Localizing international swimwear for Chinese consumers’ preferences | Daxue Consulting

An introduction to the swimwear market in China

The demand for swimwear in China has increased considerably in recent years, adding to an already formidable Asian swimsuit market. China is the fastest growing swimwear market in Asia, with an average of 9.6% annual market growth. This flourishing market is driven by the increase in disposable income that accompanies the ongoing Chinese economic boom.

In 2018 alone, per capita, disposable incomes in China saw an increase of 6.5%.With rising incomes, consumers have the money to travel to tropical destinations at home and abroad, creating a rapidly increasing swimsuit demand in China. Based on data from the China National Tourism Administration reports, 4.44 billion domestic trips and 131 million overseas trips made by Chinese people in 2016. Common trip destinations include beach cities like Sanya, the country’s 8th most popular domestic tourist destination, and tropical countries of Thailand and Vietnam, according to data from Chinese travel website Mafengwo. During peak summer months, Fujiazhuang beach in Dalian sees about 40,000 visitors daily. With travel rates on the rise, Chinese tourists are drawn to tropical destinations where they can participate in water sports and other aquatic activities, which has created a demand for swimwear in China.

As China’s conservative culture becomes increasingly cosmopolitan, and the culture of local beauty competitions and contests is fostered, swimsuit demand among Chinese consumers is growing as a result.

Moreover, the evolution of fashion and clothing standards has created new markets for brands to capitalize on. Swimwear is one such market that was previously not developed in China.

An analysis of Chinese swimwear consumers

Chinese men and women share common uses for their swimwear, including swimming and water sports, beach activities, seaside travel, and hot springs. Children’s swimwear is also a growing segment as parents take their children to pools and beaches, creating a children’s swimsuit demand in China. Price is an essential purchase

The majority of people searching on Baidu for swimwear-related terms are in their 30s. Notably, men account for over 2/3s of swimwear searches, with a trend towards men over 30.

Male consumers in China’s swimwear market

Men’s swimsuits can be divided into “beach shorts” and “swim trunks.” [D1] Beach shorts are modeled after Western trends, with typically loose fits and bright, patterned designs. However, male consumers in the Chinese swimsuit market typically only wear beach shorts to relax on the beach, not for swimming. Conversely, swim trunks are for serious swimming, vigorous exercise, and water or beach sports. Swim trunks fit tightly and run almost exclusively in dark colors without patterns. The brands entering the swimwear market in Asia should cater to local preferences when choosing or designing products.

Female consumers in the Chinese swimwear market

While Chinese men may prefer to purchase more ‘functional’ and skin-bearing suits, in the swimsuit market in China women buy for mainly aesthetic purposes. Chinese women overwhelmingly prefer modest swimwear, such as one-piece suits, suits with skirt designs, and sleeved suits. Bikinis are widely unpopular in the Chinese swimwear market: of the 1.24 million women’s swimsuits sold thus far Taobao, only 127,000 of those were bikinis. This trend stems not only from a conservative culture but also from a preference to follow the beauty trend of pale skin. Aside from price, sun protection through fabric quality and coverage is an important purchase factor. Though modern suits show more skin than historical ones, they are still highly conservative. Consumers’ swimwear tastes in China differ drastically from western demands, so international brands entering the Chinese swimwear market must adapt their products to fit local preferences.

Chinese women like to focus on swimwear with “slimming effects.” Popular swimwear search terms on TMall are the phrases “hides stomach,” “conservative,” and “slimming.” The swimwear industry in China has adapted to fit this preference.

Many resources exist online to help women categorize their body shape and subsequently choose a flattering suit.

Swimwear consumers in China, both male and female, are ready and eager to make purchases in the Asian swimsuit market and engage with new brands, creating an exciting opportunity for international companies to capitalize on an emerging market.

International vs. domestic brands in the Chinese swimsuit market

International brands in the Chinese swimwear market are primarily high-end Western companies that target high-income consumers and families. In advertising, these companies emphasize their brand’s elite culture and history in an effort to differentiate themselves from the relatively new domestic brands. International swimwear brands promote through online and offline channels and tend to utilize KOLs (influencers) more than domestic brands do.

Chinese swimwear brands sell mainly through online channels, and regularly outsell the international brands in terms of volume, because their products are more cost-effective. Where international swimwear brands like to focus on the status and prestige of their brand costumers, local companies fixate on consumer volume.

Promotion channels of the swimwear market in China

Beyond traditional advertising mediums, swimwear in China is promoted through specialized swim websites, magazines, pop-up stores, and KOLs.

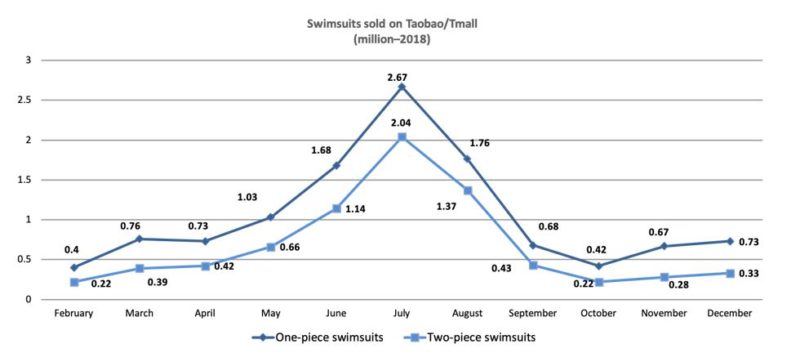

Swimwear demand in China is highly seasonal, with peaks in June, July, and August. Accordingly, swimwear advertising in China ramps up in the spring and summer before declining again in fall and winter. This advertising cycle revolves around the purchasing habits of Chinese swimwear consumers.

Figure 6: Seasonal sales of swimwear online. Source: taosj.com.

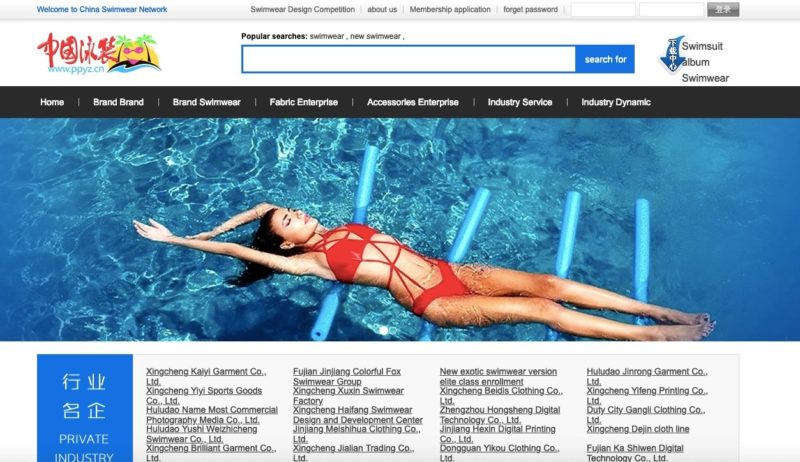

Websites related to the swimwear industry in China

Searchable on China’s Baidu are websites exclusively dedicated to everything aquatic, from water sports to fashionable swimsuit trends. Swim attire is a key focal point of these sites. A few such swimming-related websites in China include ppyz.cn and 86zgyzw.cn. These sites categorize swimwear companies, showcase new designs or fashionable trends, and allow visitors to explore new brands. Swimwear brands in China can claim a page to describe their products and business philosophy, link to their own sites, and promote swimsuit or fashion exhibitions. In addition to providing necessary addresses and phone numbers, companies also detail their distributors, suppliers, and manufacturers. The swimsuit industry in China is well adapted to advertising in the internet age.

Using magazines to advertise swimwear in the Chinese market

Advertising in magazines has managed to maintain a valuable ROI in an age where e-commerce dominates. Magazines in China reach key consumers who are actively seeking to stay ahead of the curve by becoming early adopters of new trends.

Brands in China’s swimwear market prioritize advertising opportunities in swimming-focused publications, recognizing that these magazines’ readers are consumers already engaged in the market and likely to buy swimwear in the near future.

Beyond swimming-specific magazines, both domestic and international swimsuit brands advertise in Chinese versions of fashion mags like Cosmopolitan, Bazaar, and FHM. These magazines’ audiences are typically high-income and career women, so the companies that advertise trend towards international, pricy, and luxury brands. The swimsuit market in China is diverse, and accordingly has a diverse set of promotion methods to choose from.

Using pop-up stores to advertise swimwear in China

Pop-up stores are a new creative method of marketing that focus on building unique, interactive, and innovative experiences for consumers. These stores are located in or around malls, but often are not directly related to the brand’s products. The goal of pop-ups is not necessarily to sell the company’s goods, but instead to increase brand awareness and boost perception.

For example, in a recent pop-up Chanel created an arcade that allowed consumers to play games inside their store.Chanel is not a gaming brand, but the fun and interactive pop-up was a massively popular attraction. Many visitors shared their experience on social media, and the store went viral. Chanel’s successful pop-up increased its brand awareness and boosted brand perception. This is the type of experience that the swimsuit industry in China should model.

Figure 9: An arcade-themed pop-up store from Chanel. Source: Chanel.

In another instance, Pepsi opened an immersive pop up to advertise for the introduction of a zero calorie Pepsi drink in China. The immersive and colorful space was a massive hit in-person and online, and consumers flocked to the pop-up to experience first-hand what they’d seen so many pictures of on social media.

Swimwear brands entering the Chinese market should take advantage of the pop-up marketing model to stand out from other brands. Pop-up should be creative, engaging, and innovating. Pop-up stores that are successfully unique and compelling can gain widespread attention online, giving the brand an opportunity to attract new customers and edge out their competitors. The swimwear industry in China would benefit from pop-up style marketing.

Using KOLs to advertise swimwear in China

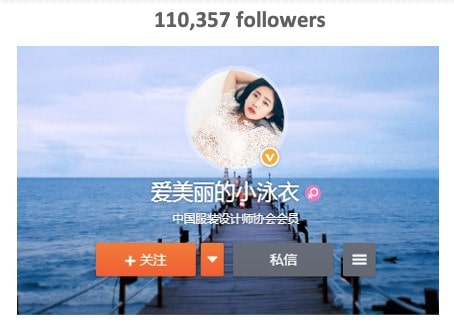

Use of KOLs is one of the most crucial promotion channels in the Chinese swimwear market. A KOL is a “key opinion leader,” commonly known as an “influencer” in the West. KOLs are famous on social media apps and characterized by their high follower counts, ranging from thousands to millions of fans. These influencers are active not only on social and live-streaming platforms but also on shopping sites such as Taobao and TMall. KOLs are a perfect medium for swimwear advertising in China.

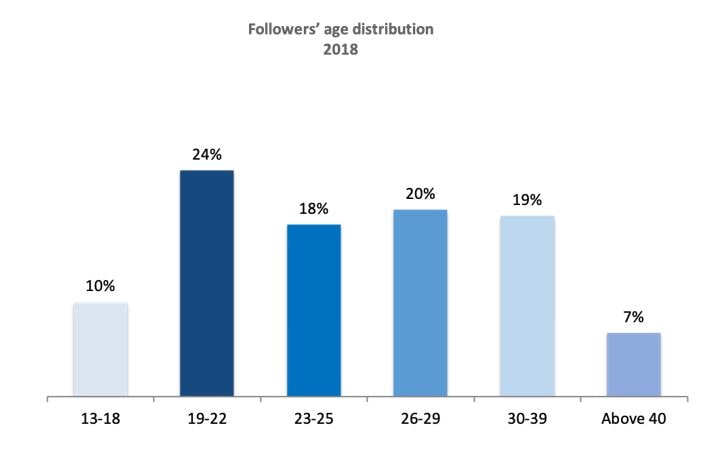

KOLs appeal most strongly to younger generations, primarily those under 30. Chinese consumers spend on average 3 hours a day on their phones, with younger age groups on the high end of that.

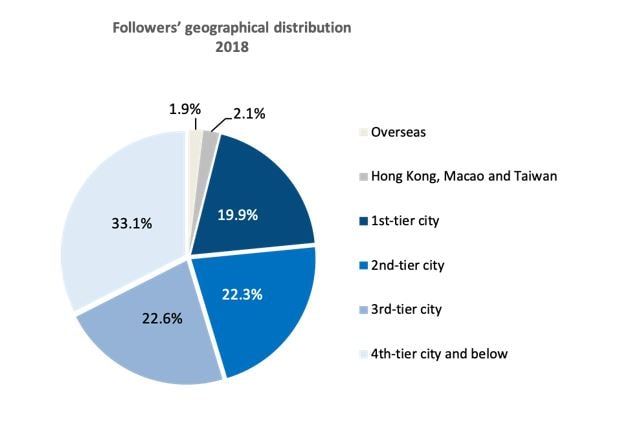

Though KOLs are popular in all regions, they have particular influence in the 4th tier cities. Lower tier cities in China make up 73% of the country’s total population, and the number of online consumers in 3rd and 4th tier cities is larger than in urban areas. Morgan Stanley predicts that China’s private consumption could grow to 9.7 trillion by 2030, with most of that growth from lower-tier cities. The swimsuit market in China will soon have to adapt to this growing body of shoppers.

KOLs are highly important as a marketing tool because their abundant followers are often easily swayed into buying products that their favorite KOLs champion. Brands that promote products with particularly famous KOLs often see an immediate spike in orders after the influencer posts about or references their brand. Swimwear brands entering the Chinese market should hire KOLs to advertise their products.

Domestic Chinese swimwear brands are more likely than international swimsuit brands to hire KOLs, as the medium is more impactful with affordable mass-market goods than high-end imported products, according to the South China Morning Post. Still, pricy international brands can successfully utilize KOLs to impact brand awareness and create a virtual customer experience. Swimwear consumers in China are tuned into the KOL marketplace, and swimwear brands should capitalize on that.

KOLs can film short videos livestream themselves trying on and modeling swimwear that viewers can immediately purchase from an embedded link in the video. Live-stream shopping channels and short videos are the perfect medium for those with shorter attention spans and appeal to consumers with a “see now, buy now” mentality. The swimwear market in China should utilize KOLs for maximum sales.

Segmenting the Chinese swimsuit market

Swimwear brands in China will often try to target specific market segments through their advertisements. For example, Speedo often curates their ads to target athletes and professionals. They partner with famous swimmers like Michael Phelps and emphasizes their swimwear’s intelligent technology and fabrics. The Speedo marketing team very much tries to imply that Speedo products will improve swimming performance. With the swimwear market in China growing so rapidly, brand differentiation is important for targeting consumers.

In contrast, international swimwear brands like Gainreel and Oysho use bright, colorful, and tropical video ads highlight their swimsuits as ideal for wearing on seaside trips. They use music and enticing set locations to emphasize holiday and leisure suitability. This focus on swimwear for vacation wear differentiates them from athletic brands like Speedo and targets a separate market segment. The swimwear market in China is diverse, creating opportunies for brands of all variations.

Swimwear promotions will sync up to the Chinese swimsuit market’s seasonal nature. In January and February Speedo rarely posts on their WeChat or Weibo, instead opting to ramp up video ads and discount or prize draws in the ramp up to peak summer months. The swimsuit industry in China listens to its consumers in both product and marketing decisions.

Distribution of Swimwear in China

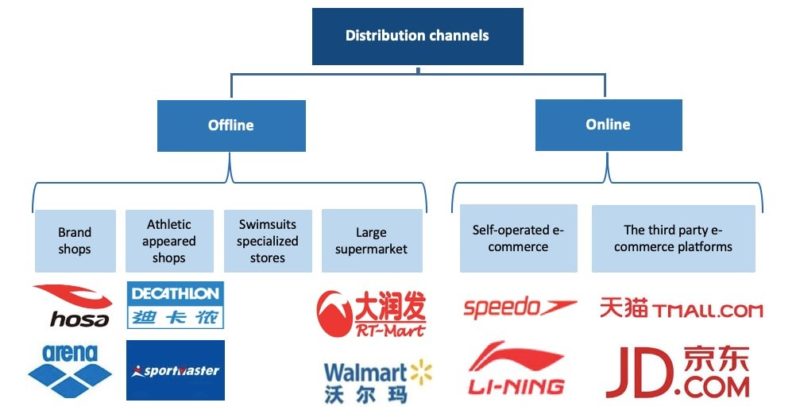

In addition to pages on third-party platforms like Taobao and JD.com, many swimear brands in China have self-operated e-commerce platforms.

To support in person purchases swimwear brands will set up their shops, sell in athletic apparel or swim stores, and display products in large mega-marts. Beyond malls, stock volumes peak at locations near beaches, swimming pools, and water parks. The swimsuit industry in China is highly intelligent and sophisticated in its distribution methods.

Takeaways for swimwear brands entering the Chinese market

When entering the swimsuit market in China, international brands must adapt their products to Chinese consumers’ requirements, bodies, and preferences. For example, for men these preferences are tight, dark, athletic swim trunks and colorful, patterned beach shorts. Chinese women favor modest and slimming suits in a variety of colors and fashions. Swimwear demand in China is booming, and all consumers desire quality materials and consistent pricing.

International brands in the Chinese swimwear market should choose clear positions, focus on influential marketing, and localize their strategy to mesh with China’s e-commerce explosion and convergence of offline-online channels.

Author: Alison Bogy

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.

![[Podcast] China paradigm #5: How to start a successful apparel brand in China with Vivian Chang](../wp-content/uploads/2018/04/China-business-podcast-apparel-brand-China-150x150.jpg)