How can foreign automakers be a part of China’s future driven by electric vehicles | Daxue Consulting

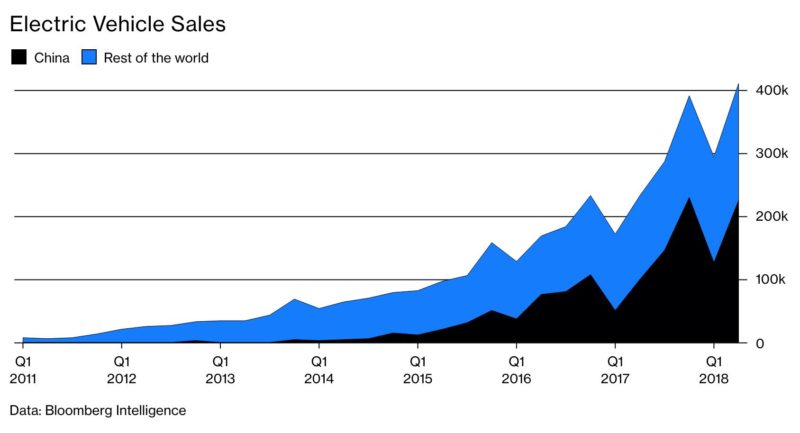

Electric vehicles (EVs), including vehicles mainly powered by electric motors, are gaining increasing attention from governments and the automaker industry globally. China has become the biggest EV market within only a short period of time and is forecasted to continue rapid growth because of the support from the Chinese government and changing car purchase preference happening in the domestic market.

Source [Bloomberg Intelligence]

The global trend: out with the combustion engine, in with the electric vehicles

However, the Chinese government is desperate to lead an electrified future since it could help China reduce its dependence on imported oil and considerably mediate the smog choking its cities. It would also help domestic automakers gain more expertise in a car manufacturing segment in which Chinese carmakers are still lagging behind in core competencies. The total volume of EVs sales in Mainland China hit 336,000 units in 2017, a sharp increase of 63% from 2016. According to Ministry of Industry and Information Technology of the People’s Republic of China (工业和信息化部), by 2020 the Chinese EVs market targets 2 million annual sales, and by 2025 the sales of electric cars account for 20% of the total auto market. It is predicted by officials that internal combustion engines will be fully banned by 2040. China, therefore, has ambition and commitments to push forward on vehicle manufacturing and technology investment concerning the electric auto to overcome current obstacles in the industry. Other countries such as France and the United Kingdom, are both aiming to ban combustion engine sales by 2040. Hence, electrification is a global trend that is looming in the automobile area.

Chinese carmaker: Automakers catch up with the electric trend

Volvo announced its intentions to produce only electric or electric-hybrids by 2019. Jaguar Land Rover plans to go all electric by 2020, while Aston Martin announced its plans to go completely hybrid by 2025.

BYD, a Chinese carmaker, had an early shift of its strategy from internal combustion engine production to electric motor development, gaining a first-mover advantage in the domestic market and is already a market leader in the Chinese EV market. The CEO of BYD, Wang Chuanfu said: “The company aims to dominate China’s electric car market with a trillion RMB in sales by 2025.”

Dozens of electric car start-ups that have emerged in recent years after the government started issuing special manufacturing permits to companies outside traditional auto industry players in China. Also, venture capital investment in China’s electric car industry accelerates, leading to many start-ups like NIO, Xpeng, etc. emerging in the market which is a battle territory at the moment.

Nevertheless, China’s government plans to cut off its current initiatives in 2020, which will likely narrow the playing field of EV companies in China down to only a handful of players that can produce the highest quality EVs. Although demand will increase as China looks to ban fossil fuel cars from its roads, high costs and an end to subsidies mean a large portion of the industry won’t realize significant returns on investment in the Chinese EV space.

China’s carmakers have taken initiatives on the growth of the EV market, and given the context of improving the urban environment, the central and local governments would constantly support the development of electric autos in China. To gain a foothold in the Chinese market, automobile firms have engaged in the adaptation of their production lines to comply with requirements set by the government.

The opportunity and challenge for international carmakers in the Chinese market

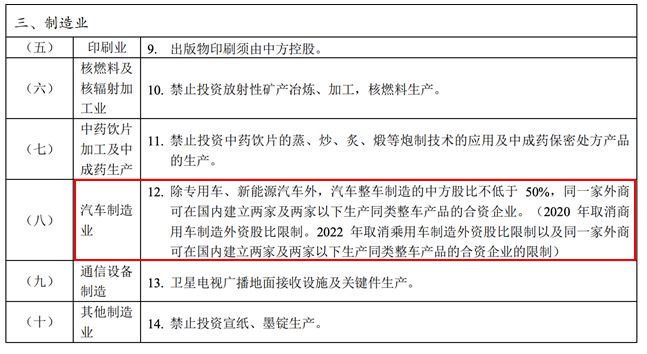

Policy for the Access of Foreign Investment

“Except for special vehicles and new energy vehicles, the proportion of Chinese stocks in automobile manufacturing is not less than 50%. The same foreign company can establish two or more joint ventures producing similar vehicle products in China. (In 2020, the ratio of foreign shares in commercial vehicle manufacturing will be lifted. In 2022, the restrictions on the foreign-investment ratio of passenger vehicles were eliminated, and the restrictions on the joint venture between the two foreign companies that can produce two or less of the same type of complete vehicle products in China.)”

According to the latest published Special Administrative Measures for Foreign Investment Access, the restriction of the stake of foreign investment of new electric vehicles has been canceled. Soon after getting approved by the government, Tesla decided to construct an auto factory in its second-biggest market-China, being capable of independently manufacturing, marketing, research and development in China, potentially leading to lower cost of manufacture, and thus, lower price for Chinese customers. Benefits from loosened regulations, we see a good chance for foreign auto firms relatively more independent on manufacturing vehicles, and less concerned about intelligence sharing than before.

China’s EV market: Policy creates barriers for international automakers

Though China’s EV market share aims at 20% by 2025, very likely to exceed that, certain obstacles are in the way of fair competition for international automakers. The Made in China 2025 blueprint, for instance, calls for domestic companies to control at least 70% of the fully electric car market by 2020. Tesla has a sizeable footprint in the country—17% of its total 2017 vehicle sales came from China. Nonetheless, the government’s plans mean that it will be difficult for Tesla, along with other international automakers like Ford and GM, to remove domestic players in China’s EV market.

What you must know about China’s EV industry

China’s EV industry: The charging infrastructure and development

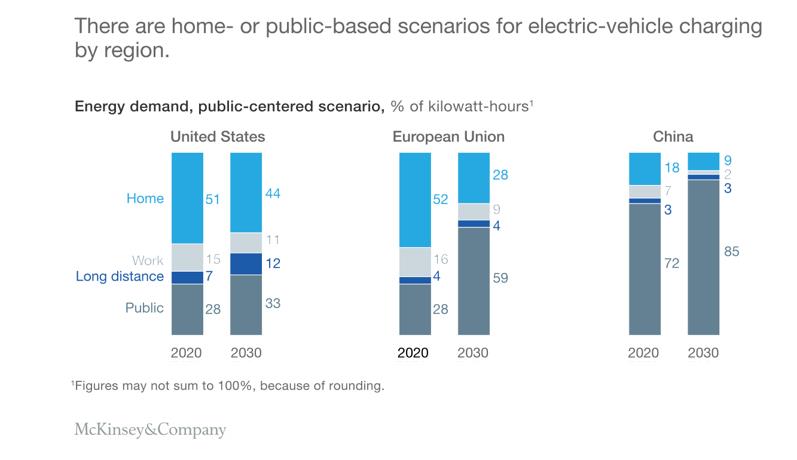

Two most used charging technologies in the EV industry is alternate-current (AC) charging (also called slow charging) and direct-current (DC) charging (also called fast charging). Although AC charging is likely to remain dominant charging demand in few years, DC charging due to its efficient performance will likely play a much larger role in China. DC charging needs a large station and cooling system, and hence public-charging is a future trend for Chinese charging infrastructure.

Besides, in the conditions of fewer amounts of single-family homes compared with European Unions and the United States, China should have much lower penetration of home charging, in another word, the increase of public charging stations as a result.

Source [McKinsey Company]

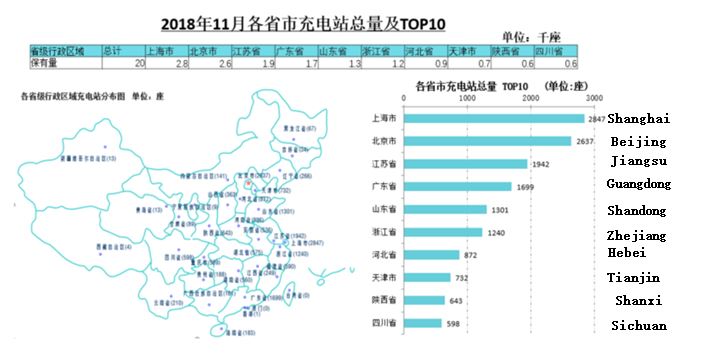

It illustrates the total amount of charging station in top10 provinces. The charging stations mostly focus on the eastern part of China.

One idea being discussed is installing charging piles at petrol stations across the country to turn them into public charging centers, but that requires the cooperation of China’s biggest oil companies and the power grid operators. CNPC (中石油) and SINOPEC (中石化), two Chinese biggest oil giants, have agreed to incorporate charging piles into their over 840 petrol stations very recently. This signals the active cooperation among local governments, State Grid (国家电网, a state-owned electricity company), two oil companies, and as a result, a widespread expansion of charging infrastructure.

The current issue existing in charging infrastructure

The statistics show a considerably low usage rate of only around 10% for public charging posts. In essence, this likely results from intentions of rapid expansion in the early stage of charging infrastructure establishment, leading to a lack of necessary maintenance and poor spots management.

This situation, however, is expected to be improved in the following years with the competition of charging industry becoming less fierce. As we are witnessing a booming growth of electric vehicles in the future, the country is looking forward to developing charging infrastructure efficiently and effectively.

How Chinese citizens are massively incentivized to purchase EV

As for subsidies for carmakers, the Chinese government wants to ensure automakers will launch models that would be appealing to consumers hence setting subsidies dependent on minimum driving range requirements. The average purchase incentive per electric vehicle may be lowered by more than a third from the 2018 levels. In addition to financial support as passing a few years, the government emphasizes the technological improvement to make sure the industry’s long-term success. As part of new rules that went into effect from February 2018, China lowered subsidies by varying degrees for EVs with a driving range of fewer than 300 kilometers. At the same time, the incentive for those that have a range of 400 kilometers and beyond was raised to 50,000 RMB.

As for license plate, China is the largest market for EVs around the world, and it is anticipated to maintain the position in the future. Currently, in several of the country’s major cities (including Beijing and Shanghai), EVs are exempt from license-plate lotteries and significant registration fees that apply for cars with internal-combustion engines. These exemptions are critical levers to make purchasing an EV more attractive, especially for younger, first-time car buyers.

The decreasing cost of batteries

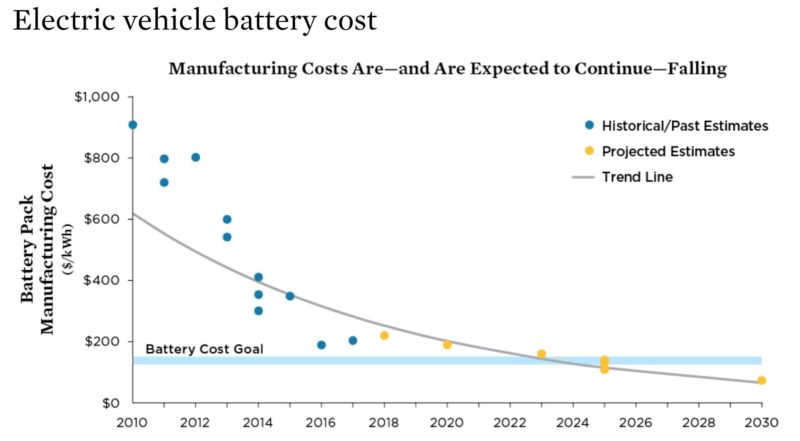

Between2014 and 2016, battery costs fell over 50% due to process improvements and scale effects, bringing EVs significantly closer to parity with an internal combustion engine (ICE) costs.

Electric vehicle battery cost. Source: [Union of concerned scientist]

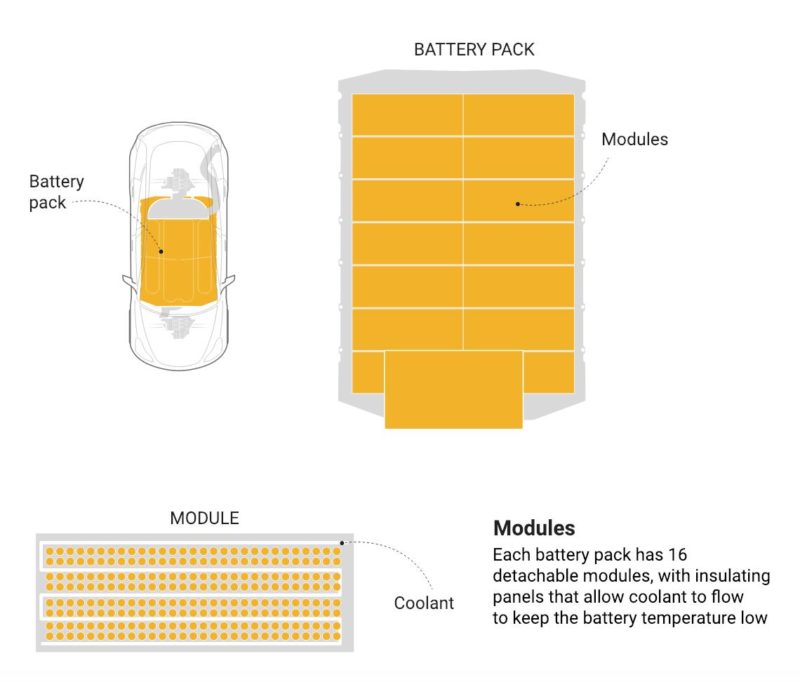

Source: [Tesla]

Credit system devised by the government specifically to regulate China’s EV industry

In essence, the mandate starting from April 1st, 2018 requires the automakers to involve clean energy components as a considerable portion of their production or imports to China. With the ambition of the Chinese government’s ultimate plan to eliminate fossil fuels vehicles, the credit system will have effects starting from the root of auto industry-carmakers in China. The rules set by the credit system are expected to operate similarly to that of the carbon credit system, allowing players in the market to transfer their credits among their rivals. Basically, the credit system follows specific equations enacted by the government, for instance, a pure-electric vehicle with a range-topping 300 kilometers will generate more credits than one with lesser performance or that a gasoline-electric hybrid. The rules apply to all companies that manufacture or import more than 30,000 cars annually. The result of the credit calculation must be positive if auto companies want to continue to sell gasoline and diesel cars in China. The credit system is considered to result in significant impact on the international auto organizations which are currently cooperating with domestic companies.

The ultimatum has left the auto companies scrambling for a major shift in their operations. After all, none of them would like to leave the world’s largest automobile market. As a result, international companies have employed various solutions in order to gain a slice of Chinese cake out of the constantly expanding market. Volkswagen, for instance, has promised at least 40 new NEV (new electric vehicle, vehicles that are partially or fully powered by electricity) models in China within the next decade. BMW plans to introduce two pure electrics in the country by 2020, in addition to the two existing plug-in hybrids. Others, who have not, to date, reached the stage to meet the mandate, have found a more temporary solution. As the report mentions, Toyota, Fiat Chrysler Automobiles, Honda Motor, and Mitsubishi Motors all plan to sell the same electric SUV, developed by Guangzhou Automobile Group.

Suggestions for international carmakers who want to penetrate the Chinese market

China’s carmakers: advancing technology by partnering with foreign companies

In line with China’s requirements, domestic auto businesses may be of urgent need of up-to-up-to-standard technologies, especially of battery development. The ideal, and quickest, a way for Chinese companies to advance their technological capabilities would be from overseas via investment in or takeovers of foreign firms, said Cui Dongshu, secretary general of the China Passenger Car Association. The auto industry is a strategical imperative for the overall development of China. Chinese carmakers need to assimilate the world’s leading technologies and products to improve their manufacturing capabilities. In addition to technology, the large potential of the Chinese auto market is lucrative. Given the further opening up policy recently announced by the government, foreign auto organizations are no longer restricted by the proportion of foreign equity in certain joint venture cooperation by 2022.

Thus, it is evident that a bunch of opportunities awaits them to align with Chinese carmakers and embracing them leads to promising business value.

Why now is the time to enter China for automotive companies

On April 17, 2018, the National Development and Reform Commission announced that foreign ownership limits on ventures producing special-purpose vehicles and new energy vehicles are eliminated by the end of 2018. The foreign ownership cap is to be abandoned for commercial vehicles in 2020 and for conventional passenger vehicles in 2022. Foreign automakers will also no longer be limited to having only two Chinese joint ventures. The new regulation is likely to boost the attractiveness of manufacturing autos in mainland China. Tesla, for instance, has reached an agreement with the Shanghai government to open a new plant in one of the centers of the Chinese automobile industry.

Besides the policy, the scale effect of the component production can be resorted to by international carmakers if they decide to build car factories in China. Also, the relaxation of the regulation starting with new energy vehicles announces a good chance for foreign electric carmakers to step into the market now. China is one of the world top producers of steel, another critical raw material apart from cobalt for manufacture. Therefore, foreign automakers are likely to take advantage of the new policy and promising market demand in China.

Author: Will Qian

One of the many challenges faced by international companies in China is the lack of reliable and transparent data about their market, especially about such fast growing and developing industry as Electric vehicles. Focus groups, consumer roundtables, and workshops are ones of the most executed methodologies by Daxue Consulting to collect these first-hand consumer insights.

So, to organize an interactive session with your potential clients in China and know their opinion do not hesitate to contact our project managers at dx@daxueconsulting.com.