How to do KOL marketing in China | Daxue Consulting

China’s Internet market is becoming more mature while user numbers are increasing. In 2018, out of a population of 1.39 billion, China had 820 million Internet users, approximately 59 percent of the population. According to China official data, 27 percent of internet users are rural users, showing an increase of 1 percent compared to 2017. There is also an increase of 4.9 percent of urban users, along with an increase of 3.8 percent of national users compared to 2017. There are 788 million individuals with a mobile terminal, 57 percent of the population and 96 percent of internet users.

Influencer marketing, or KOL marketing as it is called in China, is increasing in popularity and has matured as well. The KOL market in China has moved from the live stream, short video, text & photos, and forum’s Q&A content types to online TV emission, E-commerce, etc. Since there is an increase of internet users, the targeted audiences of KOL marketing visits more channels as well, allowing brands to have the opportunity to cover higher amounts of target audiences. Trends of faster urbanization and fragmented segmentation are evident.

What is KOL in China?

The term KOL stands for Key Opinion Leader. They provide their opinions on points of views, estimations, beliefs, judgments, and attitudes toward a product or brand to the public. KOL in China refers to a person, organization, or community with a group of loyal followers engaging with them who produces quality content on social media. Why are KOLs influential or growing in popularity? They are rising in popularity because of online to offline marketing, or O2O marketing. KOLs exhibit the ability to widening a brand’s audience and increasing brand awareness, drawing customers from online channels to physical stores to make purchases.

Level Mapping: KOL categories and types

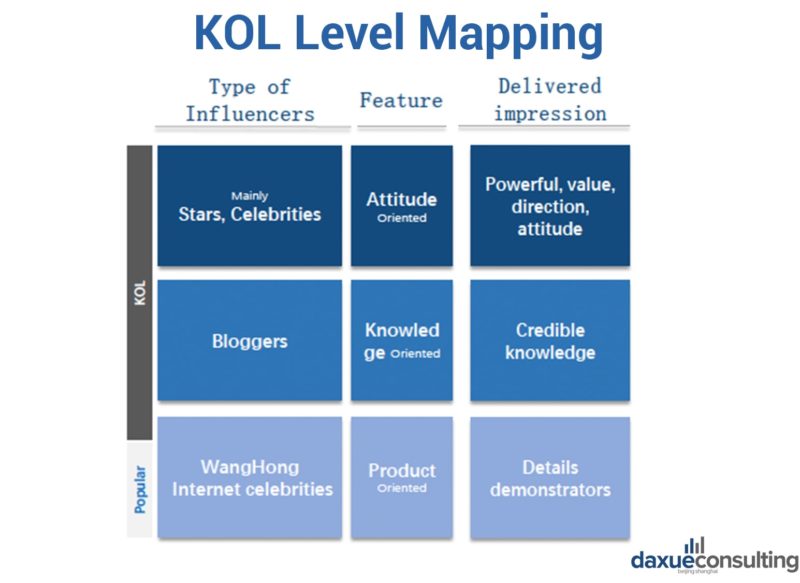

In the KOL strategy in China, KOLs can be divided into segments: 1) Stars, celebrities; 2) bloggers,; and 3) Wang Hong.

The first segment includes big-name stars and celebrities such as Kris Wu, who are attitude oriented, often times delivering powerful and valued opinions, direction, or holds a certain attitude distinct to them. The second segment pertains to bloggers who demonstrate expertise in a related field. They deliver an impression of credible knowledge. Lastly, there is a segment containing Wang Hongs. Wang Hongs are KOLs; however, it is also important to know that there is a differentiation between the two. Wang Hongs are Internet celebrities that are product oriented and popular because of their appearance, whereas KOLs are popular for their opinions.

Demographics (as of 2018)

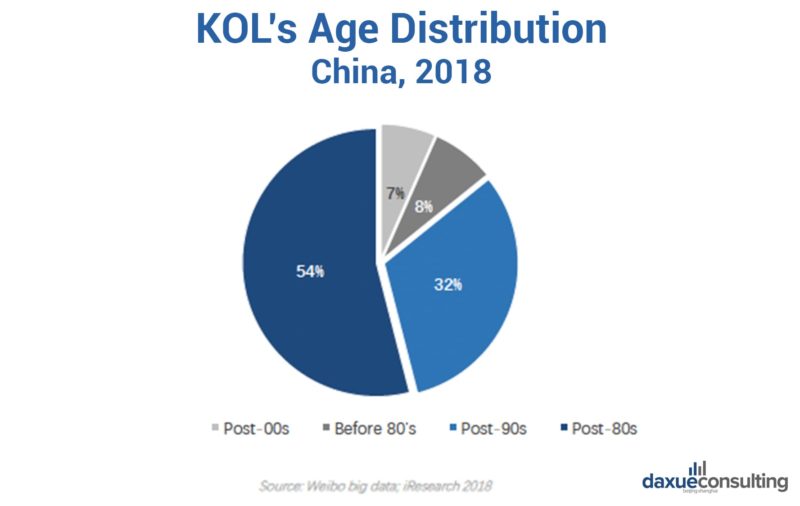

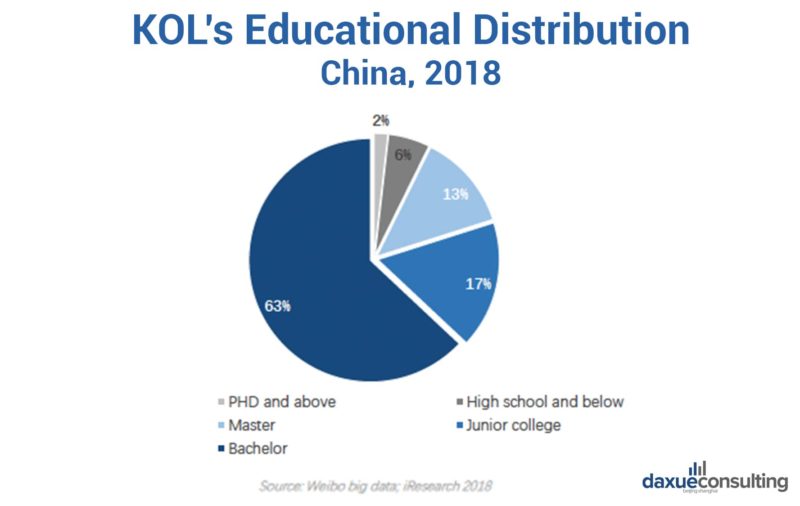

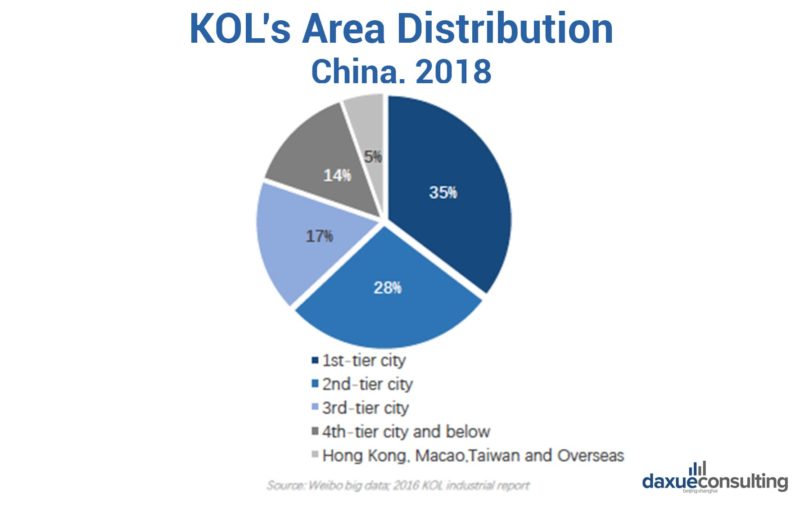

KOLs of the post-80s and 90s generations seems to be prevailing the market with a high education. Individuals born during this time make up 86 percent of KOLs. Those born before the 1980s and after 2000 only makeup 15 percent. The majority of KOLs has completed junior college, have a bachelor’s degree or masters, showing that higher education levels are prominent among KOLs. Lower education levels, that of high school and below or higher than master’s are not very prominent. Females are dominating KOL marketing in China. They account for over 50 percent of the market compared to males. The majority of KOLs seem to be located in first-tier cities with second-tier cities close behind. Regions such as Hong Kong, Macao, Taiwan and overseas shows the least percentage of KOLs.

KOL Market value in 2018

In 2018, the KOL market value was about 102 billion yuan according to Weibo big data. There was an increase in the amount of KOLs on Weibo. KOLs with more than 100,000 followers increased by 51 percent, and those with more than 1 million increased by 23 percent. The overall amount of followers on Weibo increased by 25 percent, equaling up to about 600 million.

Target Audience

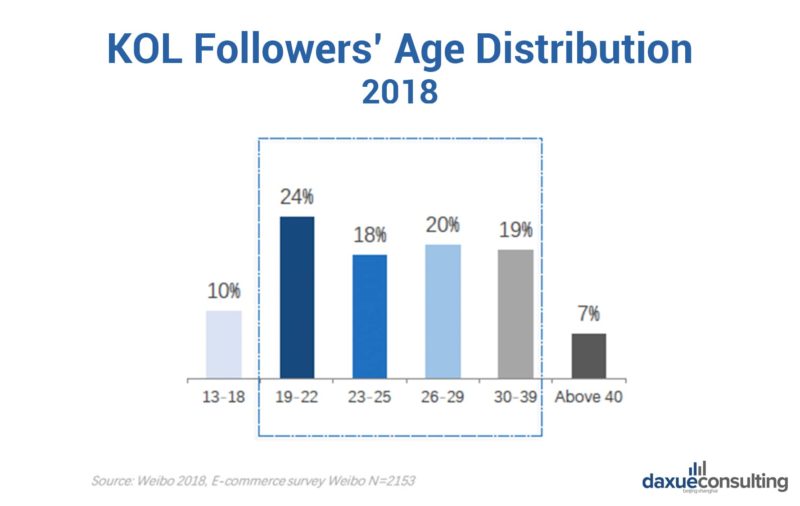

The KOL strategy in China targets individuals of the post-80s to 00s generation who live in all type of cities. Consumers decide on who to follow based on the KOL’s type of content and topic.

Audience demographics

The main target audience of KOL marketing in China seems to be individuals of the 90s and 95s-00s generations. Compared to older generations, the younger generations have the highest interactions on Weibo, especially with celebrities. They are more susceptible to the influence of KOLs and celebrities with high engagement with them. They also display a higher interest in things like cosmetics, bags, and shoes, and are interested in topics like celebrity related news and romance. The 80s generation is interested in multiple issues such as general news, travel, health, and family. They are more mature luxury buyers with a higher ratio of pert-a-porter jewelry than younger generations.

Consumer types

Consumption habits can be broken down into two types based on needs.. Together, consumer type and needs decide which kind of KOL they will follow.

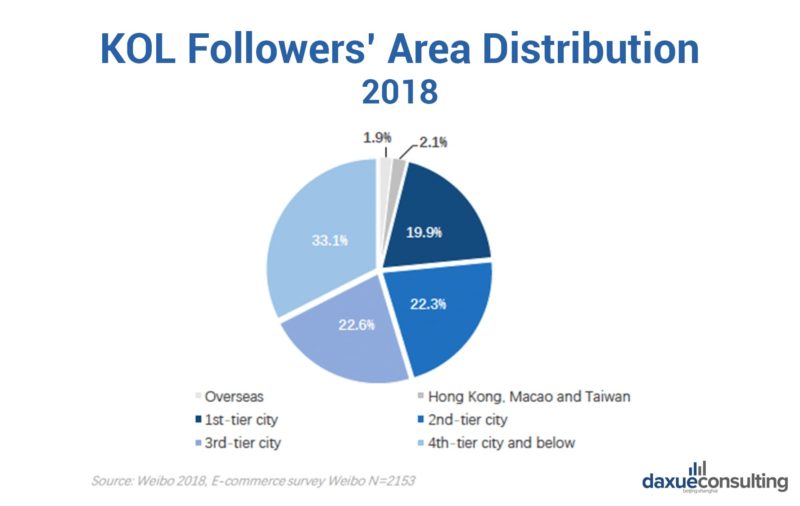

The first type of consumer is one that is oriented around general knowledge. These individuals are mainly in tier 2 or lower cities with a relatively higher ratio of “free time” and disposable income or “available income.” Comparably, they have a higher focus on famous brands and star products.

The second type of consumer is one who is value, emotion, and attitude oriented. They are mainly located in tier 1 and tier 2 cities with a “busy” lifestyle. Comparably, they have a higher frequency of overseas travel experience and similar aesthetic sense to the westernized style.

KOL Market Strategy in the Chinese market

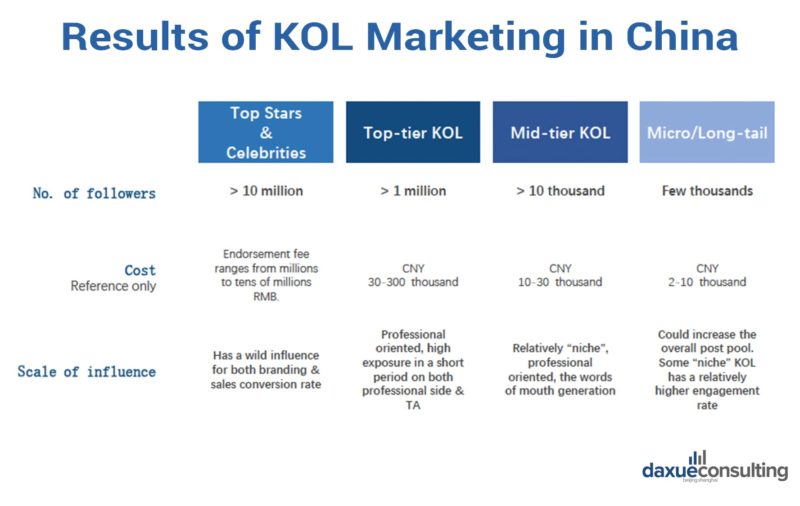

The KOL strategy in China is centered on the influence of KOLs. The influence of the KOL will determine a brand’s ROI and awareness. The effects of KOL marketing can be received in 1 to 3 months after implementing KOL campaigns. Top stars & celebrities with over 10 million followers have a wild influence for both branding & sells conversion rate. Top-Tier KOLs in China with more than 1 million followers are professionally oriented with high exposure in a short period on both the professional side and target audience. Mid-tier KOL in China with more than 10 thousand followers are relatively “niche,” professional oriented lies within the word of mouth generation. Micro/Long – tail with a few thousand followers, could increase the overall pool of posts. Some “niche” KOLs has a relatively higher engagement rate.

How to reach the target audience in China

KOLs reach target audiences through platforms. Platforms vary in type along with how they are used. There are three commonly used platform types in China: Social media, E-commerce, and Video. Top social media platforms such as Wechat and Weibo are used for posts, short-form video content, articles, and photos. According to data released from each platform, Wechat had 1038 million monthly active users in 2018 and Weibo had 446 million. E-commerce platforms such as Taobao, Tmall, and Xiaohongshu are used for selling and circulation of products. Taobao had 600 million monthly active users, Tmall 74 million, and Xiaohongshu 30 million. Video platforms such as Tencent, Youku, and Douyin are used for long-form video content such as live streams. Tencent had 503 million monthly active users, Youku had 493 million, and Douyin had 500 million. Internationalization of contents, such as the trends, value, style, “new” quality, and curiosity, are important incentives to follow KOLs. Mobile users with internet access in China spend an average of 4.2 hours on Apps, 38 percent of the time they spend on social media. Localized management of KOLs (e.g., Public relations, marketing strategy, output) could assist companies with having higher ROI rates.

Content types

The type of content on each site also varies along with the topic. Content types can be divided into 4 categories: Q&A, Text & Photo, Short videos, and Live-stream. According to the 2018 Weibo E-commerce survey, Q&A accounts for 10 percent of shared content, Text & Photo 38 percent, Short Videos 55 percent, and Live-Stream 22 percent. The market value of Short videos was approximately 20 billion yuan, an increase of 300 percent compared to 2017 and an increase of 156 percent compared to 2016. Live-stream market value in 2018 was approximately 68 Billion yuan, an increase of 50 percent compared to 2017 and an increase of 64 percent compared to 2016. The increase in shared content is thanks to the development of the internet and the “concrete effect.”

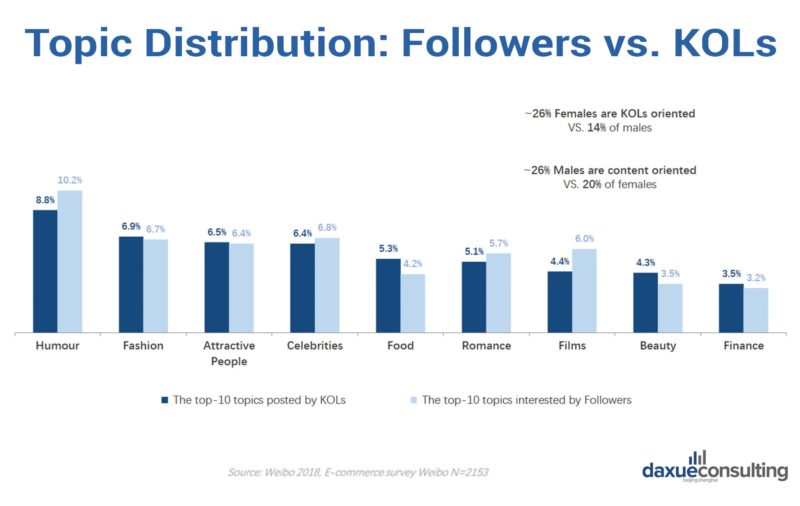

Topics of content vary and differ between what KOLs post and followers are interested in.

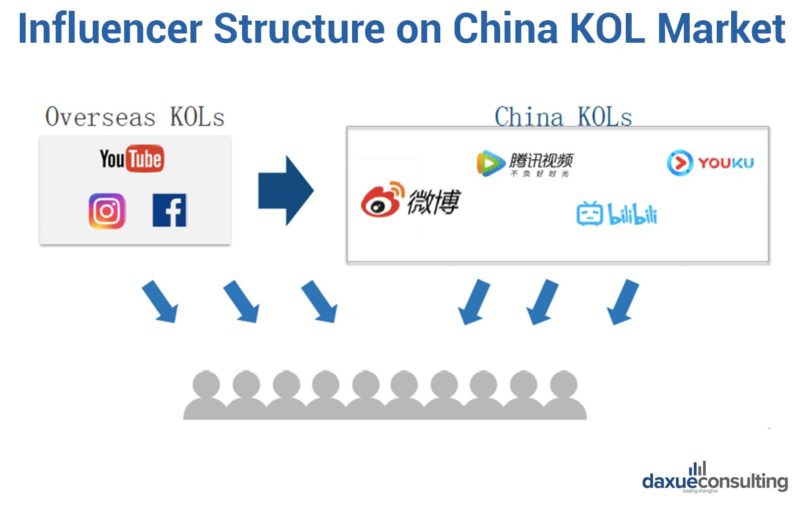

Influencer structure on China’s KOL market

China’s KOL market is still influenced by overseas KOLs, i.e., influencers overseas. Overseas KOLs utilizes western social media apps to circulate content. This content still reaches audiences in China. The content from these platforms can also enter the KOL market in China through being uploaded, shared, and distributed on Chinese platforms such as Weibo and Youku.

KOL Marketing in China Terms to know

To successfully utilize all aspects of KOL marketing and identify the correct type of KOL that is right for you, along with the correct type of campaign, it is good to know words and phrasing associated with KOL marketing in China. Knowing these words and phrasings could lower the amount of confusion that would be created if you did not know them or how to utilize them. They are a way to categorize, identify, and select multiple aspects when you work with KOLs in China.

On the Brand Side

As a brand, there are a few associated and used terms when working with KOLs in China that you should know and become familiarized with:

- The “Head” KOL (头部 KOL)

Top KOL, with 1million+ followers on each platform. Could present exclusively on only one platform as well.

- Micro KOL & Longtails (小众 & 长尾)

Number of fans of Micro KOL > Longtails. KOL has a small of followers. Qualified ones could have a ‘clear’ personality, therefore, have a higher ROI. Long-tails are more affordable and tend to have less fake followers along with higher engagement rates.

- MCN (Multiple Channels Network)

Type of “agency” managing KOL overall activities and content creation. Covered services include content creation, marketing, and e-commerce strategy.

- PGC (Professional Generated Content) (专业生产内容)

Content made within a team. Mainly video content oriented.

- “Water Military” (水军) & “Zombie Fans” (僵尸粉)

The water military is a term for fraudulent followers and bots that boost daily and monthly active user numbers. These followers generate comments, and these comments are recognized as fake. The zombie fan refers to the number of fans.

Common terms for Consumers

As the targeted audience for KOL marketing, there are a few things that you should know as consumers. One key thing to remember is terms used or associated with KOLs and the KOL market in China. Commonly used terms that every consumer should know are:

- “Planting the grassland & pulling up the grass” (种草 & 拔草)

Meaning: Put on my “shopping list,” “to do list,” “to eat list” etc.

- “Niche” (小众)

Meaning: Could refer to “anything,” that gives an impression of being “stylish,” “nice”, or something trendy. E.g., KOL, brands, products or a destination for visiting.

- “Sales” Queen (带货王)

Meaning: The “reference” of being “trendy,” “stylish,” “pretty,” etc. They often have a very high conversion rate.

KOL marketing failures

Along with the China KOL marketing strategy come failures. Here are a few KOL marketing failures that could produce the opposite results and how to avoid them.

- Fake KOLs – have a large number of followers without actual engagement. Pay for fake followers to make a post go viral. To avoid using a fake KOL, brands should examine the content, viewers’ comments, and speed of reads vs. reply.

- The wrong Target – having the wrong target audience can result in you not having any ROI, feedback, or visibility. Make sure you have the right channels and KOLs before launching the campaign

- Having a negative effect – content that is not suitable to target audience’s values or attitude could result in a negative effect. Try to have content that takes into consideration your audience’s values and attitude.

- High brand concentration – Top KOLs or celebrities endorse numbers of brands. This could blur the brand’s positioning. Avoid choosing a KOL that endorses multiple numbers of brands to ensure that your brand will have visibility.

- Being “disliked” by KOLs – It is very dangerous if a KOL does not like the brand or product. Avoid doing anything to have your product or brand disliked by the KOL.

- No campaign brief with clear communication – Without clear communication during the brief, the campaign is bound to have problems. The influencer will not be able to avoid any mistakes if they do not know what you do and do not want. Give detailed information to guidelines, content requirements, goals, and products to avoid any confusion when you work with KOLs in China.

- Influencer content does not meet expectations – as a brand, you have to give the influencer content opportunities to create a story that involves the product. Without content opportunities, they cannot produce something satisfactory and cannot just create an ad for the product without creative freedom. KOL knowledge of audience is often greater than the brand’s knowledge of the audience.

Tips for KOL marketing in China

Now that I have discussed the KOL strategy in China and how to avoid a few failures of KOL marketing, here are a few tips to using the China KOL marketing strategy and how to implement them.

- Avoid being “too commercial”. A too commercial KOL ad in China could lose “trust.” Make the difference between the KOLs and the actual advertisement. E.g., too short or formal posts or purely positive comments.

- Use the Right Channels. Some KOLs could be exclusive on only one or two platforms in the Chinese market. This makes it essential to know the right channel and to assist brand reaching the desired target audience (e.g., Weibo vs. Douyin vs. WeChat).

- Update with a target audience. The fact of gathering direct opinions with your target consumers would be one of the best ways to know high qualified KOLs that are “niche,” “valuable” or “trendy” nowadays in the Chinese market.

- Stay up-to-date on platform regulations. New rules on platforms are often not announced publically, so as a brand you should be aware of the regulations on each to avoid content being taken down or content reach being affected.

- Structured Management. Communicate with marketing team or agencies as detailed as possible when you work with KOLs in China. E.g., the objectives, the “touch points,” type of consumers (location, social class), brand positioning, etc. in order to match the “associated KOLs” and with the data tracking to manage the KOL’s ROI better.

- Make a “KOL plan”. Set the main objective(s) before making the KOLs marketing plan. E.g., increase brand awareness vs. increase the conversion rate vs. brand image maintenance, etc. which is very helpful to find the right KOLs in China.

- The % ROI for the tier of KOL. Both Head KOL and micro KOL are important in the China KOL market strategy. The key is to have the right KOLs “package” or a “good” mixed amount of account types and duration.

- Find the right “Touch Points”. “Emotion” marketing is one of the best ways for the Chinese audience engagement. The market could be very effective if the right emotion “touches” the desired target audience. E.g., “attitude” “value” “lifestyle” “aesthetic sense” and so on.

- Plan with reactivity. Marketing plan and strategies are necessary; however, it is important to keep the flexibility in both the short and long term since China’s market changes rapidly.

KOL marketing trends in China 2019

KOL marketing in China has shown trends in both vertical development, and horizontal expansion, as well as a change in the management model. In vertical development, there is a higher professional, specialty in terms of KOL types and diffusion channels. The KOL market in China has been developed from bloggers, celebrities to include live streamers. As long as it is opinion-leading, the fact of being digitalized would provide more possibilities: AI, animation, emojis, etc. China KOL marketing strategy management model has shown changes from a direct KOL focus to KOL agency, to the MCN model or even to the overall market consulting (e.g., data, analysis, evaluation, strategy, etc.). With the horizontal extension, the market is now multiple industries oriented, such as travel, environmental protection, finance, health care, household appliances rather than only a few sectors dominated.

The KOL market in China varies with a high speed, overall management change from individuation to industrialization (e.g., from PCG merged with MCN) so the management structure should also be updated from “pure marketing” to “multiple functions,” such as channels, KOL’s segmentation, effectiveness data, ROI, etc.

Author: Shyaiah Mitchell

When it comes to China market insight why to choose Daxue Consulting?