Skin and immunity concerns drive the Vitamin market in China

The size of the vitamin and health supplements market shows an upward trend. The most popular items of the vitamin market in China are vitamins E, C and A. Although most Chinese brands are trusted in vitamins and health supplements market because of their long history, Australian Brands, like Swisse, are also very popular. COVID-19 gradually increases health awareness and stimulated the vitamins consumption in China, which makes it a promising market for health supplements products.

The development of vitamins and health supplement market in China

The market size of healthcare products in China is growing

Large market size of healthcare products represents the high potential in China.

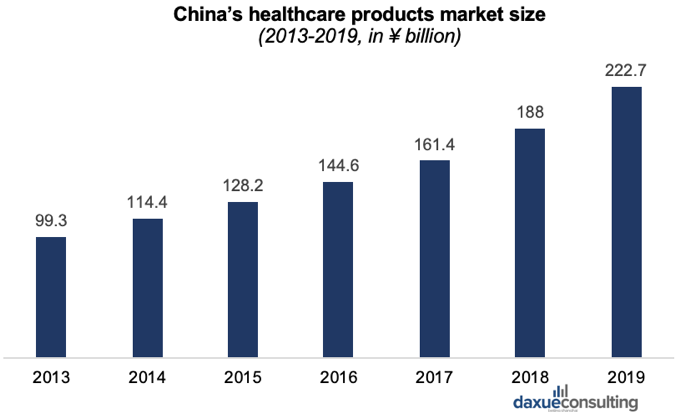

According to iimedia, the market size of healthcare products in China, maintained around a 10% YOY growth rate between 2013 and 2019. This which is similar to the US growth rate in 1970’s. China’s healthcare market size reached ¥222.7 billion in 2019, which makes China the second largest market for healthcare products, just after the U.S.A.

Data source: iimedia, Market Size of Healthcare Products in China

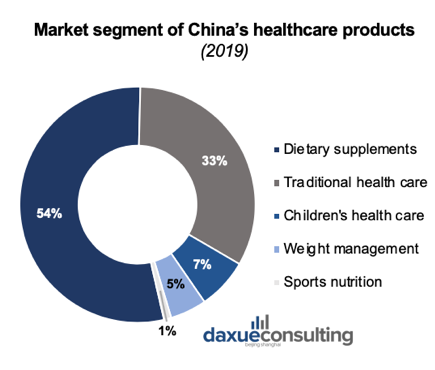

The market segment of healthcare product was occupied most by dietary supplement with more than half of the market in 2019.

Data source: chyxx (中国产业信息院), Market Segment of Healthcare Products in China

The health supplements industry in China developed along with the improvement of Chinese people’s living standards and health awareness

Most Chinese considered a healthy lifestyle to include physical and mental health. A healthy lifestyle should be without physical illness and with positive mental health, good social life etc.

Many Chinese see health supplements as a part of a healthy life. Hence, health supplements, such as vitamins and fish oil, are an important choice for health-conscious Chinese consumers. In a survey conducted by iimedia, 48.6% of the participants choose health supplements as their first choice to improve their health condition.

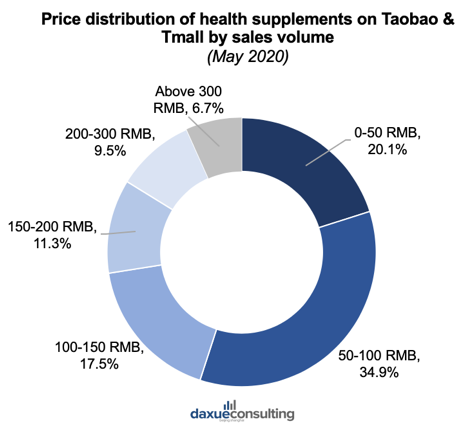

Price distribution of health supplements ranges from RMB 50 to over RMB 300. Most consumers buy health supplements for under 150 RMB on Taobao and Tmall. Customers’ price preference means high-end products are popular among a small group.

Data source: Taosj (淘数据), Price Distribution of Health Supplements in Chinaby Sales Volume

China’s demand for vitamins is continuously growing

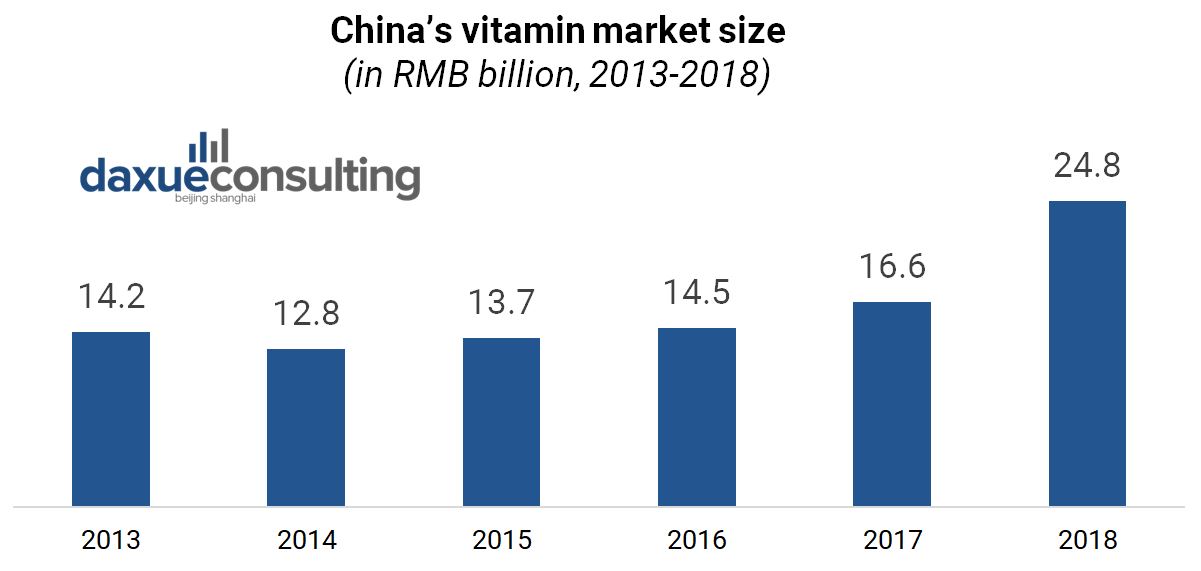

Vitamin market in China is expanding, as vitamin products are becoming widely used in China. An increase in market size can be expected under COVID-19 impact.

Data source: iimedia, ‘Size of Vitamin Market in China

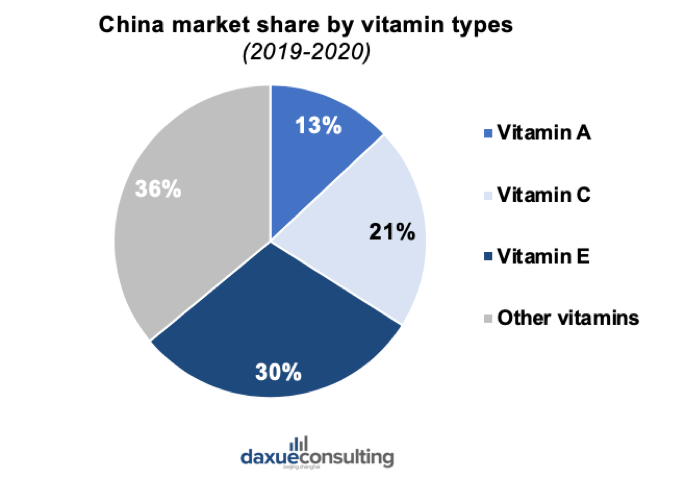

Vitamin E is the most popular vitamin in China, followed by vitamin C

Vitamin E is the most popular vitamin in China, making up 36% of the market. Followed by vitamin C, which takes 30%. The popularity of vitamin E is is partly due to the fact that Chinese believe it can prevent cancer. Chinese’ vitamins preference is different from other countries, such as USA, where vitamin D is very popular.

Data source: chyxx (中国产业信息院), Market Share of Vitamin Market in China by Vitamin Types

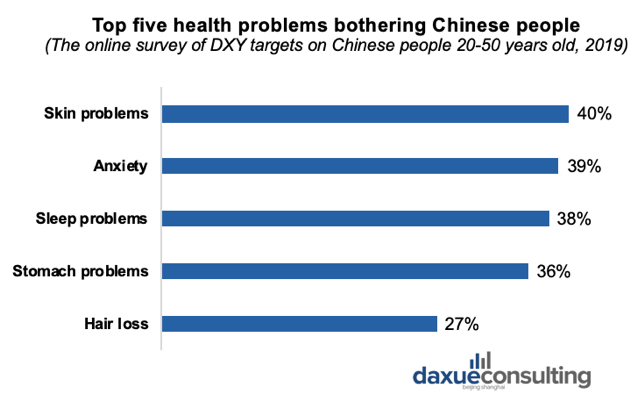

Skin care is the #1 concern among Chinese vitamin consumers

Vitamins which target skin health have large market potential in China. From information by DXY (丁香医生), 40% of the survey participants regard skin problems as a bothering health problem.

Data source: DXY (丁香医生), Top Health Problems Chinese Concern

Skin problems, as the biggest health problem plaguing Chinese people, have led to an increased demand for vitamins, as some vitamins are beneficial to skin health. Vitamin A, C and E can help skin maintain a youthful state, prevent pigmentation, freckles and wrinkles. Thus, they are popular in vitamin market in China. For example, Gold Partner (黄金搭档) sold over 90,000 monthly vitamin C chewing tablets, which is #1 vitamins product for skin problems on Tmall. Considering the apparent concern for skin health, it is also no surprise that China’s skincare market is booming.

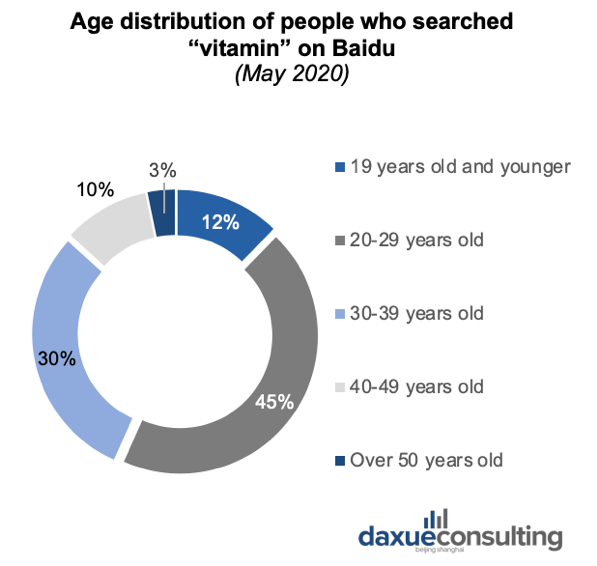

Millennials are the target market

Chinese millennials are the target group in vitamin and health supplement market in China, as post-90s gradually become the main force of vitamin consumption. According to Baidu Index, age of people who searched “vitamin” on Baidu distributed mostly in aged 20-29 years old.

Data source: Baidu Index, Age Distribution of people Searching ’Vitamin’

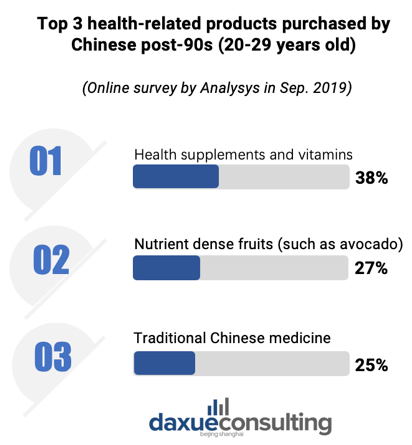

In one survey about post-90s’ health products consumption, top three health-related health-related products purchased are health supplements and vitamins (38%), nutrients dense fruits (27%) and traditional Chinese medicine (25%).

Source: Analysys (易观), Top Health-related Products Purchased by Chinese post-90s

Consumer Analysis in vitamins and health supplements market in China

Core drivers of purchasing vitamin and health supplements

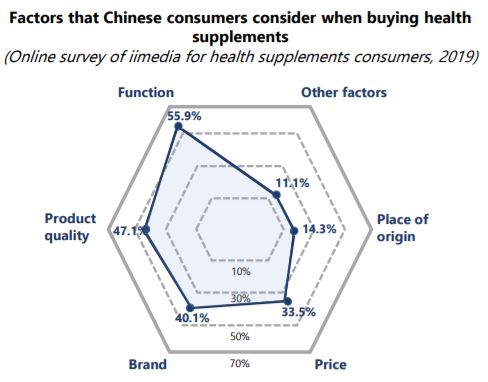

Function, product quality, brand and price are four main drivers of purchasing, according to an analysis, which aims to research what factors effect most when Chinese consider buying vitamin and health supplement.

Data source: iimedia, Main Drivers of Buying Vitamins and Health Supplements

Most customers’ positive perceptions are related to functions. On Weibo or Zhihu, Chinese consumers mentions the function of relieving fatigue and skin whitening ect., when talking about vitamins health supplement.

Data Source: Sample of Weibo & Zhihu Posts, netizens opinions in the Vitamin and Health Supplement Market in China

Core obstacles of purchasing vitamins and health supplements

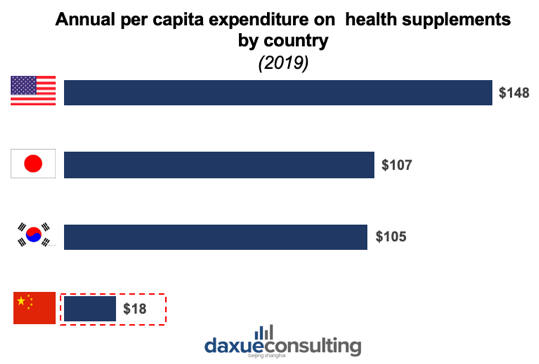

There is a large gap between China and developed countries in per capita consumption of health supplements. In 2019, per capita expenditure spent on health supplement was only $18 on vitamins and health supplements, while in America, that was $148, eight times higher than in China. However, the market is now growing fast as COVID-19 stimulated the consumption in China.

Data source: chyxx (中国产业信息院), Expenditure on Health Supplements by Country

Factors, such as Price, product effect and reputation, will stop potential customers from purchasing vitamins and health supplement. Most complaints of health supplements result from effect. Consumers gave negative comments when the high price does not match the value. In addition, the reputation of health supplement in China is damaged by media. Most Chinese customers are bombarded with negative information of health supplement, which to some extent embedded a negative image of vitamins and health supplements in Chinese.

Data Source: Sample of Weibo & Zhihu Posts, Obstacles for Entering Vitamin and Health Supplement Market in China

Other obstacles, such as the size of tablets and taste, also potentially stop people from purchasing vitamin and health supplements. Although Centrum (善存)’s multivitamin products have high popularity online, Chinese customers complain the design of bottle and the size of tablets on RED (小红书).

Source: Sample of Weibo & Xiaohongshu Posts,, Comment about Centrum (善存)

Market Competition in China’s vitamin and health supplement market

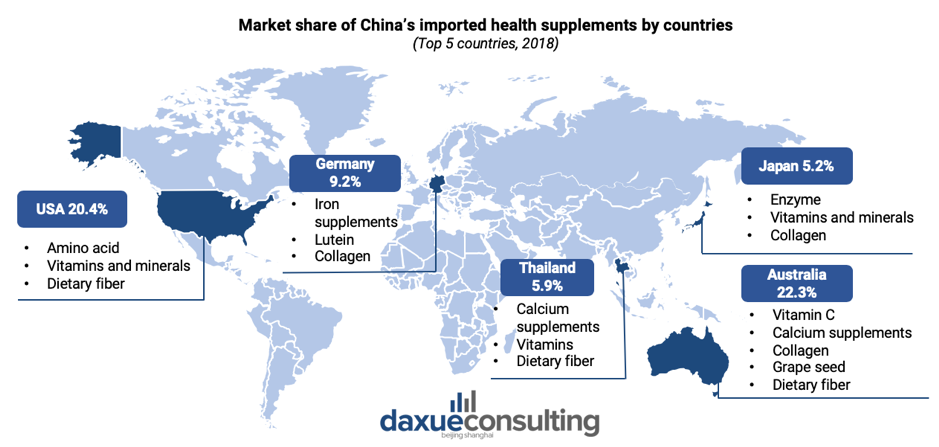

Vitamins and health supplements from Australia and U.S.A are the most popular in China.

2018’s customs data by CBNDATA, shows that Australia and U.S.A are top two import countries of the vitamin and health supplement market in China. Australia and U.S.A account for 22.3% and 20.4% of VDS imports to China respectively. Their brands quickly seized China’s health supplements market share by cross-border and social e-commerce.

Source: CBNDATA , Customs data, Top 5 Imported Countries in Vitamin and Health Supplement Market in China

Besides Chinese brands, Australian brands, such as products from Swisse and Cenovis, are the most popular on China’s online market. By-Health (汤臣倍健) ranked #1 in May 2020, followed by Swisse (#2) and Centrum (#7).

Data Source: Taosj (淘数据), ‘Top health supplements brands on Taobao & Tmall

Most vitamin and health supplement brands leverage online and offline campaign to build brand image and promote

How brands build youthful image through cooperating with celebrities?

Many health supplements brands aim to build a youthful brand image by using young KOLs and actors as spokespersons. For example, By-health rebuilt its brand image by endorsing young celebrities, Xukun Cai (蔡徐坤) to attract young consumers and associate with younger personalities. In order to shape the young image, By-health cooperated with Transformers and released cross-over products on Tmall.

Source: Tmall, Youthful Image of By-health

Cenovis is trying to raise brand awareness and attract more young consumers through endorsing Chengyu Hua (华晨宇) who is a singer with high-traffic in mainland China.

Source: Cenovis’s endorsement with Chengyu Hua

Centrum changed brand’s perceptions into young, funny and approachable by cooperating with Joker Xue (薛之谦, a famous Chinese singer and actor). Centrum worked with Joker Xue to film videos ads on Tencent.

Source: Tencent, Centrum filmed videos ads on Tencent

Offline marketing activities to reach Chinese vitamin and health supplement consumers

Many brands use offline marketing activities, such as sport events and pop-up stores, to interact with consumers in vitamin market in China.

By-Health built a museum which can use AI and hologram technology to educate about nutrition science and provide health examinations. These activities help visitors understand health situation and sell By-Health’s products.

Source, By-Health, By-Health’s Science and Technology Museum

Swisse built a immersive urban oasis pop-stores in malls during 618 promotion, where Chinese customer can see its healthy and natural brand image vividly. In addition, Swisse cooperated with The Color Run (Color run: Five-kilometer paint race), the sport event attract most young generation in China.

Source: Swisse, Australia-themed pop-up shops (Left) & Swisse X The color run (Right)

In order to expand target population, Centrum launched a carnival to interact closely with children and sponsored a child-parent TV program.

Source: centrum, Centrum carnival & TV Program

Covid-19 stimulation: How Covid-19 stimulated the sales of vitamins and health supplements

Chinese consumers are more interested in vitamin and health supplements as COVID-19 increased their health awareness

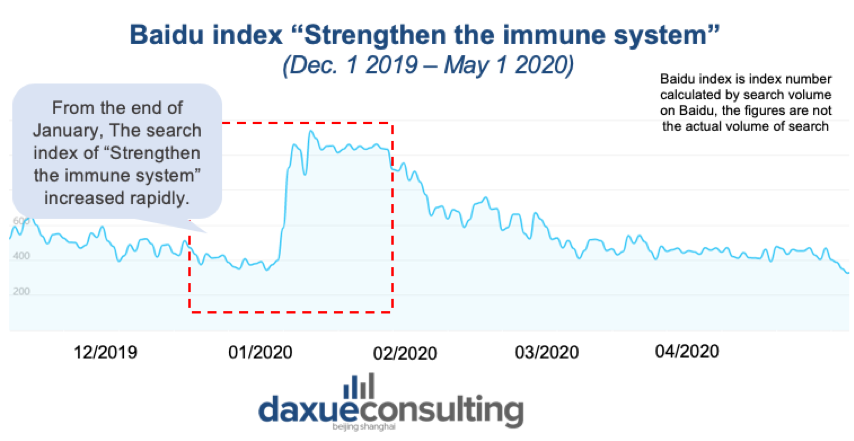

The health supplements industry in China developed along with the improvement of Chinese people’s living standards and health awareness. Chinese netizens showed more interest in improving their immunity during the coronavirus outbreak in January 2020. Demand for vitamins and health supplements that can enhance their immunity became strong during COVID-19.

Source: Baidu Index, Search Trend of ‘Strengthen the Immune System’

Chinese people showed strong demand for vitamins and health supplements that can enhance their immunity. Accordingly, health supplements that could improve immunity got more sales.

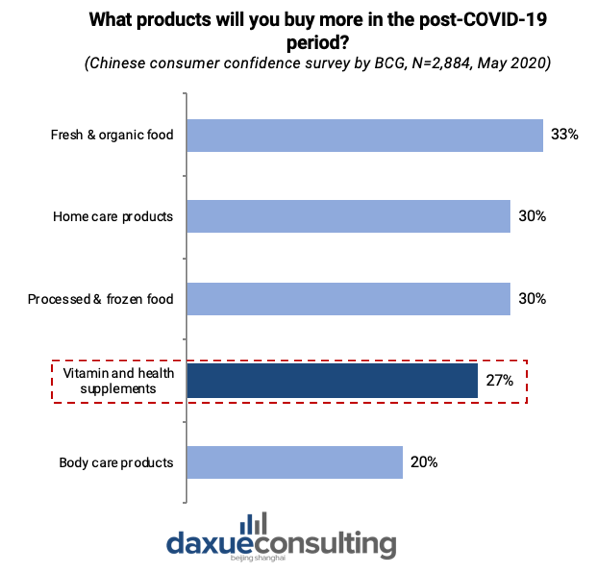

More Chinese consumers have showed purchase intention for vitamin and health supplements since the epidemic increased their health awareness.

Data Source: BCG (Boston Consulting Group), ‘What Chinese will Buy Most in The Post-COVID-19’

Brands seize the opportunity to increase sales revenue during the most serious period of COVID-19

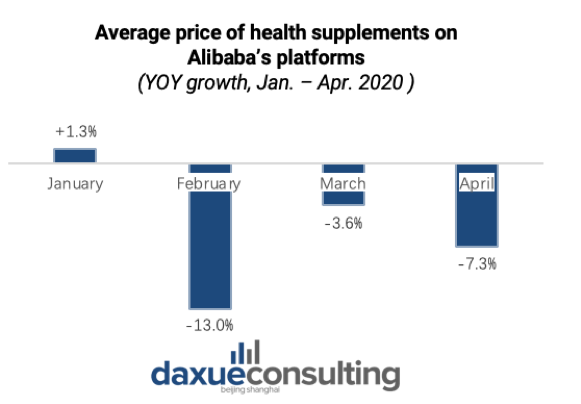

The biggest price drop of health supplements was in February, as many brands decreased online price to have more consumers during the most serious period of COVID-19. However, many consumers were focused more on personal protection and disinfection products.

Data source: CHUANCAI securities, SOOCHOW securities, Changes in Price of health supplements in China during COVID-19

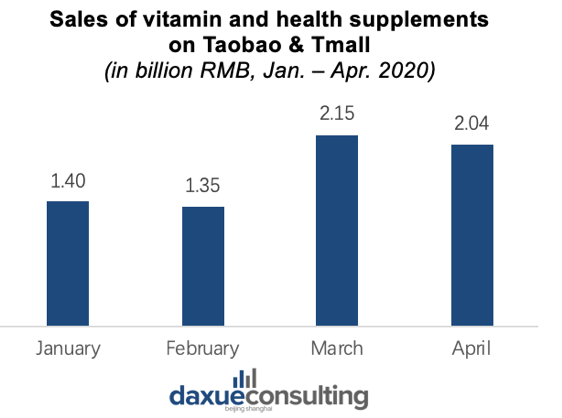

Then, the sales revenue of health supplements greatly increased from March along with people’s health awareness further improved.

Data Source: Taosj (淘数据), E-commerce Sales of Vitamins and Health Supplements

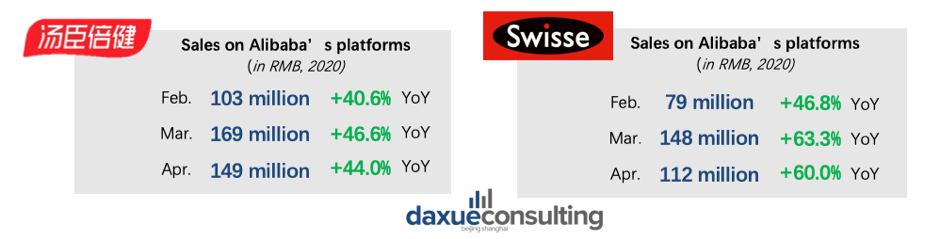

For example, the health related products of BY-HEALTH (汤臣倍健) and Swisse had significantly increased their online sales.

Data source: Taosj (淘数据), Sales of By-Health & Swisse during COVID-19

What can we learn about the vitamin and health supplement market in China

- Physical and mental health are both important for Chinese people

Many Chinese people are eager to have both physical and mental health. Therefore, in addition to promoting physical health, how to help consumers relieve mental pressure is also an important sales point for all health-related brands in the Chinese market.

- People under 30 are the key customers for many brands

Many health supplements brands aim to build a youthful brand image to reach out more young consumers in China. They frequently used young KOLs and actors as spokespersons. At the same time, Baidu index analysis shows young Chinese consumers have the most interest in vitamins and health supplements.

- Skin health is a top concern of Chinese vitamin consumers

More and more Chinese people are bothered by skin imperfections. Because of Chinese beauty standards, skin whitening is an important driver for Chinese women to take vitamins. Therefore, some health supplements launched products targeting skin problems and received positive feedback.

- COVID-19 stimulated consumption in the vitamin market in China

The COVID-19 outbreak brought great attention to physical health, Chinese people showed strong demands on vitamins and health supplements to enhance immunity.

See our full report on China’s vitamin and health supplement market

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast