Business opportunities in the Chinese beauty market: Consumption upgrade of the Skincare market in China|Daxue Consulting

Skincare market in China overview

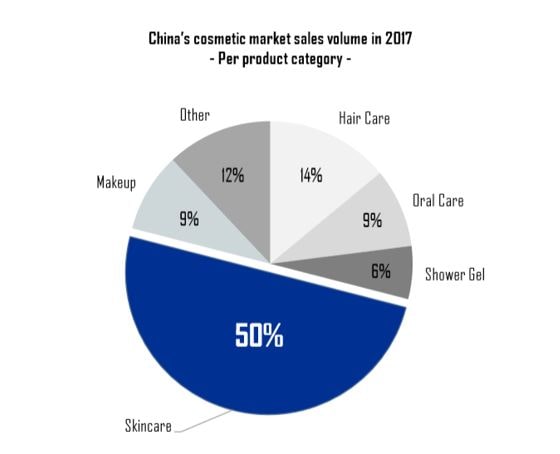

The skincare market in China sales volume reached 26.5$ billion, representing 50% of the total cosmetic market’s sales revenues in 2017 – twice as much as the world average. Skincare products in China are seen as essentials among Chinese women, and increasingly more so among men. In 2017, the sales volume of skincare products in China amounted to 50% of all sales in the Chinese cosmetics market.

How COVID-19 made skincare a focus of China’s cosmetics market

Data Source: NetEase Positioning & CTR; McKinsey, What Chinese consumed more of during the coronavirus

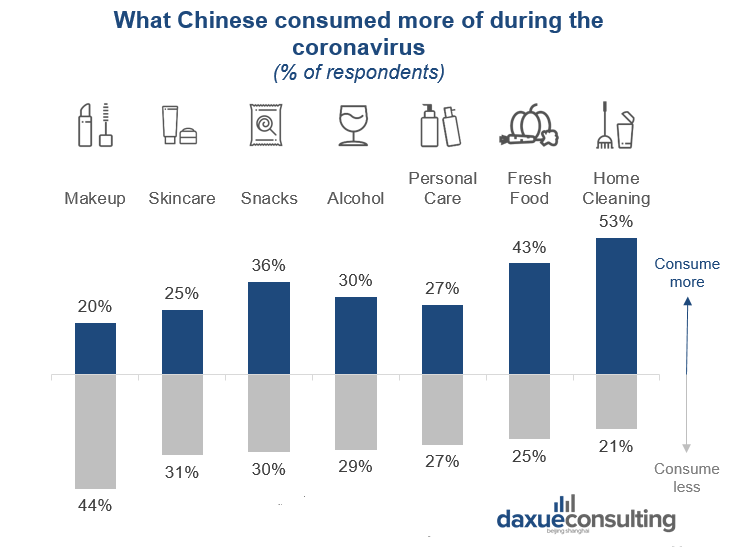

Skincare products are gaining popularity over make-up

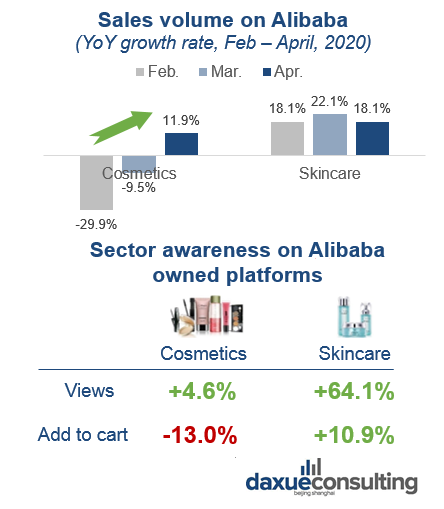

The cosmetics’ sales volume in China declined by 29.9% in February 2020 compared to February 2019, but the skincare segment was impacted the least. Based on social listening, during the outbreak, people consumed and talked more about skincare products than cosmetics. Netizens enthusiastically shared their skincare experience at home during COVID-19. This social media listening combined with sales data shows upcoming trends in China’s skincare consumption.

Data Source: SCMP; sycm.taobao.com, Alimama.com, Sales volume of skincare products on Alibaba during COVID-19

So long as people wear masks, skin repair will be an important skincare function

Due to the damage from wearing face masks for a long time, “skin repair” functions had become a hot keyword among Chinese beauty consumers. The sales of skin repair focused products increased doubled in between December 2019 and February 2020. Some Weibo and Xiaohongshu users said they want to improve their skin condition and leave a good impression when they go back to work.

‘Sensitive skin’ is another keyword for brands

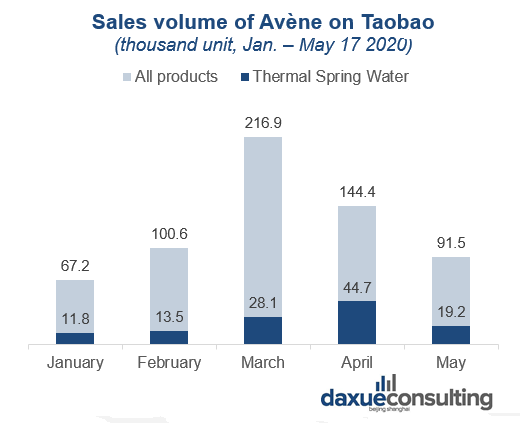

Also as result of wearing facemasks and frequently using disinfectants, many Chinese are finding they have sensitive skin, and desire products that can help with sensitivity. Brand messages even include ‘repairs damage from face masks’. For example, sales of Avène, a French skincare brand focusing on sensitive skin, grew in China. This includes an importance of anti-irritating and soothing properties.

Data Source: Taobao; Jumeili; Xiaohongshu, Sales volume of Avène on Taobao

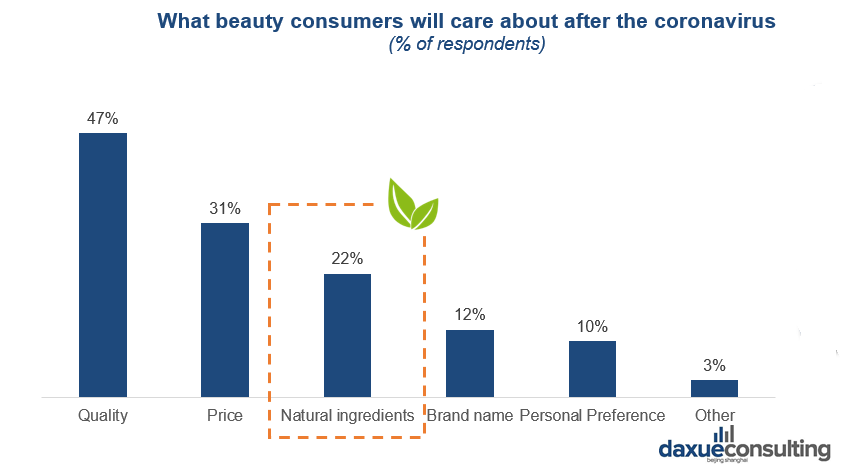

Increased preference for healthy and natural ingredients

As China recovers from COVID-19, health and safety are now key concerns of more Chinese people. This will likely inspire the beauty industry to focus more on products with natural and healthy concepts. 22% of beauty consumers report being concerned with whether skincare products have natural ingredients, while only 12% report brand name being a concern.

Data Source: Jumeili, What beauty consumers will care about after the coronavirus

Changes in purchasing behavior in the Skincare market in China

For years, Chinese skincare consumers have traditionally been price sensitive and therefore focused on the mass market segment. This gave skincare market in China a pattern made of high market penetration (95% in 2016) and a particularly low spending per capita compared with other markets.

However, since the last few years, skincare in China has been going through declining market penetration. Since then, the skincare category has started to become more quality-driven vs price-driven.

Chinese skincare consumers are spending more

Chinese women have been paying more attention to their skincare habits over the past few years. Three main points can be highlighted for 2017 in the Skincare market in China:

- 90 percent of female consumers increased their spending on skincare products in China.

- 58 percent of Chinese female skincare consumers upgraded their purchasing habit by switching to the favorite brand’s premium product line.

- 36 percent of Chinese female skincare consumers left their favorite brand behind and started purchasing more expensive brands.

The willingness to invest more money into better quality and, therefore, more premium products has considerably increased. Spending more money also goes along with sharpening product knowledge to ensure they choose the option that best fits their expectations.

Market trends and drivers in the Chinese beauty market

Skin care products in China

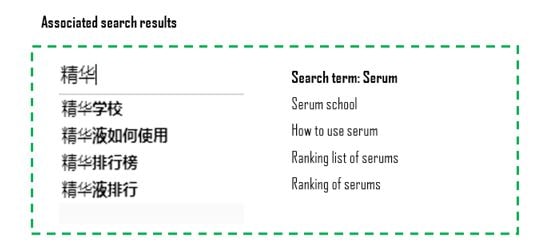

Serums as a complex product that Chinese consumers have yet to master

Serums in China generates the largest number of Baidu search results. Baidu searches tend to focus on the role and function of serum, showing local consumers have limited knowledge but great interest in serums. Due to the complexity of such product (easily mixed-up with essence and boosters), Chinese skincare consumers seek to understand the product functions and how to properly use it in their beauty routine.

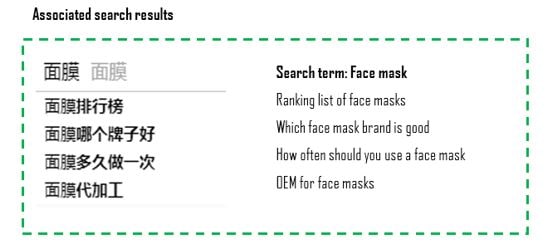

Face masks are an increasingly popular item among skincare consumers in China

The Baidu search for face masks comprises both sheet and cream masks, two popular products among the local audience. Results are composed of both product recommendations and product tutorial content, which demonstrates different levels of knowledge about the product.

Face cream is already well-known Skincare product in the Chinese beauty market

Search results for face cream in China are focused on product recommendations and face cream’s sales ranking, showing consumers select their products on a rational basis. Lancôme and Estée Lauder appear in the relevant search results for face cream, showing top-of-mind awareness among Chinese consumers on this product segment.

The top Chinese skincare brands

Chinese skincare brands’ presence on the Chinese skincare market has significantly grown over the past few years. They are now gaining market share over long-established foreign players such as L’Oréal Paris and also boast a better market share growth. Local brands implement a more aggressive PR strategy involving brand ambassadors (Singer Jay Chou for Pechoin, TFBoys for Chando) and TV show endorsements (The Voice of China for Pechoin, If You Are The One for Kans, Street Dance of China for One Leaf) to quickly boost their awareness among their target audience.

Top 6 Chinese skincare brands in terms of market share in 2017:

- Pechoin – 4.5%

- L’Oreal Paris – 3.3%

- Chando – 3.1%

- Olay – 2.8 %

- Kans – 2.7 %

- One Leaf – 2.0 %

Male skincare: A promising market segment

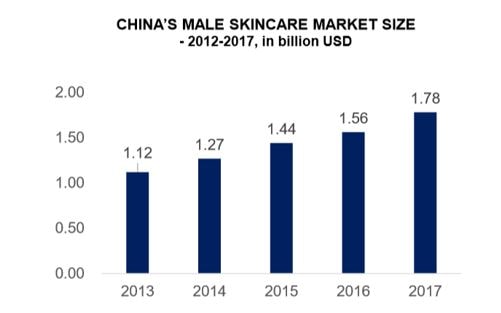

The male skincare segment grew by 18.5% in terms of sales volume between 2013 and 2017. According to a recent study conducted by Weibo, male users’ interest in skincare products is growing so fast that male consumers nearly double their spending on skincare products every year.

Besides, for male skincare, face cream is the most popular SKU among Chinese men, but the face mask is quickly catching up.

Most common marketplaces to buy skincare products among Chinese consumers

In China, consumers tend to buy skincare products mainly from such marketplaces as an exclusive store, supermarket, online, or agencies.

Also, the information channels for skincare products in China shows that an increasingly complex purchasing decision process is basing on a plurality of sources. Product safety is a key concern for local consumers when it comes to purchasing skincare products. In fact, 90% of them admit going through extensive research before purchasing any product. As a result, they rely on an increasingly complex data collection process based on a wide range of online and offline channels.

Moreover, Chinese consumers tend to favor product reviews shared by market experts and other consumers. This is the reason why online channels, where consumers can access specialized KOLs reviews (e.g., BBS, official WeChat accounts) and other consumers’ comments (e.g., on social media platforms and 3rd party platforms like Tmall), have such significant influence on the Chinese consumer’s decision-making process.

Tighter regulations as the Chinese skincare market matures

On January 10th, 2019, the China National Medical Products Administration (NMPA) released a report tightening the supervision and inspection of cosmetic products with any medical-related terms. To avoid confusion between cosmetics and medicines/pharmaceuticals, any cosmetic packaging or specification is forbidden to bear curative effects, promoting medical effects, or using medical terms. Any product registered as “cosmetic product,” but presented as a cosmeceutical product will be considered illegal.

Digital marketing for skincare products in the China

Online promotion combined with social channels is essential for brands to achieve success in the Chinese skincare market

China has 1.39 billion people, with 820 million Internet users, accounting for 59% of the total population, and 788 million mobile terminals, accounting for 57% of the population. With a large number of internet users in China (more than half of the total population), online communication is becoming a necessary branding and promotional method for cosmetics brands in China. In recent years, the amount of internet users has grown steadily, and the amount of social media users has grown significantly. The online growth rate of the beauty industry is 11 times that of the offline growth rate.

What’s more, top Chinese social media platforms drive a significant amount of online traffic, such as WeChat and Weibo with hundreds of millions of active users per month. Online video platforms such as IQiyi, Tencent and Youku also carry huge traffic that can convey information to a large audience. Live-streaming and short video are new rising channels that are also effective. These platforms give brands a great opportunity to expose their brands and products.

Skincare market in China: development of Chinese social media and the rise of KOLs

KOLs play a crucial role in the marketing of beauty-related products in China. The interactive communication of mobile social platforms enables brands to establish a connection with consumers more effectively and pertinently, and KOLs serve as a bridge to guide communication among consumers in the Skincare market in China. When KOLs post on Weibo, consumers buy immediately at a conversion rate of 1.5%. 56% of the influence value in the Chinese beauty market is from KOLs and only 19% from Chinese social media.

Successful KOL promotion case in China, SK-II: A celebrity and fashion KOL crossover

Leveraging super topics (a specific section of Weibo which operates like a forum and allows brands to monitor the most popular hashtags and follow conversations based on topics) with the influence of celebrity and vertical KOLs is a method by which it is possible to greatly enhance brand awareness and generate large exposure to consumers, getting higher view volumes through deep interactions with social audiences.

SK-II’s promotion activity in 2017, the super topic “#Pursuit of beauty has no boundaries#,” got great attention, with 66.58m views and 56K discussions. Celebrity Chen Bolin, top fashion KOL Li Yilin, and gogoboi went to the “Devil City” in the desert, going far, challenging the limits, and led to high SK-II super topic forwarding rate and brand exposure.

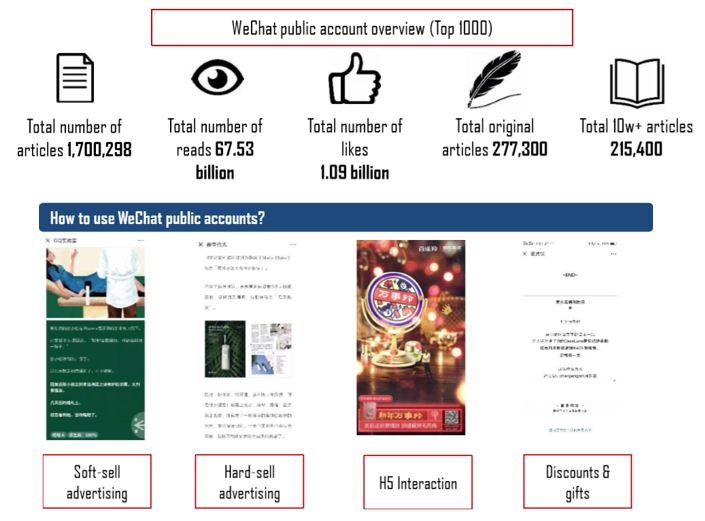

WeChat strengthens daily communication between Chinese skincare brand and consumers

WeChat has a huge user base of 1.08 billion active users per month, and it tends to be more active in the information exchanged with consumers. As an important method of information publishing, WeChat public accounts reconstruct the relationship between enterprises and consumers.

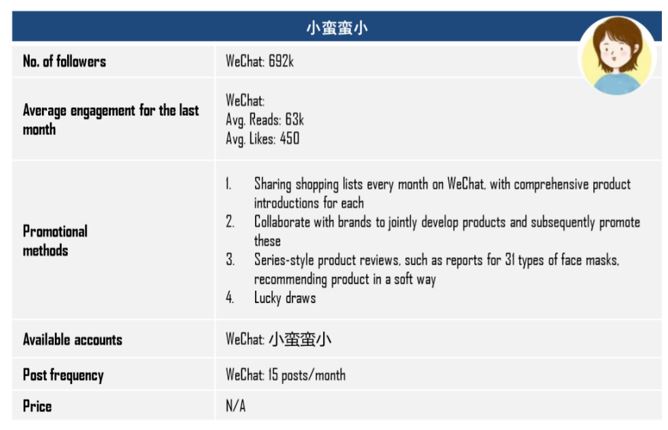

Popular Wechat cosmetics KOLs case: A WeChat “celebrity” curating beauty-related content for her fans

Xiao manman xiao (小蛮蛮小) is one of the earliest bloggers to share their lifestyle and shopping products online in China. Through years of personal accounts operation, Xiao manman xiao has built a personal image, covering Xiaohongshu, Weibo, and WeChat platforms. On her public account, Xiao manman Xiao constantly shares her favorite and most useful products on her social media platforms, with detailed information and embedded purchase links. Thanks to her solid foundation in the beauty recommendation area and trustworthy image, her platform generates high sales conversion rates.

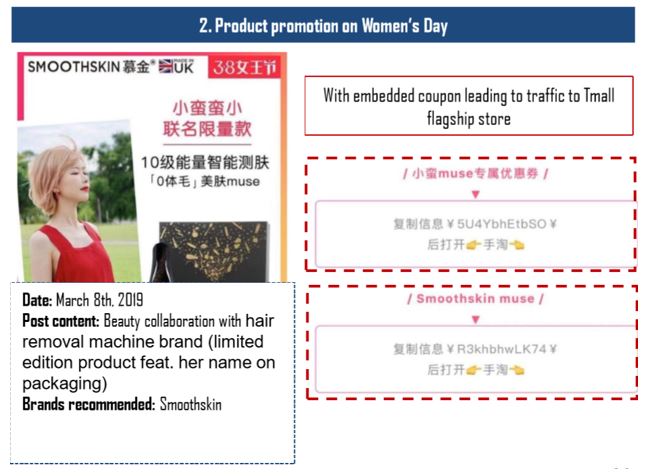

On Women’s Day, Xiao manman xiao held a sales campaign of Xiao manman xiao co-limited hair removal machine, which was welcomed by fans.

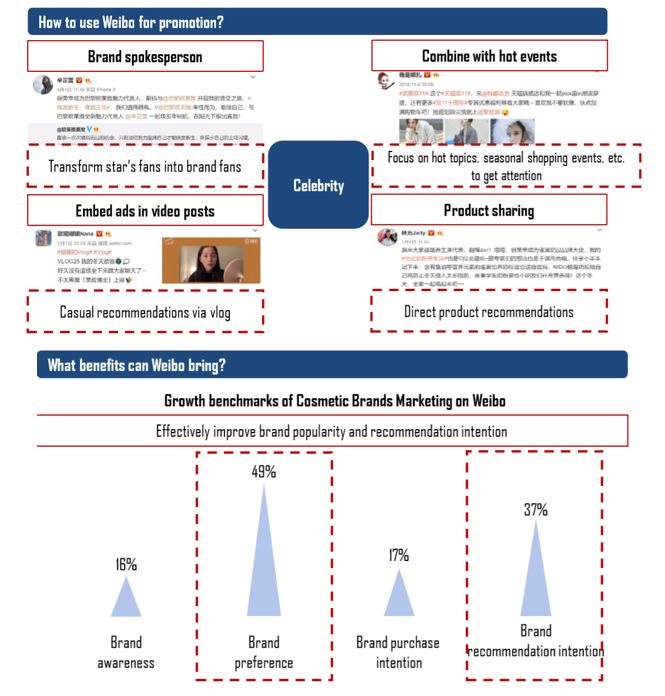

Promote your Skincare products in China with Weibo’s power

From 2018 to 2019, the number of Weibo users continues to grow. As of January 2019, Weibo monthly active users reached 320 million. For the younger generation of cosmetic consumers, Weibo has become one of the most important platforms for obtaining and exchanging beauty information.

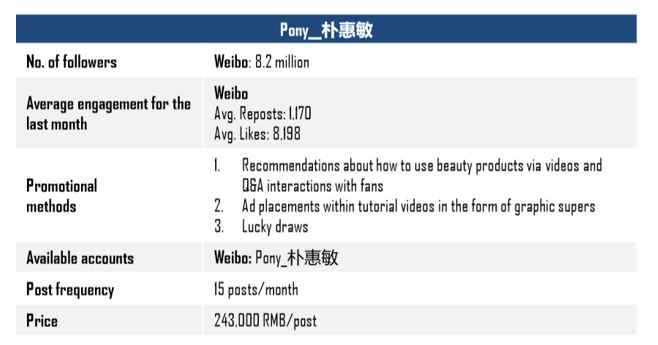

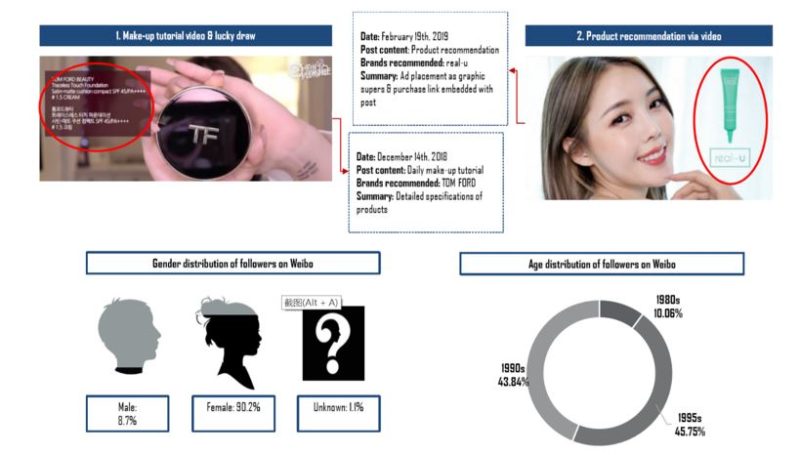

Popular Weibo cosmetics KOLs case: A Korean cosmetics KOL influencing Chinese consumers

Coming from Korea, Pony started to write a beauty blog in 2008. Since then, she has been sharing the most trendy make-up skills, and fashionable makeup looks to the public. Her makeup techniques are famous for easy-to-apply, practical. By sharing online makeup tutorials and unique makeup techniques, she has become one of the most influencing cosmetics KOL in both Korea and China, In 2016, she opened an account on Weibo and attracted 2.5 million fans within just 8 months. In addition, she usually posts make-up tutorial video & lucky draw and product recommendation via video. Females born in the ’90s make up 90% of total followers.

Digital marketing in China for skincare products with the help of Xiaohongshu

Xiaohongshu, also is known as “Red,” is one of the largest and fastest growing social E-commerce apps in China.

So how Xiaohongshu leads to more brand discovery and impulse buying?

Customer randomly browses other users’ product reviews, then stumble across an interesting post or product, and lead to the product page, finally purchasing.

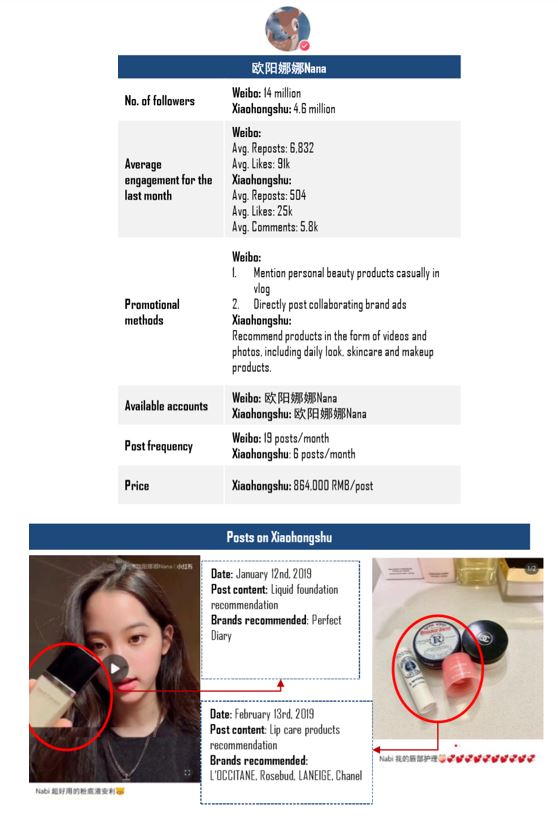

Popular RED cosmetics KOLs case: Celebrities sharing products as beauty bloggers is a new trend

Nana Ouyang is a Taiwanese cellist and actress born in 2000. She was born in a family of artists, learning cello since childhood, and is now a student at Berkeley’s music college, which helps her build a positive youth image. Best known for her TV and reality shows, she is ranked 100th on the list of the most commercially valuable celebrities of 2018. Thanks to her sweet appearance, lovely personality, and outstanding talent, she has now accumulated over 14 million Weibo fans and nearly 5 million fans on Xiaohongshu.

In her vlog, Nana Ouyang shares different aspects of her life, which is appealing to her fans. She also recommends her favorite products as an influential KOL on Weibo and Xiaohongsu. She has posted over 120 times on Xiaohongshu, forming an authoritative voice among her audience. The brands she recently recommended are Armani, Dyson, LA MER, CPB, TOM FORD.

Opportunities for international skincare brands in China

The skincare segment in China represents a particularly high share of the cosmetic market (50%). This well-established presence of Skincare products in China makes the market mature and the consumers savvy. China’s skincare market is going through a “premiumization” stage, in which local consumers are willing to pay a higher price for higher quality products.

Well-established foreign brands will benefit from this “premiumization” as the local consumers still consider them as trustworthy and reliable. International brands can, therefore, capitalize on its Western origins and expertise to establish their reputation and nurture consumer trust.

Also, the male beauty market is a promising niche. Chinese men have become quickly interested in skincare products. According to a recent study conducted by social media platform Weibo among its users, male consumers nearly double their spending on skincare every year, and the market segment grew by 18.5% in terms of sales volume between 2013 and 2017.

International brands need both to establish the brand in China in the right way so that it can communicate its positioning correctly, and to increase its brand exposure so that more consumers can discover the brand, understand it, and therefore purchase it.

Author: Zichun LI

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions