Marketing strategies of foreign cosmetics brands in China

Foreign cosmetics brands account for more than half of cosmetic market in China

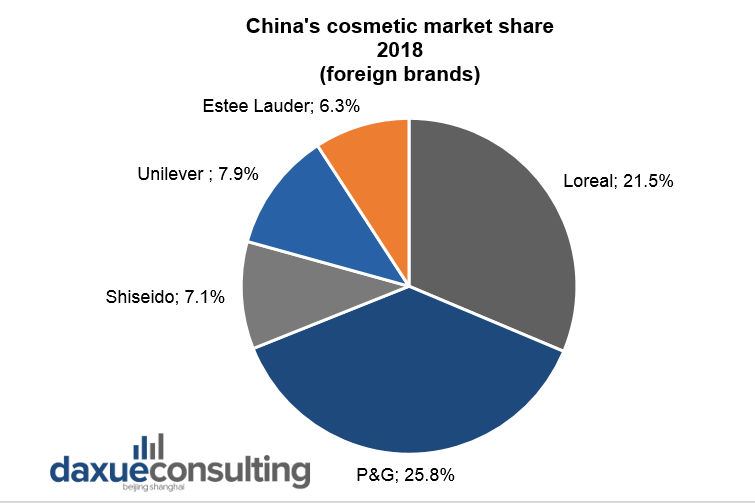

China is the second largest cosmetics market in Asia and the fifth in the world. It has been a profitable paradise for foreign cosmetics brands for a long time. Foreign cosmetics brands in China own around 70% of the market. In 2018, P&G and L’Oreal had the biggest market share in China, with 25.8% and 21.5% accordingly. The American Procter & Gamble, the French L’Oreal, The Japanese Shiseido, the Anglo-Dutch Unilever and the American Estee Lauder are the key players in China’s cosmetic market.

Data Source: qianzhan, China’s cosmetic market share 2018 (foreign brands)

Chinese consumers’ behavior is evolving very quickly, due to the huge economic growth. Hence, the middle-class in China are more sensitive to their life quality and health-awareness. Therefore Chinese consumers have been more interested in using overseas products which have a long history and more refined products.

Marketing strategies of foreign cosmetics brands in China

L’Oreal is a huge success among foreign cosmetics brands in China

L’Oreal shows rapid growth in Chinese e-commerce

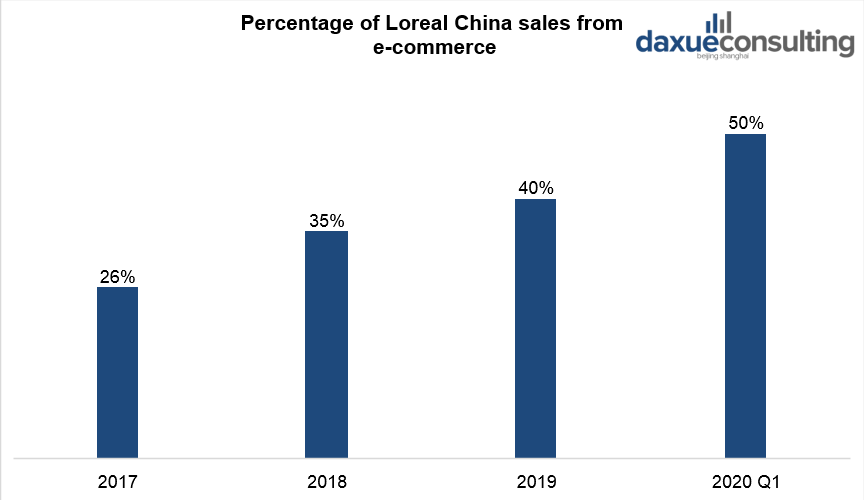

The French brand has grown ten-fold on e-commerce since 2011. It is the leader on e-commerce in China, which is the fastest growing channel for L’Oreal. In 2020 e-commerce already makes up 50% of L’Oreal’s China sales.

Data Source: L’Oreal Group Annual Reports, Percentage of Loreal China sales from e-commerce

The next step for L’Oreal is new retail: the combination of the offline and online channels. It includes such technologies as augmented reality, virtual reality, and artificial intelligence. Today L’Oreal in China already provides skincare diagnostic supported by artificial intelligence for Vichy on Tmall.

Foreign cosmetics brands actively use KOLs in such online platforms as WeChat and Weibo. For example, many celebrities like Li Gong, Zhilei Xin (Famous Chinese actresses) promote L’Oreal cosmetics among Weibo users.

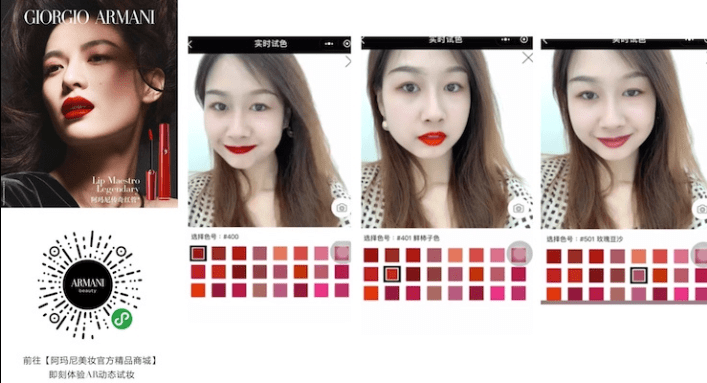

Personalization and co-branding are the key cosmetics marketing strategy in China for L’Oreal

More and more companies focus on offering personalized experiences for their customers. To create a more customized digital experience, L’Oreal has integrated technology to let people “try on” lipsticks by pointing their smartphone camera at themselves. The L’Oreal-owned Giorgio Armani make-up brand became the first luxury line to use the technology on WeChat. WeChat users can order them from Giorgio Armani Beauty’s mini-program shopping site. Users also can screenshot, save and share images as well as view before and after images to elevate the consumer shopping experience.

Source: Cosmetic Design Asia, Loreal Group has launched of its Augmented Reality (AR) make-up try-on application ModiFace in China

L’Oreal’s quick rebound after COVID-19

The French brand reported that its China sales have seen signs of recovery since the COVID-19 outbreak. Despite overall sales for the quarter shrinking globally, L’Oreal China achieved high growth in March 2020. The CEO of L’Oreal Group, Jean-Paul Agon highlighted that the company’s performance in China was “remarkable”. “China was able to close the quarter at plus 6% which is pretty amazing when you think about the difficulty that they had due to the pandemic.” L’Oreal China recovered quickly due the early restoration of operation and wide usage of the online-to-offline model. Additionally, during the Women’s Day Festival on March 8th, 2020, L’Oreal group launched an online shopping event in China to trigger sales.

In March 2020 sales of L’Oreal Group in China became positive again. That proves that using of online-to-offline model and social networks promotion were successful marketing strategies for L’Oreal in China, and especially boosted their sales through the tail end of the pandemic.

Estée Lauder tops the list of 100 most prestigious cosmetics brands in China

Estée Lauder targets young Chinese millennials

The beauty brand targets young millennials to tap into China’s booming cosmetics and personal care industry. Its shift away from older consumers is part of its long-term investment strategy in the country. Estée Lauder’s cosmetics marketing strategy in China is to position itself as millennial-focused. It quickly identified that tapping into the high spending ability of young Chinese consumers with specialized luxury lines is essential for its success.

To gain a clear, competitive edge over its rivals, it redesigned its marketing campaigns. For example, Estee Lauder in China increased digital engagement, leveraged social media platforms such as WeChat and Weibo. Additionally, like many other foreign cosmetics brands, it collaborated with the local celebrities.

Estee Lauder focuses on digital strategy

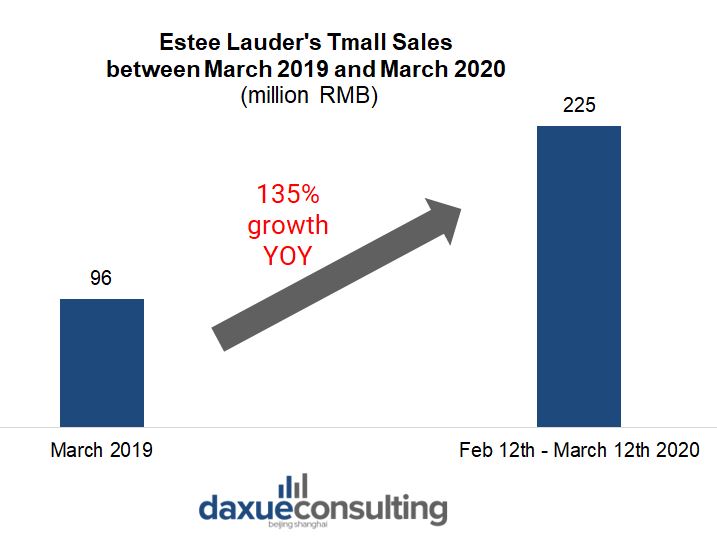

E-commerce in China has developed rapidly and is a popular way to shop for most Chinese. Thus, it took a specialized online strategy to adapt to the Chinese market. E-commerce represents approximately 30% of Estée Lauder’s business in its top markets. In 2014, the brand became one of the first high-end cosmetics brands to enter Tmall. They built a professional team with 50 persons to focus on the brand’s Tmall store and independent e-commerce shop. In 2017, the sales revenue of Estee Lauder Group in China had 40 percent growth. Notably, e-commerce accounted for 50 percent of that increase. Also, as a part of its cosmetics marketing strategy in China, Estee Lauder opened online stores for its sub-brands. It helped to bring more consumption to the Group.

Data Source: WalkTheChat Analysis, Evolution of Tmall flagship sales between March 2019 and March 2020

KOLs and special products push the sales of Estee Lauder in China

Estee Lauder invests heavily in digital marketing, social media, and KOLs. For example, Yang Mi, a famous actress in China, is Estee Lauder’s brand ambassador. Her first cooperation with Estee Lauder in February 2017 earned over one million shares on Weibo and brought over 500 percent more sales. Meanwhile, some popular KOLs in China helped to increase consumption. In 2019’s double 11 presales, Chinese actress Li Jiaqi sold over 0.4 million Estee Lauder’s Advanced Night Repair in a short time.

Estee Lauder’s matrix covers almost all categories of cosmetic products and price ranges, reducing the risk that customers switch brands as their preferences evolve. Notably, Estee Lauder Group launched a brand called Osiao in Hong Kong in mid-October, 2012. This brand is specially designed for the skin of Asian people.

P&G’s cosmetics marketing strategy in China highlights premium innovation and product mix

P&G launches a premium skincare brand in China

Unlike other top foreign cosmetics brands in China, Procter & Gamble (P&G) decided to put focus on the premium segment. In 2019 this American company brought a premium skincare brand called Oriental Therapy to the Chinese market. Chinese herbal medicine inspired the company to create this cosmetic line.

What makes it especially unique is that it meets skin’s different needs during the four seasons. According to Oriental Therapy’s Weibo post, the beauty line focuses especially on Chinese women. The brand is now available via Tmall, WeChat, and Xiaohongshu shopping platforms. P&G believes that Oriental Therapy will fill the gap P&G has in its beauty offering in China. One of its key products, Springtime Hydrating Essence costs 450 RMB or 65 USD. The brand’s skin-care sets cost between 740 and 1140 RMB, or 107 to 165 USD.

Source: Weibo, Premium skin-care brand Oriental Therapy for China

However, P&G faces a lot of competition among foreign cosmetics brands. For example, companies like Estee Lauder and Shiseido are also upping the ante through launching new brands including DARPHIN and D-Program.

P&G uses Alibaba to sell in China

To expand its e-commerce P&G has turned to Alibaba Group, which operates the country’s largest online marketplaces. Alibaba also offers digital marketing solutions and access to a huge audience via its media ecosystem, including Alibaba-related companies such as video-streaming site Youku and the Twitter-like Weibo microblogging site.

“E-commerce also plays a significant role in brand building, which is changing P&G’s century-long brand-building model.” – says Jasmine Xu, the company’s vice president for Greater China e-business and branding. Oriental Therapy has also opened a flagship store on Tmall, where it offers products in different combinations.

China is the second biggest market for Shiseido

Shiseido adopts cooperative cosmetics marketing strategy in China

In 2020 the Shiseido Group opened its first Beauty Innovation Hub outside of Japan at its flagship space in Shanghai. Shiseido Beauty Innovation Hub represents a new way of working to drive consumer-centric solutions in China. At this space, Shiseido plans to collaborate with Chinese startups and disrupters, and create innovation which will deliver true value. Cooperation and localization, rather than head-on confrontation, is the strategy Shiseido takes. The Beauty Innovation Hub aims to work with local startups in the extended beauty space. On top of this, Shiseido in China plans to experiment and create new businesses. The hub serves as an open innovation platform for Chinese startups, opinion leaders, area experts, media and scientists.

Source: Medium.com, Shiseido Beauty Innovation Hub in Shanghai

Shiseido in China joins Tmall to promote online sales

In 2018, Shiseido revealed their New Retail strategy. A part of this strategy is a platform they developed called the “Shiseido Official Beauty Star Product Hall”.

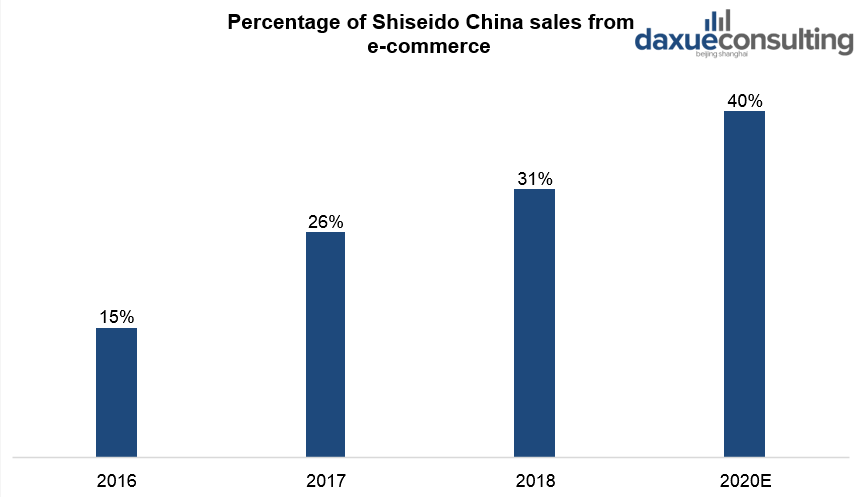

In 2019, Shiseido signed a partnership with Tmall. It helped to develop new products based on what Chinese consumers are searching for on Tmall. The first co-developed products, a ‘mild and refreshing scalp shampoo’ and an ‘essence oil for split ends’ will launch on Tmall under Shiseido’s hair and body care brand Aquair. Shiseido said it expects e-commerce to generate 40% of its China sales by 2020.

“Without a doubt, whether it be e-commerce or digital innovation, Alibaba is the leader. Alibaba is one of the most important strategic partners for Shiseido China as well as for the entire group,” said Fujiwara, Shiseido’s CEO.

Data Source: Shiseido Annual Reports, Percentage of Shiseido China sales from e-commerce

Mary Kay uses scientific innovation in China

Mary Kay China targets young consumers

As Chinese consumers are more and more informed about beauty, Mary Kay is facing the challenge of developing interesting products. “In China, beauty consumers demand for products and services are constantly increasing.

The current consumer trend of skin rejuvenation in China is strengthening, and the purchasing power of the 18 to 24 age group is rising,” said Katherine Weng, general manager of Mary Kay China. To cater to younger consumers, the company’s cosmetics marketing strategy in China is to create “bold and interesting” products. In 2019, it launched Pink Young brand in China. As company claims, “It’s the answer for today’s woman who wants to show her femininity along with her fierceness.”

In 2018, the company invested around $50 million in the Mary Kay Science and Technology Center, located in Shanghai. Additionally, the company sees the need to increase its online presence. It has launched a new channel which enables consumers to use WeChat to place orders with independent beauty consultants.

Mary Kay focuses on direct sales in China

Mary Kay is one of the world’s biggest direct selling enterprises of skin care products and cosmetics. Within a short time, Mary Kay China established its name among Chinese consumers and experienced steady growth in the country’s first-tier cities. Now, it has set up 35 branch offices across the country. When the company first began expanding beyond China’s big cities, its direct-sales model was new to consumers in China’s second- and third-tier cities.

Mary Kay has three key strategies. First, it drew up strict rules on how beauty consultants should conduct themselves and present Mary Kay products. Second, it developed advertising campaigns in a variety of regional print and broadcast media. Third, the management team established special training programs for consultants.

The sales force represents a competitive advantage. Consultants know their customers well. Such personal networks are vital because Chinese consumers tend to trust people with whom they have a good relationship. Their close relationships with relatives and friends would ease making follow-up visits to get feedback and introduce new products.

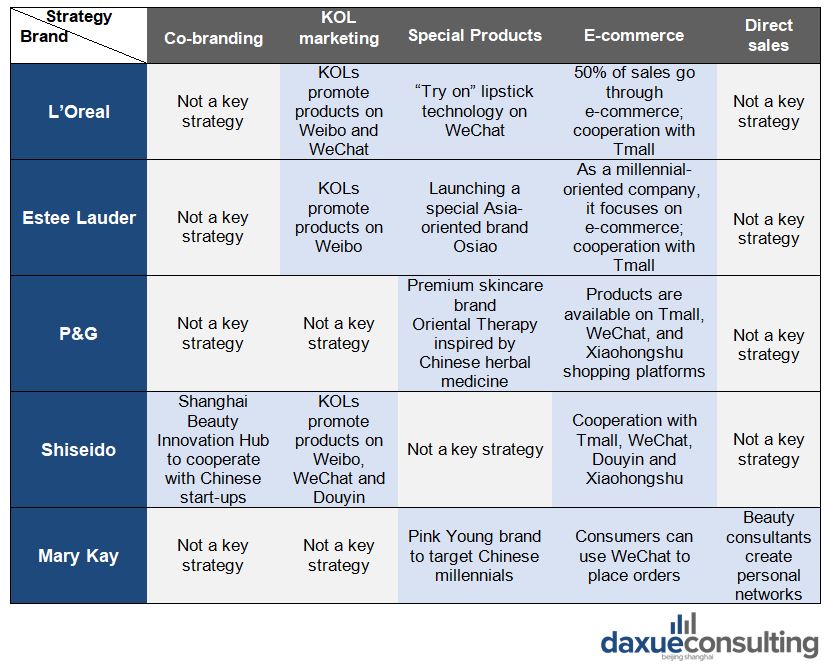

Summary of the marketing strategies of foreign cosmetics brands in China

Co-branding

Not many foreign cosmetics brands use co-branding as a key strategy. Co-branding helps brands “exchange” customers, and effectively expand their consumer base. As competition in the Chinese cosmetics market is fierce, such giants as L’Oreal or P&G have not shown interested in involving other brands for cooperation. Shiseido has another approach. It has its Innovation Center in Japan, where it also cooperates with other local brands. Thus, cooperation with the Chinese start-ups was a natural marketing strategy for this company.

KOL marketing

KOLs are popular social media users who can influence a wide audience. In China they usually post on WeChat or Weibo, but other platforms like Xiaohongshu can be considered depending on the target audience. Many foreign brands cooperate with them to expand their audience, especially among millennials. To gain new consumers and increase sales, L’Oreal and Estee Lauder chose this cosmetics marketing strategy in China.

Direct sales

Direct sales are a traditional channel for all foreign brands in China. However, as of 2020 most brands consider e-commerce as a key sphere for development. During the COVID-19 outbreak direct sales showed its vulnerability. Mary Kay is the brand which always had its special strategy of creating personal relations between beauty consultants and customers. Nevertheless, now Mary Kay in China is also considering using digital technologies to promote its products.

E-commerce

The target audience in the cosmetics industry is the post-80’s and post-90’s generations. They always keep up with the latest trends and care a lot about their appearance. One of the most effective ways to approach them is to find where they spend most of their time: online platforms and social networks. Most foreign brands widely use online methods to expand their influence in the Chinese cosmetics market.

Special products

Some foreign brands focus on a special approach to the Chinese market. They create products and sub-brands oriented on the Asian audience. It could be skincare products created specifically for Asian skin or inspired by the Chinese traditional medicine. That helps to increase customers’ loyalty and increase sales in the Chinese market.

Author: Valeriia Mikhailova

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

<iframe src=”//www.slideshare.net/slideshow/embed_code/key/naoF39ytNoyFpJ” width=”595″ height=”485″ frameborder=”0″ marginwidth=”0″ marginheight=”0″ scrolling=”no” style=”border:1px solid #CCC; border-width:1px; margin-bottom:5px; max-width: 100%;” allowfullscreen> </iframe> <div style=”margin-bottom:5px”> <strong> <a href=”//www.slideshare.net/DaxueConsulting/the-cosmetics-and-personal-care-market” title=”The cosmetics and personal care market in China by Daxue consulting” target=”_blank”>The cosmetics and personal care market in China by Daxue consulting</a> </strong> from <strong><a href=”https://www.slideshare.net/DaxueConsulting” target=”_blank”>Daxue Consulting</a></strong> </div>