How to choose the right distribution channel in China: Chinese online marketplaces vs. Your own E-Commerce Website | Daxue Consulting

With more than 610 million digital consumers, China is currently the world’s leading e-commerce market. With such potential, it is not surprising that China has become the new goldmine for all online retailers, local or international.

However, selling its products to Chinese consumers requires some adjustments and a specific marketing strategy for cross-border e-commerce in China. The first choice that every retailer must make is, therefore: selling via my own e-commerce website in China or via Chinese online marketplaces?

Retail e-commerce in China: the Eldorado for international retailers

The incredible phenomenon of e-commerce and mobile commerce in China

China is by far the largest e-retail market in the world and surpassed the biggest players like the United States in 2013. Thus, in 2018, online retail sales in China totaled over 9.00 trillion yuan (around 1.33 trillion USD). This is an increase of 23,90% from 2017.

Such a performance makes China a must-go market since it accounts for 55.8% of global online retail sales.

A common misconception is that Chinese online marketplaces are full of poor quality and counterfeit goods. The reality is quite different: all types of consumers buy products every day on these platforms, from food, care, and cosmetic products, clothing, to cars, household appliances, and high-tech equipment. Any international retailer has to be aware of that. According to a recent study by Nielsen in 2018, 39% of Chinese consumers are willing to “buy products of better quality with relatively higher prices.”

You should also take into account the hegemony of Mobile Commerce in China (m-commerce). The omnipresence of mobile phones in China is a reoccuring concept in our research. Indeed, in February 2019, about 1.58 billion phone subscriptions were registered in China. As for online shopping, 592 million of the 610 million online shoppers in China make online purchases via their phones.

200 million consumers willing to buy foreign products on online marketplaces in China

In recent years, cross border e-commerce in China has grown faster than overall e-commerce, creating big opportunities for international retailers. The platform Tmall Global introduced 122% more overseas brands last year, over 80% of which entered the Chinese market for the first time.

China cross-border e-commerce grew to a 16.86 billion USD market at the end of 2018. The number of Chinese consumers who buy foreign products online is estimated to exceed 200 million by 2020.

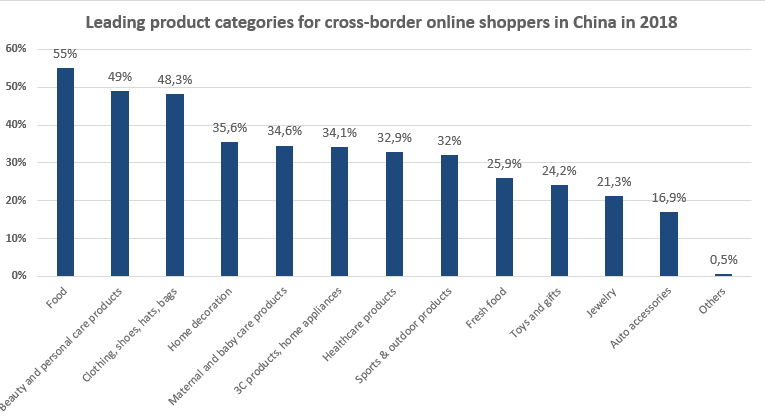

In 2018, 55% of online shoppers in China reported buying foreign food in the year, 49% are personal care or beauty products and 48% are fashion accessories or clothing.

Because this phenomenon is already happening, the country is now working towards lowering barriers to facilitate Cross Border e-commerce in China.

Choosing the right Chinese online marketplace for your brand

A marketplace is an online platform whose objective is to connect sellers and buyers to offer consumers a wide choice of products and services. In the West, a majority of brands sell their products on their brand.com website but in China, it is less popular. The majority of brands sell their products via a shop on these Chinese online marketplaces.

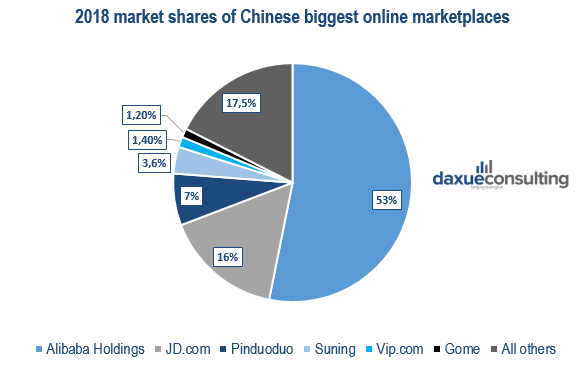

China has dozens and dozens of marketplaces but 6 of them dominate the market:

But since the Chinese ecosystem is complicated, how do you choose among all the existing platforms? Which platforms are best for which targets? What is the trendy platform in 2019?

How to distribute your products online among Chinese consumers: The battle of the giants

In China, Alibaba, which owns Taobao and Tmall, is constantly at war with JD.com, partly owned by the giant Tencent. Together, they account for more than 70% of the retail e-commerce market in China.

Taobao & Tmall: what are the differences?

Taobao is probably one of the best known Chinese online marketplaces abroad, especially because it sells just about anything and everything.

It partly owes its success to the fact that it offers free registration for its users. Indeed, small businesses and entrepreneurs particularly like this platform for its ease of use. Sellers can sell their products at auction or through the fixed price. The platform is also in partnership with Chinese social networks such as Sohu, Sina Weibo, and many Chinese television programs, which increases its promotional power.

However, Taobao requires a presence in China; a registration of your brand in China, which is not the case for Tmall.

This is why many international brands are turning to Tmall instead.

Tmall is the favorite Chinese online marketplace among foreign brands to reach Chinese consumers in all industries. Important brands have opened shops on Tmall such as Adidas, Ray-Ban, Gucci, GAP, Calvin Klein, Samsung, Burberry, and many others. From a general point of view, the platform does everything to be more premium than Taobao by pushing international brands with a specific program allowing direct purchases from Europe, the United States, Hong Kong or Australia. Additionally, sellers have to put guarantee deposits to prove the authenticity of their products.

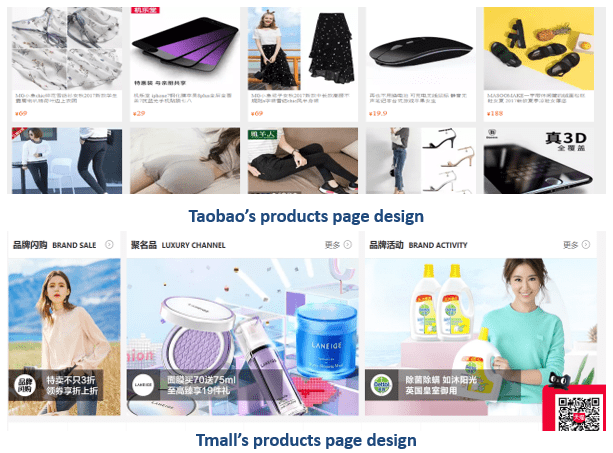

Although at first glance, the two websites seem to look alike, when starting looking for products or special offers, the interfaces differ. On the screenshots below, we can see that Tmall has a simplified interface, more neutral and more organized products to give itself a more premium side and to look less like an old market.

JD.com

JD.com is Alibaba’s main competitor. The platform sells all types of products and has an English version. JD Mall’s cross-border service, JD Worldwide, allows international merchants to sell directly to Chinese consumers without a physical presence in China.

JD.com is also the leading company in terms of high tech, AI delivery through drones, robots, and autonomous technologies worldwide.

![[Source: JD.com]](../wp-content/uploads/2019/06/Daxue-consulting-online-market-places-China-comparing.png)

Choosing to go to JD.com or Tmall will depend on many factors including your marketing strategy for the Chinese market. If you want to develop a strong social media strategy, JD.com is surely a better choice. This will optimize your Wechat performance. If you prefer to have the greatest possible visibility and work on your SEO directly on Chinese online marketplaces, then Tmall is more powerful. Its search engine and referencing system are quite simple to use.

Each Chinese online marketplace has its own specificity

Suning, known for electrical goods

Suning is one of the former market players, owning many malls across China, the brand also launched its E-Commerce platform in 2014 with a focus on electrical appliances.

It features roughly 300 foreign storefronts and offers store operator and financial support services.

Kaola.com, known for reliable and genuine products

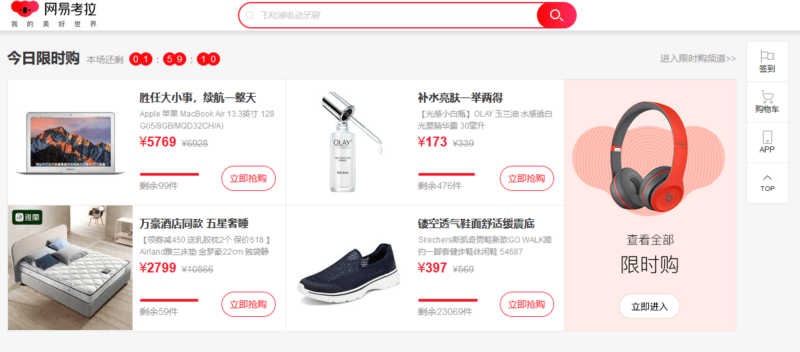

Kaola.com is a cross-border platform selling hundreds of western brands. It lets sellers showcase their products across many online forums, portals, and marketing channels. It is mainly known for offering reliable and genuine products, especially from Japan. This trust from customers on Kaola comes from the fact that it is owned by Netease, which has come up with a business reputation for 20 years.

Merchants from roughly 40 countries sell their products on the Kaola platform.

Pinduoduo, known for its offers at derisory prices

Pinduoduo is today an undisputed leader in e-commerce in China with more than 418 million buyers in 2018. This Chinese online marketplace, which offers low-cost offers, has understood the requirements of the new Chinese market, i.e., the Tier-3 and Tier-4 cities in China.

The app is specialized in bulk or grouped purchases at very low prices. It is prevalent among the players in the farming industry in China.

Vipshop.com, known for flash sales and promotions

VIPShop is the largest flash sale website in China. Founded in 2008, the company has partnered with more than 1,000 brands to bring certain amounts of items at a lower price. The site mainly covers clothing and electronics. For the first quarter of 2019, Vipshop’s number of active customers was close to 30 million.

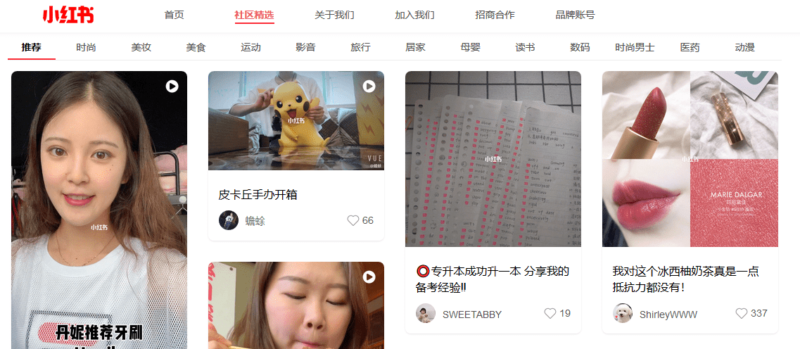

Xiao hong shu or RED, known for its social side and young users

Xiao hong shu is not a classic marketplace but a mix between a social network and an e-commerce website. It is like a forum where users post their opinions on products, trends and the best brands. It has, therefore, become the best place to learn about products or services and buy them directly online. Today the platform has a search engine to find product information, reviews, ratings, and online shops. Xiao hong shu can be considered the future of Chinese online marketplaces.

Why you should no longer hesitate: The advantages of selling on Chinese online marketplaces

Brand.com website :Save time and money

Opening a shop on a Chinese online marketplace will be much faster than creating your own e-commerce website or brand.com website in China. Especially since you have to take into account that it has to be optimized for smartphones, that you will need to get an ICP license, to buy a ‘‘.cn’’ domain name, etc.

Indeed, online marketplaces in China have dedicated teams that are able to build seamless and user-friendly mobile apps. They often provide technical support and marketing guidance to merchants. Solutions like Tmall Global allow foreign businesses to set up an online shop without the need to establish anything in China (not even an inventory!)

On your own e-commerce website, you will also need to develop a local SEO strategy by adapting to Chinese market codes. You will need to leverage Chinese platforms like Baidu or Weibo to drive Chinese traffic to your new website.

And finally, Chinese online marketplaces have another advantage for brands’ distribution strategy, which is logistics. In terms of import fees, warehouse renting, delivery team, it is much easier to sell via local marketplaces that can set up everything for you.

Chinese consumers daily habits: That’s where the traffic is

This is the first reason why it is highly interesting to sell on these platforms: this is where the Chinese spend the most time. Unlike in Europe or the United States, where consumers tend to value the brand’s website more, in China it is the opposite.

Indeed, stand-alone websites in China are generating only 10% of the total e-commerce sales. It means that if your brand awareness in China is low, it will unfortunately drown in the Internet Ocean!

Moreover, even to search for information, Chinese Internet users do not use traditional search engines like Baidu but go directly to these Chinese online marketplaces.

The Leading Chinese online marketplaces that have won the hearts of Chinese consumers

Chinese consumers crave assurance when shopping on Chinese online marketplaces. Leaders have developed product authentication systems and communication campaigns based on trust, to position themselves as the safest and most legitimate sources of products.

For example, two years ago, Tmall launched a campaign for 11.11 to show the authenticity of international brands on its platform. Each iconic brand used its own visual identity and Tmall’s visual identity logo to show their authenticity.

Customers also have high confidence in customer service where, for example, their payments are held in escrow until they have received and are satisfied with the goods.

These efforts to ensure quality and authenticity are particularly visible in the strategies put in place to attract luxury brands to these platforms. Chinese online marketplaces are today fighting the market of counterfeit goods and trying to attract international luxury brands. For instance, Alibaba has recently launched its Luxury Pavilion, a by-invitation-only platform dedicated to premium brands and JD.com has created its white-glove delivery service with delivery staff dressed in black suits.

However, there is still a long way to go. According to the global consultancy KPMG, only 24% of luxury labels are today on Tmall and 10% on JD.com.

To attract foreign brands, these cross-border e-commerce platforms make your life easier!

In March 2019, Tmall Global announced two new initiatives to boost cross-border e-commerce in China: Centralized Import Procurement (CIP) and Tmall Overseas Fulfillment (TOF). Tmall Global currently hosts more than 20,000 brands in over 4,000 categories from 77 countries and regions and wants to expand this number even further.

CIP is a program that sources products for all of Alibaba’s channels. Using Alibaba’s procurement centers around the world, it will be easier for foreign brands to export their products to be sold directly on Alibaba’s various platforms.

TOF is a low-cost and low-risk solution for smaller brands to test the market potential in China before fully entering the market. It means brands will receive marketing advice and tools to help boost awareness. For the moment, TOF is only available in the U.S., Japan, South Korea, but it will expand into Europe later this year.

Disadvantages: Why having your own e-commerce website in China may be the right solution

Legislations and fees

In China, the platform fees can be significant. With a brand.com website you may experience lower per-transaction costs as you are not required to pay commissions to the marketplace operator.

| Tmall Global | JD.com | Kaola | |

| Deposit* | Between 150,000 and 300,000 | Between 30,000 and 50,000 | between 10,000 and 100,000 |

| Technical Service Fee* | Between 30,000 and 60.000 | 12,000 | No fee |

| Real-time Technical Service Fee (comission)* | Between 2% and 5% | Between 5% to 8% | Between 5% to 7% |

*All prices are in RMB

In addition, VAT in China is not as low as people might think. The standard VAT payer status is 6-17%.

As far as regulation is concerned, some steps can become very distrupting when selling on Chinese online marketplaces. First, new product listings require approval from the operator, which can take weeks or even months. Also, in most cases, it is much easier to have a legal presence in China. The key to success in this challenge is to establish relationships with local partners you can trust for local operations like domestic warehousing, national delivery service, Chinese speaking customer service and return policy referenced to a local Chinese address.

Minimal control

In terms of collecting data on your buyers, it is much more difficult to access it through a Chinese online marketplace. The rules on personal data in China are much stricter than we think!

You will also not control returns, exchange requests, and will not have access to all feedback, which can be a significant disadvantage, especially if you are entering the Chinese market. Indeed, Chinese online marketplaces do not allow you to manage your customer service yourself.

As Mike Vinkenborg, project leader at Daxue Consulting said:

‘‘With your own e-commerce website in China, it is easier to manage your distribution network, interact with physical stores to manage stocks, references and create in-store events or promotions for your customers.’’

Towards a hybrid approach: How to leverage both a Chinese online marketplace and your brand website in China?

According to Mike Vinkenborg, the best e-commerce strategy in China is to couple your brand.com website with a presence on the Chinese online marketplaces. But what are the benefits of this hybrid approach?

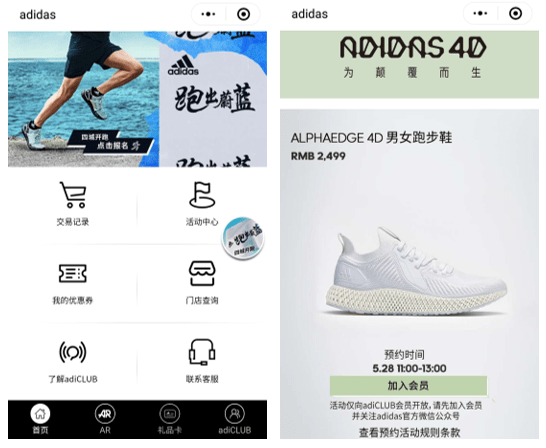

Having a store on Chinese online marketplaces is the best option to get in front of as many consumers as possible and get sales, and a stand-alone website is excellent for brand awareness. Setting up a store on a well-established platform will allow your brand to be part of the Chinese shopper’s journey of discovery. Indeed, online shoppers in China like to log into their favorite shopping platform to see the latest trends and promotions. But then, if you want to build a sharp brand image, your online store on Tmall or JD.com may not be enough. Having your brand website in China will let you create the experience you want for your customers. However, to maintain logic and consistency, you must keep the same prices and promotions on all your channels.

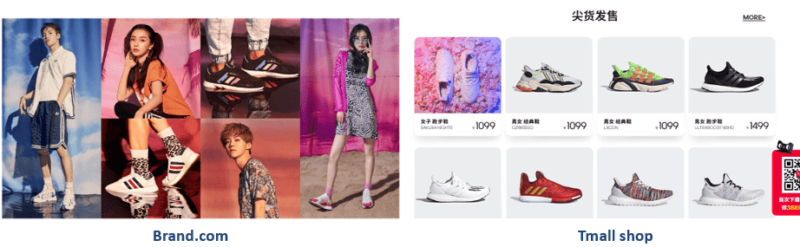

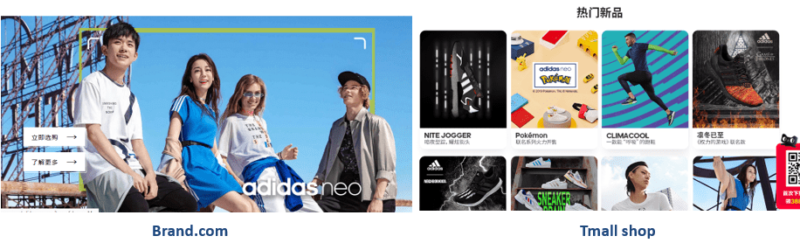

For example, Addidas uses this approach in China. As you can see below, their brand.com website is more focused on brand identity, values, and story, and their Tmall shop is more about sales and products.

Shoppers who go to a brand’s e-commerce website in China are are already not only like the products but also the values the brand conveys. On the contrary, consumers who only go to their Tmall store are more likely to be simple buyers of the products they like for their quality or because they are trendy. That is why it is a relevant e-commerce strategy in China to multiply your channels to reach different audiences.

Finally, to further optimize your customer journey in China, use social messaging commerce. It is easy to link your website to your Wechat account to offer a Wechat store to your customers. It gives your brand the opportunity to push content through articles, HTML 5 pages and provide added value services. You can also create a WeChat Shop which is perfectly embedded into the platform thanks to the one-click-payment.

Thus, having both your brand website in China, linked to a Wechat store, and a customized store on one or several Chinese online marketplaces will allow you to maintain control over your brand’s identity, customer service, and customer data while remaining in the middle of the Chinese ecosystem. You can then allocate your products and services over different platforms, owned and paid. The perfect strategy will, of course, depend on your objectives, resources, and size.

Mike Vinkenborg concludes that e-commerce in China has evolved very quickly in recent years, faster than anywhere else in the world:

‘‘Xiao hong shu and Wechat mini-programs were nothing two years ago. This shows how fast online e-commerce is developing in China.’’

If you have any questions or would like to discuss your e-commerce strategy in China, feel free to contact our project managers at dx@daxueconsulting.com

Author: Steffi Noël

Make the new economic China Paradigm positive leverage for your business

![[Podcast] China Paradigm 44: How to leverage offline to online communication in China](../wp-content/uploads/2019/06/online-communication-China-podcast-150x150.jpg)