Louis Vuitton in China: The king of luxury brands in China

Louis Vuitton Malletier, commonly known as Louis Vuitton or LV, is a French fashion house founded in 1854 by Louis Vuitton. The brand’s products range from luxury suitcases and leather goods shoes, watches, jewelry, accessories, sunglasses and even books. Since first entering the market in 1992, Louis Vuitton has been in China for 28 years. The demand for Louis Vuitton in China is strong,.

The King of Luxury Brands

On June 12th 2019, reports published by Millard Brown revealed the top brands worldwide. In one report, it said the value of as a whole increased by 29 percent last year. Louis Vuitton tops the global luxury brands list for with a brand value of 47.214 billion USD. Chanel and Hermes ranked second and third respectfully. In recent years, China has become the biggest market for Louis Vuitton. The brand first set its image in Chinese people’s heart by promoting its travel culture. Between 1997 and 1998, LV carefully selected pieces from its museum and hosted its historical design exhibitions in Beijing, Dalian, Chengdu, Shanghai and Guangzhou. The shows attracted much attention and now most people in China become familiar with the brand name.

Louis Vuitton China strategy

On July 24th 2012, LV opened up its biggest exclusive store in mainland China—Louis Vuitton House Shanghai which is considered as an important step to LV’s China strategy. LV’s sales channels include 40 offline stores and three self-operated online stores. These channels contribute about 8 percent of sales during nine months between October 2018 and May 2019. With little presence on B2C E-commerce platforms, LV’s website and app are in the central position of Louis Vuitton China strategy. Three self-owned sales channels are below:

Brand official website in China: louisvuitton.cn

Sells to Chinese consumers directly

Louis Vuitton China established its official website in 2004, with the main functions of selling directly to Chinese consumers. In the 9 months between October 2018 and May 2019, about 8% sales came from LV’s online store.

Delivery

Louis Vuitton China provides free delivery, which is carried by SF Express. Products are normally delivered 1-2 days after payment while Pre-order products are delivered within 1-8 weeks.

Pick-up

LV’s official website provides click & collect service. Click and collect allows Chinese consumers to collect products ordered online in offline stores.

Returns

Additionally, after-sales service can be applicated through official website. Returns are available within 7 days by receiving and then consumers can get free door-to-door collection and delivery service.

Louis Vuitton’s China website has high performance

By allowing online purchases on LV’s brand website, the click-through rate of the site increased by 14% and had become LV’s highest performing retail channel. From 24th November to 1st December in 2019, LV’s official website ranked in the top 3 percent in the entertainment and fashion category.

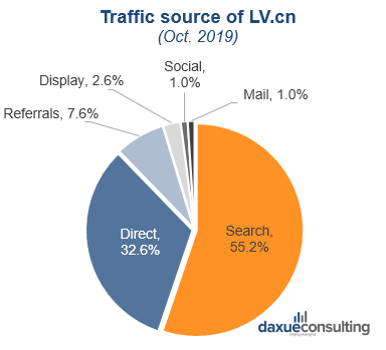

[Data source: similarweb, “Traffic source of Louis Vuitton China website”]

More than half of traffic comes from direct search. Louis Vuitton China market strategy has successfully improved its brand awareness and more Chinese consumers search LV because of the brand itself but not for specific products.

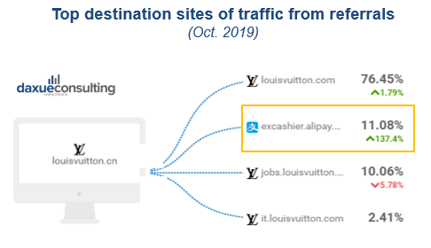

[Data source: Similarweb, “Top destination sites of traffic of LV.cn from referrals”)

With significant traffic growth on excashier.com in October 2019, it seems that Louis Vuitton China market strategy works well and Louis Vuitton in China has successfully built its independent brand image. About of website visitors from referring site complete a transaction.

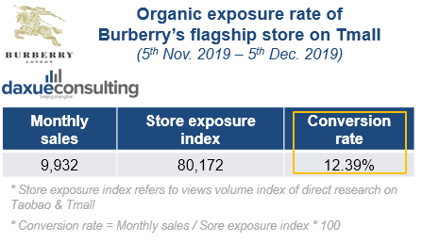

[Data source: Taosj “Organic exposure rate of Burberry’s flagship store on Tmall”]

By comparing conversion rate at 12.39% with Burberry’s Flag shop on Tmall, traffic monetization capability of LV’s official website is no worse than competitors on the Chinese biggest E-commerce platform.

Louis Vuitton’s APP

Maximizing APP convenience

LV’s brand APP has roughly the same product category, delivery and other services available on official website. Louis Vuitton China is trying to capitalize on digital opportunities by leveraging its APP channel, which cannot be realized by having store on Chinese E-commerce platforms.

For example, Louis Vuitton in China applies artificial intelligence technology on its APP, users can find products by scanning a QR code, which connects to LV’s intelligent products. It provides more convenient shopping process for Chinese consumers.

Continuously updating app to improve user experience

Louis Vuitton China continuously updates its brand App according to feedbacks from users in order to improve their experience. Only in 2019, LV has critical updates of LV app in APP Store.

WeChat brand store

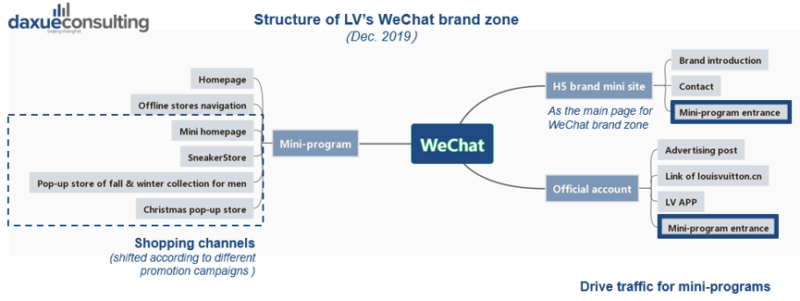

[Source: daxue consulting, “Structure of LV’s WeChat brand zone”]

Louis Vuitton China opened its WeChat Store in 2019, and its magnificent WeChat brand Zone can roughly divided into two functions for sales and for promotion.

“Homepage” works as the main page of mini-program ecosystem, and provide entrance to other mini-programs. Louis Vuitton totally attaches 4 entry points including WeChat posts, navigation bar in chat-box, brand mini site and WeChat search engine to mini-program, which only has the function of selling products to consumers and conducts flexible traffic control within the mini-program ecosystem as it could be redirected from one to another.

Promotion Strategy of Louis Vuitton China

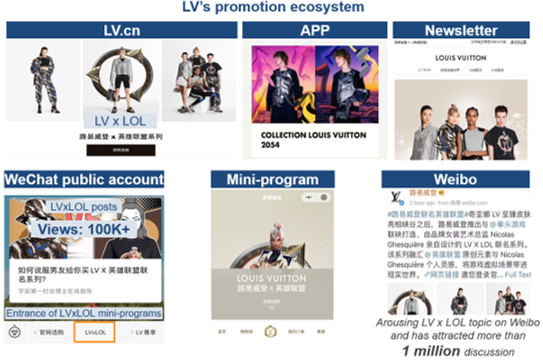

Louis Vuitton dedicates to establish a noble brand image in the Chinese market. It makes a series of publicity and promotions to let Chinese consumers get better understanding of its brand history. LV sets a complete promotion ecosystem, which includes Chinese social media platforms, searching engines, a WeChat public account, a Weibo account and Newsletter to meet different market demands. In June 2019, Louis Vuitton’s digital marketing innovation in China took another exploratory step, becoming the first luxury brand in mainland China to invite fashion bloggers to take over the official WeChat public account and the first luxury brand to open a Xiaohongshu account. All of LV’s promotion channels are demonstrated as below:

Concentrating on Chinese social media platforms

[Source: daxue consulting, “LV’s promotion channels”]

LV’s XHS account aimed at improving visibility by raising topics and discussion on hot products,and the promotion on XHS are mainly targeting on young netizens in China.

Also, Weibo could be an ideal channel to catch potential consumers by reaching more than 4 million followers.

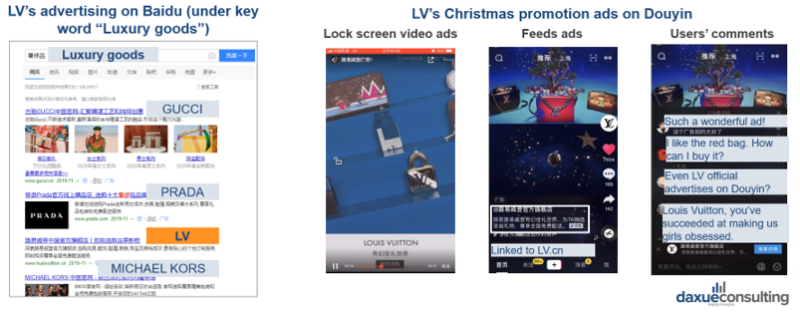

[Source: daxue consulting, “LV’s advertising on Baidu and Douyin”]

Apart from advertising on the Chinese largest search engine Baidu, Louis Vuitton China also started to do advertisement on Douyin, which owns large volume of traffic and ideal promotion channel for brands.

Although Louis Vuitton China has no presence on Chinese E-commerce market, these advertisements can drive all traffic to its own sales channels.

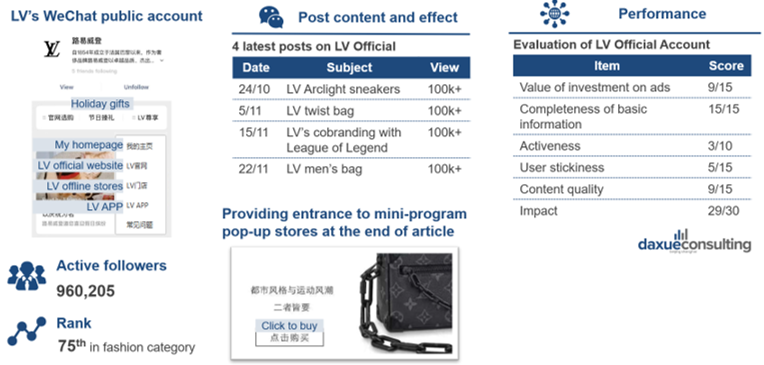

WeChat gives LV more opportunity to increase sales

[Source: daxue consulting, “Homepage, post content, performance of Louis Vuitton China”]

LV’s WeChat public account is well-connected with other channels. Most article posts are correlated with different marketing campaigns. Since all articles are quite successful, we can know that these posts do drive large volume of traffic to its WeChat stores. In a nutshell, Louis Vuitton in China improves by establishing and operating its self-owned sales channels.

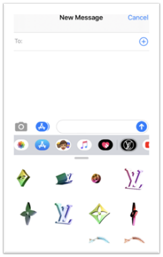

Creating branded stickers to get closer to consumers

[Source: daxue consulting , “LV iMessage stickers”]

In January 2018, LV embedded LV touch into iMessage and provided branded stickers based on its brand visuals. After downloading LV app, every iPhone user can send the sticker through iMessage. LV leverages iPhone users’ social connection to expand influence and improve brand awareness. Also, it is a good trigger to attract people download LV app.

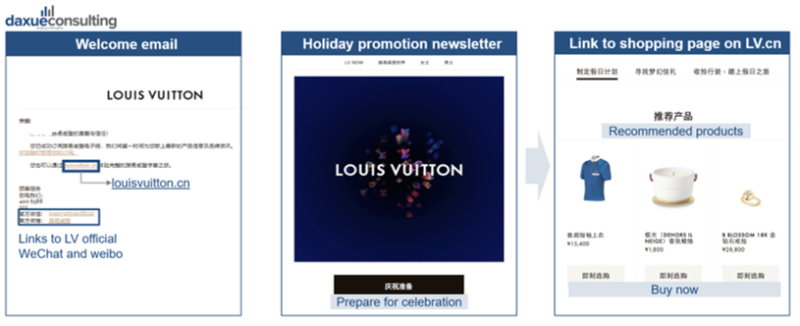

Utilizing newsletter to realize customer retention

[Source: daxue consulting, “LV utilizes newsletter to realize customer retention”]

LV’s newsletter is designed to drive traffic to brand own website and its major social media accounts. Ensuring direct communicating with potential consumers to stimulate demand and realize retention.

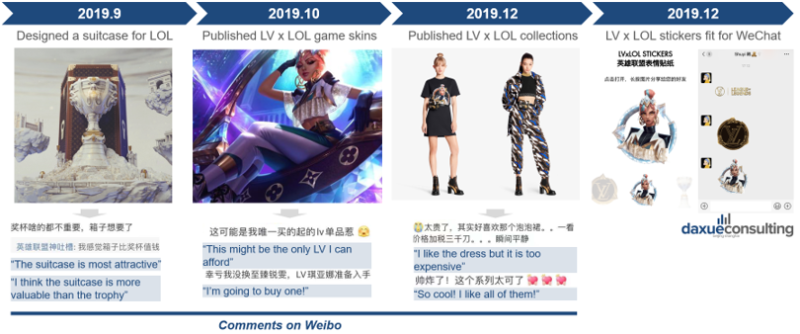

Co-branding Campaign: LV x LOL

From the instruction above we can know that LV carries out promotion strategy in China by coordinating five promotion channels, Louis Vuitton China can cover new groups of consumers. In the next part, we will learn the promotion ecosystem of Louis Vuitton China from a real case. LV reached a fresh audience through a co-branding campaign with League of Legends, a world-leading video game.

In 2019, Louis Vuitton China collaborated with League of Legends and created a series of co-branding products.

[Source: daxue consulting, ‘LV’s co-branding promotion strategy in China’]

As a luxury brand with a lower consumption frequency, the collaboration helped LV improve brand awareness in China’s luxury market, as well as strengthened its brand.

LV’s promotion ecosystem works well to meet different demands

[Source: daxue consulting, ‘Louis Vuitton China promotion ecosystem’ ]

LVxLOL co-branding topic on Weibo has attracted more than 1 million discussion, it high exposure to public. The purchasing link attached to posts on LV’s App, Newsletter and Weibo drive traffic to LV’s official website. WeChat Account’s navigation bar and articles provide entrances to its mini-program.

Will too much popularity cause the brand to lose distinctiveness?

Since the Chinese middle-class’s per capita income is rising, and also due to a changing lifestyle, as well as more open-minded and educated Chinese regarding brand preferences, . However, at the same time, China’s upper class is losing interest in luxury brands such as Louis Vuitton. Chinese netizens are saying, Louis Vuitton in China has become so common that even a nanny can own one. “The real rich do not want LV or Gucci anymore because they are just too common. The rich become even richer and want more unique and self-expressive products. They are turning their heads to brands like Chanel and Hermes.”

Luxury lies in the concept of distinct possession, which means not everyone can own it. Although LV is such a shining star in China’s luxury market, it still needs to pay attention to its brand image and position as it further develops in world’s biggest .

Louis Vuitton’s China market strategy puts the brand in charge of consumer traffic

It’s called Brand Independence, and your brand can do it too

Much of China’s e-commerce is done through large platforms like Taobao, Tmall and JD. While there are benefits and negatives to selling through platforms, it can be limiting for aspirational brands like Louis Vuitton. Through this case study, we notice that Louis Vuitton drives traffic to platforms that it owns, its own website and its WeChat Miniprogam. Because LV drives traffic to these sites, it remains in control of consumer data. At the same time, it can create a stronger brand identity and separate itself from competitors and counterfeit products that are listed on online marketplaces. Brand independence may be right for your brand, email our project team at dx@daxueconsulting.com to start your China market strategy project.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes

![[Podcast] China paradigm #22: How to run an international creative agency in China](../wp-content/uploads/2019/04/China-marketing-podcast-22-150x150.jpg)