Ralph Lauren China | Case study of a late entrant in luxury

Ralph Lauren: Late arrival in China

Ralph Lauren Corporation is an upscale American lifestyle company and fashion retailer founded by American designer Ralph Lauren. The company focuses on high-end clothes for men and women. Widely recognized for its Polo Ralph Lauren flagship label, Ralph Lauren Corporation also manages several other brands. Ralph Lauren in China is playing catch up with other luxury brands due to being a late entrant.

For world luxury brands, China is a vital market due to its potential and growth. However, unlike other brands such as Louis Vuitton and Chanel, which has long set their exclusive stores in many cities in China, Ralph Lauren entered the Chinese market in 2011.

Ralph Lauren’s first year in China

In its 2011 fall collection, Ralph Lauren incorporated many Chinese elements into its designs, including the color China red, emerald green and the materials such as jade, Chinese embroidery, Qi-pao and a dragon robe.

According to CEO Roger Farah, when Ralph Lauren entered the luxury clothing market in China, choosing the right location for the Ralph Lauren stores in China was very important. On the one hand, Ralph Lauren in China seriously considered opening some stores in second and third-tier cities. In 2011, the best locations in major Chinese cities such as Beijing and Shanghai were already occupied by other luxury brands. At the same time, second and third-tier cities were rapidly developing.

How a new entrant can position itself as a high-end brand

On the other hand, most consumers living in these second and third-tier cities would ignore the brand since they had not heard of it before. Even if Ralph Lauren opened a huge flagship store with a big investment in these cities, it struggled a bit to gain a loyal customer base due to its late entry into the Chinese market. Besides, Ralph Lauren pushed through its e-commerce strategies as well to raise brand awareness. According to the luxury analyst Luca Solca in Sanford Bernstein, Ralph Lauren in China was a late player, but its unique focus on the middle class would lead to its success if it executes its strategies properly. The two problems Ralph Lauren faced in 2011 were to position the brand as a high-end fashion brand and to construct a Chinese team full of people who were familiar with the Chinese market.

Up to February 12, 2020, Ralph Lauren in China has 106 stores. And of these, 13 of them are located in Beijing, and 18 of them are located in Shanghai. Although Ralph Lauren is a newcomer to the luxury clothing market in China, its performance continued gaining momentum. In 2019, Ralph Lauren had an increased 10% revenue in Asia, and mainland China was responsible for 30% of the revenue growth.

Market strategies in China: Celebrity and KOL marketing

Launching Chinese e-commerce stores

In 2017, Ralph Lauren China launched on the e-commerce clothing market, with stores on Tmall (天猫) and JD.com(京东), and the social platforms, Sina Weibo and WeChat. When selling directly on marketplaces-Tmall and JD.com rather than partnering with wholesalers, brands like Ralph Lauren would have more control over their pricing and positioning. Also, it increased effort to enhance relationships with luxury customers in China through partnerships with powerful KOLs and celebrities in the region.

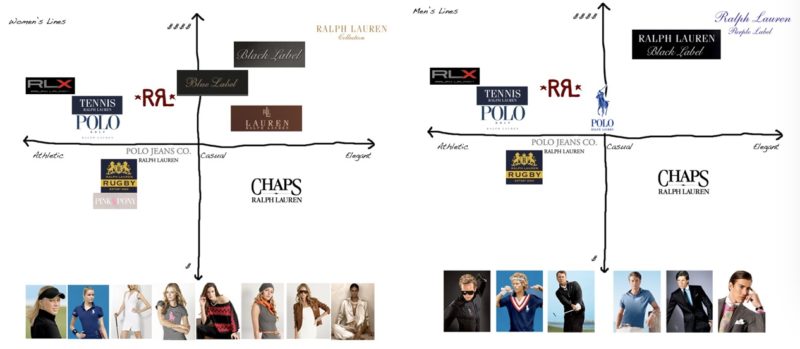

Ralph Lauren is comprised of eight lines, ranging from formal and elegant to more casual and affordable to specialized for unique designs.

[Source: ASHLEY E. DAVIDSON ‘FASHION AS ART AS FASHION’ showing the positioning of Ralph Lauren in China]

Leveraging celebrity endorsements in China

Ralph Lauren in China has positioned it as a high-end luxury brand while it’s marketing content and partnerships with Chinese celebrities. The hashtag #RLCelebs# on Weibo, always used by RalphLauren official, has accumulated 170 million views and 481 thousand discussions by February 12, 2020. Under the hashtag #RLCelebs#, RalphLauren official posts with celebrities wearing Ralph Lauren apparel from Ralph Lauren collection or Ralph Lauren label, which are more expensive. Such celebrities apparel and accessories are available in Ralph Lauren flagships include on the digital platform to support the sales growth. The bottom line market is padded out by the more affordable Ralph Lauren lines, which can effectively boost sales as well.

[Source: Weibo ‘Ralph Lauren China Celebs’]

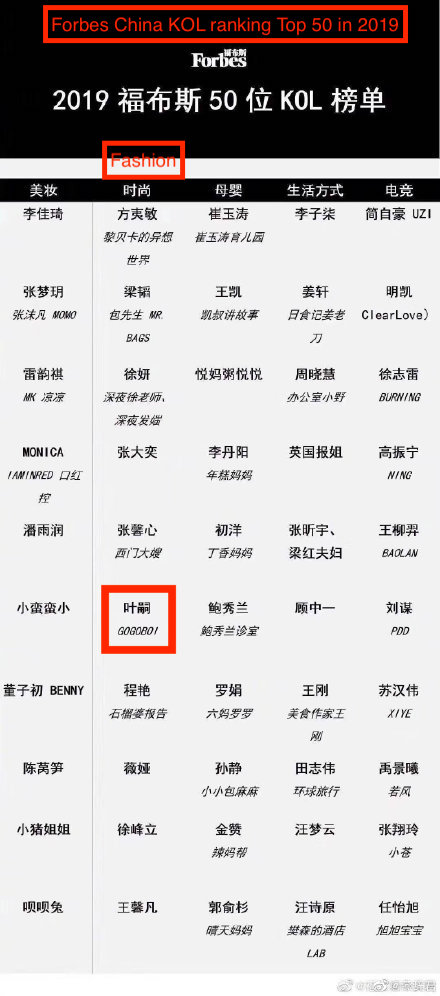

Brand consultants also help Ralph Lauren in China find the right KOLs to partner with and help it figure out its target customers in China and how to target them based on customer data. Gogoboi is a fashion blogger famous for his trenchant criticisms of celebrities’ taste in clothes. Forbes China declared the top 50 KOL ranking in 2019, and Gogoboi ranked 6th of the fashion section, which means he has an enormous amount of influence of the fashion industry in China.

[Source: Weibo ‘Forbes China KOL ranking’]

Ralph Lauren in China has collaborated with him for many times. They even threw a party for him and his daughter. Gogoboi tweeted a Weibo to thank Ralph Lauren for the party.

[Source: Weibo ‘Ralph Lauren & gogoboi’]

Consumers’ impression of Ralph Lauren in China

Some consumers are still confused about Ralph Lauren’s position due to its numerous lines and polarization of pricing. The hottest topics of Ralph Lauren on Zhihu, a Quora-like question-and-answer website in China, are asking if Ralph Lauren is popular abroad and if it is a luxury brand. One of the topics also shows that some of the consumers only have the impression of Polo shirts but have no idea of any other items.

[Source: Zhihu ‘Ralph Lauren’]

Ralph Lauren hit by U.S.-China Trade War

However, as NBC recently noted in May 2019, the challenge for Ralph Lauren in China has nothing to do with Ralph Lauren’s consumers in China, but rather the ongoing U.S.-China trade war and higher cost of importing ‘made in China’ items it started.

Although Ralph Lauren makes many of its high-end lines products in Italy, some of the casual lines, such as Polo and Lauren by Ralph Lauren lines items are made in China. According to a J.P. Morgan analysis in May 2019, Trump’s latest round of China tariffs significantly affect companies with exposure to Chinese imports include Ralph Lauren since the duty covers clothing. Ralph Lauren dropped more than 3%.

The U.S. and China have signed an agreement to ease the trade war that has disturbed the international markets and placed burdens on the global economy. China has pledged to boost US imports by $200bn above 2017 levels and strengthen intellectual property rules. If the trade dispute continues managing to be resolved, strength in the Asian market would help with crisis and pressure in Ralph Lauren’s market in the U.S..

In 2020, Ralph Lauren in China closed about half of 106 stores due to the coronavirus

[Source: Meiletao.com ‘Ralph Lauren store in Beijing’]

The luxury market in China is critical to the global luxury market, accounts for about 35% of the international luxury industry. The coronavirus illness restricts travel freedom of consumers in China, may also negatively impact consumption capability of Chinese consumers and is also likely to disrupt supply chains. The Luxury market in China could experience the most material influence.

“As far as the supply chain is concerned… while the China opportunity is a massive growth opportunity to some extent, it’s a blessing to be underpenetrated today,” said Chief Executive Patrice Louvet on the earnings call, according to a FactSet transcript. Louvet said Ralph Lauren in China has to determine how much the supply chain has been impacted by the coronavirus after workers return from their New Year holiday. It has already taken measures to diversify its supply chain.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes