Unpacking the world’s largest Auto market: Is new energy vehicles the future of China’s car industry? | Daxue Consulting

Since 2009, China has been home to the world’s largest automotive market. What’s new in China is also the leading automotive manufacturer worldwide. In 2016, China’s annual vehicle production accounted for nearly 30 percent of all vehicles produced worldwide, exceeding that of the European Union or that of the United States and Japan combined.

NEVs have been a hot discussion over recent weeks and months. As the Chinese government rolls out subsidies and incentives for EV producers and consumers, the rise of NEVs has seen great promise in China. [Source: Daxue Consulting]

What are the opportunities to capture within the Chinese auto market?

As the world’s largest automobile market, both in terms of demand and supply, there are many opportunities for auto brands looking to diversify their product and improve their position in the Chinese market. In 2017, China produced almost 25 million passenger cars and around 4 million commercial vehicles and is forecasted to further drive demand in this sector with close to 35 million expected vehicle sales by 2020. Given the country’s population, the potential for China’s automobile market is enormous. By 2020, there will be an estimated 200 million vehicles on Chinese roads, but proportionally only less than 1 car for every 5 individuals. Thus, in this sense, presents a grand opportunity for both foreign and domestic Chinese auto producers to capture this market share.

In highlighting the strengths in the Chinese auto market, continued investment flows into the market from automakers and suppliers combined with underpenetrated rural markets, a gradual rebalancing of the economy towards a consumption-led model, and growing incomes along with the easing of the one-child policy will support private vehicle sales and create growth opportunities in the SUV and minivan segments. However, many weaknesses still remain, those include car purchase restrictions in a growing number of cities, saturated markets in the coastal areas, removal of tax incentives on small engine vehicles, and a slowdown in motorcycle sales provide downside risk to sales and may lead to a slowdown in passenger vehicle sales.

Despite these weaknesses, many opportunities for both foreign and domestic brands still remain, primarily those coming from China’s air pollution problems and government incentives for EVs creating long-term opportunities for automakers in the space. Moreover, improving quality and brand names have seen certain Chinese carmakers such as Geely and BYD making a name overseas. Furthermore, auto financing remains another growth opportunity due to the under-penetrated nature of consumer credit. On the other hand, there remain various threats to the Chinese auto market, specifically, the promotion of greater fuel efficiency to weigh on sales of local companies and automakers that import larger vehicles (SUVs), and uncertainty surrounding NEV subsidies and increasing discounts on SUV sales that threaten the sustainability of the Chinese market’s biggest growth areas.

What is behind the drop in auto sales & how will China bounce back?

Despite many “positives” emulating from the Chinese auto industry, the car market in China is struggling, and things are apparently only getting worse. The latest data from the country’s top auto industry association shows that in November 2018 China’s automobile sales fell 13.9 percent from a year earlier, marking the steepest such drop in nearly seven years in the world’s largest auto market. However, from the way things look, it is a trend that is set to deepen. The drop in sales to 2.55 million vehicles, a fifth straight decline in monthly numbers, comes against a backdrop of slowing economic growth and a crippling China-U.S. trade war. The November drop comes on the heels of almost 12 percent declines in each of the past two months, putting China on track for an annual sales contraction not seen since at least 1990. Hence, from this point of view, current auto sector struggles are just another reason to expect weaker growth in 2019.

Moreover, vehicle sales growth in China will continue to cool as the phasing out of tax incentives on small engine vehicles which began in 2017, dampens consumer demand. In addition, global economic pressures will continue to provide further headwinds to growth in domestic auto sales. This slowdown in economic growth will undermine consumer and business confidence and thereby act as a barrier to growth in big-ticket item purchases. Nonetheless, beyond 2018, new vehicle sales in China are forecasted to maintain an average annual growth rate of 1.9% over 2019-2022, reaching a total of 31.8 million units by the end of 2022. This relative cooldown in the growth rate is likely a result of rising used vehicle sales and the continued slowdown of the Chinese economy.

Despite these struggles in the “regular” automobile market, there is one sector that is showing promise, new energy vehicles. Chinese consumers are leading the world’s boom in electric vehicles. The Chinese market has stayed on track of purchasing more than 1 million electric vehicles (EVs) in 2018, after seeing a sales growth of 53% in 2017. In essence, China’s leadership is charting a course to an all-electric future, targeting 2 million annual EV sales by 2020 and a complete ban on internal-combustion engines, which officials predict will happen before 2040. In combination with lowering technology costs and rising disposable incomes, there should be further growth in the electric vehicle market in China in the years to come.

In order to promote NEV (new energy vehicle) sales, China has introduced various measures, such as tax exemptions, subsidies for car purchases and a requirement for government departments to buy more new energy cars, as a way to save energy and reduce air pollution. NEV manufacturers have also received financial support from the government to reduce their R&D and production costs. Seeing a rapid expansion in the past few years, China’s production of NEVs grew from about 17,500 units in 2013 to 517,000 units in 2016. The growth and emphasis on NEVs in China is not only a measure to reduce urban air pollution, but can also be seen as a way for Chinese automobile manufacturers to become globally competitive against traditional automobile manufacturers which specialize in internal combustion engines.

Which vehicle segments are selling in the Chinese market?

The total volume of automobile industry sales in China reached 28 million units in 2016, of which 24 million units were passenger cars. The passenger vehicle segment includes sedans, sport-utility vehicles and multi-purpose vehicles. In terms of sales volume, commercial vehicles only took up a small part of the car market in China. The leading automobile manufacturer in China was SAIC Motor Corporation, with around 6.5 million units sold in 2016. Dongfeng Motor Corporation and FAW Car Co. came in second and third place, with about four million and three million units sold in 2016.

In 2015, one million luxury passenger vehicles and 75,000 ultra-luxury passenger vehicles were purchased in China. The overall sales volumes within those two segments increased by 35 and 67 percent year-on-year, respectively. The leading luxury brand was Audi with 727,000 units sold, followed by BMW and Mercedes-Benz with 629,000 and 429,000 units. Within the ultra-luxury vehicle segment, Jaguar Land Rover was the highest selling car brand at about 138,500 units, followed by Porsche with about 63,280 units.

Ferrari Shanghai, Luxury brands are alive and present in the Chinese market. Source: [Daxue Consulting]

Market forces driving China’s auto industry in 2018

One of the main factors impacting the growth of sales in the passenger vehicle segment is the phasing out of tax incentives on small-engine vehicles, which will lead to a rise in retail prices for these cars. The Chinese government began raising the purchase tax on cars with engines of 1.6 liters or less to 7.5% in 2017, from its previous special rate of 5%. However, as of January 1st, 2018, the purchase tax on these vehicles was returned to its normal rate of 10%. Thus, the return to a higher tax rate will place pressure on consumer purchasing power with regard to their ability to afford new small engine cars in the years ahead, which will, in turn, continue to dampen sales growth and market share of vehicles in this sub-segment. As a result, this will have a negative impact on sales growth, given that these vehicles account for around 70% of sales in the total passenger car market, and demand for them is relatively more price elastic than other more expensive segments.

That being said, trends show that SUV sales will continue to outperform all other PV segments in 2018 and ahead. The consumer shift towards the SUV segment will continue over the coming years, driven by a rise in income levels and increasing family sizes due to the scrapping of China’s one-child policy. Furthermore, the number of Chinese households earning a disposable income of USD 25,000-50,000, that enough to be labeled as middle class, is forecasted to grow from 25 million in 2018 to 50.5 million by the end of 2022. Therefore, this increasing number of affluent Chinese households will fuel consumer preference for larger, more premium-feel vehicles. As a result, this will serve as another factor to drive demand for SUV sales over the coming years.

Foreign Ownership: No Immediate Impact From Ownership Cap Removal

This photo, in the back alleys of Tongji University in Shanghai, shows how the British auto maker has partnered with the local university in order to implement programs in science and technology in order to promote for greater car innovation moving forward. Source: [Daxue Consulting]

One of the reasons why ending these agreements may not bode well is, as a result of these JVs, supply and factory networks, research centers and other joint activities have been developed, which means that untangling these partnerships and buying out contracts from their respective local partners in order to become fully independent entities would prove costly and unattractive for foreign automakers. In addition, these JVs come with advantages in the form of access to subsidies, local suppliers and distribution networks, which existing and any new entrants to the Chinese market will continue to consider when making production decisions. It will, therefore, be some time before we see a wholly-owned foreign auto manufacturer set up operations in China, outside of the possibility of Tesla entering the market.

Tesla shop in Shanghai. It is well covered in the media of Tesla’s China plans. Moving forward, Tesla will be an important player in the Chinese EV market, as well as an important innovator for the future of vehicles in general. Source: [Daxue Consulting]

Do market trends tell us that domestic Chinese auto firms are ready to compete?

Policy from Beijing on these issues supports the notion that China believes its automakers are ready to compete on their own with global rivals after decades of partnerships. Primarily from a result of these previous JV agreements, Chinese firms have generated cash and expertise from these partnerships, which have allowed them to improve their car designs, safety and technological features, thus putting them in a better position to challenge foreign rivals in the domestic market. In particular, Chinese automakers, such as Geely, BYD, and Chery Automobile, are now in a stronger position than they were decades ago to compete with foreign automakers in terms of financial resources and technology. Furthermore, for example, Geely bought a nearly 10% stake in Daimler AG in 2018, becoming the German automaker’s biggest shareholder and gaining access to its technologies. Also, Chinese carmakers Chery’s and Guangzhou Automobile Group Motor’s standards have improved so much that they are both making plans to enter the American market. This shows that domestic makers in the Chinese auto industry are rising fast, and competition with them must be taken consideration for foreign brands looking to expand their position in the market.

BYD, a Chinese automaker in the NEV segment, one of the largest in the country. This is a photo captured in one of their dealerships in Shanghai. Chinese domestic automakers in the NEV segments have seen great promise in recent years. Source: [Daxue Consulting]

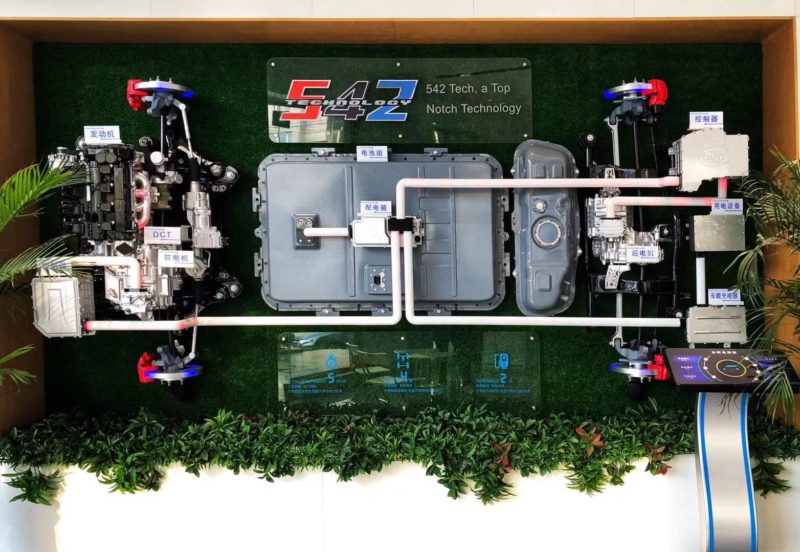

The 542 technology aims to set the standard for key performance of upcoming new energy cars. All future BYD hybrids will meet these performance goals where 5 stands for a 0 to 100km time of around 5 seconds, 4 equals 4 wheel drive (4WD) and 2 means no more than 2 liters of fuel consumed in the first 100km. The traditional standards for power and fuel consumption will be once again redefined and using these performance achievements all BYD hybrids will be able to overtake most hybrids produced by the traditional Western and Japanese brands. Source: [Daxue Consulting]

Auto industry moving forward: New Energy Vehicles

In early November 2018, Wang Yang head of the national political advisory body (CPPCC), chaired a bi-weekly consultation session on the topic of lobbying for a ban on gas-powered vehicles. Wang reiterated the importance of new energy vehicles for China’s development by saying, “Developing NEVs is the inevitable way for China to transform from a big automobile manufacturer to an automobile superpower.” However, it wasn’t Wang’s comments that catch the eye. It was the actual industry players who were actively lobbying to gut the traditional auto sector. They requested that officials set a specific timetable to end sales of fossil-fuel powered vehicles as soon as possible. They also pushed for more investment in NEV infrastructure, particularly battery charging stations and hydrogen refueling stations. In essence, what this means for the market is that China’s NEV policy is not just about the environment. It’s also about industrial policy. Since they are so far behind on traditional vehicles, they want to compete where other countries don’t have such an established advantage.

XPeng, a Chinese top producer in NEVs, showcasing its new G3 SUV model. Xiaopeng 小鹏 along with Nio 蔚来汽车, will be a top competitor in the market in the future to come. Source: [Daxue Consulting]

With regards to partnerships, this lifting of ownership caps could certainly open the door for Tesla’s entrance into China, where it struggled to agree on an ownership structure in order to set up a domestic manufacturing facility. The attraction of being able to enter the Chinese market without having to share technologies with local partners and keeping 100% of the profits will be a draw for other foreign EV manufacturers. Chinese firms such as BYD and BAIC will, therefore, face tougher competition from more price competitive and technologically advanced foreign EVs, which will no longer carry the 25% import tariff on their price tags.

Production of foreign autos in Mainland China

As a result of weak domestic demand, total vehicle production in China will only grow 2.6% in 2018, reaching 29.8 million units by the year’s end. Breaking this down, PV production will grow 1.5%, totaling 25.2 million units, while CV production expands 9.3%, totaling 4.6 million units. Moving forward, from 2019-2022, BMI estimates total vehicle production to grow at an annual average rate of 4.6%, reaching a total of 32.4 million units by the end of 2022.

Nonetheless, looking at the current market trends, lending support to domestic production will be large motor companies that are drawn into local production for the domestic market in order to avoid the 25% tax levied on imported vehicles. Plans by General Motors (GM), Ford and Jaguar to manufacture vehicles locally are examples of large motor companies looking to limit costs and grow their bottom lines. The latest investment by GM in ramping up production by a total of 360,000 units in the first half of 2017 will be a key driver to local car production. Other new projects that are set to come online are British automaker Jaguar’s production of its new E-Pace at Chery Jaguar Land Rover’s manufacturing plant in Changshu in 2018, Lincoln producing its line of luxury SUVs in China by late 2019, and Ford producing its new generation Focus model in 2019 as well. Thus, although many problems currently plague the Chinese auto market, there are many factors that are influencing the equation, and on top of that, there are many opportunities still present and ones that are opening up for both foreign and domestic Chinese producers to take advantage of. However, as the government moves on the path towards more technology and energy efficient led vehicles, it seems that cars in these segments may be most popular moving forward, along with a shift towards SUVs.

Author: Jeffrey Craig

Daxue Consulting offers further analysis of energy vehicles industry evolution in China

Daxue Consulting has extensive experience in a research project and strategic consulting related to the markets with constant and fast evolution. Our team offers a forward-thinking approach to topics such as digitization, high-tech implementation, artificial intelligence and many others.

To know more about the electric vehicle market in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.