Coach in China: A fast-growing affordable luxury brand

Coach’s history dates back to 1941. It started as a family-run workshop in New York City with a simple goal—to make beautiful, functional items in modern shapes from the finest leathers. In 1979, Lew Frankfort joined the company and came up with the concept of an “affordable luxury brand.” In the late 1980s, Coach began a series of expansions and innovations that have made the brand reliable, fresh, and relevant. Nowadays, Coach has become a leading design house of modern luxury accessories and lifestyle collections with global annual revenue of USD$4.27 million. Defined by a free-spirited, all-American attitude, the brand has a strong presence in many countries, including China. Coach in China has been a success.

China has become an essential market for Coach

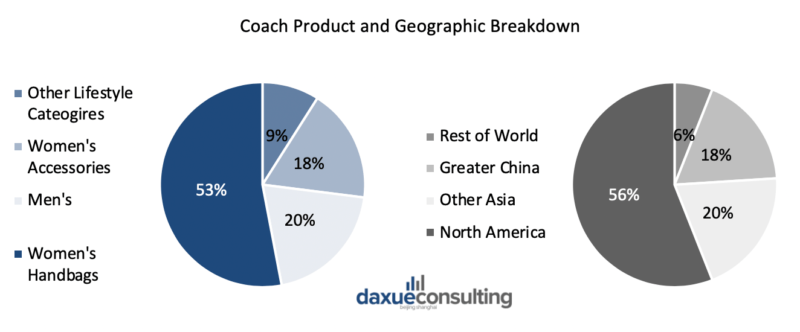

Coach entered mainland China in 2008, with only USD$50 million in annual sales. However, after the financial crisis of 2007-2008, global luxury brands are increasingly reliant on China’s burgeoning middle class for growth. Nowadays, Coach has more than 300 stores in mainland China. As of fiscal year 2019 (June 30, 2018 – June 29, 2019), sales in China accounted for 18% of the total sales, and the increase in Coach’s comparable-store sales is primarily due to the increases in Japan and China. In conclusion, the Chinese market has become the driver of Coach’s global growth.

Coach’s Marketing Strategy in China

Although Coach is regarded as an affordable luxury brand and targets the middle class in North American and European markets, the price of Coach in China is less affordable. It is said that the price difference of Coach’s products between China and America reached more than 40%, which pushes Chinese consumers to purchase Coach abroad. Besides, Coach is suffering from brand dilution. The overuse of “Coach” on its outlets-line products links Coach with a downmarket image, which damages the brand.

To retain the market share and to increase its brand awareness, Coach has carried out a series of innovative marketing strategies.

Global Marketing Strategy: A Concept of Morden Luxury

Starting in 2015, Coach changed its marketing strategy in order to maintain a leading position in the marketplace and to reduce the risks of brand dilution, especially during the competition with its rival Michael Kors. In 2015 and 2017, Coach acquired the luxury shoes brand Stuart Weitzman as well as the affordable luxury brand Kate Spade. These purchases caused Tapestry Inc. to become a group owning multiple brands.

In June 2013, the famous British fashion designer and previous creative director of Mulberry and Loewe, Stuart Vevers, joined Coach as executive creative director. In February 2014, he made a confident debut for Coach at the American leather goods house’s first-ever ready-to-wear presentation at the New York Fashion Week. The chic design combined with functionality and utility received consistent praise, and the collection was predicted to play well to young customers. The inclusion of a clothing line made Coach more like a luxury brand.

Coach tried to distinguish its full price line from the affordable line. The handbags and other leather accessories in the full price line adopt an inconspicuous design and usually do not have any of Coach’s logos. However, the design of products in the outlets line continues to embrace logos. This strategy helps Coach to maintain status among China’s middle class.

Cooperating with Chinese Celebrities

In recent years, luxury brands such as Dior, Gucci, and Tod’s have had closer cooperation with Chinese celebrities. Chinese consumers interpret it as a signal that these foreign brands value and respect Chinese consumers. Coach in China has applied similar strategies to develop and maintain an intimate consumer-brand relationship as well.

In 2018, Chinese actress Guan Xiaotong and idol Timmy Xu joined Coach’s global campaign for fall and winter collections. In 2019, Guan Xiaotong, together with Japanese model Kiko Mizuhara headlined Coach Women’s Spring and Summer advertising campaign. These campaigns were widely broadcasted through entertainment news and fashion magazines in China, becoming hot topics among Chinese consumers and attracting a great deal of attention. Collaborating with young celebrities and popular idols has been proved as an effective marketing strategy in China. Since Guan Xiaotong and Timmy Xu are favored by young Chinese consumers and since the campaigns were aimed at arousing Coach’s brand awareness among young consumers, Coach China became more youth-oriented.

On July 26, 2019, the Chinese supermodel, Liu Wen, was named the new ambassador of Coach in China. Liu Wen is one of the top-earning supermodels in the world. She has 4.8 million followers on Instagram and 24 million followers on Weibo. As an influential celebrity, Liu Wen was expected to have a positive impact on Coach.

Coach’s Collaboration with Tmall: A Road Full of Frustrations and Taboos

China is a country with an advanced digital eco-system. In 2018, 42% of global e-commerce took place in China. It was expected that in 2019, e-commerce sales would account for 36.6% of all retail sales in China. Consequently, more and more luxury brands are launching an e-commerce platform to boost their sales in China.

Coach is one of the pioneers of digitalization in China. In late 2011, Coach and Alibaba started their first cooperation in launching an online flagship on Tmall. At that time, it was a meaningful event for both sides—Tmall needed a luxury brand to get rid of its downmarket image, while Coach was the first global luxury brand to launch an official Tmall flagship store. However, this cooperation only lasted two months. Although Coach explained afterwards that the short collaboration was based on a contract, it was widely believed that Coach was upset with Taobao’s failure to remove counterfeit goods from the site.

Coach China’s pursuit of Brand Independence

Afterward, both Alibaba and Coach faced turning points. In 2014, Coach lost out in competition to Michael Kors in its primary market—North America. What made it worse was the fact that sales growth of Coach in China slowed to a two-year low. In contrast, in 2014, Alibaba listed its Initial Public Offering (IPO) on the New York Stock Exchange (NYSE). Hence, in August 2015, Coach collaborated with Alibaba for the second time and decided to reopen its online shop on Tmall. Once again, Coach closed its online shop on Tmall after a year. Coach claimed that the decision was due to the change of distribution channels in China, and Coach decided to focus on building its own online shop on WeChat.

The two attempts on Tmall both failed. It seemed that for Coach, collaborating with Tmall was not a successful marketing strategy in China. The strategy of not selling on online marketplaces is known as brand independence, and Louis Vuitton in China also employs this strategy.

However, in September 2019, Coach partnered with Tmall for the third time as its owner Tapestry Inc indicated a renewed priority geared towards the Chinese market. According to Coach’s CEO, the third Tmall attempt has shown excellent results, with 90% of customers being first time Coach Consumers. Currently, Coach’s Tmall flagship has 0.75 million followers.

Coach’s WeChat Brand Zone

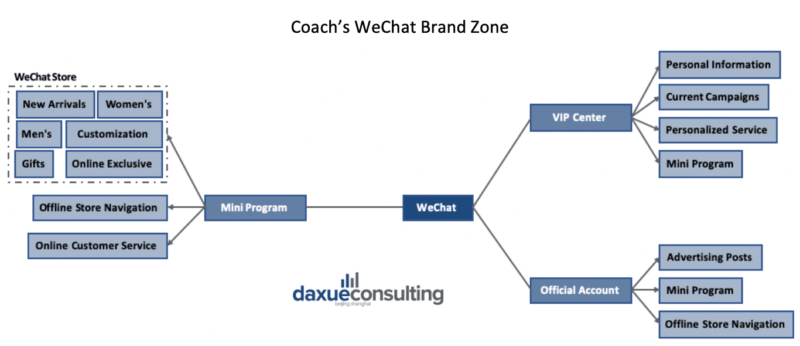

Coach opened its WeChat Store in 2016. Its WeChat brand Zone can be roughly divided into three functions: sales, promotion, and customer management.

By following Coach’s WeChat Official account, consumers can manage their personal information (including membership cards and coupons), unlock exclusive offers, and get personalized services in the VIP Center. Coach’s Official Account also provides information about promotions, new collections, and product recommendations. Both the VIP center and the official account provide links to Coach’s mini program. The mini program mainly works as the WeChat store. In addition to product sales, it also provides locations of offline stores and online customer services.

Campaigns and Promotions of Coach in China

Coach has used various promotion methods to meet different market demands, including official accounts on different social network platforms, search engines, newsletter, etc.

For instance, Coach’s WeChat account provides customer services, extensive introductions of products and campaigns, and access to the Wechat store. Loyal customers can also manage their membership cards and unlock personal exclusive offers in the VIP center.

Xiaohongshu

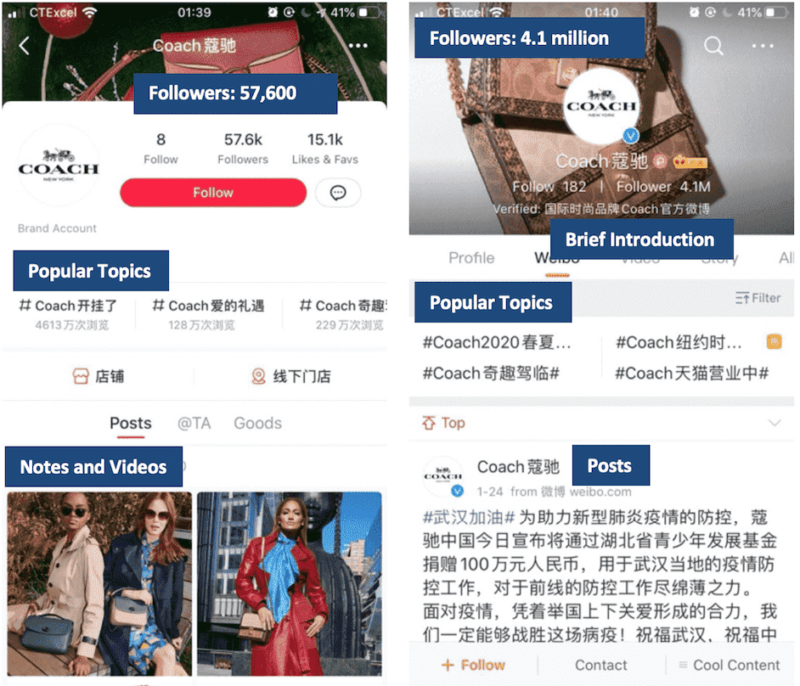

Xiaohongshu is a social commerce platform where brands can interact with customers and leverage KOL marketing. Specifically, in Xiaohongshu, Coach can publish products notes, communicate with others, and lead related discussions. Through interacting with key opinion leaders and loyal customers, Coach can simultaneously advertise its products and its value to followers. Xiaohongshu, as a platform with young active users and fashion lovers, is an excellent platform to reach target customers and to attract potential customers.

On Weibo, brands can interact with followers. Coach’s official Weibo account has more than 4 million followers, which makes it an important platform to advertise this affordable luxury brand to a large group of people. The extensive reach can increase the brand awareness across society and catch more potential customers. Besides, Weibo is a platform to interact with endorsed celebrities and their fans. As the fan economy has become a phenomenon in China, a close collaboration with celebrities will help Coach increase sales.

Fashion Controversy in China: How Coach was involved

Due to China’s modern history, in Chinese people’s minds, national sovereignty and territorial integrity are sacred and cannot be violated under any circumstances. Therefore, if western brands are insensitive to the one-China policy, it is likely to stir controversy in China. In August 2019, Coach released t-shirts that showed a list of cities followed by their respective countries. However, Hong Kong and Taiwan were listed as their own sovereign nations, instead of as parts of China. This sparked Chinese people’s boycotts of Tapestry Inc. Subsequently, Coach’s newly named brand ambassador, Chinese supermodel Liu Wen announced that she would terminate cooperation with Coach.

Although Coach in China apologized on Weibo and would remove the offending T-shirt from all its retail channels around the world, the faux pas still harmed the brand image.

Coach’s success in China is due to both brand independence and digital marketing

Brand independence is an often overlooked option for brands trying to create a strong brand image in China. It is essentially a strategy where brands do not rely on marketplaces, rather they direct traffic to their own platforms. Your brand also has the power to use a brand independence strategy, just contact our project team at dx@daxueconsulting.com

The luxury and the duty free market in China are intertwined. Learn everything you need to know about Chinese duty free consumption from our report

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes

How much percentage Coach’s sale in China accounts for its sales in the whole world?