China’s winter apparel market is taking off with winter sports and winter tourism

With a middle class that is growing by the tens of millions, China is home to many size-able and burgeoning markets. Some of these markets are powerhouses in themselves when measured in comparison to those of other nations. Over the years, China’s various markets have doubled, tripled and even quintupled in size. Some have however taken longer to reach maturity than others. One of these markets that have been slower to grow than others is China’s winter apparel market, which includes items such as winter coats, accessories and winter sports gear.

Events such as The Harbin Ice Festival and Snow Festival are helping push up demand in China’s winter apparel market. Attracting a larger number of tourists yearly, the festival requires tourists from regions farther south to invest in winter apparel, even if just to be worn once.

Preparation for Beijing 2022 Olympics boosts winter sports market in China

In light of the upcoming Winter Olympics Game, this market is worth examining so as to better understand what benefits it holds for foreign companies. Some companies stand to benefit handsomely from the combination of upcoming events and current socioeconomic trends in China. Some of these trends include the Chinese youths’ increasing fixation on luxury sports, winter scenery tourism, Chinese government support for winter sports participation and of course the 2022 Winter Olympics.

[This scene of the construction site of the Olympics Winter Village in Zhangjiakou is a sure sign that China is taking preparations for the games seriously. Zhangjiakou, located in Hebei just outside of Beijing, is poised to become a new mecca of winter sports tourism in China. Source – Greg Baker / AFP]

How the 2022 Winter Olympics may increase spending on winter apparel in China

In 2008, China took to the limelight by hosting the Summer Olympics in Beijing. Now China is preparing to appear in the spotlight again as it prepares for the 2022 Winter Olympics. Scheduled to take place in Beijing and nearby Hebei Province, the winter games already have the world watching China.

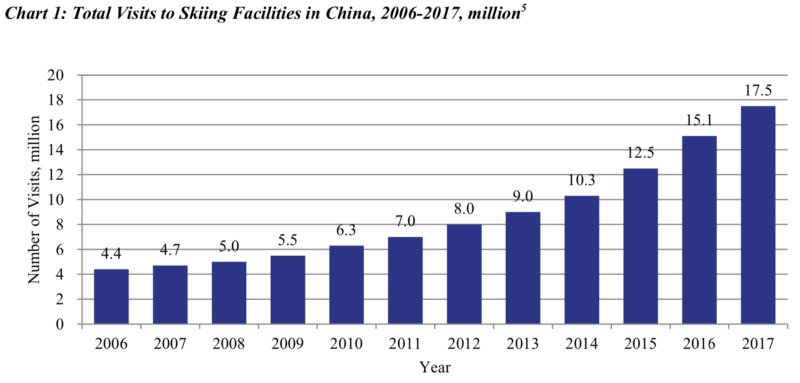

Since the games are expected to attract hundreds of thousands of visitors from around the world and within China, the potential to increase interest in winter sports among visitors is high. Perhaps in conjunction with the Chinese government support, the 2022 Winter Olympics have begun to increase spending on winter sports and on winter apparel. For example, total visits to ski facilities in China has grown nearly fourfold since 2006 and this trend is likely to continue post-games.

In the lead up to the Olympic Games in 2022, it is likely that these trends will intensify. As with other Olympic Games, it is likely that there will be lasting impacts on the Chinese winter apparel market well after the games. Foreign companies that have not yet considered the effects of the Olympics on this market would do well to assess their potential benefits.

[Shown in the graph is the steady increase in visits to domestic skiing facilities within China. Source – EUSME & China-Britain Business Council]

Trends in luxury sports will bolster growth in China’s winter apparel market

Trends across China catch on fast, sometimes spreading like wildfire. Notably examples are the tourism trend of daka (going to a tourist destination simply to take a unique photo, usually in imitation of a celebrity,) bike-sharing platforms such as Mobike or Qingju and the ubiquity of mobile pay. One trend gaining traction that has such potential to grow fast is the popularity of luxury sports in China. Foreign companies looking to profit from this emerging trend may look to China’s winter apparel market as a place to start.

Skiing and snowboarding in China are growing

The growth of luxury sports can be captured in statistics showing the increase in snowboard sales, which grew by more than 20% in 2016. While most reports on this topic highlight the robust growth in snowboarding, especially among younger consumers, it is also worth noting that skiing is still growing steadily, with annual growth near 10%. As both of these growth rates are faster than China’s overall GDP growth, it can be said that markets for snowboarding and skiing are performing well in China.

As skiing is considered a luxury sport and usually requires the purchase of expensive equipment, the market has the potential too. A report published by EUSCME shows that the Chinese skiing market alone is expected to grow from €600 million to €3.5 billion between 2016 and 2022.

The popularity of luxury sports in China combined with other factors will bolster increased demand not only on domestic skiing facilities and services, but also on winter apparel.

[Snow-covered mountains across China provide an excellent setting for the growth of China’s winter apparel market. Shown in the photo is Hailuo Gou National Park in Western Sichuan, an up and coming place in China’s domestic winter scene tourism market. Source – 睿睿]

Winter scenery tourism in China is becoming more popular

As Chinese consumers become wealthier, their appetite to visit tourist destinations domestically and internationally grows more and more voracious. Due to the astounding growth in disposable income in China over the past few decades, trips to these types of destinations have exploded. In 1984 there were only 5,000 annual visitors to Jiuzhaigou National Park in northern Sichuan. By 2002 however there were over 1 million annual visitors to the park.

Popular winter scenery tourism destinations in China include Hailuogou and Jiuzhaigou in Sichuan Province, Xueli Mei Mountain in Yunnan and of course snow and ice festivals in the Northwest. In addition to these well-established winter scenery destinations, a few others are in development, such as Bipenggou and Miyaluo scenic parks, also in western Sichuan.

The staggering increase of Chinese tourists visiting these sorts of tourist destinations has increased the demand for winter apparel sales and is likely to continue doing so as China’s middle class continues to grow.

[This promotional advertisement shows the government’s ambitions to increase interest and participation in winter sports, notably skiing in Shaanxi Province in this case. Source – 竞报体育整理]

The Chinese government supports winter sports

In combination with these other factors, the growth of China’s winter apparel market is being driven by none other than the Chinese government. Perhaps in conjunction with policies to increase China’s participation in football, Chinese government support for winter sports is most likely aimed at increasing China’s rankings in high-profile international games. That being said however, there is great potential for this government support to directly benefit foreign companies.

The government’s support for winter sports in China is manifesting itself in a few different ways, but most notably through policies, infrastructure and programs. Policies that will encourage the growth of this market include preferential tax and financial policies aimed at developing the winter sports market in China. In addition to the physical construction of winter sporting infrastructure, the government has also taken measures to set aside land for winter sports through land use and zoning policies. Finally, the government has created various programs that stand to increase the size of the winter apparel market, notably educational and youth programs that are designed to raise interest in winter sports among children.

Regional level governments support winter sport facilities in China

In addition to these ambitious national-level goals, regional governments have been pushing their own agenda in increasing the size of the market, such as in Jilin Province, where the provincial government has been working to construct world-class winter sports facilities.

Since the Chinese government has such a strong mandate and almost always achieves its goals, government support in these three categories is very likely to push up interest, participation and spending in winter sports and winter apparel by Chinese consumers. Foreign companies should take note.

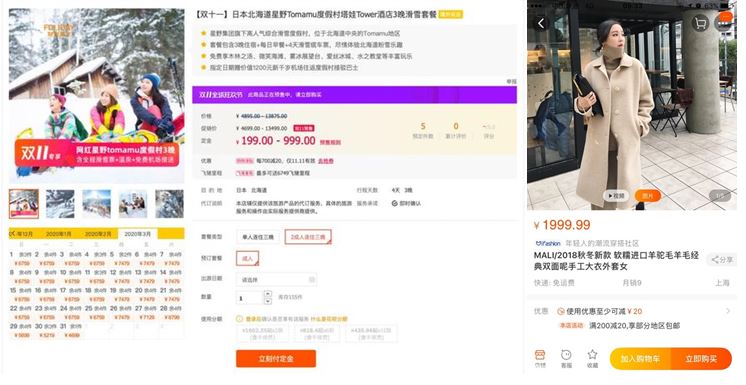

[Screenshots of the oversized effect Internet celebrities have on markets in China, in this case the winter apparel and winter sports market in China. Source – Taoabo]

What is the takeaway for foreign companies in regards to China’s winter apparel market?

With China’s increasingly important presence in international events and media, now is a crucial time for foreign companies to look at new and promising markets within China. As multiple studies have shown, the demand for winter sports apparel in China has reached a liftoff point as China’s middle class has come of age. Despite being slow to the game of market share, China’s winter apparel market has the potential for strong growth during the next decade.

The takeaway for foreign companies is that the 2022 Winter Olympics in Beijing will increase sales of winter apparel and winter sports equipment not only leading up to the games, but also for years to come following the event. In addition, winter sports expositions in China will complement the Olympic Games by increasing interest in winter sports in other socioeconomic groups. Next, the growth of winter scenery tourism in conjunction with the growth of the Chinese middle class was and will continue to be a sustaining drive in the demand for winter apparel in China. Most importantly, the trend of winter sports being seen as a luxury sport by Chinese youth is going to be a boon to this market as Chinese consumers continue to enjoy higher levels of disposable income.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes