The credit insurance market in China

What is credit insurance?

Credit insurance is a part of the non-life insurance market. It is a type of insurance where the insurer is liable for the economic loss suffered from failed contracts or failing to pay off debt. Credit insurance in China can protect companies from the risks of trade such as customers failing to pay. The credit insurance market in China is growing along with the increase of global trade.

Size of credit insurance market in China

In addition to China Credit Insurance, only commercial insurance institutions such as Ping An, PICC, and Dadi Insurance have entered the credit insurance market. However, due to their lack of awareness and understanding of credit insurance business, they have also failed to develop credit insurance business on a large scale, so the business scale of credit insurance has always been relatively small compared to the entire national economy. Domestic credit insurance is still a huge market that is just beginning to develop.

In 2018, China’s credit insurance premium income was approximately 24.25 billion yuan. Except for the credit insurance premium income decline in 2013 and 2015, other years showed a steady growth overall, and the year-on-year growth rate reached the largest in 2009.

The credit insurance claims expenditure in 2018 was approximately 12.79 billion yuan, an increase of 35.1% year-on-year. Except for the slight decrease in credit insurance claims expenditure in 2014 and 2015, the overall year showed a steady growth trend, and the year-on-year growth rate reached the highest level in 2008.

Products in the credit insurance market in China

General commercial credit insurance in China

General commercial credit insurance is for commercial activity. The holding party requires the insurer to act as the guarantor of the other party and assumes the holder due to the credit risk of the guarantor. Insurance that suffers from loss of commercial interest. The contract stipulates that after the insurance accident occurs, the insurance company shall calculate the amount of the insurance company according to the loss and damage degree of the target according to the insurance liability. The amount is determined based on the subject value of the commercial contract between the parties.

At present, the domestic credit insurance market in China generally covers wholesale and not retail. Its insurance types mainly include sales credit insurance, loan credit insurance and personal loan credit insurance.

Sales credit insurance in China

Sales credit insurance provides credit guarantee for deferred payment or instalment payment of domestic trade. The insured is the manufacturer or supplier.The insurer underwrites the credit risk of the buyer (ie the obligor); the purpose is to ensure that the insured (ie the right holder) can recover the credit on time and protect the trade.

Loan credit insurance in China

Loan credit insurance guarantees the loan contract between the financial institution and the enterprise to cover credit risk. After the lender has insured the loan credit insurance, the borrower can obtain compensation from the insurer when the borrower is unable to return the loan. Loan credit insurance is one of the important means to ensure the normal turnover of bank credit funds.

Personal loan credit insurance in China

Personal loan credit insurance is insured when the financial institution makes a loan to a natural person because the debtor fails to perform the loan contract causing the financial institution to suffer economic losses. Since the individual’s situation is very different and the residence is scattered and the risks are different, the insurer must conduct a comprehensive investigation and understanding of the borrower’s use, operation, business reputation, and private property, and require borrowing if necessary. The person provides counter-guarantee; otherwise, it cannot be rashly covered.

Export credit insurance in China

Export credit insurance covers the loss of exporters’s business while operating in China, covering the commercial and political risks. According to the contract, the insured pays the insurance premium to the insurer, and the insurer compensates the economic loss caused by the buyer’s credit and related factors under the insurance contract. In the credit insurance market in China, export products mainly include short-term export credit insurance and medium- and long-term export credit insurance.

Short-term export credit insurance in China

Short-term export credit insurance refers to an insurance that covers a credit period of no more than 180 days, and the export goods are generally a large number of primary products and consumer products. Short-term export credit insurance in China is currently the head office of the export credit insurance institutions insurance companies and their branches. The most widely used, most insured and relatively standardized export credit insurance category.

Medium and long-term export credit insurance in China

Medium and long-term export credit insurance refers to export projects of capital or semi-capital goods with a credit term of more than 2 years. For example, complete sets of production equipment for factories or mines, large-scale transportation vehicles such as ships and aircraft, overseas engineering contracting and special technology transfer. Due to the large amount of medium and long-term export projects in China, the contract execution period tends to be longer. Additionally, the operation is often complicated, and the products or services involved need special design and special manufacturing. Therefore, insurance contract does not have a uniform format. Instead, the insurance contract parties negotiate the insurance conditions, insurance rates and charging methods according to different export products, service contents, delivery conditions and payment methods.

What is unique about the export credit insurance market in China

The business product line is unitary. It is mainly based on the export credit insurance business and of a certain scale of domestic trade credit insurance. However, it is still focus on the credit risk arising from the provision of commodity product transactions, and there are fewer commodities involved in underwriting credit risks due to various forms of credit business, not to mention products related to investment and consumption.

Due to market access, policy factors and products factors, the institutions that currently operate export credit insurance is monopolized by Chinese Credit Insurance only. There are no more than five institutions that operate domestic trade credit insurance in China.

Institutions are often reluctant to utilize credit insurance in China

Due to incomplete laws and policy measures, institutions are still reluctant to participate in the credit insurance market on a large scale. Credit insurance lacks relevant legal guidance, maintenance and restraint, and lack uniformity in business and products. Compared with property insurance and life insurance business operators, credit insurance has high technical coverage, high risk concentration, high cost of underwriting claims, low protection for operators, and low efficiency of comprehensive operations.

The credit insurance market in China has yet to reach maturity

Credit insurance is underdeveloped in China because of its special business model in terms of marketing and operation. China Export and Credit Insurance Corporation, known as Sinosure, reflects typical issues faced by China’s credit insurance industry. Sinosure has been the main and most important credit insurance provider since 2001. The state-owned insurance company can promote the rapid development of export credit insurance in combination with policy and government objectives. Areas whereby economic model is export-oriented, such as The Pan-Pearl River Delta Region(PPRD)and Yangtze River Delta, are well-protected by local government. The local government directly insures companies in order to protect the survival of local export-oriented enterprises during a financial crisis.

On the other hand, as the only company that operates policy-oriented export credit insurance, and the main provider of credit insurance in China, it is also hindrance for credit insurance to develop in China. For example, the problem of China Credit Insurance’s registered capital and the amount of risk commitment is seriously mismatched, the problem of reinsurance and sub-insurance is difficult to implement, the problem of excessive insurance coverage and excessive insurance procedures. Although these problems reflect the issue of China’s Credit Insurance, at the same time, it can be said that it is a problem that must be encountered by the operating agencies involved in the credit insurance business.

Export Credit Insurance companies in China

Sinosure (China Export and Credit Insurance Corporation)

[Source: Sinosure official website; Sinosure products includes mid/long tern export credit insurance, overseas investment insurance, trade insurance etc.]

Sinosure is a Chinese credit insurance company founded in 2001.

By providing insurance for foreign trade and foreign investment cooperations, Sinosure promotes the development of economics and trade, and focuses on supporting the export of goods, technology and services, especially high-tech, high-value mechanical and electrical products and other goods, to promote economic growth, employment and balance of payments. The main products and services include: medium and long-term export credit insurance, overseas investment insurance in China, short-term export credit insurance, domestic credit insurance, credit guarantee and reinsurance related to export credit insurance, accounts receivable management, business account collection, information consulting and other export credit insurance services.

By end of 2018, Sinosure has accumulatively invested more than 4000 billion USD and provided export credit insurance for more than 1.1 million companies. Sinosure accumulated payments of $ 12.79 billion USD to companies and accumulated more than 3.3 trillion yuan for 200 banks in financing export companies. According to statistics from the International Berne Association, the total scale of China’s credit insurance business has ranked first among global peers since 2015.

As a policy-oriented financial institution established to meet the needs of economic globalization and China’s foreign economic and trade development, China Credit Insurance will closely focus on serving the country’s strategic goals. Sinosure will take policy as the guide, and take customers as the center to build the company into a responsible, trustworthy credit risk management institutions with global influence.

Credit Sales Insurance

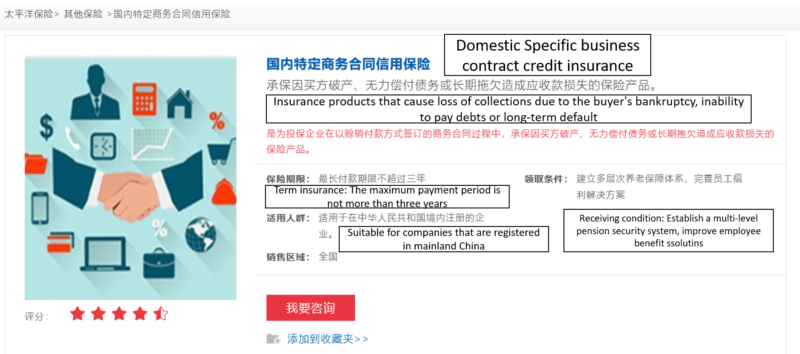

Domestic credit insurance company: CPIC

[Source: CPIC official website]

CPIC has a credit sales insurance named Domestic Specific business contract credit insurance. This insurance product is for loss of collections due to the buyer’s bankruptcy, inability to pay debts or long-term default. The maximum payment period is not more than 3 years and the insurance product is only suitable for companies that registered in mainland China.

There are several unique selling points in CPIC credit sales insurance. CPIC credit sales insurance will help the beneficiary company with better risk management and control, easier access to capital and improve financial portfolio. CPIC also provides more flexible payment terms, which allow the company to be more competitive in cash flow. The insurance terms can customize based on different companies risk and finance situations, and set risk controls accordingly.

The insurance process is rather simple and straightforward. The company that wish to be insured need to submit to CPIC and CPIC will do the necessary background research and review before approval and passing the contracts.

International Competitors

Euler Hermes

[Source: Euler Hermes official website. Euler Hermes credit insurance is not only suitable for multi-national companies but also small and medium companies]

Euler Hermes is a credit insurance company that offers a wide range of bonding, guarantees and collection services for the management of business-to-business trade receivables. Euler Hermes(EH) is a subsidiary of Allianz SE. it is rated as AA by standard and Poor’s. The group posted a consolidated turnover of 2.7 billion euros in 2018. EH employs more than 5,000 employees in over 50 countries and insured global business transactions for 962 billion euros in exposure at the end of 2018.

However, large-scale projects face multiple risks such as contract disruptions, chargebacks, forfeiture, or political risk. Transaction protection guarantees a single policy with up to eight years of irrevocable limits (up to 100 million euros), which will bring all the benefits of safer financing to financial institutions, investors, exporters and companies conducting international trade. The terms are tailored to each project and contract, to align with customers’ business goals, including structured transactions and single transactions.

Moreover, Trade credit insurance covers accounts receivable due within 12 months to protect your cash flow. EH track the financial status of your customers, and update information at any time, so that customers have confidence in doing business with them. In the event of a bankruptcy or long-term default, customers will be compensated for the goods and services you have delivered.

Loan Credit Insurance Companies in China

International competitor – AIG

AIG provides several basic credit insurance such as trade credit insurance whereby receivables arising from underwriting sales of credit between the insured and its buyers, including the buyer’s bankruptcy or insolvency and long-term default. Pre-shipment financing credit insurance whereby loss caused by the insured debtor failing to deliver the insured goods according to the contract and the debtor failing to pay the insured any unpaid balance of the pre-shipment financing during the waiting period. Factoring credit insurance whereby underwriting the buyer’s credit risk due to arrears or bankruptcy resulting in losses to the investor.

AIG have several unique selling points such as fast and quality service provided to customer. AIG can approve buyer limits in a relatively shorter lead-time. AIG also share a strong support from its business partners. Its service network is prominent in global major markets. AIG have easy access to loan services due to its high financial credibility over the years and strong financial portfolio, many foreign-invested banks are willing to provide loans to AIG. The insurance process is also clear and straightforward. Meanwhile, there is no need to declare each cases during the insurance period. AIG has a strong underwriting capacity, adequate underwriting limits, extensive international reinsurance support, and more than 30 years of credit risk underwriting experience. Companies who choose AIG can enjoy flexible underwriting methods and fair rates as AIG formulates rates based on international market levels, making it more competitive. Moreover, AIG is using XOL model of underwriting, and is the only insurance company on the market that provides non-cancellable credit limits.

Domestic Competitor- Ping An 中国平安

Company loan credit insurance does not need mortgage nor guarantees. Ping An provides simple procedures, flexible terms, fast approvals and rapid loan disbursement. The loan will help to expand company’s working capital for enterprises and to help them expand their domestic and international business loans.

There are some criteria that a company must fulfill before Ping An can approve the loan credit insurance. The company must be established for 2 years, has a bill nearly half a year that is approximately 1.2 million, has a value-added tax invoice and two years of annual statements, the most recent monthly statement, and the most recent six months of invoices; more importantly, applying for corporate credit The personal loan of a corporate applicant in the past three months cannot be overdue, and the corporate debt ratio cannot exceed 60-70%.

Learn more about the non-life insurance market in China

Auto insurance makes up a majority of China’s non-life insurance market, learn more about China’s auto insurance market from our report below.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes