Pet food market in China: the forecast is expecting Chinese pet food expenditure to get heavier

Raining cats and dogs in China

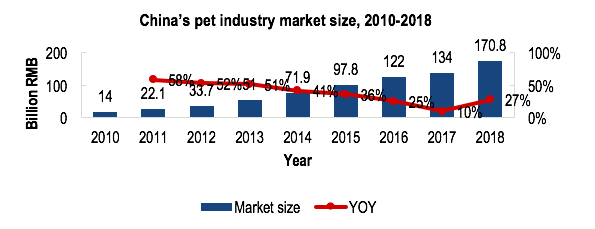

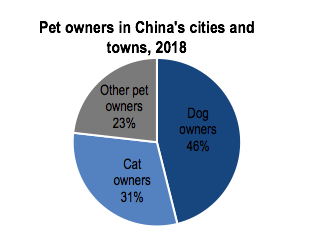

China is ranked among the top three countries with the most cats and dogs with the total number of pet owners equalling 73.55 million in 2016. Among this number, 33.9 million were dog owners and 22.58 million owned cats. This clearly shows a preference for dogs among the Chinese population with 46% of pet owners owning dogs in comparison to 31% owning cats and only 23% owning other animals as pets. China’s pet industry alone has gone through significant but stable growth as it rose from 14 billion RMB in 2010 to 134 billion RMB in 2017. Of this, online pet sales themselves account for more than half of China’s pet food market at 51.8% according to which in conjunction with Pet Fair Asia run one of the largest pet trade shows in China. This popularity shows the growing interest in pets, with the partnership running their 7th annual Pet Food Forum in China this year attracting petfood professionals from China, Southeast Asia and other countries, who were seeking insights and information about the Chinese market. As the popularity of owning pets increases, the pet food market in China is further expected to rise by 27% from 2017 to totaling 170.8 billion RMB by the end of 2018 which is a 17% increase from the growth rate of the previous year.

|

|

Areas with the most downpour

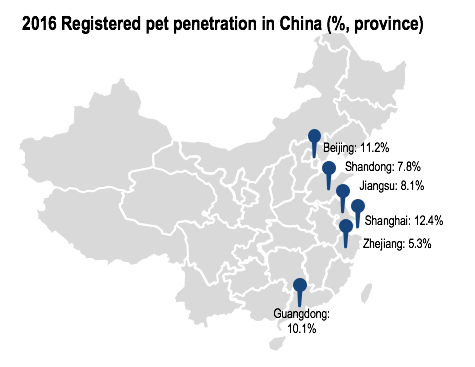

There has been an increase of income which is continually rising with the fast urbanization of China and the rising middle class. Shanghai has the most registered pets in China at 12.4% with Beijing following at 11.2% and Guangdong also at 10.1%. Further, the cities of Shanghai, Beijing, Guangzhou, Tianjin and Chengdu are all where pet raising is the most popular. This due to the higher disposable incomes of these cities playing a critical role in making pet raising more popular. The rising standard of living has made consumer spending steadily increase. This is specifically seen in relation to pets, with each dog or cat being estimated to cost their owner 5,016 RMB on average in 2018, a 15% increase from 2017. Further, the coastal border of China occupies the majority of pets in China, accounting for 54% of the registered pets throughout China.

Among these, however, are two larger groupings of owners. Firstly, those who are in the older demographic. This is with 61% of people 65 years old and above owning a pet. This age group takes good care of their pet and it typically keeps them company in their older age. Comparatively, those who are younger, around the age of 20 to 30 years, in the emerging urban middle class, own a pet partly due to recent social trends. This younger group pampers and takes good care of their pet due to their affection towards it. However, a well looked after pet also conveys social status and affluence. This is as it illustrates the owners’ disposable income, in that they can not only own and look after a pet but that they can spend money beyond the pet’s basic needs.

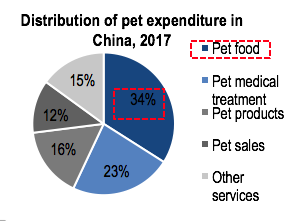

Weather leading to an increase in demand for trustworthy and premium products inside the Chinese pet industry

Issues with food safety have encouraged Chinese people to have a deeper look at their food consumption and buy more imported products. This greater concentration on health has applied to both themselves as consumers and their pets as pet wellbeing has become increasingly more important. This is apparent as pets are treated more like family members as they fulfill the emotional needs of their owners. Additionally, pets have become part of a more stylish lifestyle in more urban areas. The increased interest in the wellbeing of pets has to lead to larger expenditure as an industry, as owners try and improve the living standard of their pets. This is evident as, in 2017, pet food was found to be the highest cost at 34%, with pet medical treatment following at 23% and pet products at 16%. This importantly shows the care with which food is chosen, especially as owners go out of their way to buy specialized pet food to ensure the welfare of their pets.

This caution is especially important as unregulated packaging practices have caused pet deaths as a result of illegal food products. Chinese authorities have been struggling to stop the distribution of tainted products in recent years, therefore making quality, safety and reputation top considerations when making purchasing decisions. Previously, open bags were used to package pet food, but as safety concerns increase this has given way to more premium packaging. As a result, today more premium pouches and cans have been produced in order to package and identify safer food. There is also a tendency to utilize plastic packaging as it is viewed as more trustworthy and convenient.

The pet food on offer and who is selling it on the Chinese market

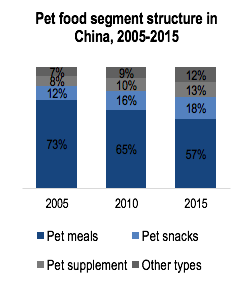

As stated, due to the increasing interest in the well-being of pets and their contribution to social status, Chinese people are now willing to spend more on their pets. This was illustrated in 2015 where 43% of the pet food market was made up of pet supplements, snacks and other types of foods as opposed to just pet meals themselves. Comparatively, in 2005 this figure was 27%. This shows significant growth within a 10-year period, with snacks and supplements for pets increasing from just over a quarter to almost half of the pet food market in China.

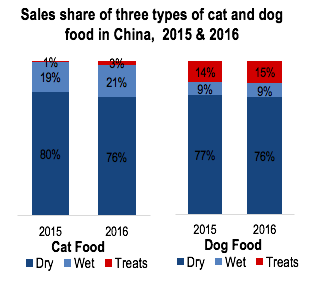

In terms of the food itself, that is the categories of dry, wet and treats, this varies between both cats and dogs. Whilst dry food is significantly higher as a whole, wet food is the second most popular for cats whereas treats are the second most popular for dogs. Moreover, between 2015 and 2016 there was a slight decrease for both animals in regards to dry food. There was, however, for cats a very slight increase in the sales share of both wet food and treats by 2% whilst treats for dogs only increased by 1%. Whilst there is little growth between the two years, both wet food and treats almost take up a quarter of sales share amongst both cats and dogs which accounts for a significant amount of sales within the pet food market in China as a whole. This, further, illustrates the increasing importance of these categories year by year especially as owners spend more on their pets and look for newer and more specialized products.

Additionally, there is growth in the sales share of grain-free pet food. This kind of pet food occupied a considerable market share in 2015 within the United States, however as a market, grain-free pet food is only just starting to burgeon in many other countries. In China particularly, grain-free pet food currently is a niche market with a very limited number of rivals. As a result, this market is currently thought of as a ‘blue ocean market’ where pet food providers can explore. Despite the lack of competitors, however, grain-free pet food has seen an increase in sale share by 158% year on year in China.

The trade war’s affect on the Chinese market

Temporary difficulties and a pause in trade relations between the United States and China is freeing up space in the pet food market in China and opening up opportunities for other countries. This is evident as last year China was reported to have exported $148 million worth of pet food to the United States but to only have imported $6.5 million worth in return. Further, this trade war has made importing pet food from the United States tougher after May this year with tighter customs inspections between the two countries. Things have heated up with it being reported that Washington tariffs have been placed on more than $250 billion Chinese goods and Beijing blocking a huge corporate takeover and making things difficult for imported cars from the United States. This stands off between countries is unlikely to last forever, however, with the pet food industry potentially being an area for compromise between the two as said by Robert B. Zoellick, a former United States trade representative in an interview in Beijing. For the moment though, this current standstill provides a fantastic opportunity for those wanting to enter the Chinese market as pet owners search for alternative quality food sources for their pets.

Dog market in China: the top dogs

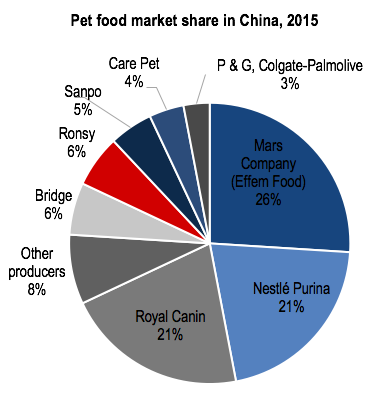

Within the pet food market in China, there are three foreign companies that possess 70% of the market share. These are Effem Food which is part of Mars Company which holds 26% of the market, Nestlé Purina PetCare holding 21% and Royal Canin which also holds 21%.

The Mars Company is the largest pet food manufacturer in the world and currently dominates this market space with the two major brands Pedigree and Whiskas. As a brand, it has wide distribution connections throughout China. It also maintains a broad product portfolio with which it sells pet food at a variety of package sizes and prices.

Comparatively, Nestlé Purina PetCare also holds considerable market share. The brand is growing rapidly across China but it is not currently as mature within the market as Effem Food is. The company itself is particularly good at communicating with consumers professionally, however, and also locating new market opportunities through research and development.

In comparison, Royal Canin, whilst it holds the same market share as Nestle & Purina, has a different target audience. This is as the brand differentiates itself by producing high-end pet food aiming towards a more affluent demographic in China. This brand takes advantage of the premiumization trends in China currently and seeks to help pet owners find the most suitable food for their pets whatever the breed, age or size by producing a wide range of products. The company also runs a consumer loyalty program called the Royal Club which is aimed at building and maintaining consumer loyalty.

In contrast, local players including Bridge Pet Care, Ronsy Pet Food, Sanpo and Care Pet among others have a heavy presence but only make up 30% of the market. These brands only have a lower end to mid-priced focus but are trying to narrow the gap between them and the predominate international brands in the market. This imbalance is not only due to the accumulation of rich experience in manufacturing pet food that western companies possess. Nor is it just due to their widespread sales networks in China. This success can also be credited to the effort put forth by international players to keep developing new products. This development extends to focusing on widening their product portfolio and knowledge in order to cater to the ever-changing needs of consumers. Mergers and acquisitions are undertaken as these players attach great importance to improving their product offerings and production facilities, thus strengthening their competitiveness in China’s market.

Locations for pet food production in China

The main geographical areas for pet food production are on the East Coast of China. This is due to the close proximity of raw materials which allow local businesses to run a more convenient and cost-effective operation. The top ingredients for the production of dog food are beef, grains and chicken. Whereas in contrast, chicken, ocean fish and chicken fat are the top ingredients for cat food. To produce these ingredients, however, different areas are better for particular ingredients. A large supply of corn and wheat in Beijing, Tianjing and the Hebei province make the production of dry food easier. Comparatively, the Shandong province is an agricultural area which produces broilers, that is chicken that is bred and raised especially for meat production. As such, pet snack manufacturers who need these materials, typically settle around this area. Local producers of dry and wet food, however, place their smaller factories in Jiangsu, Zhejiang and Shanghai.

Recent regulation for pet food production in Mainland China

With the recent development of the pet food industry in China, the government this year has introduced stricter regulation for the production and importation of pet food. This is in order to improve food safety. These regulations now require producers to acquire a production license for those locally producing cat or dog food. These regulations particularly apply to those producing either pet compound food or pet food additive premixes. Pet compound food is categorized based on its ability to meet the nutritional needs of the pet, whereas pet food additive premixes are labeled based on their capacity to provide additional needs for pets by including benefits such as vitamins. A third category was also created, for snack pet food which does not necessarily provide any nutritional benefits but is given as a treat or reward to pets. However, a license is not needed by manufacturers to produce these.

Distribution channels for China’s cats and canines

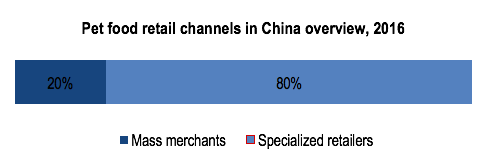

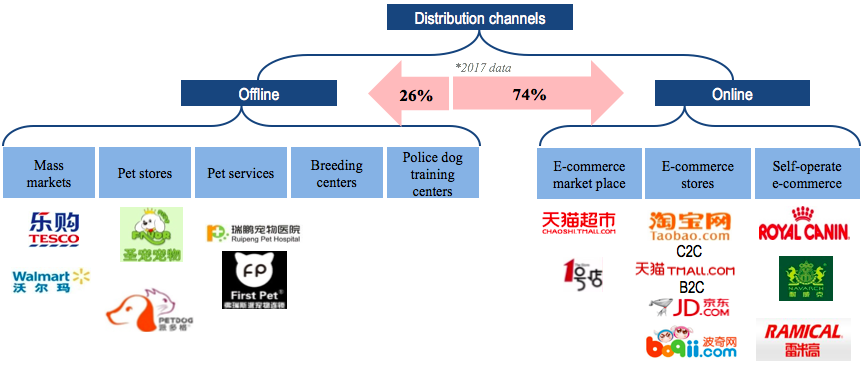

In terms of distribution, 80% of pet food retail channels in the market were made up of specialized retailers in 2015. This can be compared to West Europe where the majority of their retail channels were occupied by mass merchants. In China, however, mass merchants only make up 20% of the market and include channels such as discount stores, supermarkets, hypermarkets and grocery stores. In contrast, specialized retailers include pet shops, pet supermarkets, veterinary clinics, DIY and garden centers, online pet specialty stores, farm and feed agricultural shops and veterinary clinics.

From 2014 to 2015, supermarket sales dropped by 15% as sales in pet stores grew by 4%. This is as pet owners want professional advice when buying food for their pets. This further illustrates the care taken into consideration when looking after pets and the increased concern shown by the Chinese population in regards to the welfare of their pets. Moreover, offline pet food shopping exceeded online shopping by 6% in 2015 as consumers seek out advice in person. This is also done not just in pet stores but also veterinary clinics as consumers look for quality and more professional advice. However, offline shopping in the future is likely to decrease due to the rapid increase in the internet penetration rate. This is also evident as distribution channels are also preferring online methods with 74% of distribution being online and only 26% being offline.

The demographics of consumers are also determinative in the way they purchase pet food. A survey conducted by Flanders Investment & Trade found that the older demographic is used to buying food in supermarkets and pet stores. As a result, they prefer to purchase products in person from traditional stores. This, however, is a problem for smaller local businesses as physical stores usually require a slotting fee, which is only affordable to large Chinese or international pet food brands. Comparatively, the younger generation tends to be more computer savvy and prefer to order pet food online as it is cheaper and more convenient. Therefore, this younger demographic drives the increased demand for online resources. This is especially evident as pet apps and forums rise in popularity in China. The most popular apps and forums being Smellme, Yourpet, Liuliu, Boqii and Fdog. Further, as China’s middle-class population blooms, the average age of pet owners now squarely overlaps the country’s more tech-savvy youthful demographic. This change in consumption habits and population provides opportunities for foreign brands to capitalize on. This is especially as the internet penetration rate increases and professional advice is wanted by pet owners.

An ideal time for foreign brands to enter the Chinese pet market

There is a demand for foreign brands and their reputation and quality. These international players are dominating the market currently with their product development strategies and extensive experience in manufacturing pet food. Therefore, Chinese consumers are more willing to trust and buy products from these brands. This is especially in light of food safety concerns arising from issues in local production thereby making consumers view foreign products as safer. This is view aids foreign brands in entering the market as there is an opportunity to emphasize their experience, trustworthiness and knowledge. Further, the premium product demand, and the growing disposable income available to the rising urban consumer middle class provide opportunities for brands who wish to enter the Chinese market and sell a very wide or specific range of high-quality products.

|

|

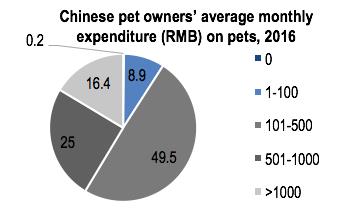

Expenditure on pets is also expected to significantly grow. Although 16.4% of Chinese pet owners spent 1000 RMB on their pets monthly in 2016, 49.5% of expenditure is only at 101 to 500 RMB with 25% of expenditure being 501 to 1000 RMB. The lower average monthly expenditure is expected to grow as disposable income does provide plenty of opportunities for brands to enter the market. This is especially evident as cats and dogs are seen as status symbols, and as pet raising remains a trend among those in the emerging middle class. Moreover, the growing care of Chinese consumers about the wellbeing of their pets and their inclusion as a family is likely to keep contributing to the increasing expenditure in the pet food industry.

|

|

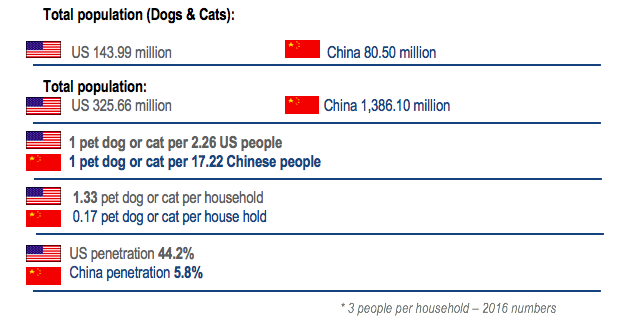

Further, it is clear that the Chinese pet market industry has a lot of growth ahead as a whole. Whilst China is among the top three countries with the most cats and dogs, it has a very small amount of animals in proportion to its population. This is evident as in 2016 it was reported that the United States had 143.99 million dogs and cats with a population of 325.66 million ending up with 1 pet dog or cat per 2.26 people. In comparison, China had 80.50 million dogs and cats and a population of 1,386.10 million resulting in 1 pet dog or cat per 17.22 people. Further, the United States has 1.33 pet dogs or cats per household in comparison to China only having 0.17 per household. The significant difference between the two countries is also exemplified in the substantial difference of the penetration rate. In the United States, dog and cat-owning families account for 44.2% of the population surpassing China by almost 40%. This considerable gap indicates that China’s pet market is far from saturated providing lots of opportunity, for not just those specializing in the pet food, but also for the pet industry as a whole to brands wanting to enter the market.

Author: Jessica Farrell

Focus groups, consumer roundtables, and workshops are ones of the most executed methodologies by Daxue Consulting to collect these first-hand consumer insights.

Daxue Consulting leverages focus groups in Mainland China and Hong Kong to gain information about Chinese consumers’ feelings, opinions, and perceptions. The following analysis aims at mapping attitudes, motivations and decision criteria of Chinese consumers.