Adidas in China: Reaching low-tier cities with high-tier products

Background of Adidas in China

The company Adidas Sports (China) Ltd entered China and built headquartered in Shanghai in 1997 with a core business of men’s and women’s sportswear and footwear. The company also entered the market of children’s wear in 2001. Adidas in China is one of the most popular athletic apparel brands, and is equal footing with Nike.

In 2019, the net sales of Adidas were shared by Footwear (57%), apparel (38%) and hardware (5%). Adidas represented 1.9% of the overall Chinese apparel market, equal to Nike.

Adida’s expansion into China

The Chinese market of Adidas is blooming. According to statistics, Adidas has a national distribution network of around 12,000 stores in China, reaching in more than 1,200 cities and expects to accelerate its expansion to 2,400 cities. It was stated to have 1000 more stores in China in 2019. Adidas is not successful worldwide but one of his important metrics is the speed of the sales growth in the Greater China. In this country including Hong Kong, Macau, and Taiwan, the German sportswear group has kept its growing trend. During the third fiscal quarter of 2018, the growth sales surpassed 23%, which indicates the 11th successive fiscal quarter with above 20% growth rate.

In fact, Adidas witnessed a slump before sustainably growing in the Chinese market. While in 2008, Adidas had 14.9% market share, but it plunged to 9.6% in 2009. Adidas run a new campaign ‘Way through 2015’ at that moment. It aimed to expand to lower tier Chinese cities and opened more stores. The stores were designed to different needs. For instance, the tone of Adidas Women is gentle and soft. The strategy switched focus from ‘sell in’ to ‘sell through’, which means that Adidas aim to not only sell products to distributors but also empower them to sell product to the final-consumers.

Production of Adidas in China

Around 25% of Adidas’ products are manufactured in China. Although Adidas has been transferring some production capacity to countries like Vietnam due to rising labor costs, China still is an indispensable production base for the company, according to a recently conducted market research study in China.

Market Position of Adidas in China

Despite the market boom, international companies are being challenged by local rivals in the Chines market. According to Euromonitor, Adidas takes up 19.5 % of the total market retail value, followed by Nike at 19.0%, Anta at 11.1% and Li Ning at 6.1%.

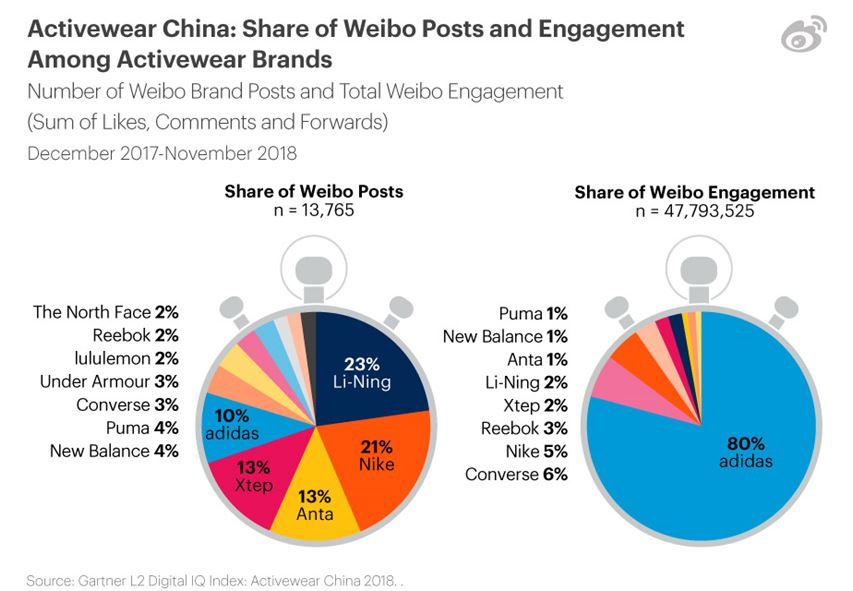

According to the research, Nike was the third most popular footwear brand in 2018 in China. Adidas earned 80% of all Weibo engagement on activewear brand accounts in the one-year period studied. This was mainly generated by posts featuring its brand ambassador Qianxi Yiyang, a member of the superstar boy band TFBoys.

Strategies of Adidas in China

- Product and pricing strategy: Instead of competing with low prices alone, Adidas sought to expand into lower tier segments by enhancing both products and pricing.

- Multi-brand strategy: Adidas used different sub-brands to improve different aspects of the brand. For instance, the company’s “Originals” line strove to increase retail value sales share to enhance awareness of the brand. While Adidas NEO targeted teenagers of 14-19, priced about half lower than Adidas Originals, and helps the company penetrate into lower tier cities.

- Sponsorship strategy: Adidas increased its brand awareness by sponsoring certain sports events and activities.

- Innovation Product Strategy: Adidas actively released new products to attract consumer attention. For example, NEO Label released in 2011 targeted at younger customers by combing sports and fashion elements.

- Internet Strategy: Adidas entered the Chinese e-commerce market in 2010 by launching the online store, tmall.com. Adidas sought to reach consumers of lower tier cities and further develop its distribution network.

- Cooperation with Chinese designer to launch new products, e.g. Angel Chen.

- Hunger marketing: Yeezy series were greatly applied with the hunger marketing strategies. It was sold in limited amount; thus, a large number of Chinese consumers were queuing for hours just for a pair of Yeezy.

- Brand ambassador: Adidas chose some Chinese celebrities to be the brand ambassadors, such as Qianxi Yiyang, Yifei Liu, Lun Deng and etc. It raised a high engagement between the brand and the consumers in social media platforms. Each topic regarding the announcement of the brand ambassador reached more than 100 million views. The hottest reached more than 1 million discussion in Weibo.

Adidas during COVID-19 in China

Affected by the epidemic, the offline retail sector was worst hit in China. Adidas’s revenue in Greater China is decreased by about 85%, comparing to the same period last year.

- To stay presented, Adidas China put more focus on its online strategies. On February 20, 2020, Adidas hold its first online product announcement in Taobao live. It had more than 2 million views and gained more than 3 million likes. 6000 sneakers were sold in the first 10 minutes.

- Discount: Adidas gave both online and offline discount to boost sales.

- Online work-out lectures: On its official Wechat mini program, Adidas provided online work-out lectures for free to maintain the interaction with their consumers. Moreover, consumers can buy products directly from the mini program.

Future Goals and Directions of Adidas in China

- Adidas moved its Asian Pacific headquarters to Shanghai in 2019. According to James Grigsby, VP of Cities and Marketplace Transformation, Shanghai is an important city for Adidas which empower Adidas to build both domestic and international brand image.

- Sales of the e-commerce channel increased by 36% to 2 billion euros. Adidas is seeking for a balance between online and offline distribution channels.

- Due to the epidemic, basically all sport events were cancelled or postponed. Adidas should look for a platform to stay its presence and talk to the consumers.

- The company’s target annual growth of 15%-20% in China in the coming years (according to a market research in China).

- Adidas understand that a majority of their consumers (90%) would first approach digital platforms to get to know the products. The digital strategies would always stay relevant for Adidas.

- Back to 2018, Simon Peel, global media director of Adidas confessed that they over-invested in digital advertising. 77% of budget was spent on performance while only 23% on the brand. A commercial published on April showed a group of Chinese entertaining celebrities just within 60 seconds. Adidas was accused of putting too much effort in entertainment marketing and forgetting to emphasize its brand core value. Adidas might need to find its sweet spot to leverage entertaining marketing in China.

Today developers, designers, and managers are part of its creation center based in Shanghai, with constant new product concepts especially made for the Chinese consumers. For the group, it is a success that will be continued. Indeed, the group expects China to contribute to a large part of their global sales growth. They will then extend their sales from lower tier cities since they are more and more attracted to sportswear not only for fitness but for daily casual wear.

For more information and insights on brand strategy in China, follow us on LinkedIn and on Wechat by scanning the QR code below

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast