Top 6 China e-commerce trends to watch out for in 2019 | Daxue Consulting

China e-commerce Trends

It is no surprise that China is the most dynamic e-commerce market in the world today. The growth in the number of online shoppers—and the sums of money consumers are spending via digital channels—is astounding. Organizations from diverse areas are racing to shift their business online or improve their existing online platforms to keep pace with this changing e-commerce landscape in China.

According to business.com data, in 2016, the annual online sales of China were valued at USD 672 billion. To put this in perspective, it is double the value of online sales in the United States, the second largest e-commerce market in the world. In this article, we will consider six top China e-commerce trends to look-out for.

Overview of the e-commerce landscape in China

The Chinese marketplace is competitive, with international and local brands fighting for the attention of consumers and their share of the market. Brands and retailers need to continuously innovate to keep pace with the growing list of customer demands.

The e-commerce landscape in China can be characterized by fads, such as mobile-first consumer behavior, social commerce uptake, and digital payments. These trends can be broken down into four main themes:

- The adoption of omnichannel technology and consumer movement between the online and offline worlds.

- The growth of mobile payments and the use of mobile phones for making online shopping purchases.

- The evolution and growth of the digital ecosystem and the addition of services by China’s top e-commerce brands to improve the existing network.

- Partnerships between Chinese social media platforms, search engines, and international players.

6 China e-commerce trends to look out for

The rise of online shopping in China

In recent years, China’s internet population passed a significant milestone. According to the Chinese government, 802 million people are now using the internet, a whopping 57.7 percent of the entire population. This was announced by the China Internet Network Information Center (CNNIC). The United States, on the other hand, has an estimated 300 million internet users.

While Chinese consumers continue to window shop, they are less inclined to spend their money in stores, compared with consumers in the West, and prefer online shopping in China. A survey of over 15000 global online shoppers published by PwC discovered that 75% of Chinese shop online weekly, while the global average is a mere 21%.

Mobile shopping

Chinese consumers have not only bypassed the physical shopping experience, but the population is also moving on from online shopping in China and opting for mobile shopping experiences. Data for 2015 reveals that mCommerce accounts for around 51% of total eCommerce expenditure in China. Comparatively, the figure is 33% in the US.

The survey results also revealed that one in four Chinese consumers answered that they shop with a mobile phone once a week or more. This number was notably higher than the global average of just 9 percent. In addition, 77 percent of all people surveyed revealed that they shop on mobile phones, where the global average is estimated to be 43 percent.

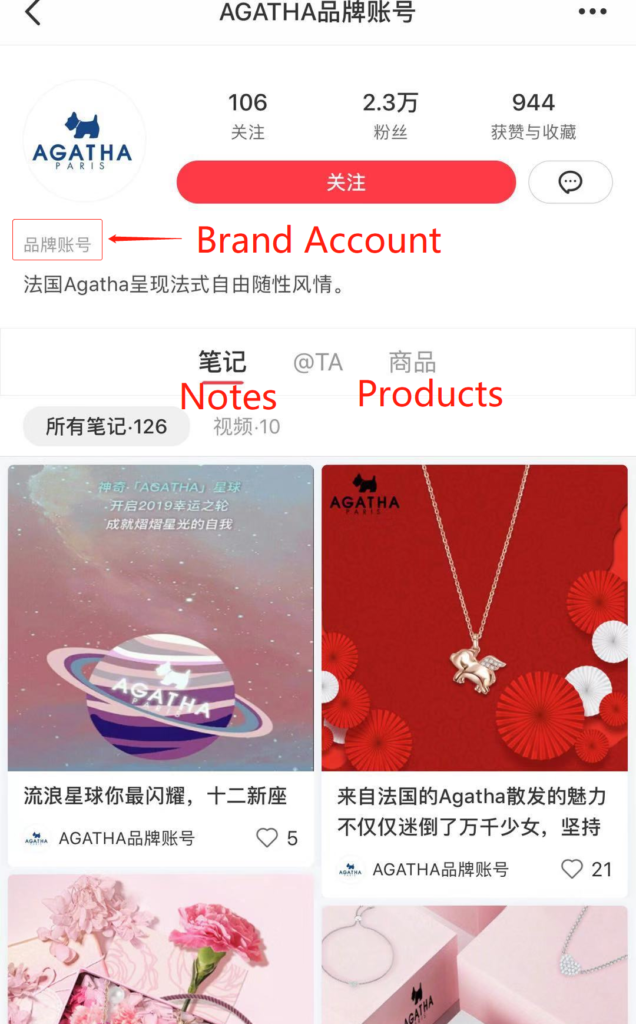

The rise of Influencer and Chinese social media

Social commerce is the integration of eCommerce and social media or vice versa. Social commerce is an influential China eCommerce trend. Nearly all major Chinese social media have fully-integrated native eCommerce and digital payment options, and this has been the case for years now.

The success of marketing strategies that take advantage of social media is down to the accessible nature of these platforms that leverage the social capital of trusted acquaintances or known opinion experts. This is further reinforced with the use of engaging advertising campaigns, which attract the attention of customers through dynamic media.

You can see examples of this sort of integration in the West on platforms such as Snapchat and Instagram.

Omnichannel marketing

Recent research on the consumer experience in China by McKinsey indicates that there is no other market in the world, where the line between online and in-store shopping is so fluid. According to the McKinsey study, over 95% of Chinese shoppers may be labeled as omnichannel-only. They either research products online and go to a physical store to make their purchase or visit a store to see a product before they order it online.

The use of robotics in logistics

Chinese organizations are increasingly adopting AI technology, including, computer vision systems, machine learning-based predictive analysis, and bots. China’s second-largest eCommerce company JD.com, which owns logistics and distributions operations, is aiming to reach a tenfold increase in sales by the year 2030, with the assistance of robotics and AI.

JD.com has indicated one likely direction for its supply chain operation. The company has developed robots capable of delivering products over the last-mile, thus helping with delivery route optimization.

B2B Marketing and Alibaba.com

Business-to-Business (B2B) Chinese marketplaces are developing quickly. Sellers can use these marketplaces to create their own websites to display services or products online, make connections with global buyers, and respond to offers to sell or buy.

In 1999, Jack Ma launched Alibaba.com, a top Chinese marketplace for global wholesale trade. Alibaba.com is based in China and is the largest B2B marketplace in the world. It began with the goal to provide an efficient B2B trading platform for the international trading world. The enterprise is a leading eCommerce stage for medium and small companies from around the globe.

Wrap up: what can we learn from these China eCommerce trends?

Many businesses in the West, look to Asia and China as both a potential threat and a new exciting market. North America and Europe’s status as market leaders have already been lost. Thus, neither of these views is entirely true. Rather the demographics, data, and movement of the e-commerce landscape in China should be approached as a model of how the world will soon shop.

Implementing these China e-commerce trends is not only about entering Asia’s growing markets; rather it’s about using the e-commerce landscape in China as a blueprint or guide. Asia can teach us how our markets will sell and deliver products, now and in the distant future.

Make the new economic China Paradigm positive leverage for your business

Listen to China Paradigm in Itunes

![[Podcast] China paradigm #25: How to connect an overseas store to 900 million Chinese consumers using mobile payment](../wp-content/uploads/2019/04/China-marketing-podcast-25-150x150.jpg)