Tesla in China

Tesla’s Background Fundamentals

Since its founding in 2003, Tesla’s vision was to manufacture mass-market electric vehicles (EVs) that offered a compelling customer value proposition. This includes a long range vehicle that possesses recharging flexibility, one that is energy efficient, low cost, and high performing without compromising design or functionality. This article details the unique strategy of Tesla in China.

Tesla’s automotive segment comprises of the design, production and sale of fully-electric vehicles. Tesla targets the premium sedan and SUV markets through its Model S and Model X, and the mainstream vehicle market through its recently introduced Model 3. The energy generation and storage segment comprises of the design, production and sale of solar energy generation systems and energy storage solutions to industrial and commercial consumers. In essence, the company benefits from core competencies in powertrain engineering, vehicle engineering, innovative manufacturing and energy storage.

A global leader in new energy vehicles

Ever since going public in 2010, Tesla has been leading the charge towards alternative power in the passenger vehicle industry. Currently, Tesla is seen as an innovative, exciting and powerful player in the global automobile industry. The company’s market valuation topped 100 billion U.S. dollars in the first month of 2020.

Globally, Tesla’s vehicle deliveries reached between 367,000 and 368,000 units in 2019. Tesla’s Model 3 has become the world’s best-selling plug-in electric vehicle model. In the fourth quarter of 2019, deliveries of Model 3 vehicles accounted for over 80 percent of the sales volume by product, duping the Model S and Model X products, which were originally aimed at customers in the high-end sphere of the market. With the release of the Model 3, Tesla is now targeting broader customer segments. Tesla is expected to add the Roadster, the Model Y, and the widely anticipated Cybertruck to its currently existing model lineup. However, for Tesla in China, its growth strategy is mostly driven by the anticipated high demand for the Model 3.

[Source: Tesla website, the Tesla Model 3]

Tesla’s China Entry

What is unique about Tesla’s China Market strategy?

In designing a successful China market entry, market entrants need to rethink and redesign their products in order to take full advantage of the possibilities of new technologies. That is what Tesla did with the EV. Tesla exploited new technological advancements and developed new complementary assets around that knowledge. On the demand side, they established strong market leadership and both created and satisfied an appetite from investors and customers for their products that perform well in terms of range, responsiveness, and user interface.

Tesla’s three China market objectives

Tesla had three objectives when entering the Chinese market. Firstly, to expand its share in the world’s largest electric vehicle market. Secondly, to stay independent of China’s requirement for foreign automakers to forge joint ventures with Chinese manufacturers. And thirdly, to protect its intellectual property built into its growing lineup of EVs.

For Tesla, the act of investing into China was a major turning point for the company. Tesla made history by becoming the first foreign car factory approved to operate fully independently while still retaining 100 percent ownership in China. Given that China has recently amended its Foreign Investment Law, Tesla no longer needs to face concerns regarding “forced technology

(IP) transfers” of its patents. This arrangement is something that auto-makers such as Mercedes-Benz, BMW, Ford, Toyota and other international carmakers have been requesting for years.

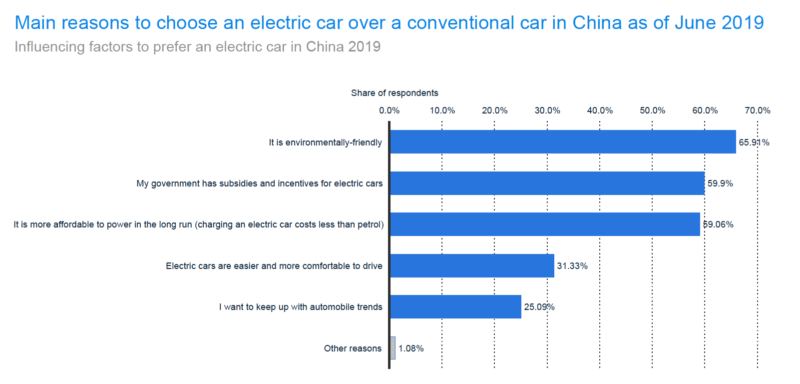

[Source: Statista, Influencing factors to prefer an electric car in China in 2019]

Tesla’s Fit in China

Why China?

China is an important market for the automotive industry, particularly for electric vehicles. China is Tesla’s second-biggest market, and selling high volumes of EVs in China is a large part of the automaker’s business plan. For Tesla, the advantages of coming to China are widely apparent and fit well with its business model.

For example, China’s vast consumer market, strong central financial system, mature industrial production chain, and lithium-ion33 battery production capacity make it an ideal place to localize production. Furthermore, China’s dominant position in the world market for several rare-earth metals and advancement in manufacturing electronics, both of which are prerequisite for the production of the three core components of EVs – batteries, electric motors, and electric controls, also make it an attractive destination for Tesla.

Tesla is expected to grow significantly in China in 2020 and beyond due to having local production capabilities after completing its Gigafactory in Shanghai in late 2019. This is beneficial to the company for two reasons. Firstly, because production in China spares Tesla from import tariffs on finished vehicles, and secondly, its locally made cars qualify for government subsidies. Because China is an important supplier of automotive parts for the global industry as well as a hotbed for electric mobility and smart grids, it has been the perfect place for Tesla.

How the Shanghai Gigafactory Plays into Tesla’s Supply Chain Strategy

Tesla’s Shanghai Gigafactory is a competition “game changer” in the electric vehicle market as it puts pressure on traditional groups to offer high-quality battery-powered models to Chinese consumers. Tesla said the Gigafactory in China was approximately 65 percent cheaper to build than its Model 3 production systems in the U.S., and that the facility was capable of producing full vehicles from body to paint to general assembly.

China is by far the largest market for mid-sized premium sedans. Thus, with the Model 3 being priced on par with gasoline powered mid-sized sedans (even before gas savings and other benefits), Tesla believes China can become the biggest market for the Model 3. As a result, Tesla indicated its intention of ramping up production and tapping into the lucrative Chinese market with its Model 3 sedans and Model Y cars.

The most important reason behind the construction of the Gigafactory was to increase production volume to the maximum in order to let prices fall and enjoy economies of scale. However, in order for this to work sales must increase significantly to justify such a strategy.

Why Tesla’s strategy succeeded where others failed

In the past, other players in the industry tried similar strategies that ended up failing. Tesla’s goal is to develop a new car in less time than their other competitors. To do so, they need a faster and more agile supplier base than anyone else. Therefore, Tesla has done something different from its competitors: it is building its own market.

This large facility, which will be sufficient for the production of half a million Tesla vehicles annually, will be completely powered by renewable sources. This will prove rewarding on eliminating energy consumption costs. The rationale behind the plant is to reduce the price of batteries for automotive and domestic consumption purposes. Considering all these factors, Tesla can be considered as one of the most important and well-rounded players in the Chinese automotive industry as far as alternative sources to traditional fossil fuels and sustainable mobility are concerned.

Assessing the current position of Tesla in China

Why did China fully support Tesla’s entry into the Chinese EV market?

Tesla’s China entry signified the Chinese government’s efforts to attract an influential foreign company, to improve its image of market openness, raise up potential domestic Chinese players, and to stimulate the interest of the global capital market. With the ultimate goal of driving China’s EV industry to new heights, China hopes that Tesla will become an industry leader that can promote the localization of EV design and manufacturing within China’s industrial and supply chain.

China’s manufacturing prowess can help Tesla overcome the “production hell” it suffers back in the States. Therefore, the Chinese government’s EV ambitions give Tesla a tailwind that it lacks in America.

What is China’s stance on Tesla and vision on its significance for the Chinese domestic EV industry?

China sees Tesla as the “Apple of the automotive industry.” By allowing Tesla into its market, the Chinese government is effectively trying to recreate the effect Apple had on the Chinese tech industry. Apple not only expanded China’s industrial chain, but also created technology spillover effects that brought Chinese tech companies such as Huawei and Xiaomi to a whole new level, helping them become more competitive. In essence, China supported Tesla’s market entry with the ultimate aim of creating industry spillovers.

He Xiaopeng, founder of XPeng Motors, stated that Tesla’s presence in China would be a positive force for the development of the domestic electric vehicle market. In this instance, China is hoping Tesla’s entry will trigger similar reactions and help accelerate the country’s transition to electric vehicles. Chinese manufacturers are currently focused on two areas: auto parts and smart electronics, but they have yet to reach the core of Tesla’s industrial chain, both in scale and technology.

What Makes Tesla’s China Business Different?

Understanding Tesla’s Supply and Value Chains

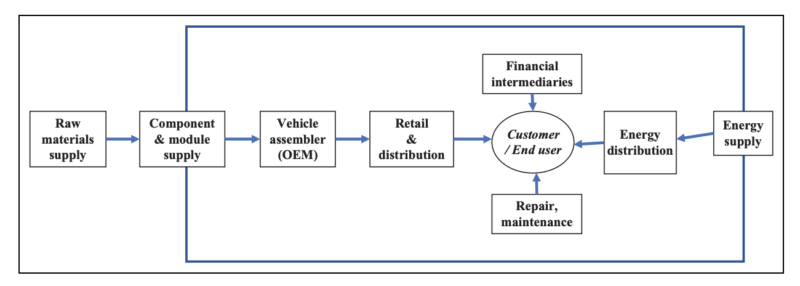

Tesla’s business model is different from those of most traditional automobile manufacturing companies because it owns the entire supply chain from manufacturing to distribution. This strategy is driven by the ultimate goal of lowering manufacturing costs and the costs of goods sold, thereby assuring the business’ sustainability. The Model X and Model 3, which unlike its previous models, target the mass market for electric vehicles. Tesla’s supply chain management strategy focuses on a long-term growth strategy involving production, inventory management, and distribution.

Because Tesla builds entirely new types of cars and possesses a completely redesigned manufacturing process, it has taken nearly complete control over the industrial value chain. Thus, for the Chinese automotive industry, Tesla has proven itself as a true disrupter in the field. This disruption has primarily taken shape in the following areas in particular: batteries, charging infrastructures, Tesla’s production, sales and distribution model. The flow chart below shows the integration of Tesla’s supply chain.

[Source: SAGE Journals, Tesla’s highly integrated business model]

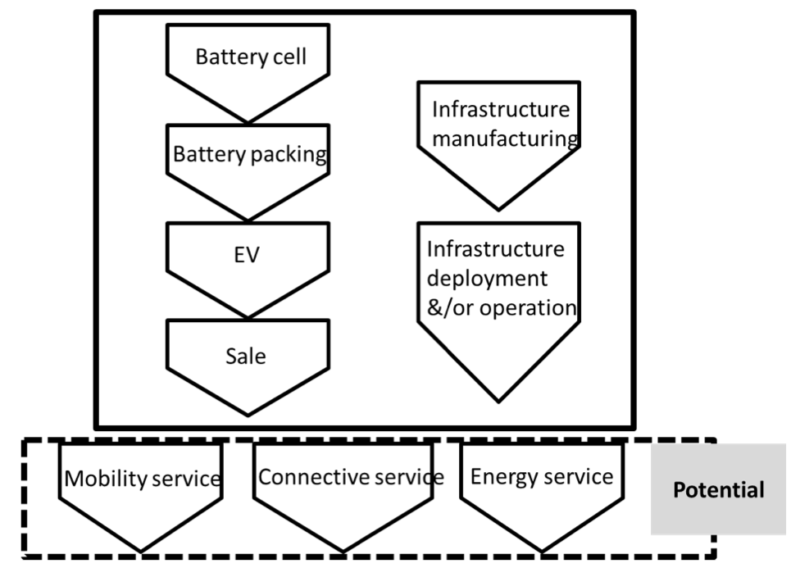

2. Tesla’s Complex Management of Battery Packs

It is widely acknowledged that the key to the sustainable development of electric vehicles in the future lies in battery technologies and charging systems. The main factor negatively affecting sales of electric cars is their short endurance mileage. Which as a result, has deterred many consumers who fear running out of power on the road. The battery, which is the crux of electric vehicle technology, is the first important problem encountered in electric vehicle innovation.

To provide a solution to this problem, Tesla’s value chain capture includes the production of battery packs. Tesla attempted to solve these issues from the outset using a core technology of combining ordinary batteries into a powerful, stable and large-capacity battery pack. Instead of developing a dedicated large battery, Tesla used a large number of mass-produced lithium batteries developed for laptops that have a well-developed supply system, are low in price, and are of consistent quality.

This proved successful as Tesla vehicles hold the number one place in long range driving. Below is a chart displaying the integration of the battery cell and packing into the EV’s production cycle.

[Source: SAGE Journals, organization structure of batteries into Tesla’s business model]

3. Tesla’s Efficient Energy Ecosystem

Tesla also realized the importance of being able to supply its own energy systems. This is where the principle of self-service became key to solving the problem of charging and supplying power. To address the above problem, Tesla is in the process of developing a new energy supply ecosystem of superstations that produce their own energy and charging stations to be distributed across China.

4. Retail and Distribution

The Tesla business model captures all aspects of retail and distribution. Which means it owns all its dealers and sales outlets as well as internally handles vehicle repair and maintenance.

Whereas on the other hand, traditional OEMs rely on a pronged selling network with one-brand and multi-brand dealers. Tesla, going against this deeply rooted system decided to market its vehicles through the Internet. Utilizing the so-called direct sales system method. Tesla’s direct sales model is a significant departure from the typical franchised dealership model. In this way, the company not only controls customer experience, but also owns the channel touch-points and data, which can lead to potential advantages for new product development.

By making customer experience a key quality, Tesla may contribute to making the car a vehicle for enhanced personal mobility. The “ultimate driving machine” may become the artificial intelligence-enhanced, high-touch living and working design. Tesla may end up as a case of entrepreneurial disruption without ever challenging the incumbents directly on their scale business of mass manufacturing, opening up the way for other entrants.

5. Sales and Pricing

Online only sales are ill-suited for most dealers, but have been done successfully by Tesla. Resulting from this sales model is the beneficial aspect of fixed pricing. What this means is that the retail price of the vehicle is the same at no matter what point you buy it from in the Tesla network. When reaching the point of being able to price an EV at fixed numbers you can entertain the idea of online sales. This separates Tesla from the market because, for other OEMs, they’d need to at least get to a point where consumers feel like they’re getting value from the brand. This pricing and distribution strategy gives them that Apple quality and feel.

6. Customer Segment

Tesla’ customer segment is vastly different to other carmakers. Most car-makers enter the multi-purpose economy or specific-purpose market. The ownership cost for EV is high.

Because Tesla continues to offer an SUV version luxury multi-purpose car, followed by a more economical multi-purpose car, it corresponds to the strategic goal of creating an affordable mass market EV. The customer segments of battery and recharging systems need to match the customer segment of vehicle.

The transnational homogeneity of these market segments means Tesla faces low pressures for local responsiveness and can offer a standardized product with minimum differentiation across markets. Tesla’s market segmentation is revealing of its high-end disruption innovation model.

7. Cost and Value

The competitive nature of the car industry has placed high pressures on cost reduction, which has pushed Tesla to increase its products’ customer perceived value. By creating value-added services, through a global network of stores, service centers and Superchargers, the company supports customers in their purchasing decisions and reduces the switching costs of buying EVs. On the other hand, developing unique core competencies in powertrain engineering and energy storage has enabled Tesla to price its product at a premium. Finally, over-the-air software updates allow Tesla to limit its products’ obsolescence, strengthening their value-for-money.

In sum, Tesla can be labeled as a value-driven business. The goal of the company was to always offer best-in-class technology embedded in its products, and therefore customers are willing to pay more to buy the goods this firm presents to the market.

Takeaways from the strategy of Tesla in China

The vertical integration approach helped Tesla learn quickly and maintain control of all the key design details. Tesla went further, vertically integrating its retail sales channel and building its own network of charging stations. Such a level of vertical integration in the auto industry last appeared in Ford’s pioneering days. In essence, Elon Musk’s China strategy is to increase car production and to expand Tesla’s charging infrastructure to accommodate increasing the number of Tesla cars on the road. By producing the energy that power its cars, Tesla sources itself in the automotive industrial energy and value chain.

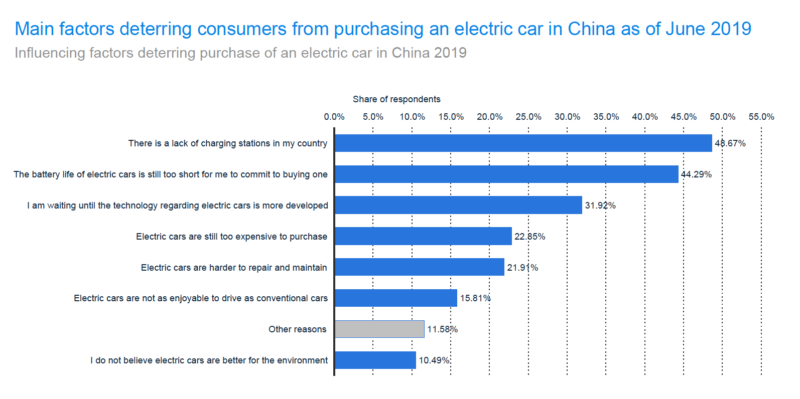

Explaining Tesla’s Success in China

Timing and vision played a significant role in Tesla’s success. Tesla was one of only a handful of pure EV car makers globally in the mid-2000s and probably the first to develop a robust EV powertrain and battery pack. The company was a first mover in betting that lithium-ion battery costs would continue to decrease for many years to come. Tesla’s hard charging nature, led by CEO Elon Musk and its unique branding approach enabled it to distinguish itself from other car-makers and attract loyal customers. Furthermore, Tesla’s business and operational model seek to address the key problems Chinese vehicle buyers have with EVs.

[Source: Statista, Influencing factors deterring purchases of electric cars in China]

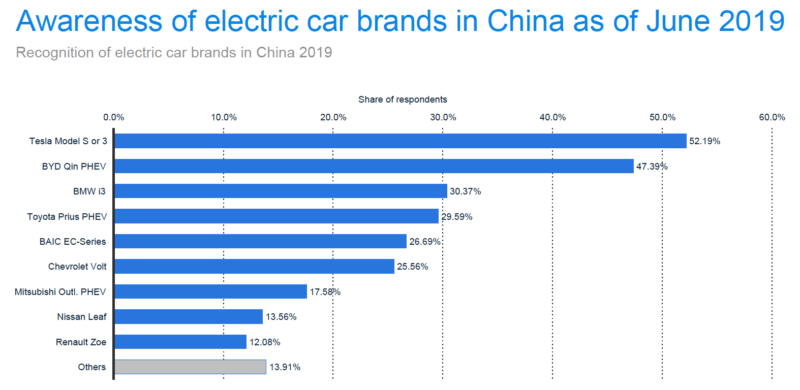

This graph shoes the effectiveness of Tesla’s brand imaging in gaining popularity among Chinese buyers. The factoring of brand awareness will be a major driver of Tesla’s growth in the Chinese market and will set the pace for future success.

Tesla’s Competitors in the Chinese EV Market

Tesla faces steep competition in China from a mix of both foreign and Chinese automakers that are already manufacturing and selling electric cars. For now foreign car companies continue to see gold in China and are boosting local production of their own electric vehicles. However, Tesla does have one big advantage in China. And that is the Chinese government has helped Tesla tremendously by giving them a special dispensation so that they can be an independent foreign auto manufacturer without needing a local partner.

Chinese automakers have benefited from some $60 billion worth of subsidies and incentives since 2012, designed to make new energy vehicles affordable for Chinese drivers. This has included research-and-development funding, tax exemptions and financing for battery-charging stations. Meanwhile, non-Chinese automakers, including BMW, Mercedes, Audi and Toyota, have already established a beachhead in Asia, with manufacturing and sales there conducted through a variety of partnerships and agreements with local entities.

Domestic competition in China’s EV indudstry

Electric vehicle makers that are already up and running in China include: NIO, which went public in September 2018, Warren Buffett-backed BYD, SAIC Motor, a partner of Volkswagen and GM, Geely Automotive Group, BAIC Group, and its subsidiary Beijing Electric Vehicle Co. Besides these, a group of electric vehicle start-ups are on the rise in China which includes Byton and WM Motor Tech.

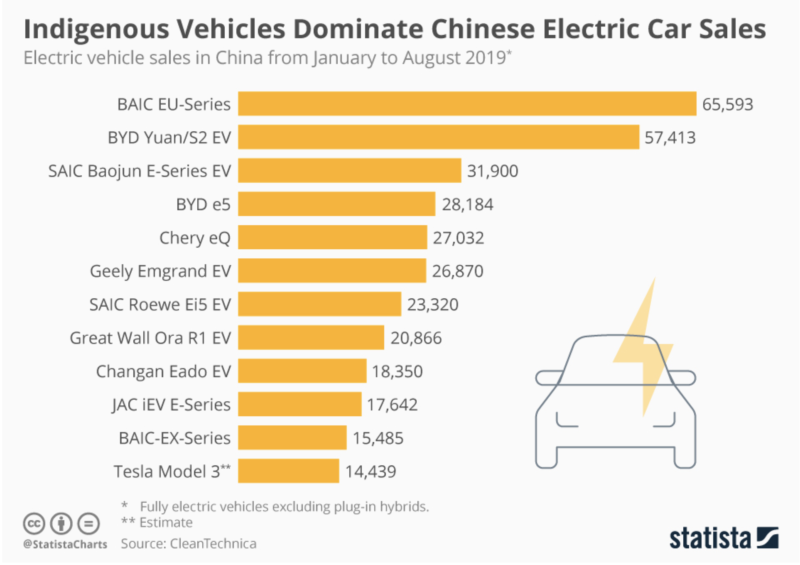

Even though Tesla is dominating electric vehicle sales in the United States, the company is trailing domestic competition in the massive and lucrative Chinese market. Clean Technica, in its its latest analysis of plug-in electric vehicle sales in China, found that the BAIC EU-Series was the top-selling model between January and August 2019. The electric sedan sold 65,593 units, ahead of two other Chinese models – the BYD Yuan (57,413) and the SAIC Baojun E-Series EV (31,900). The Tesla Model 3 was far behind, selling 14,439 units in the first eight months of 2019. However, the market has seen change in 2020.

Tesla’s Strategic Approach to China in Comparison to NIO

Many high-profile EV start-ups in China like NIO are attempting an ambitious shortcut to duplicate the Tesla approach by jumping into design and marketing without first building ordinary capabilities. The logic with this strategy is that leapfrogging past ordinary capabilities is possible if operations can be outsourced. However, this approach puts stress on the asset orchestration and other capabilities of management.

For example, this has put increased stress on NIO because it does not manufacture its own cars. It contracts state-owned JAC Motors to make their vehicles. In turn, JAC charges fees for every car. Thus, due to its partnership with JAC, NIO generates lower margins than its peers like Tesla that manufacture their own cars. Moreover, while the company initially planned to construct its own manufacturing facility in Shanghai like Tesla’s Gigafactory, it finally dropped the plan due to financing issues. This is a representation of how Tesla’s government financing from China significantly improved its market results.

Therefore, as NIO relies on JAC, there is not much room to streamline manufacturing costs. On top of that, NIO does not have a dealership network and instead sells its vehicles through apps and a network of NIO houses, located in some of the most expensive areas of China’s largest cities. Lastly, huge vehicle recalls are affecting the reliability and reputation of NIO, in addition to taking a toll on expenses and margins.

Thus, to address the issues encountered by NIO along with the feedback from Chinese EV consumers, Tesla has provided a product that has access to charging stations, a strong battery, and advanced technological functions for improved customer experience.

The future of Tesla in China

The profitability of each multinational automaker’s China strategy depends on reading (‘sensing’) the EV market correctly. Decisions automakers in China must make include; which market segment(s) to target and whether to create China-specific designs to better accommodate the sometimes inferior Chinese batteries they are required to use.

Strong sensing and sense-making capabilities allow firms to perceive where the industry is heading, enabling management to identify critical capabilities and bottleneck assets that need to be acquired or enhanced. This is where Tesla proved ahead of the market.

Author: Jeffrey Craig

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes