Market of chocolate in China

For more information and insights on China’s market, follow us on LinkedIn and on Wechat by scanning the QR code below

Market of chocolate in China

Chocolate has been considered as an exotic product to Chinese consumers until 1970’s. Segregated for decades from the global market and brands, China shaped up to be the pivotal market for the global chocolate companies with its limitless market potential. Mars Foods was the first major confectionary to make its entry into the open Chinese market in the early 1980’s. At the present day, all 20 global chocolate giants have made their presence in the world’s largest consumer group.

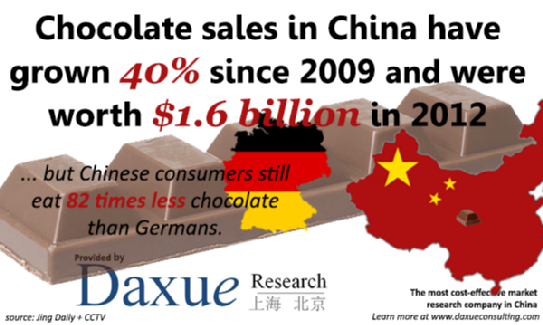

With all the chocolate giants making an entry into China’s vast and complex market, the expected growth of the market of chocolate in China is set to increase by 46% by 2015.

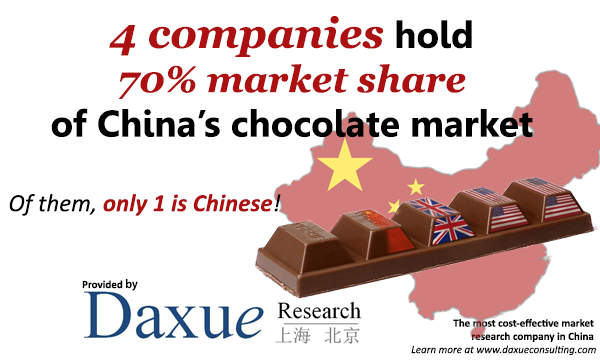

Market Scenario: The Big Four

The big four dominate the market of chocolate in China. Multinational heavyweights Mars Foods, Ferrero Rocher, Nestle control 64 % of the chocolate confectionary market. According to Euro monitor International, Ferrero Rocher has the strongest increase in 2013 with 31% market share. Ferrero Rocher’s dominance is attributed to their premium image and strong marketing campaigns using gold color packaging to portray high-end lifestyles to consumers. Mars Foods holds the second biggest share in the market with 23.3%. An important factor leading to Mars Foods dominance in the market is to their distribution chain, which is the best among the big players.

Leading domestic brands LeConte, owned by COFCO, a massive Chinese food conglomerate holds 6.7% market share and Golden Monkey with 1.5% market. In spite of their aggressive effort to compete with their international competitors, they have been out- spent and out-marketed. Hershey’s, an American major made its entry into the Chinese market with an acquisition of 80% stake in Golden Monkey. The acquisition of the local Chinese firm will provide the necessary expertise on flavors that appeal to the local market for the American chocolate giant on Chocolate market in China.

What Chinese Consumers Want?

At present China has leapfrogged to become the second largest economy in the world with annual GDP growth rates of 9-10% for 30 years. Over 40 years, with impact of internet and overseas travel, the Chinese consumers have unlimited exposure to high-end trends in the global market and demand a better lifestyle quality.

Today, China’s chocolate market demands variety of product portfolio at different ranges and complex distribution strategies in the multitier retail market to cater the needs of different income groups tastes and expectations across hundreds of millions of consumers. Global companies like Mars Foods and Ferrero Rocher are best positioned to strive across the Chinese multitier market as they offer wide range of products, across different price ranges. For instance, Mars Foods can sell their leading brand of Dove chocolate bars, smaller in size at an introductory price for emerging consumers in second tier cities and higher priced Dove chocolate boxes in major cities, with more high-end consumers. These sort of competitive advantage as resulted in about 90% of the market share to the global chocolate firms.

LeConte and Golden Monkey are the only local brands with noticeable market share in a market dominated by foreign brands. The reason for poor performance in the market for several other domestic companies are attributed to no difference in taste, few varieties of brands, improper selection of raw materials and processing equipment, no adequate infrastructure, poor marketing activities and thus, no or limited brand value among Chinese buyers.

Targeting multi-tier market to gain market opportunities

Apparently, major global brands have been dominating the market by a long margin compared to domestic brands due to their brand awareness, taste and premium offering. However, compared to the global consumption, China accounts for less than 2% of chocolates consumed. Most global chocolate companies have concentrated their marketing in relatively small parts of the country, targeting only a fraction of the potential consumer population. The big chocolate companies must therefore push their products into China’s emerging tier-2 and tier-3 cities but the challenge will be significantly more complex.

Domestic companies should focus more on brand awareness and product innovation to improve their market share. In the future, with millions of new consumers emerging from multi-tier markets, chocolate companies will have more opportunity to build long-term sustainable and successful business in China.

Nestle, was a dominant force until 2005 in the market, but lost its popularity among China’s brand centric consumers. They made the mistake of lowering the prices of Kit Kat bars and other version of their confectionaries. The Chinese consumers had the image of chocolate as an exotic, luxury foreign product, and made their purchasing decisions largely on the basis of brand and luxury packaging.

References

Baker & Michael, 2008, the strategic marketing plan, first edition, China, Youth Liberators. 40-66, 107-123

Lawrence L. Allen, 2010, Chocolate Fortunes: The battle for the hearts, minds and wallets of China’s consumers,

www.marketingtochina.com/imported-chocolate-market-in-china

www.qz.com/159923/hershey-just-made-a-500-million-bet-on-chinas-chocolate-craving