The short video market in China: Embodying the fast pace of modern lifestyle

The little puppy held by your favorite actor on your screen has already provided you a burst of happiness. Conveniently, videos automatically slide endlessly one after the other, displaying content chosen specifically for you by an algorithm. It’s so addictive that you suddenly realize an hour has already passed. The short video market in China is highly sophisticated and widely used, a growing part of the stay-at-home economy in China.

Just like the content on these platforms, the figures of the short video market in China are making heads dizzy. The Coronavirus crisis has shed more light on an already booming industry. A large number of mobile users and the addiction for short video content among Chinese Millennials were already the drivers of the consumption of short video content. This viral trend is reshaping the content market, with short video marketing strategies in China becoming increasingly crucial for marketers.

The short video market in China soars on traffic growth and AI development

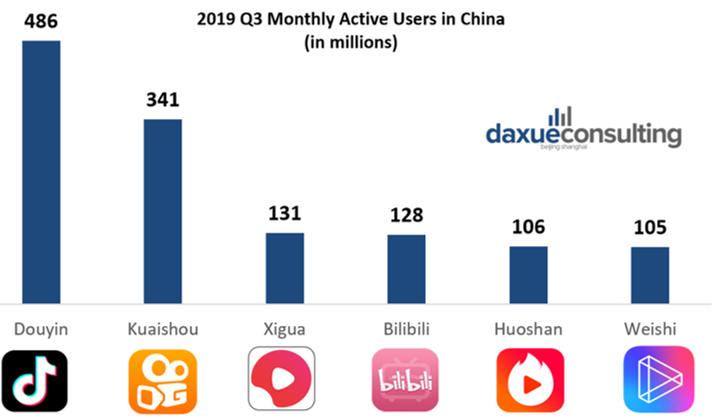

According to a QuestMobile report released in June 2019, the total users of these short video products has reached 820 million, meaning that 7 out of 10 mobile internet users in China are using these platforms to record, share or enjoy videos. The leading players in Mainland China are Bytedance’s Douyin and Kuaishou. Baidu and Tencent are trying to catch up with their own platforms, respectively Haokan and Weishi.

[Data Source: Questmobile – short video apps in China, MAU June 2019]

Each short video platform has its distinction

TikTok / Douyin’s ByteDance, the global player

Douyin was created in 2016 by the Chinese tech giant ByteDance. It is by far the most widely known short video app thanks to TikTok, its global franchise. The app is available in 75 languages across the world. User base is mainly young women, displaying music-inspired content videos. No matter the size of an influencer, Douyin’s recommendation algorithm is based on users’ virality engagement with a piece of content. As long as people engage with a video, it will continue to spread further. Influencers can also use the live-streaming function to interact with their fans.

[Source: Douyin, the #1 short video platform in China]

Kwai / Kuaishou targets rural audiences in China

In 2012, Kuaishou went from a GIF-making app “GIF kuaishou,” to a short video platform. In 2019 Q2, the app became the second-highest-grossing video app globally, behind YouTube and ahead of Douyin.

Tencent and Alibaba-backed Kuaishou, known as Kwai on the international market, is the biggest competitor of Douyin, with a higher percentage of male users. Targeting China’s grassroots society, 64% of the platform’s users live in lower-tier cities. These users are heavily engaging with content and are willing to comment and to share. However, compared to Douyin, Kuaishou’s content might be of lower quality, and its ability to monetize content is far weaker. With less revenue coming from large brands advertisers, Kuaishou draws revenues from its live broadcasting function in which viewers have to pay to interact with the broadcaster.

[Source: Kuaishou, the #2 short video platform in China]

Xigua, known for its high-quality content

Xigua was created in 2016 by Bytedance to target a different audience from Douyin’s, with males accounting for a greater proportion of users. The platform attaches great importance to high-quality content, with both algorithms and user sharing helping drive traffic to high-quality videos longer than one minute. Besides, people can quickly find videos which interest them thanks to a more precise classification menu. However, the platform lacks active Chinese Key Opinion Leaders (KOLs) who can set the standard.

[Source: Xigua, a lesser known short video platform in China]

Bilibili, from mangas to makeup

Bilibili was born in 2010 from the willingness of its creator to share videos about anime fandoms, manga, and video games. Since then, the platform has diversified, attracting a lot of traffic thanks to content around lifestyle, entertainment, beauty, or technology. The app also offers a live streaming service that allows fans to interact with their streamers.

Bilibili’s audience is far younger than other short video platforms, with 80% of the viewers falling into the 16-25 age bracket. Moreover, the average time spent daily on Bilibili exceeds 85 minutes, and the engagement is relatively high. As of now, brands in the tech and entertainment industry have attracted high retention and engagement on this online video platform. We can also expect fashion to be a big draw in the future.

[Source: Bilibili, originally a manga platform, now is popular a video platform in China]

AI enables the development of short video platforms in China

The monetization of traffic on these applications is crucial, and Artificial Intelligence could help. AI is already the main engine for improving users’ journey on the short video apps, with the ability to enhance the visual quality, select content recommendations, and generate ideas of new content. A better user experience brings more traffic, which in return enables mass advertisement, user subscription, and many monetization opportunities.

Chinese traditional tech companies such as Tencent, Baidu, Alibaba all invested, developed, or acquired short video apps, feeding them with technology to enable commercialization of content. AI algorithms have transformed the content industry from ‘people looking for content’ to ‘content reaching out to people.’ Thus, a study conducted by Netflix shows that 80% of hours streamed on Netflix are based on personalized recommendations. Wholly enabled by AI, instead of relying on word-targeted searches or interest-channel browsing, these short video apps in China directly feed under-60-second, user-targeted short videos to users.

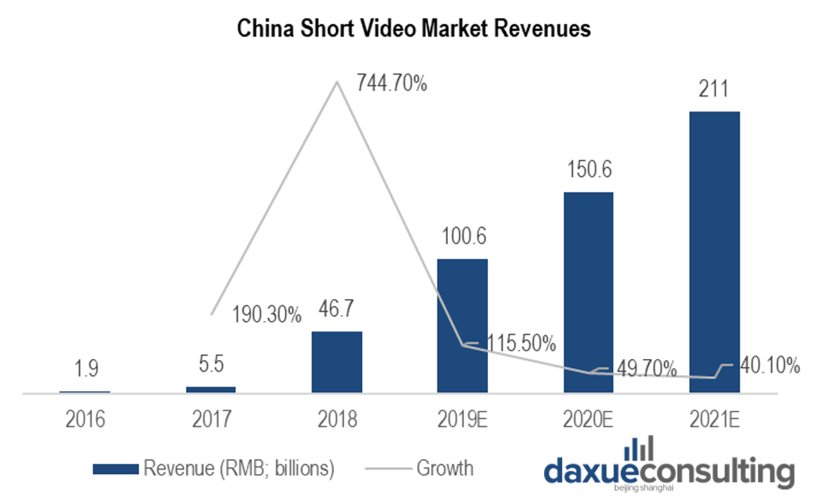

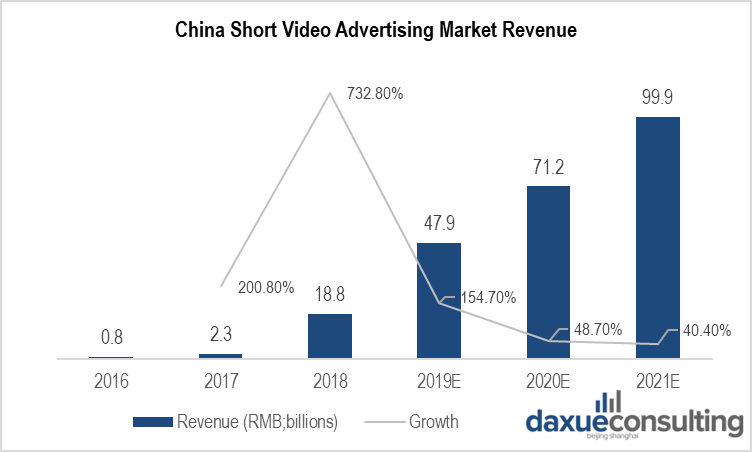

By collecting likes, comments, and other data metrics such as response time, machine learning tracks user behavior and tailors content, deciding what video to show next. Thus, in China, the average daily use time on short video apps is 45 minutes. The growing user’s attention generates a large amount of advertising revenue, with the value transferred from the brands to the online video market in China. Therefore, following the traffic growth, the short video market in China is skyrocketing on the back of a better monetization of its content. In 2018, China’s short video market revenues grew by 744% year-on-year, an impressive leap forward which is expected to last.

Driving forces of the short video market in China embody modern Chinese lifestyle

In addition to their ability to optimize the viewer’s experience and monetize content, short video apps represent a new type of format that perfectly suits Chinese consumers of the 21st century. The digital transformation of China changed lifestyles, pushing daily-life activities from offline to online. In 2017, improved connectivity and video maturity enabled live-streaming and short video apps to penetrate the Chinese mobile internet ecosystem.

Post 70s lifestyle

Chinese people are getting more time-poor, meaning that the short video format adapts perfectly to this new fast lifestyle. Short content can be viewed on public transport when leaving work, or at home before going to bed. The peak of usage of these apps lies, therefore, between 6 pm and 11 pm.

Outside of the short format, the success of such platforms could also be explained by the lifestyle of the new generation of mobile users. Gen Z (defined as the “post-95” generation, aged 15 to 24) are more inclined to express their views openly. Even if they want to be perceived as independent and brave, they are by no means immune to the influence and group behavior. Consequently, they love to interact with people they identify with, feeling that they participate to the conversation. For example, this group of consumer fuels choreography challenges on Douyin, supports their favorite artist via the live-streaming function of Kuaishou, or follows the latest fashion style of biggest KOLs on Bilibili.

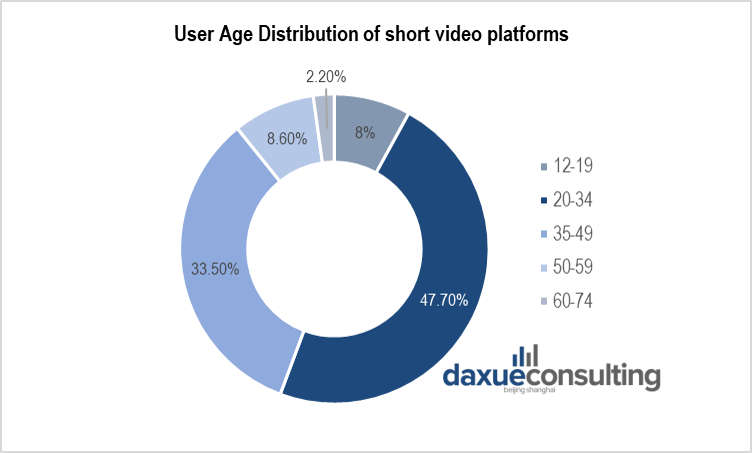

Users under 50 represent close to 90% of the total users on the short video platforms in China. Nearly 50% of whom are under 35. Another characteristic of Chinese consumers under 50 years old is their proclivity to spend money freely. Even if a big part of Chinese gen Z is still unemployed, 70% of them receive more than 3,000 yuan in pocket money per month, with 20% of them receiving more than 10,000 yuan. Beyond this generation, Chinese people enjoy a modern and quick lifestyle with less time to spend than money.

Covid-19 drives traffic on short video apps in China

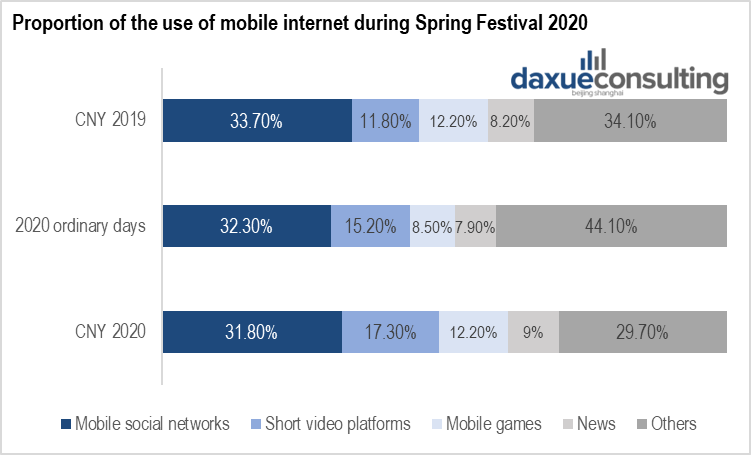

During the Coronavirus, the shift towards online services quickly accelerated. No matter the age group of the consumer, it needed to rely on online services to keep its habits. With people streaming from all over China, Chinese people have flocked to these platforms to collect real-time information on the epidemic situation. During this period, short video apps represented more than 30% of the time of news acquisition among Chinese netizens, and 17.3% of the total use of the mobile internet. Compared with the 2019 Spring Festival, short video consumption time exceeds that of mobile games.

[Data Source: QuestMobile, How Chinese netizens spent their time online during Spring Festival of 2020]

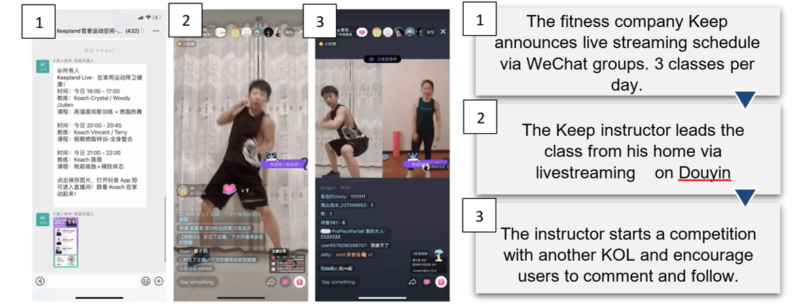

Moreover, the economic impact of the Coronavirus in China pushed offline industries to go online. Examples of such industries making smart use of the live-streaming functions are the night clubs and the gyms. Thus, a five-hour live-streaming set at OneThird, a nightclub of Beijing, brought back $285,000 in tips donated by the viewers on Douyin. Banking on the trend, Douyin’s rival Kuaishou made deals with clubs across China to stream their shows.

[Source: Douyin – Keep’s Short video marketing strategy in China during the Coronavirus]

Could short videos be the future of marketing in China?

With an incredible engagement from its users, short videos are a boon to promote, market, and sell products. Marketers can use it as a tool for communication, sharing reviews from Chinese key opinion leaders, and for targeting narrow audiences. Another option is to invite followers to share and like a post to win a prize in return. In addition, live-streaming allows for audience interactions and feedbacks, which could provide useful data for marketers.

Proof that marketers would invest the stage, the advertising revenue from the short video market in China is expected to reach close to 100 billion RMB (14.1 billion USD) by 2021.

[Data Source: Statista, 2018, China’s short video advertising market revenue]

Short video KOL marketing

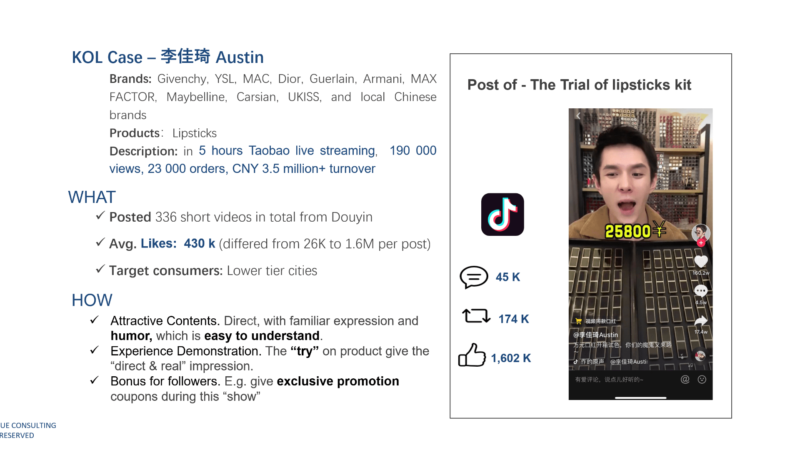

However, as the possibility are numerous, short video marketing strategy in China can quickly become complex. One of the most effective uses of Chinese short video apps is to promote a brand is through influence marketing in China or KOL marketing. Chinese KOLs exhibit the ability to widen a brand’s audience, drawing customers from online channels to physical stores to make purchases. Resulting from their ability to attract traffic, Chinese KOLs can attract brands and advertising, helping short video platforms in China to achieve a better monetization. Consequently, the short video market in China is competing to close exclusivity deals with the biggest Chinese KOLs.

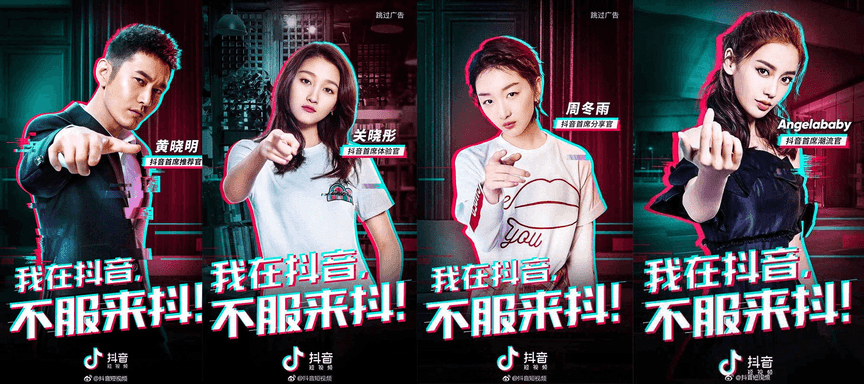

[Source: Douyin – influencer marketing in China to promote the short video app]

The 15 to 60-second format is challenging for creators and brands, which are not able to enter in-depth in the storytelling that makes video content valuable. As of February 2020, short video platforms like Douyin are adopting longer video formats to attract higher quality content. If brevity is making it hard for marketers to inform and persuade, the conversational content of these platforms could represent the future of marketing in China. Live-streaming functions and chasing engagement from the audience to enriches the experience are seen indeed as the next marketing trends in China.

Short video marketing strategy in China: How Daxue can help you

As a competitive market research agency in China, Daxue Consulting can help you creating your short video marketing strategy in China. Our team is dedicated to giving you the best understanding of Chinese consumers and to assist you in each step of your social media strategy process.

Understand the target audience

First, Daxue Consulting can perform customized social media listening plans to analyze comments on Chinese short video platform Douyin, as well as shopping platforms in China – which are directly accessible via the short video app, like Taobao, Tmall, JD.com. This social listening phase will help you identify the best channels according to your targeted audience.

Choose the right KOL for your audience

This first set of raw data is useful to identify Chinese live-streaming KOLs that would fit for your brand, product, or service. Some KOLs could be exclusive to only one or two platforms in the Chinese market. This makes it essential to know the right social-media channel and define a short video marketing strategy in China to reach the desired target audience (e.g., Douyin vs. Kuaishou vs. Bilibili).

According to our case study, Austin, a former makeup artist for L’Oréal, would be the perfect candidate to market a cosmetic brand among young consumers in low-tier cities market in China.

If you want to know more about influence marketing in China to kickstart your short video marketing strategy in China, make sure to check out Daxue Consulting’s KOL market report!

Chinese leading players to go global

While the short video craze is reaching new heights in mainland China, Chinese actors are gaining traction from foreign markets. Embodying the fast pace of the modern Chinese lifestyle, but also the western one, ByteDance’s Tiktok (known in China as Douyin) is booming. In 2019, TikTok managed to achieve more downloads than Netflix, Facebook, or Gmail on the Appstore. Kwai, which is owned by Kuaishou, repeatedly tops the Brazilian app store’s most downloaded chart.

Chinese players are looking for fresh opportunities abroad, while the short video market in China became increasingly saturated. By appealing to certain demographics and cultures, plenty of short videos platforms thrive in China’s domestic market. Replicating these same strategies on a global scale for Chinese companies could be riskier. Indeed, if there is still room outside of China for TikTok or Kuaishou, it is not guaranteed for the others.

In China, the huge engagement of the users attracts influencers and advertisers who helps achieving the monetization of the content. For Chinese short video startups going global, achieving monetization is a real challenge, knowing that the engagement rate of foreign users is far weaker.

Author: Maxime Bennehard

Check out our report on the KOL market in China

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes

![[Podcast] China Paradigm #24: How brands can master Chinese social media, livestreaming, and KOL marketing](../wp-content/uploads/2019/04/China-business-podcast-Livestreaming-Kols-150x150.jpg)