Business intelligence: International trade in China

Trade China: statistics

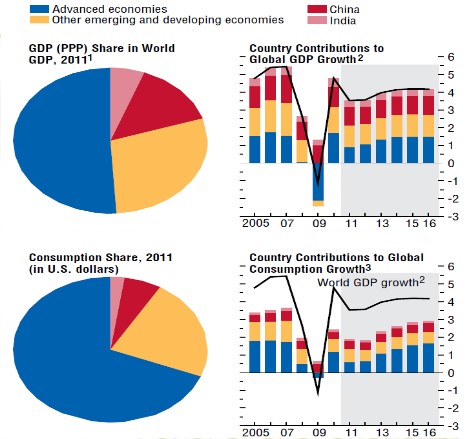

According to a white paper on China’s international trade issued in December, 2011, Chinese international trade has grown at record-breaking speeds. In 1978, the total volume of imports and exports from China amounted to 20.6 billion dollars, ranking 32nd in the world. In 2010, the total volume of imports and exports increased 143-fold to 2.974 trillion dollars. China’s exports account for 10.4% of the world’s total exports and its imports account for 9.1% of the world’s total imports. The structure of exports has also changed tremendously. The portion of primary products dropped from 50.3% in 1980 to 5.2% in 2010,,and the portion of manufactured goods rose from 49.7% in 1980 to 94.8% in 2010.

The top ten trade partners of China in 2010 are: the European Union (16.1%), the United States(13.0%), Japan(10.0%), ASEAN countries(9.8%), Hong Kong(7.8%), South Korea(7.0%),Taiwan(4.9%), Australia(3.0%),Brazil(2.1%), India(2.1%) and the remaining partners account for the rest(24.3%).

In 2009 and 2010, the value of total exports was, 429.27 billion dollars and 552.18 dollars respectively, with failure rate only 0.12% and 0.13%.

From 2000 to 2009, the annual growth rate of China’s exports and imports was, 17% and 15% respectively, far higher than the world average of 3%.

The world’s 15 most valuable brands in 2011 were: Apple, Google, IBM, McDonalds, Microsoft, Coca Cola, AT&T, Marlboro, CMCC, GE, ICBC, Vodafone, Verizon, Amazon, and Walmart. Only two Chinese companies are in that list.

Trade in China: potential problems and weaknesses

The low level of value chains is a big drawback to China’s trade system. The value chain is the process that involves raw material collection and transportation, production of half-finished and finished products and the consumption and re-circulation of final products. Today, improvement trade is becoming an important part of the global value chain. Take the Jiangsu province for example. Currently, only 20.7% of Jiangsu companies engage in the production of intermediate products, and the remaining 79.3% are still doing product assembly and producing spare parts.

Foreign traders hold a large portion of shares in China’s big companies. In China’s 28 main industries, foreign traders have majority ownership of 21 of them. In a report issued recently by the Development and Research Center of State Council, among China’s open industries, the top five enterprises of each industry are controlled by foreign traders.

Problems also arise from the frequent trade friction in China. Chinese products have long been known for their low price and good quality and are universally welcomed. However, this can lead to trade blocks with companies that cannot compete with China’s manufacturing industry and agitate the anti-China sentiment of some Western countries. Since the mid-1990s, China has been the world’s number 1 anti-dumping country for 16 consecutive years.

Trade in China trends

The cost of labor in CHina is rising. This combined with trade conflicts and the appreciation of RMB is forcing foreign firms to gradually move out of China, and move the outsourcing business to countries where labor is cheaper, such as Vietnam, Bangladesh, Cambodia, and Indonesia. China’s next task in its dominant manufacturing industry is to devise a method to differentiate itself with cheaper alternatives and maintain the strength of one of its largest and most significant industries.

Daxue Consulting Business Intelligence in China

Sources: