Why we predict the children’s oral care market in China will boom | Daxue Consulting

Children’s oral care is a niche market in China but has a pearly white future. Due to China’s second child policy, an increasing number of infants are born every year, leading to higher demand for infant care products. In addition, because of the progressed living standard and education level of the general Chinese population, parents are more conscientious about children’s health and are willing to invest more to provide their children with high-quality products. Therefore, various kids-related markets are thriving, including children’s oral care market.

China’s oral care market at the beginning of a long upward climb

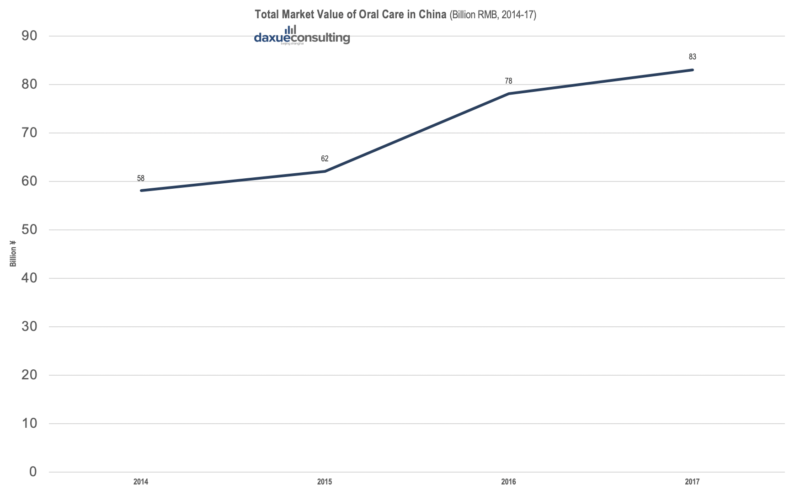

The Chinese oral care market is considered as an “ Until China’s consumption upgrade, the niche market of children’s oral care was previously unexplored, brands positioning themselves for children’s oral care are sailing into a blue ocean market. As demonstrated in the graph shown below, the market size of the oral care market is increasing, from 58 billion RMB in 2014 to 83 billion RMB in 2017. The growth rate from 2014 to 2018 is 14%, 16%, 15% and 14%, respectively, which means the growth rate is fairly consistent.

The total market value of oral care in China [Source: Daxue Consulting]

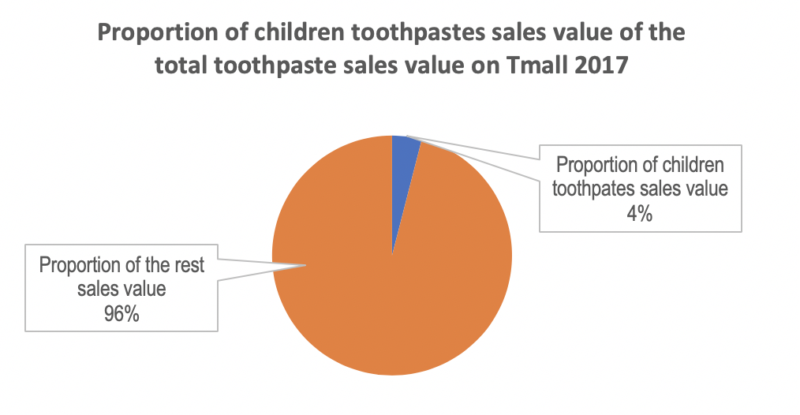

Additionally, in the past12 months, the total sales value of toothpaste on Tmall was 1,446 million RMB but sales value of children’s toothpaste on Tmall was 52.71 million RMB, accounting for only 4% of the total market. Although the market share is small, the growth of the children toothpaste market is fast. The YoY growth rate of toothpaste market in 2017 was 73%, while the YoY growth rate of children toothpaste market reached 114.17%. According to “2017 Children Oral Care in China White Paper” released by Saky Kids, driven by the middle class, China oral care market is expected to reach 500 billion RMB by 2020. The CAGR of children oral care market in recent three years reached 10%, taking a leading position in overall oral care growth. Children electronic toothbrushes have a YoY growth of over 64%.

Additionally, in the past12 months, the total sales value of toothpaste on Tmall was 1,446 million RMB but sales value of children’s toothpaste on Tmall was 52.71 million RMB, accounting for only 4% of the total market. Although the market share is small, the growth of the children toothpaste market is fast. The YoY growth rate of toothpaste market in 2017 was 73%, while the YoY growth rate of children toothpaste market reached 114.17%. According to “2017 Children Oral Care in China White Paper” released by Saky Kids, driven by the middle class, China oral care market is expected to reach 500 billion RMB by 2020. The CAGR of children oral care market in recent three years reached 10%, taking a leading position in overall oral care growth. Children electronic toothbrushes have a YoY growth of over 64%.

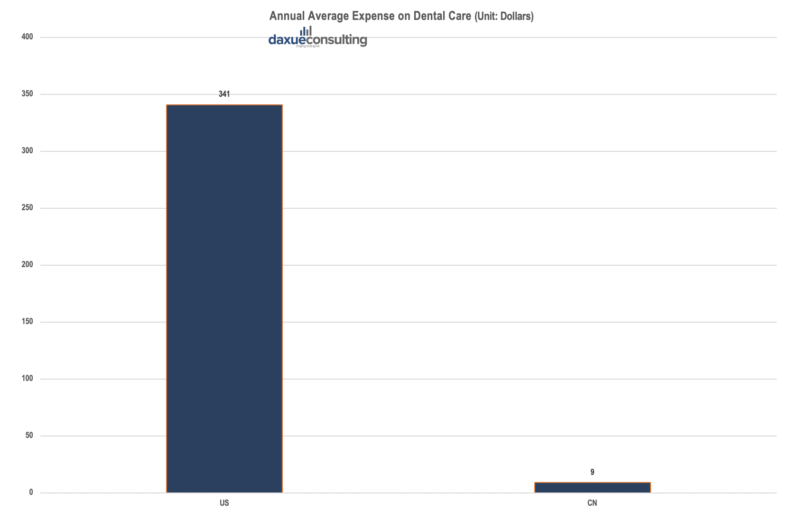

Chinese children’s dental health problems are still severe

According to the White Paper, more than 60% of Chinese kids have oral illnesses. 66% of 5-year-old kids suffer from tooth decay 97% of which are untreated, which means the general public still hold the belief that “a toothache is not a real sickness” and are not treating them. In fact, children oral problems not only influence appetite, but 32% of children’s oral problems also influence their confidence in communication with others. Moreover, parents’ misunderstandings are impacting children oral health: currently, most of 25-45 year-old grown-ups developed good oral care habits after 7 years old, which means most children are not receiving sufficient guidance on dental care at an early age. The three biggest misconceptions are: 1) 30% parents think that baby teeth need no care because they will be replaced a few years later; 2) Many parents believe children don’t require specialized oral care; 3) Some parents think brushing their teeth is enough and there’s no need for children’s dental nutrition. The other extreme is that some parents think it’s necessary to brush children’s teeth after every meal, which actually causes damage to children’s teeth. These misconceptions are still requiring parents to compare with the developed countries, Chinese people’s average expenses on dental care are significantly lower. For example, as shown in the graph, US population has an average annual oral care expense of 341 dollars, while Chinese only spends 9 dollars per year on average, which is apparently not correspondence with dental illness morbidity. Therefore, as the general public gets more and more educated on how to correctly treat the dental problems, the demand for the oral care product will rise dramatically.

Annual average expense on dental care in China [Source: Daxue Consulting]

Chinese parents are paying more attention to children’s dental health

Baidu Index Analysis

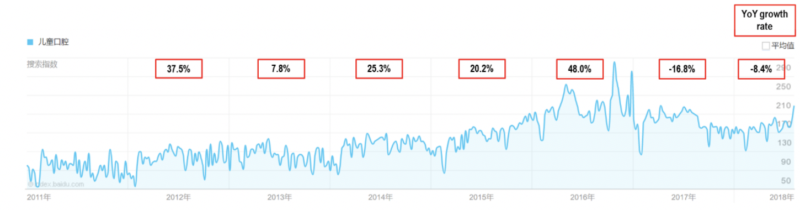

As the Chinese population is receiving more information on oral care, Chinese parents are more particular about their kids’ dental products. According to Baidu Index, the search for “children toothbrush” has a YoY growth of 23.7% in 2014 and 26% in 2015; then the search frequency turns to constant in 2016-2018. Correspondingly, the search of “children oral care” was also boomed in 2015 and 2016, which has a YoY growth of 20.2% and 48%, respectively and turns to constant in 2017 and 2018. Such trends mean the Chinese population has already developed the ideology that young kids should use specialized oral care products.

Baidu Index of “Children toothbrush”

Baidu Index of “Children oral care”

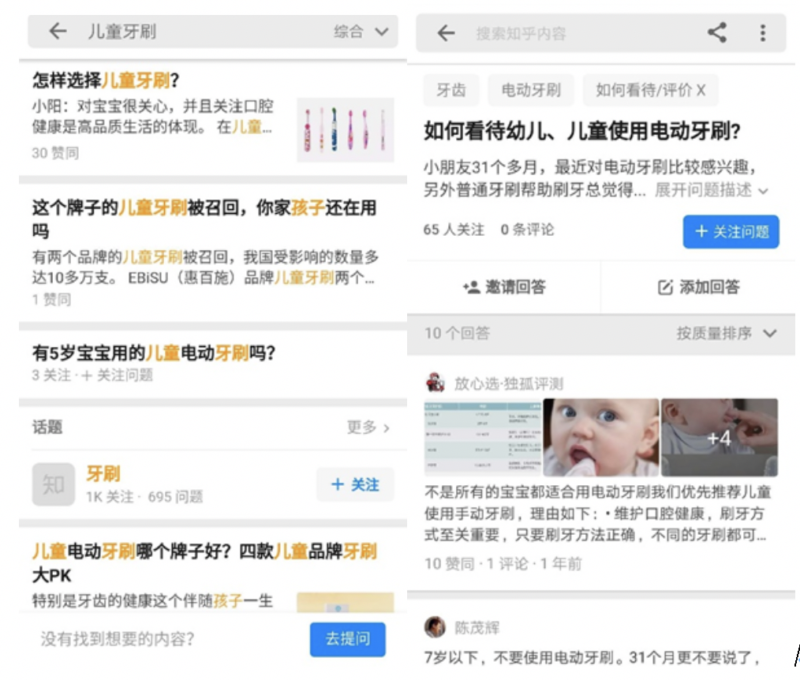

Social Platform analysis for “Children Toothbrush”

In addition to obtaining information about children oral care through search engines, Chinese parents are also willing to discuss their opinions and experience on social media and discussion forums, like Zhihu, Weibo and Xiaohongshu. On Zhihu, when searching “children toothbrush”, the results of “how to choose toothbrush” and “whether children should use electric toothbrush” appear as the most common questions. Answers show the belief that parents should choose children toothbrushes with soft bristles and short and thick handles. For electric toothbrush, most answerers suggest that children under 12 should not use an electric toothbrush, which could prohibit children from learning how to brush teeth correctly.

Zhihu searching results of children toothbrush, which shows parents opinions and recommendations of children toothbrush brands

Social Platform Analysis for “Children Toothpaste”

As for children’s toothpaste, “how to choose toothpaste” and “whether children should use fluoride toothpaste” are most concerned. Answers show that parents should choose edible toothpaste for babies and after children learning how to rinse the mouth, children can use fluoride children toothpaste which can prevent dental caries.

Zhihu search results of children toothpaste, which shows parents’ opinions of different toothpaste brands

Such popular searches also appear on Xiaohongshu and Douban. For these social media platforms, the users mainly search for recommendations of the specific dental care products and learn from the user experience of other consumers. Parents tend to recommend products of good using experience rather than complaining bad quality products. Besides parents, KOLs are also a large group that posts such product recommendations. Comments and recommendations on social media are mostly towards oversea brands. Articles about comparison and evaluation of different brands are viewed and commented more, which means these articles may cast a bigger impact on parents. In the recommendation, component, taste and appearance of products are most concerned. According to social media posts, consumers are willing to share their consuming in supermarkets, overseas stores and dental hospitals. Parents prefer oversea brands for children toothbrush and toothpaste. Thus, many consumptions occur overseas or online on oversea products platforms. Therefore, these two channels can be considered as ideal places of distributing advertisements and goodwill of certain brands and products.

Xiaohongshu search result for toothbrush and toothpaste

Chinese parents are paying more attention to product brands than basic oral care knowledge

Moreover, dental hospitals are the places that parents can get professional and personalized advice. It is easy for parents to accept doctors’ recommendations. On Weibo, doctors’ personal accounts and some institution accounts will push children oral care information to teach parents how to take care of children’s teeth. Children oral care articles and Q&A can be found on Zhihu and WeChat as well. However, both Weibo and WeChat show less concentration on children oral care information than adults’. The view, shares, comments and likes numbers of these articles are fewer compared with other oral health or goods information. On WeChat, even though there are a few articles about children oral health, the numbers of readers are no more than several thousand. These trends show that the knowledge level of the general public on children oral care area still needs to rise.

Zhihu and WeChat official accounts search result for children oral health, which provide basic information and knowledge of children’s oral care

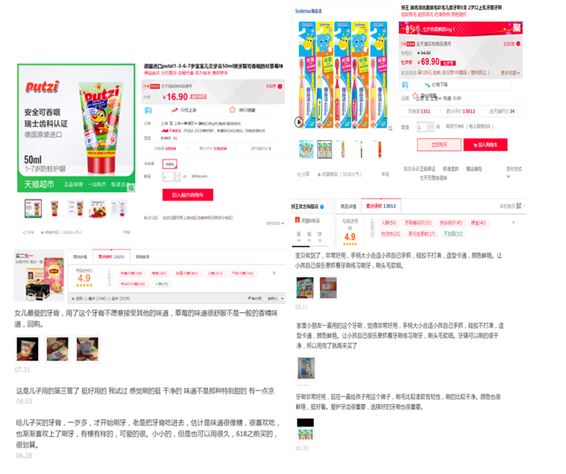

E-commerce platforms are still the main purchasing channel for Chinese consumers

Since 2002, E-commercial platforms gradually become the main purchase media for Chinese consumers. For children oral care products, online shopping is also the most popular trend. On e-commerce platforms like JD and Tmall, popular children toothbrush and toothpaste products (most are oversea brands) receive mainly good comments, which means their rates of good comments reach 99% on JD or their comment grades reach 4.9 on Tmall. For the representative toothbrush, consumers comment that the toothbrush has the proper size, soft bristles and cartoon appearance which attracts kids. For the representative toothpaste, consumers comment that the toothpaste tastes good, is effective in cleaning teeth and attracts kids. Such positive feedback reflects that the current dental products are more and fitter in the consumer’s expectation and design right according to their demands.

Tmall and Taobao search results for children toothbrush and toothpaste

The competition in the Chinese market between oral care brands is fierce

The oral care brands are competing fiercely in China. According to Sohu Technology, the top 10 brands on Tmall in 2017 include which together account for 40.87% of the total market share. The top 3 children toothpaste brands based on YoY growth rate are Putzi (28.38%), Lion (狮王) (4.88%), Jing’s (婧氏) (0.66%).

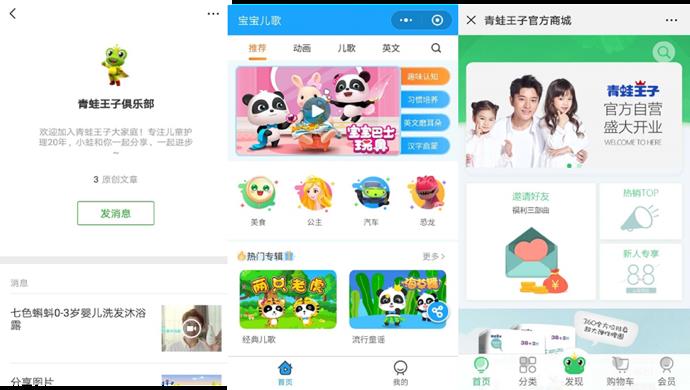

Example of a successful Chinese brand: (青蛙王子) is the top seller on Taobao was established and come into children care market in 1999. It is one of the traditional local brands in China. Frog Prince was the first daily chemical firm that came into the cartoon industry and it has invested and produced three cartoons. In addition to children oral care products, Frog Prince has children skin care, shampoo, baby paper diaper, mother skin care products. Frog Prince went public in Hong Kong in 2011 and acquired the American branding in 2012. Frog Prince has a sales value of 12,174,003.29 RMB in 2018. However, their revenue has been declining since 2013. In 2016, revenue of children care products reduced by 30.4% comparing to 2015. Noticeably, Frog Prince launches high-end Rainbow Baby series products in 2017 and is trying to differentiate their product to increase the revenue.

| Frog Prince | The lowest price | The highest price | Average price | Top seller price |

| JD flagship store | 19.8 | 32.5 | 24 | 19.8 |

| Tmall flagship store | 19.8 | 45.9 | 31 | 19.8 |

Frog Prince also has a great marketing strategy. The cartoon character, Frog Prince, is in almost every Frog Prince ad video. Some ads serve as dental knowledge distribution method to tell the audiences that parents should choose toothpaste according to kids’ age and Frog Prince is professional for every age group. Other ads convey the concepts of children’s dreams and accompanying children, which effectively attract children’s attention, not only the parents.

Frog Prince’s ad videos

Frog Prince also develop their brand awareness on Weibo and WeChat Official accounts. On Weibo, Frog Prince Official already has over 124 thousand fans. Their contents including advertising campaigns and children care information. The comments in Frog Prince’s Weibo show that products are loved by children because of good smell and taste. However, the posts usually get tens of shares, comments and likes, which means Frog Prince’s Weibo does not have much influence.

|

|

Frog Prince official site and WeChat official account

Foreign brands happily entered the Chinese market: Putzi is the fastest growing brand in 2017

Putzi is owned by German manufacturer Dental Kosmetik. Dental Kosmetik has a history of over 100 years and it was the origin of the modern toothpaste. Innovative dental and oral hygiene products are the basis for Dental Kosmetik. In 2017.8 to 2018.8, Putzi ’s online sale are 3,081,146.91 RMB. Putzi has entered the Chinese market in recent years’ trend of buying from foreign brands. For now, Putzi have no flagship stores on either JD or Tmall, but consumers can buy Putzi products in self-run, supermarket or third-party stores on JD, Tmall, Mia, DangDang, Koala, Amazon, Suning and Yihaodian. To further build up the brand awareness and raise the sale revenue, Putzi can establish a flagship store on the E-commercial platforms and have a more easily-accessible purchase channel. In addition, Putzi has no print ads or video ads for the Chinese market and neither official Weibo and WeChat account yet, which can also limit their potential consumers to know the brand.

| Putzi | The lowest price | The highest price | Average price | Top seller price |

| JD supermarket and self-run | 16.9 | 45 | 30 | 16.9 |

| Tmall supermarket | 16.9 | 16.9 | 16.9 | 16.9 |

Top brands are developing new products in the Chinese market to attract consumers

According to an industry insider, currently the number of children’s toothpaste brands on the market are not large and the market is still at the primary stage of educational marketing. But many brands have realized the potential of children toothpaste market and started to attach importance to capture the market. The competition of professional children toothpaste has become increasingly intense and segmented. For example, the traditional domestic children’s care brands such as Baby Elephant (红色小象) and Frog Prince (青蛙王子)have launched new products such as children mouthwash to extend its product line; higher-end toothpaste brands like P&G, Yunanbaiyao (云南白药), LG, Sushida (舒适达) and international adults’ toothpaste brands, such as Colgate, Crest and Lion have also launched products for children, like children toothpaste and children toothbrush. For these high-end and international brands, their abundant resources on research and development can promote the sales of whole product lines due. Besides these traditional oral care brands, cross-industry players such as Diaopai (雕牌) also targets this market segment by providing their own product mix to this market as they have more diverse resource and perspectives. In addition, children’s electronic toothbrushes also have a large market potential In the foreign market, 40%-60% children use electronic toothbrushes, while the market in China is less than 1%. However, the technology of most domestic children electronic toothbrush manufacturers needs improvement. Most domestic children electronic toothbrush manufacturers use technology for adults’ electronic toothbrush directly, but actually children electronic toothbrushes have their own requirements.

China east coast cities and Guangzhou are showing the highest interest in purchasing children’s toothpaste

Due to the developed E-commercial structure, China east coast cities and Guangzhou are the top buying cities of children’s toothpaste. These regions all well-developed areas with large population basis. Also, more and more young parents have decided to stay in these newly developed cities, which further increases the demand for the children toothpaste. As shown in the graph below, these cities also have a higher presenting index of Children Toothpaste on Taobao, which coincidence with the population and the level of development.

Presenting an index comparison of major Chinese cities. Guangzhou’s children oral care market has the highest presenting index

As analyzed above, the Chinese children oral care market is expanding rapidly from customer, producer and industry aspects. For the customer, the main purchaser for the children oral care industry is the parents, who concern more and more about the quality of the children goods. They not only learn more about the famous brands but also have more incentive to learn more about the basic oral care knowledge; however, comparing to the developed countries, Chinese oral care market still has room for expansion. For the producers, there are several tycoons in this industry that occupy most of the market share and most of them are developing new products to attract more consumers. For the industry, as the Chinese people are gradually forming the ideology that dental health is a part of the overall health level, most people are more concern about the oral health, which can lead to a boomed children oral care market. Author: Xiangyu (Lavender) Mao

One of the many challenges faced by international companies in China is the lack of reliable and transparent secondary data about their industry. It is especially true for such specific and immature market as Chinese Children Oral care.

In this perspective, Daxue Consulting has conducted primary research methodologies including interactions with Chinese young parents and kid-caregivers in various sectors (early learning, baby food, baby & mother care, childrenswear, toys). Focus groups, consumer roundtables and workshops are in particular ones of the most executed methodologies by Daxue Consulting to collect these first-hand consumer insights. To arrange a focus group in China and find answers to all questions do not hesitate to contact our project managers at dx@daxueconsulting.com.

![[Podcast] China Paradigm 38: How to start a dream driven elderly care business in China](../wp-content/uploads/2019/05/China-podcast-Elderly-care-business-China-150x150.jpg)