Volvo China is facing challenges despite prospering in Europe

Volvo in China

China makes up 20% of Volvo’s global sales. Volvo’s retail sales are the highest in Europe (50%), followed by China, and the US (15%). The best-selling car line is XC-models (56%), which include SUVs cars, followed by V-models (29%), which include medium-sized and large cars, and S-models (15%), which are sedans. In 2018, Volvo broke the 600k mark with 642,000 cars sold, including 130,593 units sold in China. 25% of Volvo cars were produced in China where Volvo established three car factories and an engine plant. Volvo China achieved double-digit growth, with a retail sales growth of 14.1% in 2018 despite market headwinds. The growth is mainly driven by locally produced S90, XC60, and XC90.

How do Chinese consumers perceive Volvo cars?

Chinese consumers have diverse perceptions of Volvo. Some believe Volvo is a premium car brand, but less “premium” than Mercedes-Benz, BMW, and Audi, the same level as Infiniti, Lexus, and Cadillac. Volvo’s unique selling point is safety, sustainability, and its strong functional value. Some say that Volvo in China does not offer as many lines as other car brands. Overall, Chinese consumers perceive Volvo cars as being cost-effective. However, when you search “Volvo in China” on Zhihu, you will come across a lot of questions asking why Volvo is only a mediocre player in the Chinese market, considering that it has a strong presence in Europe.

Geely’s Acquisition of Volvo

Volvo, an established player in the global luxury car market, has long enjoyed its status as the safest car brand. It has over 43,000 employees all over the world and has established sales and services networks in over 100 countries and districts. Currently, it classifies its vehicles into six car types: small SUVs, Large SUVs, Executive Cars, Large Cars, Medium Cars, and Sports Cars, with Executive Cars and Small SUVs being the core segments, both in terms of revenue share in Volvo’s portfolio and market leader position in the respective segment.

Volvo’s sales started declining in China

In the year 2005, Volvo made a profit of about 300 million dollars, but then later underwent three consecutive years in a deficit. In 2008 alone, due to the global economic crisis, its sales fell by more than 20% and it lost 1.5 billion dollars.

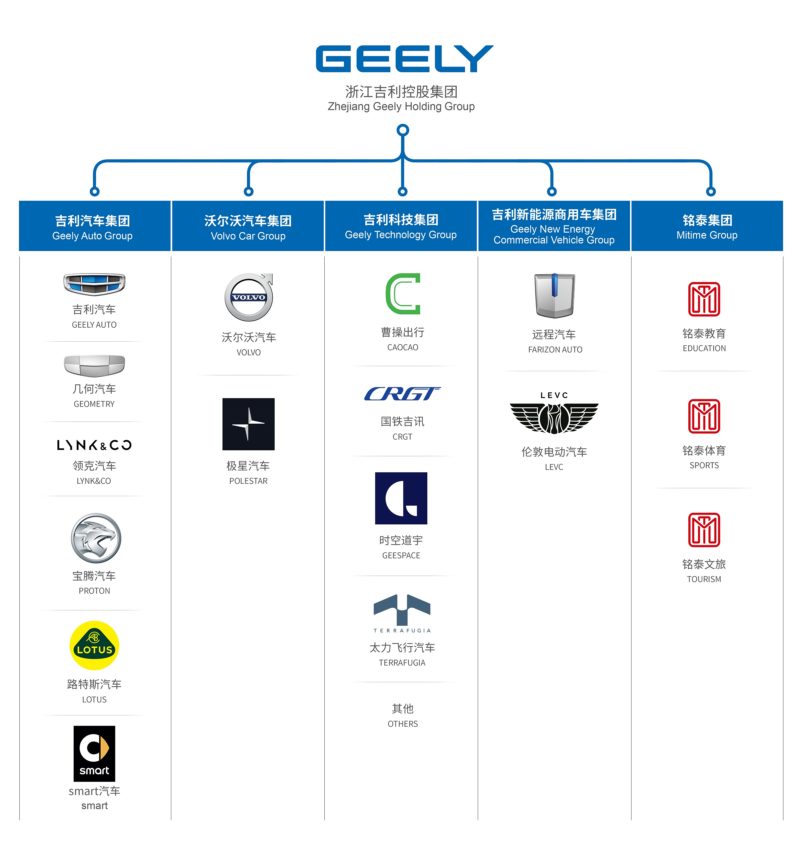

[Source: zgh.com “Geely’s brand portfolio, including Lynk & Co and Polestar that are co-owned by Geely and Volvo”]

Geely is one of the top ten companies in the Chinese automobile industry. Ever since it entered the sedan field in 1997, it has seen success in the Chinese market. It was listed in the Fortune Global 500 as the only private automotive enterprise from China in 2012 and is called the fastest developing and the best-developed automobile company in the 50-year history of China’s car industry.

Geely acquired Volvo in 2010. The reasons why Volvo chose Geely are as follows: First, Volvo’s sales have been dropping over recent years. Second, choosing Geely allows Volvo to gain easy access to China’s rapidly growing car market. Third, Geely had been researching Volvo for eight years and was already discussing the acquisition for three years before it actually took place.

Differentiation creates synergy

The acquisition is considered a win-win for both sides by most market analysts for several reasons. Volvo has always focused on luxury cars while at the same time Geely focused on low cost lower or medium grade cars. Through this acquisition, Geely broadens its product offering and customer base. Besides, it acquires a company that targets different consumers and can avoid cannibalizing any of its existing sales. Secondly, Geely has a deep understanding of China’s automobile market. Combining this with Volvo’s reputation and technology, Volvo can take a step in achieving its plan for a global market. Also, by entering China, Volvo effectively lowers its production cost, since China has an advantage in labor costs.

China’s Automobile Manufacturing industry at a glance

The Automobile Manufacturing industry includes complete automobiles and automobile engines. Suppliers of China’s auto manufacturing industry includes paint manufacturing, plastic parts manufacturing, automobile body, and trailer. The demand side includes auto & parts wholesaling, car dealers, and car rentals. The major player in the industry are Shanghai Automotive Industry Corporation, Dongfeng Motor Co., Ltd., and Beijing Automotive Group Co., Ltd., which accounts for 34.8% of the industry market share. The primary activities in the automobile manufacturing industry are manufacturing of complete automobiles (passenger vehicles and commercial vehicles), non-complete automobiles (commercial passenger vehicles and freight vehicles), passenger vehicles (basic, MPVs, SUVs, cross-over, non-complete), commercial vehicles and automobile engines. Out of the products and services segmentation, basic vehicles and SUVs are leading the industry, which takes up over 76.6% of the industry products and services.

The industry is highly shaped by government policies

The automobile manufacturing industry in China has experienced ups and downs over the past ten years. Due to favorable government policies, the industry revenue increased significantly from 2008 to 2010, with a growth rate of about 30%. . However, from 2011 to 2012, the revenue growth dropped due to the cancellation of purchase tax reduction on vehicles with less than 1.6-liter engines. From 2013 to 2014, the automobile manufacturing industry in China slightly bounced back, revenue increased by 19.6% and 11.5% respectively, amounting to $594.5 billion in 2014.

Slower economic growth impacts vehicle demand

With the growth in China’s economy slowing in 2015, the sales of automobiles fell in the first nine months. The government then cut the purchase tax on vehicles with engines smaller than 1.6-liters by half. The sales, thereby, slowly went up to $647.6 billion, up 8.9% from 2014. In 2016, industry revenue reached $742.6 billion. However, with the exit of preferential policy, the sales growth of automobiles slowed down spontaneously in 2017. In 2018, the industry experienced its first decline in auto sales in over 20 years, mainly due to the slowdown of the economy and a corresponding decline in demand.

The factors contributing to the growth of the industry include rising domestic demand across urban and rural areas, growing exports, rising household income levels, competitive pricing in the industry, and most importantly, favorable government policies which further drove industry revenue growth.

The dynamics of the automobile manufacturing industry in China

Declining demand for imports and growing exports volumes

The import volume of automobiles decreases while the export volume is increasing significantly in China’s automobile market. In 2017, Chinese vehicle exports increased by 50.3% from 2016, exporting over 1 million units. The reasons are two-fold. China’ exported automobiles have price competitiveness as manufacturing cost is considerably lower because of the abundance of low-cost labor force. The development of emerging foreign markets including Africa, South America, and the Middle East, also boost the export volumes. China has strong ties with countries in these areas, which creates opportunities for trading, marketing and investment for domestic manufacturers. Apart from that, governmental institutions encouraged domestic auto manufacturers and exporters to establish brand names in foreign markets.

Strong support for new energy automobiles

The industry has also been aided by the government’s strong support for new energy automobiles in China. The Chinese government grants significant subsidies to both manufacturers of electric cars and consumers who purchase them. The government is also investing in electric vehicle charging points across the country. Moreover, the local governments have also added their subsidies as well as electric car-friendly policies in many cities in China. These preferential policies and a favorable environment might lead to a shift in consumers’ purchase preference from conventional cars to electric cars and stimulate industry growth over the next few years. However, slower growth rates are expected as the industry matures and automobile ownership levels near saturation.

What are the major players doing?

The number of enterprises in the industry has decreased and is expected to continue decreasing due to merges and acquisitions activities. Large organizations acquired smaller ones while expanding their operations across the country by increasing establishment numbers. Organizations with a disadvantage in technology and low capital are expected to exit the competition.

[Source: Autohome (汽车之家) app. “Volvo’s On Sale product lines on autohome.com, mainly sedan and SUV lines”]

There are various answers to this question. Some said Volvo does not have the advantage of “country of origin (COO)” compared to brands from German. Due to the low awareness of Sweden among Chinese customers, the secondary associations of COO does not prevail in Volvo’s case. The market is still dominated by German brands. Some feel that Volvo’s reputation in China devalued after Geely’s acquisition. Since Chinese automobiles are not commonly associated with “premium” and “luxury”, hence, the Geely-owned brand is undergoing a reputation crisis.

Volvo’s response to price competition in China’s automobile market

The market shows an increasing price competition and softened demand for cars. Volvo in China is responding to the scenarios in a fairly aggressive way. According to an industry insider, the S90 T4 model, the master product of Volvo in China, has been marked down for several times in just one year and three months, from the original price of CNY406,800 to CNY295,000, a total price drop of CNY111,800, CNY70,000 in just 6 months. This was just a starting point for Volvo’s price drop in China. The S90 T5 model, an upgraded model of S90 T4, only sold for CNY280,000 with gifts, a price drop of CNY130,000, which signaled a huge self-depreciation as a premium car. A similar situation happened to XC60, Volvo’s signature SUVs, the price drop was enormous. XC60, the best performer in the European market, reaching sales of nearly 100,000 units, only sold 46,800 units in China.

[Source: Pixabay “Volvo’s signature SUV model XC60”]

“Volvo’s price drop in China takes a toll on the brand’s long-term development”

The industry insider further demonstrated the consequence of Volvo’s price drop. Although Volvo sold over 600,000 cars in 2018, including 130,593 cars in China, such performance was not comparable horizontally. Volvo ended up ranking the seventh in the premium and luxury cars market in China, following after Cadillac, Lexus, JLR (Jaguar Land Rover), being the last of the “second-tier” brands.

Negative consequences of price drops

There are negative consequences of Volvo’s constant price drops. Many of Volvo’s dealers in China are losing profit and some chose to stand up for protecting their rights, not to mention offering comprehensive in-store and after-purchase services to customers. The younger consumers do not favor Volvo cars as they are afraid of a loss of investments. After constant price drops, Volvo in China cleans up its benign ecosystem of superior dealers and customer segments. The brand used to appeal to high-class elites who resonate with and are loyal to the brand, but now Volvo appeals to customers who are seeking low prices above all, comparing prices between different dealers for the lowest price, who are less likely to show brand loyalty. When the brand meaning and brand judgment deteriorate, it is difficult to achieve brand resonance.

A new target consumer

The industry insider demonstrated that the fact that the price drops quickly in a year makes loyal customers aloof. Needless to say, customer loyalty is of importance to a brand. The customer groups that Volvo is now appealing to buy Volvo cars for the price and are not familiar with the essence of the brand, hence, they might feel unsatisfied with the automotive interior design, the handling, and are less likely to spread positive word-of-mouth. When the brand enjoyed the short-term sales growth brought by low prices, it has to bear the long-term depreciation of its target customers. Moreover, in March 2020, Volvo recalled over 120,000 cars in the global scale over automatic emergency braking (AEB) issue, which might taint its reputation as the safest car brand.

The consequences of ‘price wars’

China’s automobile market is changing, so are automobile brands. With overall improved quality among most manufacturers and fierce competition, price became an additional method of differentiation between similar products in the market. However, the consequences of the “price war” among automobile manufacturers are profound. The entire supply chain has to adapt to the overarching pricing strategy, which will inevitably give rise to a series of changes from the organizational level to the end customers. Hence, it requires organizations to be capable of change management and be agile to tackle the changes in the market. In Volvo’s case, apart from enjoying the short-term benefits of price drops, Volvo in China is in time of contemplating its long-term development in this dynamic market, especially considering that Volvo and Geely are reportedly planning a merger in the following years. In short, how to address promptly the changes in the post-price drop era will be an issue for Volvo in China in the coming years.

Author: Wenxing Li

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes