What are investors speculating on the Chinese art market? | Daxue Consulting

China has the second-largest art market in the entire world. According to ArtNet, in 2017 the Chinese art market accounted for 20 percent of total sales in the $57 billion global sectors. However, speculation around Chinese art influences collectors and investors’ confidence, and shape the new trends of the art market in China. Despite the growing popularity of Chinese art, the market has experienced a slowdown in 2018, and international auction houses should understand both the risks and opportunities involving the art market in China.

Market demand for traditional Chinese art

Traditional Chinese art has become one of the most popular categories of art. First, it is important to know what is considered Chinese traditional painting, because there is some room for confusion over its definition. The art in this category includes classical paintings from before the 20th century as well as contemporary paintings. What define them is a common painting style that involve ancestral themes, materials and techniques. Artists use water-based ink and color on paper or silk, most often representing landscapes and continuing the themes of earlier compositions, thus creating a thematic series.

The Chinese antique market has also experienced a recent boom. It is partly explained by its fluidity: the demand of certain periods often change. While once it was pieces from the 15th century that were popular, it is now the 18th and 19th century’s artworks that are in demand. There is also an increasing flow of 19th century Chinese porcelain coming back to China, repatriated by Chinese art buyers from America and Europe.

According to The Telegraph, China has now established itself as the world’s largest antiques market, relegating America into second place, and this position benefits positively the popularity of the Chinese art, particularly of traditional style.

Recent growing interest in art in China

Thanks to China’s long history, the country is in a

“China is creating new collectors every day, and when a mainland Chinese begins collecting, he always collects Chinese art”, said James Lally, a New York dealer who in 2015 sold 40 percent of his traditional Chinese art to Chinese art buyers from the mainland.

Chinese collectors of art are actively repatriating Chinese antiques and traditional art, which has given the Chinese art market a boost. Hoping to benefit from this wave, western art owners are increasingly selling art in China, and major auction houses are moving towards Asia and particularly in Hong Kong. Staying in Hong Kong can be beneficial in avoiding taxes and issues with Chinese customs while staying close to mainland Chinese art buyers. However, international auction houses in mainland China have their advantages, mostly due to payment regulations.

Demand for high-value art in China: pushing exorbitant prices

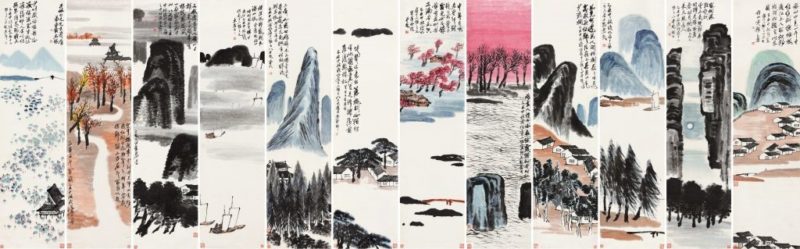

On 18 December 2017, a landscape collection by Chinese artist Qi Baishi sold for $141 million at a Poly International auction in Beijing, setting a record for Chinese artwork sold at an auction worldwide. Top-quality artworks by master painters create tension in bidding salesrooms in China. The Chinese fine art auction in 2017 has seen a success specially after improving lots quality in the continuous offering high-end and high-value lots. Throughout the year, top-quality artworks have created some tension in bidding rooms in China. Even if the sold lots rate dropped a little in 2017, the turnover of Chinese fine art auction actually reached a new high at $5.103 billion, according to Art Price.

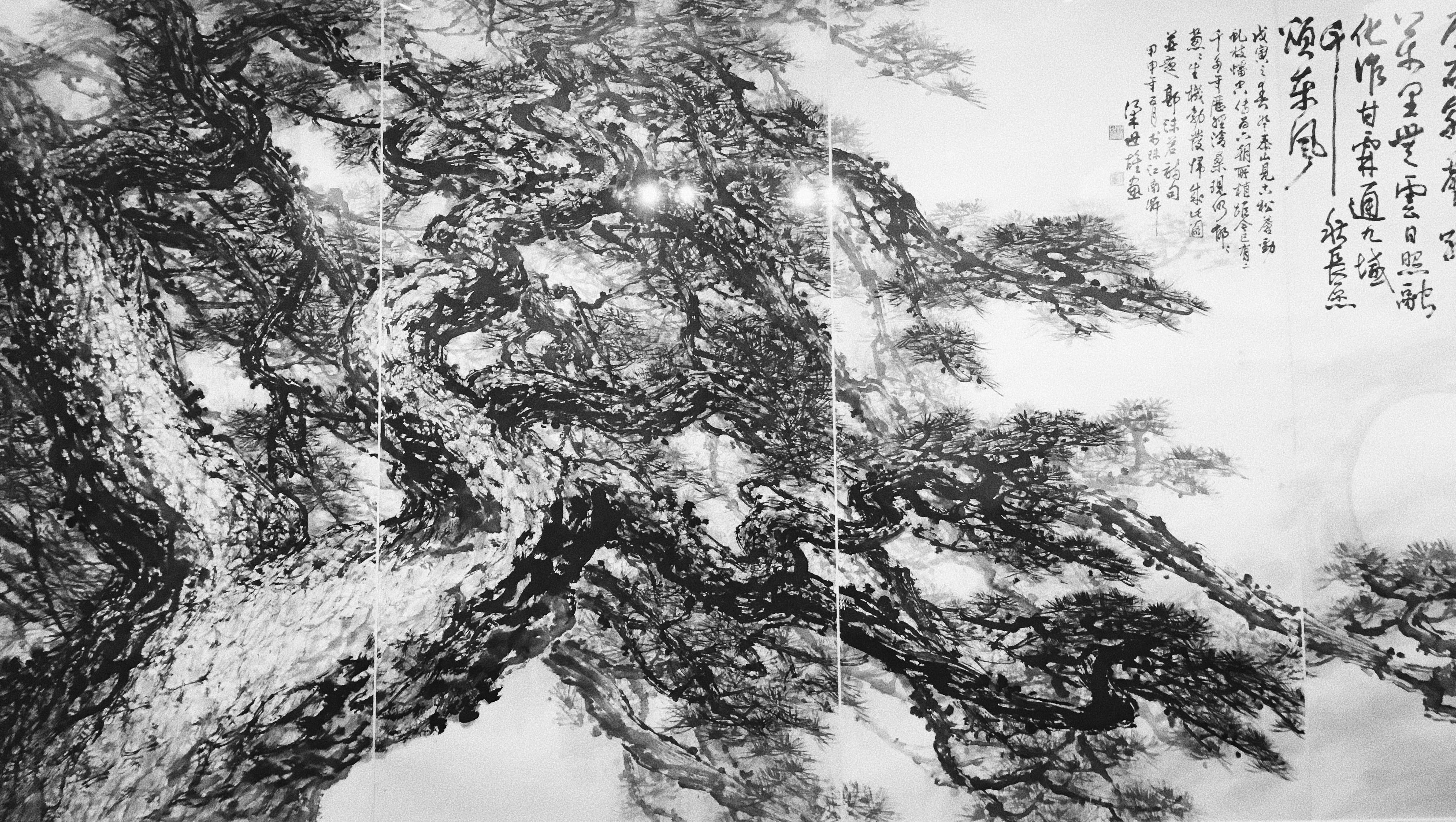

Imports of foreign art are down by around a fifth, and Qi Baishi was not the only Chinese artist with skyrocketing prices. “The Goddess of Cloud and the God of Longevity” by Fu Baoshi, who died in 1965, made more than $35 million in 2016, and China’s most expensive living artist is Cui Ruzhuo, with his “The Grand Snowing Mountains” painting reaching $39 million in 2015.

Chinese are more and more willing to pay eight or even nine figures price on true masterpieces, notably in the high-end and ultra-high-end market (lots above $14 million -or 100 million Yuan). In 2017, 38 lots sold in this bracket, more than double the number reported in 2016, according to Artnet’s report of 2017.

The returns on high-quality art in China

The exceptional performance of the Chinese art market in 2017 is positively related to the slower economic growth of the country: due to uncertainties in real estate and stock markets, more cash flowed into high-quality and authentic works of art that are considered to have a steady investment return. At the same time, the market considers purchasing art and antiques as an advantageous opportunity for long-term investment, and Chinese collectors of art and investors are returning to traditional Chinese works of art.

The wave of new buyers in China: investors turned into collectors

China may no longer be overrun by speculative collectors who neither know nor care about the works they’re buying. The new generation of Chinese art collectors are enthusiasts that don’t just venerate the art by its monetary value, but they understand the history and cultural significance of the works they collect. They are a small but influential group coming from the enormous growth of “new money” in China. With their passion for Chinese art – both classical and contemporary-, their influence goes beyond the simple purchasing of pieces: they are pursuing memberships in powerful art organizations, setting up foundations, and building new museums, thus boosting the market.

Taxi driver-turned billionaire, the story of an art collector in China

Liu Yiqian was once a taxi driver in the Chinese port city of Shenzhen. He became a millionaire by buying shares from state-owned companies before reaching a small fortune, which was enough to start investing in art.

Liu Yiqian and Wang Wei are one of Asia’s most world-renowned collecting power couples. They spend on high-profile Chinese antiques, but their purchases are not made for speculative purposes. The have established the Long Museum, which has two Shanghai branches that collectively house China’s largest private collection of art. Thanks to this influential group of collectors like Liu Yiqian and his wife, China has been experiencing a boom in art museums.

The slowdown of 2018 in the Chinese art market

Are reports predicting an end to the booming art market in China?

Released in 2018, the Claire McAndrew’s annual report on the global art scene, produced for Art Basel and UBS presents some discouraging results for the art market in China. There has been a “contraction in supply of high-value art in China and cautious buying, as trade and debt crises loomed”. Sales through the mainland’s dominant auction sector fell by 6 percent over the year and China’s art market share was of 28.96 percent of the global total, a 5.21 percent reduction compared to 2017.

One of the two items that sold for over $50 million was Zao Wou-Ki’s Juin-Octobre 1985, auctioned by Sotheby’s Hong Kong for $67,5 million.

With increasing debt crisis and slower economic growth in China, buyers have been more cautious in 2018. Lower-risk contemporary paintings have seen a larger success than in the previous years, influencing the market confidence on Chinese art.

What is over the horizon for China’s art market in 2019?

As China is said to be the world’s biggest economy by 2020, major Chinese cities such as Guangzhou and Chengdu are hailed as the next great wealth spots and home to the growing multibillionaire class. However, the new elite of Chinese collectors seem to have developed a strong interest in international contemporary art, partly because of Western galleries and fairs’ efforts in promoting Western Art. International galleries have been opening spaces at an increasing pace this last year, mostly in Shanghai and Hong Kong.

China’s share of Western art’s revenue is growing rapidly, with an increasing number of Chinese buyers of western art and of Chinese auction houses selling it. Competition among top auction houses from London, New York, Hong Kong and Beijing has become stiffer than ever.

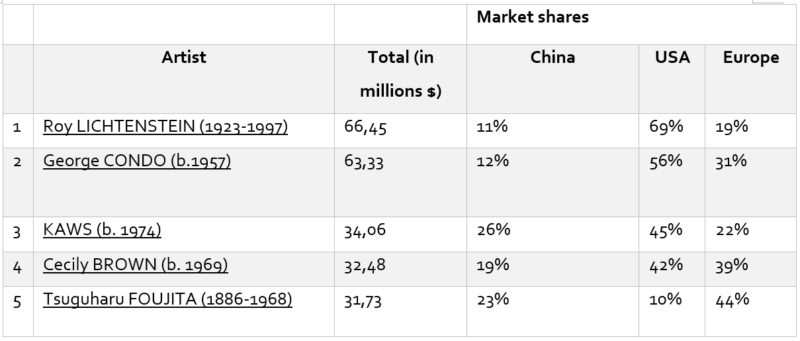

Selection of top 5 international artists in 2018

At the same time, the restructuring of the Chinese art market that started in 2015 continues with the country’s auctioneers currently trying to reduce their unsold rates, according to Art Price.

Risks around the art market in China

Throughout 2018, the downturn in sales in the art market in China was influencedby many factors, such as the government’s ban on selling Chinese antiques, the difficulties of extracting large amounts of money from China, and the increasing default on payments.

Constraints for Chinese collectors of art and International auction houses

One of the reasons of the Chinese art market’s slowdown in 2018 is the obstructive legal environment around the art industry in China: overseas auction houses cannot sell certain “cultural relics”, which includes Chineseartwork from before 1949. It does not come as a surprise that the cultural relics are the most profitable sales today in China.

This is partly explained by the fact that China seeks the return of its own heritage. To benefit from the return, it won’t permit foreign firms to sell these antiquities in China. At the same time, foreign firms cannot auction Western antiques in China (from before 1949) either. Only Christie’s has been approved to conduct auctions in China, and Sotheby’s has been forced to collaborate with a state-owned multimedia company in Beijing in order to carry out some of its sales.

With the growing demands of the new Chinese collectors of traditional Chinese art, these regulations limit prestigious foreign auction houses to serve the domestic market, resulting on a visible slowdown in the market.

Difficulties on extracting money from China

In addition, a government banking policy states that Chinese citizens from the mainland are limited to taking out only $50,000 per person per year, including transfer to Hong Kong, Macau and Taiwan. Immediate payment by credit card is possible, but usually the money is transferred from Hong Kong even if the client is from mainland China. Even if clients are well-capitalized, delay payments still persist, which slows down sales in auctions.

Defaulting on bids and payment in the Chinese art market

In the latest Art Basel report, Claire McAndrew warned that non-payment by Chinese art buyers is getting worse. It is partly due to problems about the authenticity and provenance of the artwork. Among all lots sold in 2017, only 49 percent of total sales were paid, and the nonpayment rate is even greater with lots over 10 million Yuan – $1,5 million- for which only 28 percent of the value had been paid.

In 2016, Sotheby’s Hong Kong took bid winner Yu Kin-po to court accused of nonpayment.

At the same time, there was a lawsuit in a Manhattan courtroom concerning a $24 million Richter painting which a Chinese bidder, Zhang Chang, who did not pay up. There are many nonpayment case among lower prices than the multimillions, but such cases rarely reach the courtroom as the costs of taking legal action are just too great.

Another potential reason, McAndrew wrote, is a historic cultural difference: “In China, bidding is not always perceived as a legal obligation”, seen as the start of a misunderstanding that has caught out action houses in the West and in China.

In some cases, dealers find themselves locked in a chain, waiting for payment of an artwork sold to pay for the new one on which they had bid. In others, owners attempt to bid up their own pieces and dealers bid wildly to increase prices. In any case, speculation forces dealers to purchase items only hoping to find buyers after the event.

Fortunately, the restructuring of the Chinese art market should benefit Western auction houses, with a new legal framework aiming to eliminate unpaid and forces to an immediate payment for purchases of artworks.

Future speculations on the future of the art market in China

The Chinese art market has developed rapidly over the past few years, and most people still treat it as an investment. With a larger market share in China, Chinese art in general and particularly from the high quality and traditional end is known to have profitable returns on investment.

The year 2018 has seen a slowdown in the Chinese art market, and experts’ predictions on the future are varied. Some of them expect to see growth in the market, with Chinese art gaining popularity in auction salesrooms across continents. Sales growth will be expected as well in Mainland China, thanks to a return to Chinese culture by repatriating antiques and investing in Chinese traditional-style art.

However, a new generation of millionaire Chinese collectors with a real love for art is increasingly interested in international contemporary art. Art experts then predict an end to the boom in the Chinese art market while spending on art in China is growing steadily.

International auction houses should be aware of the limitations and risks on selling art in China or to Chinese buyers. Currency restrictions and defaulting on payment are bound to negatively affect the art market in China if the government does not rush into regulation reforms.

Author: Ines Beneyto Brunet

Let China Paradigm have a positive economic impact on your business

Listen to China Paradigm in iTunes