COVID-19 impact on Chinese consumption

COVID-19 impact on Chinese consumption had unique outcomes in every industry. For example, mobile games and short-video markets experienced tremendous growth, while restaurants and services struggled to make ends meet.

What Chinese people did at home during the epidemic

The main lock-downs of the Coronavirus epidemic in China lasted over two months. However, as China’s economy is recovering from COVID-19, the potential for another outbreak is ever-present. The months that consumers spent indoors have significantly altered China’s stay-at-home economy. Even when the pandemic becomes a thing of the past, the length of the outbreak is long enough to cause new habits to form, and the severity of the outbreak is enough to forever change consumer values.

Six new trends of China’s market during the epidemic

- Mobile games have seen explosive growth

The average DAU of Arena of Valor reached 50 million during the 2020 CNY.

- Video industry performed well overall

Short videos got more welcomed. Live-streaming and foreign movies and TV dramas are growing popular.

- Fresh food ecommerce is facing more demands

Major platforms are in short supply. The DAU of JD one-hour delivery reached 1 million, while Hema reached 400 thousand.

- Online education becomes necessary

After the government announcing to postpone the starting day of school, online learning APPs achieved dramatic growth.

- Online medical care attracts more attention

The demand on remote medical inquiry and O2O medical ecommerce in China increased remarkably.

- Remote working has become the mainstream

The DAU of Dingtalk is going to exceed 100 million, with absolute advantage in the market.

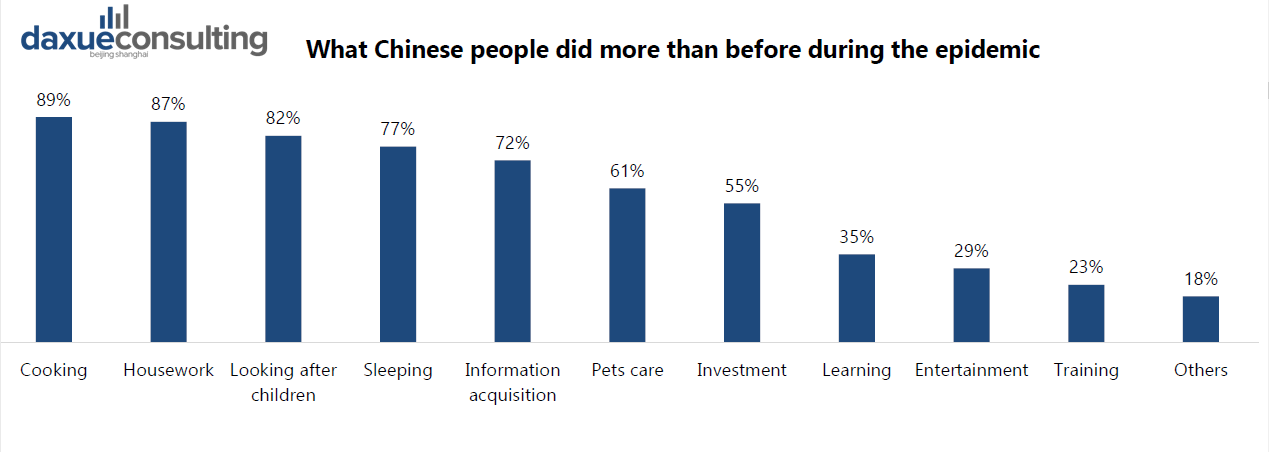

Main activities of Chinese while at home

In addition to daily household duties like cooking, childcare and pet care, Chinese people spend more time on information acquisition as well as investment. The end of the outbreak could give way for consumers’ growing reliance on social media and APPs for information and an increase in financial awareness.

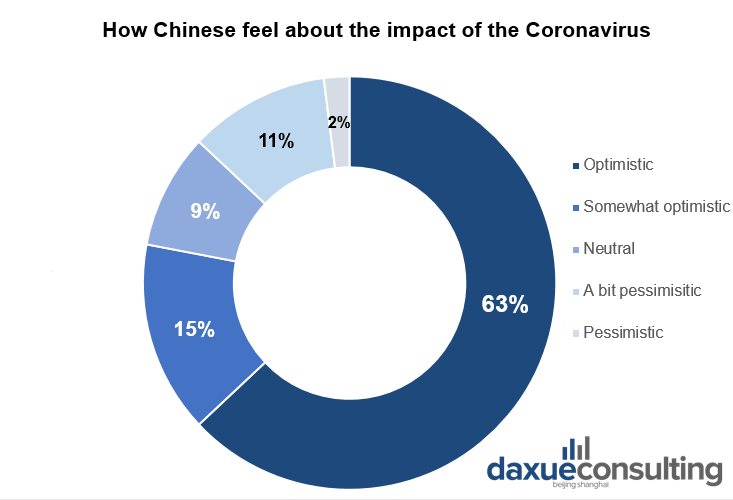

In general, Chinese people felt optimistic about the impact of the Coronavirus in China. 63 percent told that they are optimistic and only 2 percent were pessimistic.

[Data Source: 199it.com, COVID-19 impact on Chinese consumer behavior report by daxue consulting. How Chinese people feel optimistic about COVID-19 impact]

Activities of Chinese people in different age groups

Under 20s

Chinese digital natives increased their time spent binge-watching TV series and online learning.

20-30yo

Millennials also spent time binge watching TV series and playing mobile games.

30-40yo

30-40year-old watched the news through short videos, and extensively talked to others and cooked.

40-50yo

40-50year olds spent more time on WeChat, cooking and watching news.

Over 50s

Those over 50 paid much attention to news, health information and the management of their community.

Chinese consumers developed new habits

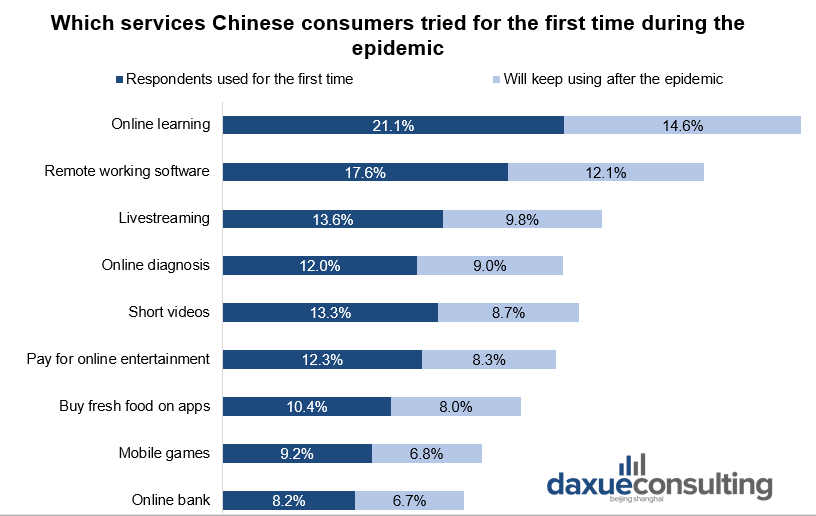

Among all respondents, 73.5% tried at least one new service for the first time. All the services listed below will likely keep a strong growth. Additionally, many people said they will continue to use these online services after the epidemic.

[Data Source: 199it.com, COVID-19 impact on Chinese consumer behavior report by daxue consulting. Most of Chinese people tried at least one new service during the epidemic]

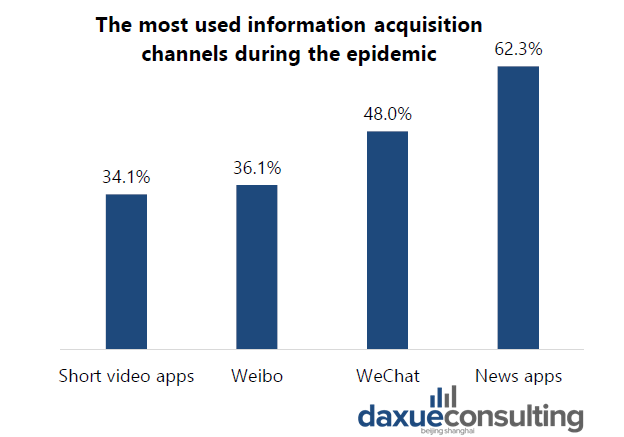

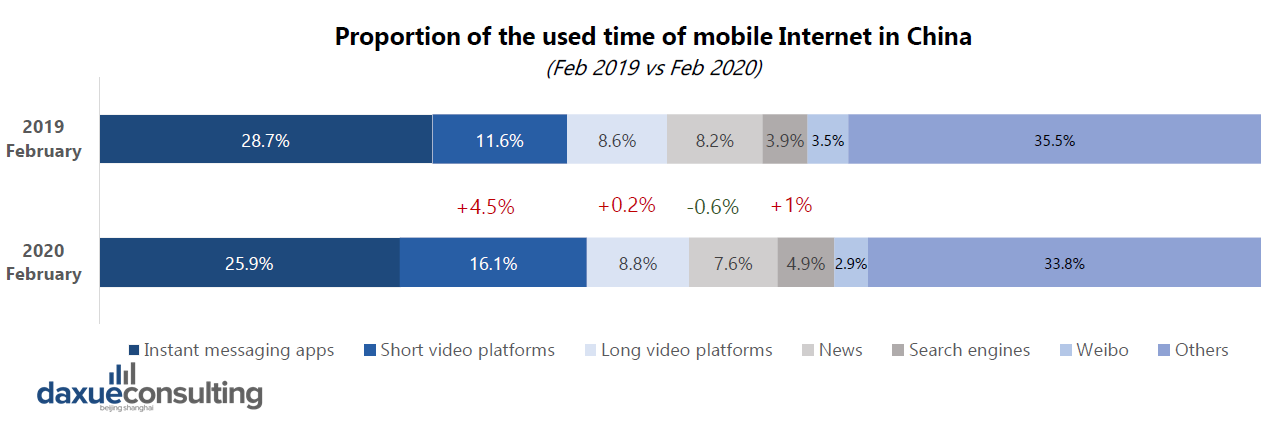

COVID-19 changed the way of Chinese people get information

Outside of news apps, WeChat, Weibo and short video apps became the main channels for Chinese to obtain information. Information supply form with social function is more likely to gain traffic in the future. 48% said they will continue to spend more time in information acquisition after the outbreak. Business and finance represent the second news trend, this financial interest will last after the epidemic.

[Data Source: NetEase Positioning & CTR, COVID-19 impact on Chinese consumer behavior report by daxue consulting. WeChat, Weibo and short video apps became important information acquisition channels]

Online study apps are now a necessity

The epidemic largely decreased the cost for online education platforms to attract consumers. Students and parents in tier-2 and 3 cities have greatly improved their awareness and acceptance of online education in China. It created huge traffic for online education platforms. During the epidemic, the daily active users of Xueersi (学而思) online education platform exceeded 10 million. Many new users are come from tier-2, 3 and 4 cities.

However, the online education industry still has some difficulties. For example, it’s hard for online educators to create an atmosphere which is conducive to learning. Many teachers don’t have much experience on online teaching and cannot conveniently interact with students. Moreover, students need supervision to help them concentrate on online courses, but many parents don’t have time. Online education platforms need to launch more interactive teaching modes to gain more consumers after COVID-19.

COVID-19 outbreak effect on Chinese consumption

Consumer tendencies during the COVID-19 epidemic

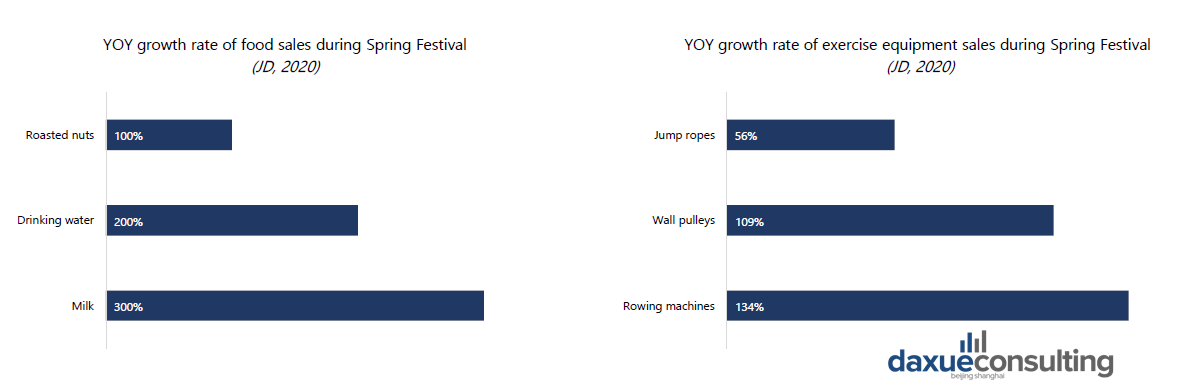

The coronavirus outbreak has improved people’s safety consciousness. JD data showed commodities that reduce disease and meet nutritional needs are more popular. Frozen food, snacks and health products have a high proportion of online consumption.

Indoor fitness equipment purchases skyrocketed during the epidemic. JD data shows that the turnover of wall pulley increased by 109% YOY during the 2020 CNY, jump ropes increased by 56% and rowing machines increased by 134%.

[Data Source: JD.com, COVID-19 impact on Chinese consumer behavior report by daxue consulting. Commodities that reduce disease and fitness equipment became popular]

Health-related consumption increased

The epidemic may have a lasting impact on attitudes towards a healthy and sanitary lifestyle.

For instance, laundry sanitizer sales increased 643% according to Suning. Antiseptic hand sanitizer sales increased 1.7% according to Suning.

Staying at home for a long time made people find new ways of stress relief, like Yoga or indoor workouts. They also started to access more info and products about disinfection.

These health-related considerations may change consumer habits, such as investments in household cleaning, disinfection products and at-home workout equipment.

Three types of consumption that reduced in the short term

COVID-19 greatly impacted China’s beverage market, especially liquors. Normally, CNY accounts for a high proportion of liquor sales. However, the epidemic caused a full-scale impact on consumption of gifts and catering.

Less automobile consumption is an inevitable short-term outcome. Consumers’ behaviors also changed during the outbreak. Online sales are now attracting more consumers since they want to prevent the risk of cross infections in 4S shops.

Coronavirus seriously affected offline air-conditioning market in China. The spread of the epidemic has greatly restrained consumer demand, especially the need for replacements that are not urgent.

Where did consumers shop during the epidemic

COVID-19 has changed consumption in both frequency and preferred channels. Many consumers choose to reduce the frequency of shopping due to fear of going out.

More than half of consumers have moved from offline stores to e-commerce. Online penetration rate during the epidemic period was as high as 68.2% which increased by 50.7%.

[Data Source: Dataway, E-commerce became a key shopping channel during the epidemic]

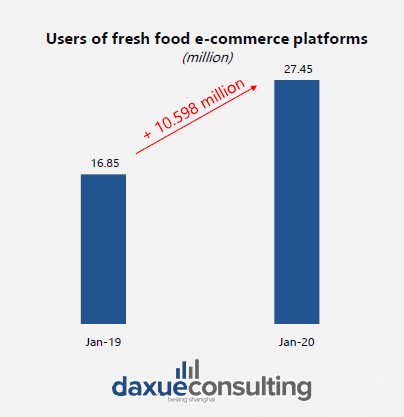

Explosive growth of fresh food e-commerce

As of 6th February 2020, JD daily active users have exceeded 1 million, Hema and Dingdong Maicai exceeded 400 thousand. The number of daily users is still increasing.

Normally, people can make a habit after using the same channel 4 to 5 times. Since the coronavirus outbreak, most consumers ordered fresh food by e-commerce far more than 4-5 times. It means the industry had not previously received much attention and will play an important role in the future.

After the panic consumption in the epidemic period, food delivery services in China will keep growing.

[Data Source: MobTech, COVID-19 impact on Chinese consumer behavior report by daxue consulting. More and more Chinese people use food e-commerce platforms]

Live-stream proactively met consumers needs

The general performance of the apparel industry fell by 60% – 80% during the epidemic. However, brands that promote products by live-stream had much more sales than others. In addition, other industries have joined the live-stream tide, such as cosmetics and fresh vegetables.

If a live-stream sales model for brands during the epidemic is sloppy, then they will have to be more strategic after the epidemic to maintain sales.

COVID-19 outbreak effect on Chinese entertainment

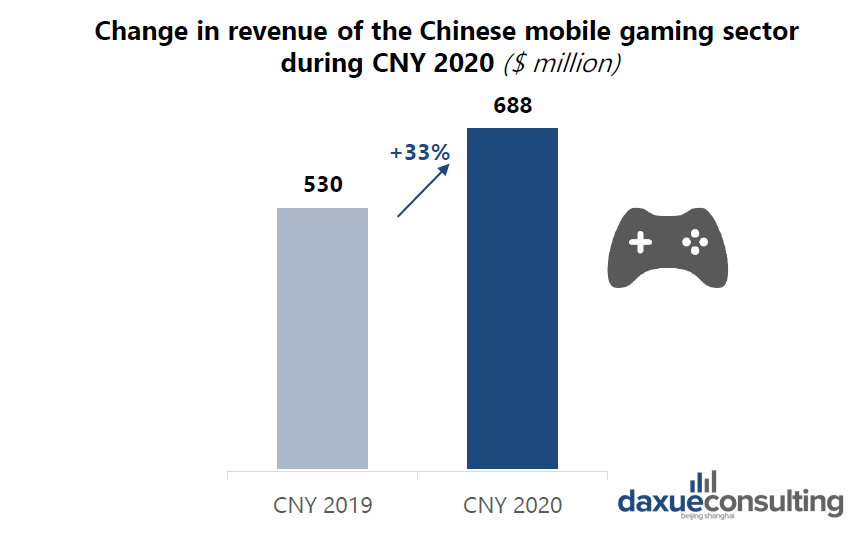

Mobile game market will upgrade

During the Coronavirus outbreak, demand for mobile games increased enormously. The top mobile game companies (such as Tencent) expended their business and further seized the market space of small companies. But the sustainability of mobile games’ boom is questionable once the epidemic subsides.

[Data Source: Capital Watch, COVID-19 impact on Chinese consumer behavior report by daxue consulting. Revenue of mobile gaming sector is growing]

Short video platforms gained many new users

During the Coronavirus outbreak, there was an increase in China’s short video market. Before the epidemic, young people widely used short video platforms. They spent more time on short video platforms for entertainment during the epidemic.

Also, it is easier for short video platforms to have new users from middle-aged and elderly groups than the past. Now many young people started to teach their parents to use short video platforms when they were at home. It makes the platforms accessible to them as a form of entertainment long after the epidemic ends.

[Data Source: Quest Mobile, COVID-19 impact on Chinese consumer behavior report by daxue consulting. Short-video market in China is increasing during the epidemic]

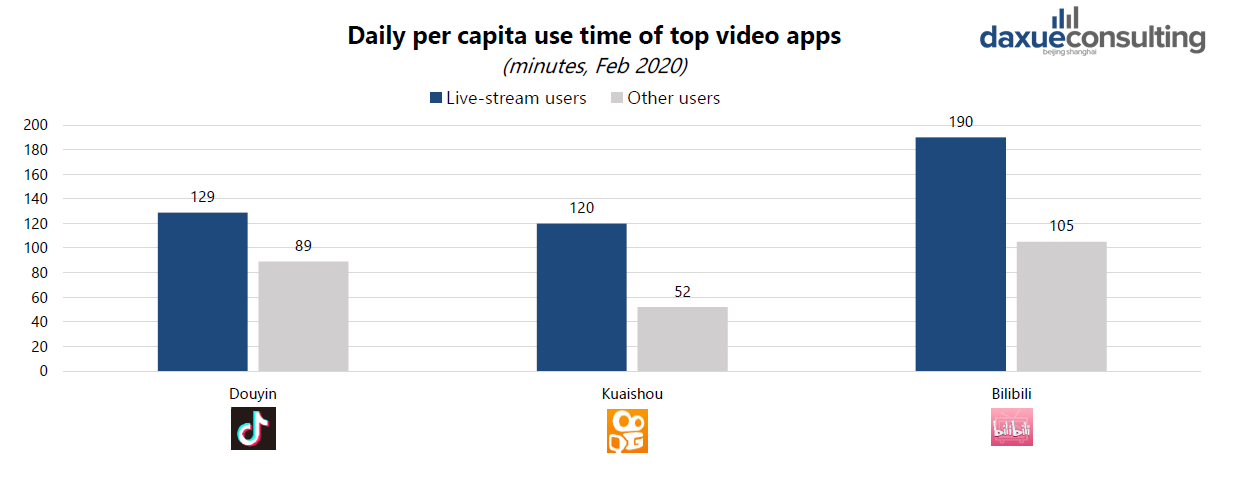

Live-stream further enhanced user stickiness during the epidemic

Live-stream is useful for enhancing user stickiness, it is growing during the COVID-19 epidemic. On top video apps, live-stream users spend more time (more than 120 minutes/day) than other users during the Coronavirus outbreak. Tourist sites and venues like museums and bars also started to use live-stream to increase exposure during the epidemic. This may be a new growth point for the live-stream market even after the epidemic.

[Data Source: Quest Mobile, COVID-19 impact on Chinese consumer behavior report by daxue consulting. Live-stream got more users during the epidemic]

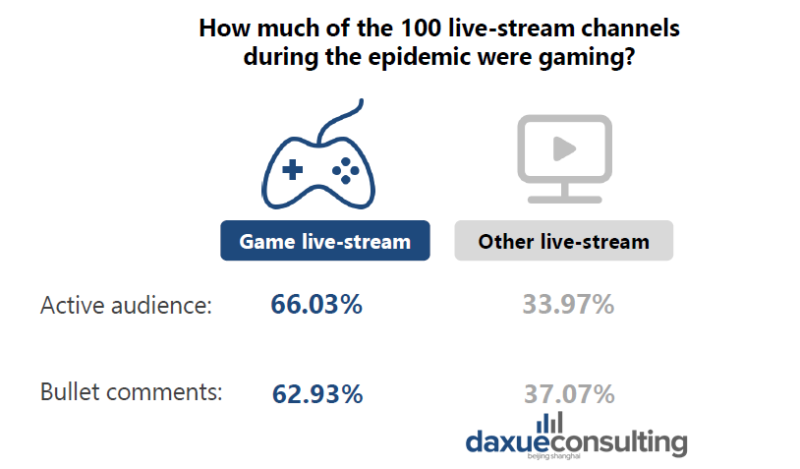

Video games are the most popular live stream

During the epidemic, video game live-streams attracted more viewers than any other live-streams. Many of those audiences follow specific gaming KOLs in China, which means they have high users’ stickiness. Since more people are returning to work, the time of live-stream is the key to remain those audience.

[Data Source: iResearch, Game live-stream became more popular during the epidemic]

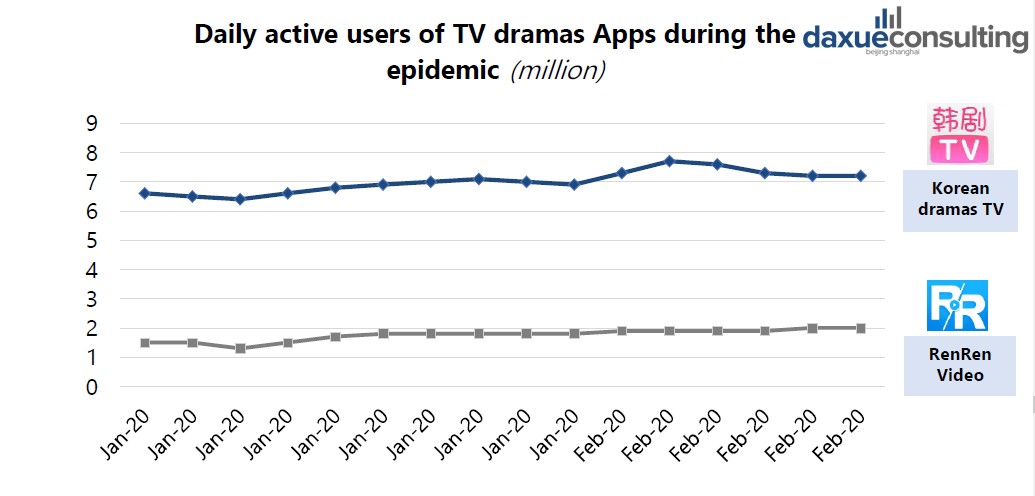

Increased demand for movies and TV dramas

Because of the Coronavirus, all movie releases were postponed or canceled. Users could see some Chinese movies on the Internet platforms such as Xigua video and Douyin. Online TV dramas also received many views during the epidemic.

Through the way of “film + Internet“, movies can have new development channels and rid the model of box-office revenue. It also can be the way of small and medium-budget films to compete with big movies.

[Data Source: MobTech, COVID-19 impact on Chinese consumer behavior report by daxue consulting. Movies and TV dramas became more popular during the epidemic]

The consumption boom after the epidemic

Chinese people look forward to going out again after Covid-19

21-30-year old hope to have dinner with friends and family in restaurants after the epidemic. They focus on the quality and health of restaurants. They are the key clients of catering market’s recovery.

31-40-year old wish to travel after the epidemic. Most of them will choose short trips in China since the epidemic is still serious in other countries. They probably will get away from the most popular travel destinations to avoid crowds.

41-50-year old plan to visit their parents after the epidemic. They usually purchase health products for their parents, thus health related products will even have more sales than before.

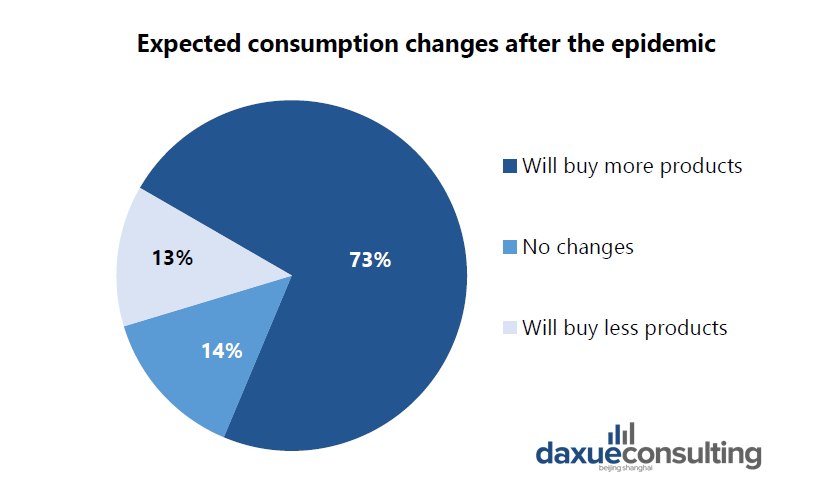

More purchases will come after COVID-19

According to the survey of DATA100, more than 70% of consumers say they will purchase more after the epidemic. Thus, Chinese consumption will have a quick growth after their daily lives return to normal.

[Data Source: 100.com, COVID-19 impact on Chinese consumer behavior report by daxue consulting. Chinese consumption will grow after the epidemic]

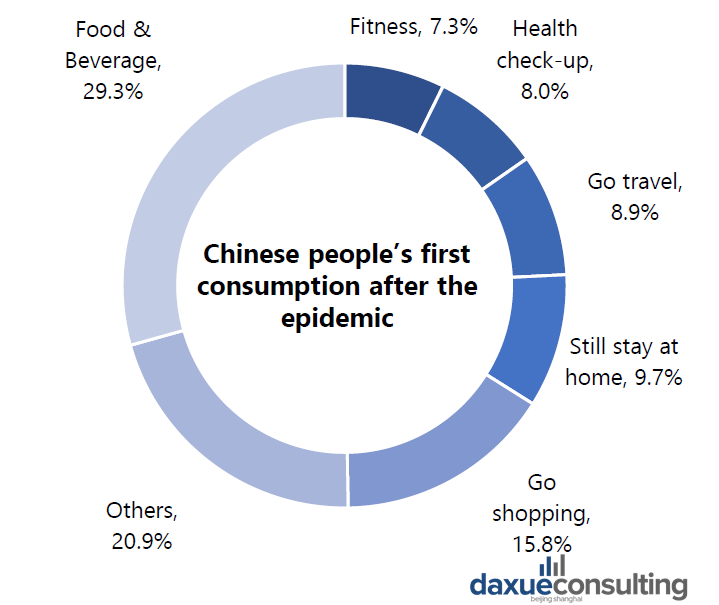

What will be Chinese people’s first consumption after COVID-19

Food & Beverage

29.3% of consumers choose “Food & Beverage” as the first consumption after COVID-19. There is no doubt that many of them would take milk tea and hot pot as the first choice.

Go shopping

15.8% of consumers choose to “Go shopping”, far exceeding other consumer scenarios. It may be related to consumers’ long-sufficient shopping desire during the epidemic.

Still stay at home

9.7% of consumers choose to still stay at home, which should be related to the fear brought by the epidemic. They will keep the way of consumption during the epidemic.

[Data Source: Dataway survey, COVID-19 impact on Chinese consumer behavior report by daxue consulting. Food and beverage will be the first consumption after the epidemic]

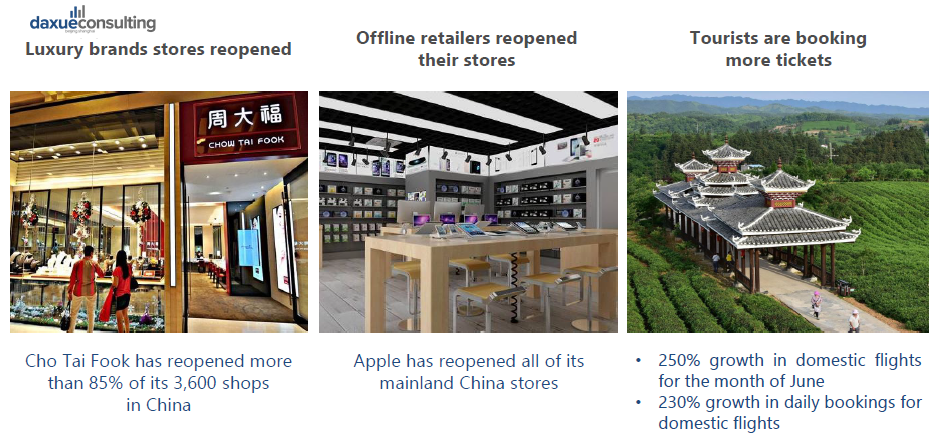

Resuming work is helping consumption recovery

China’s recovery from COVID-19 outbreak impacts on consumption. More than 50% employees were already back at work during the first week of March 2020.

The white-collar people in the first-tier cities are the first group back at work. They showed high consumption demand for F&B, especially delivery services. The food delivery is growing very fast in tier-1 cities.

Consumption areas that are starting to recover

[Source: Reuter Communications, China gradually goes back to business]

Increased caution regarding health and finance

In terms of consumption, Coronavirus has a greater impact on young people, especially consumers between 20-30 years old. The epidemic may invoke feelings of financial insecurity. Hence, they may be inclined to have less impulse spending and save more.

The health management of the Chinese consumers will be the primary consideration. Additionally, consumers may pay more attention to the science behind health and diet. Health products and organic food may have long-term growth trends.

The epidemic made consumers realize the importance of insurance, they will secure further family risk prevention from purchasing insurance.

Key Takeaways

Chinese daily life went online during the epidemic

The Coronavirus outbreak largely increased the time spent online, it further digitalized the Chinese people’s consumption, entertainment, and social lives.

Health-related market achieved much growth

Due to the epidemic, the Chinese consumers are paying more attention to health-related goods such as household cleaning products and fitness equipment, this habit may continue for a long term.

Fresh food e-commerce should continue to expand penetration

The epidemic has provided a large growth for fresh food e-commerce to increase the penetration rate of the industry, so it may follow the trend to improve further.

Many consumers will remain cautious

The sense of panic and depression during the epidemic may linger, part of consumers may be more cautious and health-conscious.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast