicles, achieving a year-on-year jump of 25%.

The best-selling BYD model in China in 2018 is the Song, 91,426 units sold, for an average price of $28,000.

BYD’s marketing strategy in China is to develop a flexible and segmented offer to reach a wider audience: BYD then decided to go on all-in on hybrid rather than pure electric with one of its model, ‘Qin.’ It is a more flexible option for consumers, who can drive it as an electric car for their daily commute and reach much farther distance without having to worry about charging.

Thanks to its various plants in China the company also has a competitive advantage to integrate all of the key components in-house. And with the help of subsidies, BYD has been able to build economies of scale, pushing down their cost per unit and allowing them to spend more on research and development.

High-connectivity: Cars in China have to be mobile-first

Connected vehicles in China have to be mobile-first

A connected car is a vehicle connected to the Internet through its communication system. It allows the driver to connect his smartphone to the car, but also the car itself to connect to the surrounding cars and infrastructure.

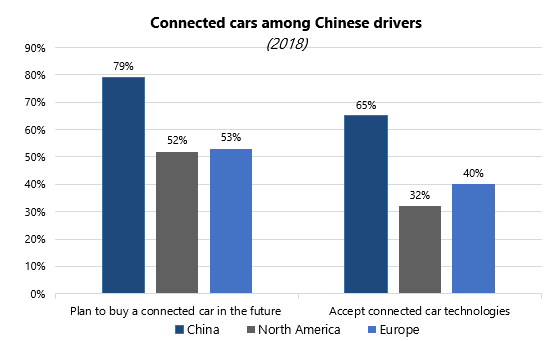

Since China is a mobile-centric nation with mobile commerce representing a quarter of the country’s overall retail market ($1.5 trillion in sales in 2019), it is normal to find this requirement in the 2018 car trends in China.

Thus the global connected-car market in China is expected to grow 270% by 2022 and 41 million people will make use of in-car connectivity by 2021.

According to a 2017 Kantar TNS study, 79% of Chinese respondents plan to buy a connected car in the future, compared to about 50% for Americans and Europeans.

According to Jack Ma, Alibaba’s chairman, there is no doubt that the future of cars in China is high-connectivity:

‘’Today, 80% of your smartphone’s functions are not relevant to making phone calls or conversation. I believe that in the future, a car will have 80% of its functions not related to just transportation.’’

But Chinese consumers are more and more difficult to please in terms of connectivity services; they are seeking innovative in-car services and are even ready to pay subscriptions for content.

Which is why automakers and tech giants are all racing peers to new tech horizons!

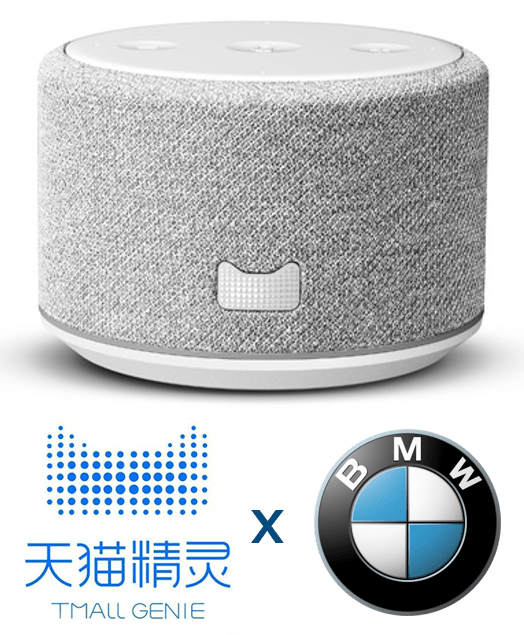

Integration of Alibaba’s Tmall Genie in BMW vehicles

The partnership between BMW and Alibaba is an excellent example: Alibaba Group’s smart assistant, Tmall Genie, will launch in select vehicles from the BMW Group in China by the end of the year.

Tmall Genie will be fully integrated into BMW vehicles, offering drivers several entertainment and shopping options in the car. Drivers will be able to use Tmall Genie to buy online, watch movies, listen to music, check the weather or make appointments appointments in BMW.

Top innovative car brands in China

Volkswagen in China has delivered its 30 millionth car to Chinese customers

For the company which connection with China started in 1978, 2018 was a real milestone. They achieve sales record with 4.21 million vehicles delivered to customers in China including 196,300 imported cars, which corresponds to a + 0.5 % evolution compared to 2017.

The best-selling Volkswagen model in China is the Lavida with 504 000 units sold in 2018, a 4-door sedan which has been sold exclusively in China since 2008. Depending on the generation, its price is between 110,000 RMB and 160,000 RMB.

Because Volkswagen was the first foreign car manufacturer in China, it can now compete directly with Chinese competitors. And the brand’s communication strategy is really to emphasize this authenticity and improves its reliable brand image.

To do that, SAIC Shanghai Volkswagen wants to show how close to Chinese consumers it is. At the end of 2018, a campaign announcing the launch of new models then revealed a desire to align the brand’s image with China’s powerful economic growth:

The timing of the publication, that was the 40th anniversary of the policy of openness and reform, was ideal.

To attract the growing target group of young, middle-class customers, Volkswagen also decided to launch JETTA as a brand in February 2019 (it was only a Volkswagen model before). The idea is to target first-time buyers, who account for 81% of the customers in the entry segment, by offering high quality, safety, stable value, and fresh design. In 2018, the brand also announced the launch of the SOL brand in partnership with the Chinese auto manufacturer Anhui Jianghuai Automobile, whose first model is an electric SUV.

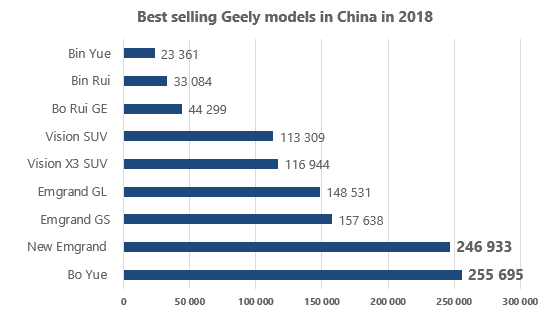

Geely in China: ‘’Making Refined Cars for Everyone’’

Geely enters the automotive industry in China in 1997 and is now among the 500 largest companies in China. In 2010 Geely group bought the Swedish carmaker Volvo.

In 2018 Geely sold 1,500,838 units in China, an increase of 20.3% from 2017 and had a 6.9% market share.

The brand has a very young customer base with 51% of customers born in the 1990sor later, it’s a new generation of young innovative consumers who have a global vision and a global mindset. Thus, Geely communicates on high connectivity and ultra-modern design to directly target this audience. They often highlight their design teams and the famous designer Peter Horbury they work with to show their modernism.

The best-selling Geely model is the Bo Yue, a compact crossover SUV with 255 695 cars sold in China in 2018.

Geely is now trying to expand internationally by developing its battery manufacturing business with CATL Geely Power Battery Co. Ltd and acquiring new foreign brands like Proton’s Norwich-based subsidiary Lotus or Daimler recently. The brand also invests heavily in new energies cars with its ambitious project Blue Geely, wanting 90% of its sales to be consist of Evs in 2020.

Contact us for any question on the Chinese marketLandrover in China: designing ‘’China SUV of the Year’’

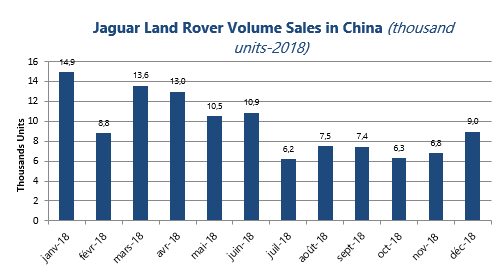

Jaguar Land Rover entered the Chinese automobile market in 2010 and has witnessed exponential growth each year until 2018. A total of 492,388 Jaguar Land Rover units were sold in China in 2018.

Land Rover’s strategy in China is to demonstrate a commitment to the Chinese market by offering unique designs and models that meet consumer requirements and preferences. That is why in 2012, JLR entered a joint venture with Chery Automobile Company to manufacture Range Rovers to build vehicles designed specifically for the Chinese market (Jaguar XFL and XEL are good examples). Thanks to this, Land Rover in China has won numerous awards that allow it to raise brand awareness: recipient of the 2018 ‘China Reputation Award’ for the second time, Range Rover Velar wins ‘China SUV of the Year’ and ‘China Car Design of the Year.’

How do carmakers promote their cars in China?

Offline promotion: How to keep a substantial brick and mortar presence for car manufacturers in China

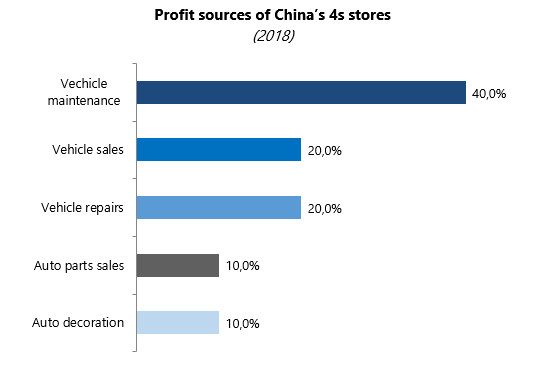

Offline promotion remains very important in the automotive industry in China today. Indeed, despite the development of the massive development of e-commerce and m-commerce in China, nearly 90% of car purchases were made at 4S stores in 2018. This means that Chinese consumers still appreciate contact with sellers and want to be able to go to offline stores to get information and buy a car.

- 4S stores in China

4S stores are today the most popular distribution channels for the vehicle brands in China. There are more than 28,000 4S stores in China. They have dominated the offline purchase channels in tier-1, tier-2, and tier-3 cities; now they are expanding to tier-4, tier-5 cities and rural areas.

Consumers choose 4S stores as they provide all in one service: ‘‘4S’’ means Sale, Spare part, Service and Survey. So, they cover all business related to vehicles such as sales (new cars and second-hand cars), maintenance, car wash, auto finance, car rental, etc.

It is also interesting to note that the competition among 4S stores is increasing, trying to fight on price, discount activities, test-drive services and insurance.

- Exhibitions, events, and shows: the entertainment marketing strategy

There are more and more events and exhibitions in China that attract millions of people each year. For instance, Auto Shanghai, the Shanghai Motor Show which has made its mark among international shows, host every two years more than 900,000 visitors from 18 countries. The 2019 edition is currently being held (April 23-28).

Automotive shows are an excellent way to stand out from the competition and showcase its best models to demonstrate the brand’s research and development capabilities.

Despite their international scope, the domestic players are most active at these shows with more than 70% of new products produced by Chinese carmakers.

- Showrooms, storefronts and flagship stores

Car manufacturers in China are now investing more and more in showrooms in major cities to impress consumers: stores are no longer just places to buy cars but luxury spaces to live a real experience.

In 2018 NIO invested CNY80 million (USD11.7 million) in a store in the iconic Shanghai tower and paid more than CNY100 million annual rent.

The brand also pays a yearly rent of about CNY80 million for a shop in Beijing’s Oriental Plaza mall.

Online promotion: Using KOLS and social media to boost your sales in China

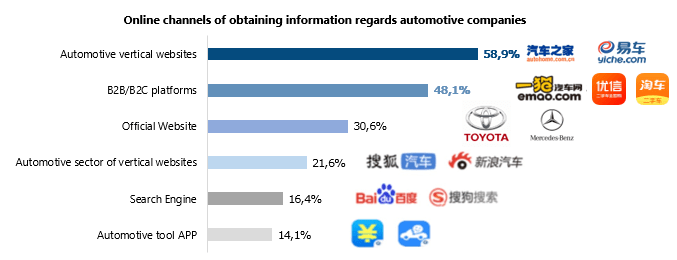

In China, websites and social media are dominating the promotion channels for vehicle brands in 2018.

With a perfect online service layout, automotive E-commerce platforms have real marketing advantages. Automotive E-commerce represented by Youxin, Emao, and Taobao makes full use of the business sector (new cars, used cars and auto finance). They are user-centric, E-commerce data-based, product and service innovation-oriented, aiming at creating a full life cycle Eco-marketing platform. It is a good source of information before buying a car in China.

Also, almost half of consumers obtain information about cars from automotive websites, since those websites usually have comprehensive knowledge about car brands and models.

On social media, young auto enthusiasts (post-90s and younger) have a stronger willingness to share content about vehicles with others. Half of the auto enthusiasts spend 5-15 minutes on every online post (website and social media) about vehicles.

Social networks have therefore become strategic for car promotion in China. This is why many brands now use KOLs (Key Opinion Leaders) to convey messages in a more subtle way. Indeed, more than 70% of vehicle consumers follow at least three KOLs, their purchasing behaviors are highly influenced by KOLs’ opinions and experience.

New retail: How the Alibaba strategy applies to the Chinese automotive market

New retail in the automotive market in China is more consumer-centric. This is a trend that has been widely followed by car manufacturers since the success of Alibaba’s New Retail strategy launched in 2016.

By collecting consumers’ data (such as interests, price and design preferences), vehicle brands are able to provide cars, auto-configuration and services based on consumers’ requests. Thus, the consumer’s journey is shorter because the touch points are blended: for example, Wechat content is now a touch point for each step of the car buyer journey in China.

This is the strategy that Ford decided to implement in partnership with Alibaba: they launched the Super Test-Drive Center in Guangzhou to allow people to buy a car from a staff-less machine in under 10 minutes.

Customers just have to go to the Tmall app and choose the model they want to test-drive via the online catalog. To register, customers must take a picture of their face and once in the store, once the customer shows their face to facial recognition,the car chosen online arrives from the multistory structure. Then, the customer can test the car for a few days (3 days max) and order it online.

How could international carmakers improve their marketing strategy in the Chinese market?

Target a young audience

New cars buyers in China are young and connected consumers. As they gain purchasing power, they are the future of the Chinese automotive market.

Do not neglect offline communication channels

The paradox of the explosion of e-commerce in China is that buyers are still demanding physical presence or human contact. Thus, offline channels must be up to the task.

Keep a close eye on your online reputation

Control your reviews and comments and opt for an influence marketing strategy because brand reputation plays a vital role in the buying cycle of a car in China.

Rely on well-made design

Content and design provide an important first step in customer experience in China in 2019: work on a modern and sophisticated design for your website, your products, and your communication.

Leverage to e-commerce and new retail

For automakers, innovation linked to the e-commerce platforms and deepening relationships with end users will be key to benefit from the increasingly technology-enabled car market in China.

Author: Steffi Noël

Daxue Consulting offers further analysis of the automotive market in China with a forward-thinking approach to topics such as digitization, high-tech implementation, artificial intelligence, and many others. To know more about the evolution of the automotive industry in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.