Food delivery in China: A rapidly expanding tech battleground

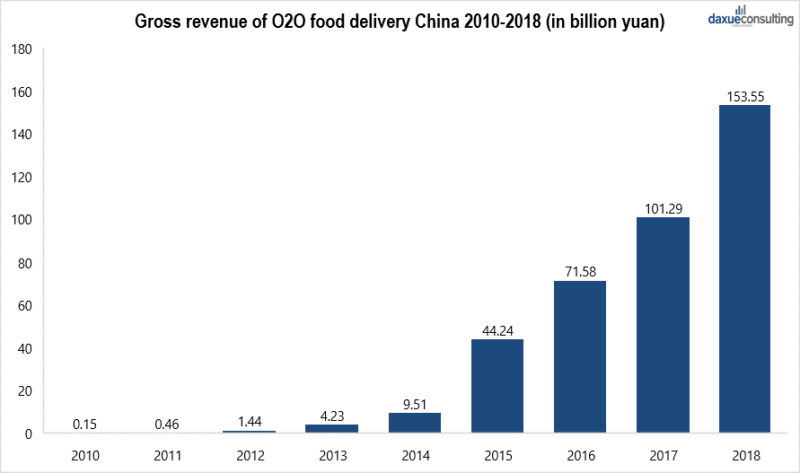

The size of O2O catering market in China is growing as more Chinese order delivery for their meals. In 2018 revenues of online food delivery in China reached over 34 billion USD. The same year, online food sales rose by 36.8%. According to a recent report from the Qianzhan Industry Research Institute, the size of the fresh food e-commerce market in China soared significantly from 4 billion yuan ($579 million) in 2012 to 139.13 billion yuan ($19 billion) in 2017. In 2019, the overall transaction value of food delivery market in China reached 195.29 billion yuan ($27 billion), and the number of users was nearly 416 million. The offline-to-online development of the catering industry has advanced due to innovations in online marketing, online food ordering, customer reviews, takeaway deliveries and other services.

[Data source: Statista, ‘Gross merchandise value of the online-to-offline food delivery market in China from 2010 to 2018 (in billion yuan)’]

Digitalization: more and more restaurants use mobile apps to engage with customers

The catering market in China has grown 700-fold in the past 40 years hitting around 4.2 trillion yuan in 2018. At the same time, the number of dining facilities jumped from fewer than 120,000 to over 4.65 million nationwide. Fast-paced development of the Internet and artificial intelligence technologies in China contribute to the digitalization of catering industry. In 2017, over 2.7 million restaurants were providing food delivery service through one of the main Chinese e-commerce platform Meituan Waimai. Another popular platform, Ele.me, the rival of Meituan Waimai, has covered 2,000 cities across the country with 1.3 million restaurants.

Whether a restaurant is upscale, fast food, traditional, or western, being listed on food delivery apps is a must in China. It gives restaurants in the Chinese market new profit sources, service awareness, and new consumers. App operations can be so profitable that some restaurants operate only for online delivery service.

O2O catering: a rigid demand from young generation

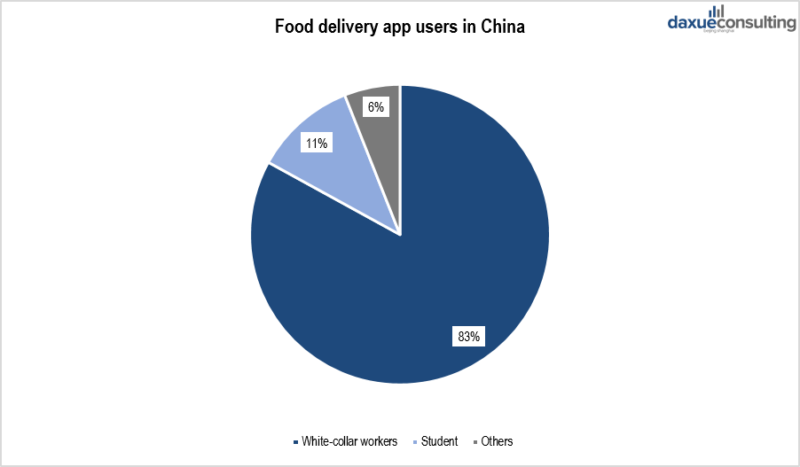

Consumers of the online catering industry are overwhelmingly young, with 75% between ages 18 and 39. From the perspective of occupation, in 2015 the food delivery app users were mainly white-collar workers, students and blue-collar workers, accounting for 91% of the total.

[Data source: iiMedia Research, ‘Food delivery app users in China’]

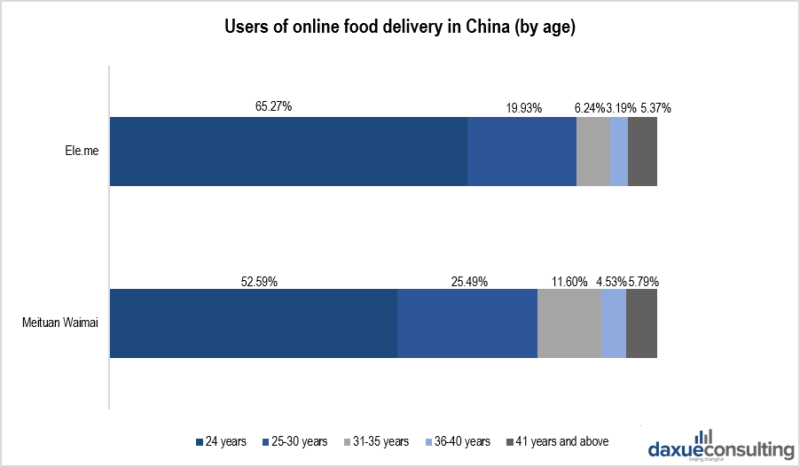

O2O food delivery in China has a rigid demand from the young generation who spend most their day at work or studying. In 2018 people under the age of 24 were the main consumers of online catering market in China. Among them, users aged 24 under account for 65.27% of the Ele.me platform and 52.59% of Meituan Waimai. They choose to order delivery food when they are at work (52.4%), unwilling to go out (51.4%), lack of time/skill to cook (39.8%), attracted by sales promotions (34.5%), experiencing bad weather (26.0%), fond of the flavor of delivering food (18.8%), and taking a habit (12.9%).

[Data source: iiMedia Research, ‘Users of online food delivery in China’]

Growth drivers of online food delivery in China

With the improvement of living standards, demand of the online food delivery industry is also getting stronger and stronger, making the revenue of online catering market increase year by year. Goldstein Research analyst forecast that the China online food delivery market size is set to reach USD 48.1 million by 2025, showing the annual growth rate of 7.2%. China generates one of the largest revenues in the world – $45,909 million in 2020, while global revenue from online food delivery is US$122,739 million.

Convenience and low price

One of the key players in O2O catering market in China – Meituan Waimai claimed it delivered 6.4 billion food orders in 2018, which is about 60 percent more than in 2017. Those orders were worth $42 billion in total, meaning the average order was $6.50. Cheap labor makes online food delivery in China affordable. Delivery usually costs around 5-6 RMB (less than $1) dollar on average and can often be free for orders of over 20RMB (Around $3). For comparison, the average order value in online food delivery company GrubHub from the US, is 32$.

As the main consumers are students and workers, convenience is a decisive factor for choosing online food delivery. E-commerce giants such as Alibaba thrive in the Chinese grocery market because they are convenient. Due to the high frequency at which groceries are needed by consumers, swift delivery and convenience are key to the business.

Traditionally, neighborhood food environment indicates approximately 1.6 km or 20-min walk from home, workplace, or school. With the newly developed O2O food delivery service, the range of food service could reach up to 10 km. It largely changes the dining experience and greatly expands the availability of food. People could easily get access to plenty of foods far away from their neighborhoods, including healthy food like fruits and vegetables.

Food delivery in China: a tech battleground

With the advancement of technology, food delivery platforms improve their performance, making food ordering more convenient for customers. They collect information from various restaurants and shops and allow customers to track order status, delivery status, and receive personalized recommendations.

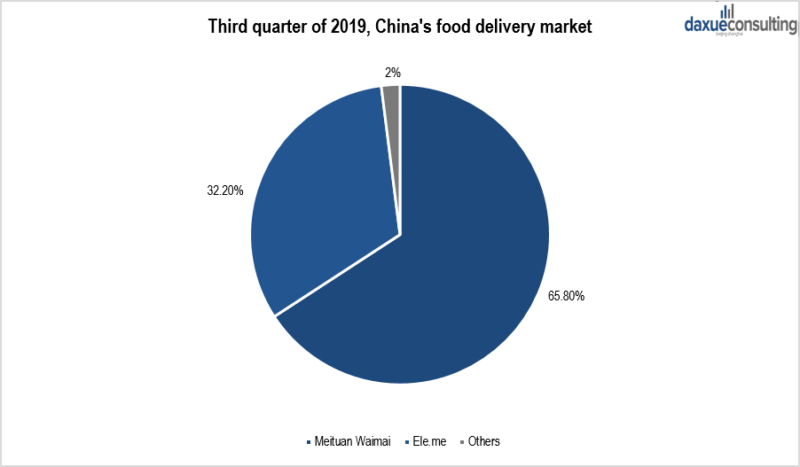

The fight for supremacy in food delivery in China is happening between two biggest companies — Ele.me and Meituan Waimai. They are backed by China’s duo of tech titans -Alibaba and Tencent, that are worth a combined $900 billion.

By the end of 2019, the market share of Ele.me and Meituan Waimai together accounted for 98% of the entire online food delivery market in China. Meituan Waimai dominates with 66% share of the market, and Ele.me has 32% share while the others account for 2%.

[Data source: qianzhan, ‘China’s food delivery market, Q3 2019, Meituan vs. Ele.me market share’]

Ele.me: backed by online giant Alibaba

In 2019 the revenue of Ele.me from food delivery and takeaway catering accounted to 6.18 billion yuan, it increased by 137% from the previous year. The mother company of Ele.me – Alibaba, claimed that increase in the number of orders happened due to the improvement of distribution operation efficiency. It includes the ability of Alibaba to integrate Ele.me with Koubei (Yelp analog) and Alipay (online payment platform). Strategic partnership with Alibaba Cloud provides Ele.me with better understanding of eating habits of their customers, while AMap (acquired by Alibaba) helps Ele.me to plan delivery routes. Besides, restaurants which have high customer feedback and big orders volume may get funding opportunities through Ant Financial (subsidiary of Alibaba).

Statistics from Ele.me in 2018 also revealed the increasing trend of fresh products delivery and the transaction volume jumped 10-fold from the last year. More than 33% of consumers who buy fresh vegetables through the app are young people from 25 to 29. The number of middle-aged and elderly Chinese customers who buy fresh vegetables on Ele.me has increased by more than 500% in 2018, comparing with the same period of the previous year.

Meituan Waimai: backed by online giant Tencent

In contrast, Meituan online food delivery revenue was 12.8 billion yuan in 2019, it increased by 44.2% from last year, what is more than double Ele.me’s revenue. In addition, Meituan’s food delivery transaction value increased by 36.5% from 2018 to 93.1 billion yuan.

Being backed by internet giant Tencent, Meituan Waimai managed to build a diversified system, which links merchants from Meituan with users of QQ, WeChat and Dianping (also analog of Yelp). In January 2019, Meituan Waimai officially launched a service based on Meituan APP where customers can buy vegetables and fruit without leaving home.

How COVID-19 affects the O2O catering market in China

The sudden outbreak of coronavirus in 2020 has an impact on the operation of the catering industry. The food delivery market in China is expected to see high growth from the end of February to the end of April. More and more customers choose to order food home instead of eating out.

The Meituan Research Institute conducted a questionnaire survey on the impact of the new COVID-2019 epidemic on China’s catering merchants in early February 2020. It showed that 69.3% of the food and beverage merchants stated that the business loss caused by the COVID-2019 epidemic was very large; 25.8% of the food and beverage merchants said that the losses were large; only 4.9% of the food and beverage merchants thought that the losses were small or had little impact. In early February 2020, a telephone survey of catering merchants (a total of 33,000) showed that nearly 30% of the surveyed merchants are gradually turning to online food delivery operation.

The survey shows that among the merchants that were in business in early February 2020, more than 70% of orders from their restaurants and shops accounted for online food delivery. In the short term, online food delivery has become an important driver for catering businesses to survive the crisis. In the long run, the epidemic has accelerated the digitalization of the catering industry.

Fresh food delivery in China: COVID-19 drives growth

As Chinese people are trying to avoid possible infections during a new coronavirus outbreak, demand for fresh food, especially through e-commerce platforms, has skyrocketed. JD Fresh, the fresh food division of Chinese e-commerce giant JD, reported that orders have increased by 215% in the first nine days since Lunar New Year’s Eve (January 24 this year). During the outbreak, online orders at Alibaba’s fresh food chain Hema Fresh also increased significantly. Affected by the epidemic, many agricultural products in China have become difficult to sell. E-commerce companies such as Alibaba and JD.com have launched a series of activities to promote online sales. From February 6 to February 12, 12,000 tons of fruits and vegetables were sold through Alibaba’s activities.

During the January and February 2020, the turnover of the fresh food delivery app Missfresh increased by more than 300% from 2019. According to the company’s data, the transaction volume per customer jumped from about RMB 85 to RMB 120 ($17.1). Missfresh’s vegetable supply increased from 500 tons per day before the Lunar New Year to 1,000 tons in early February.

The epidemic created unprecedented opportunities to encourage customers to move daily necessities from offline channels to online channels. In the long run, this will drive the development of the entire supply chain system and more advanced online merchandise sales.

Using of new technologies in catering industry: Robot-delivery service

[Photo source: Handout, ‘A photo of Meituan’s unmanned delivery vehicle’]

During the epidemic, online food delivery demonstrated great advantages. “Contactless delivery” ensured three meals a day for people in locked-down cities, including delivery of fruit and vegetables for urban residents in order to prevent and control the epidemics.

In January 2020 Meituan Waimai announced in-app feature for contactless delivery, allowing the courier to leave an order in a convenient spot for the customer to pick up without interaction. So far Meituan Waimai claimed that contactless delivery has been launched in 184 cities across the country and is expected to cover the whole country. Customers can get contactless delivery in two ways, one is to remark the information directly on the order page, and the other is to communicate directly with the deliveryman to negotiate the place of getting order. Another food delivery service giant Ele.me announced a deployment of delivery robots to send meals to rooms in some quarantined hotels.

As some food enterprises gradually recover their food delivery services, hoping to compensate some financial losses, contactless food delivery in China growth will last for a period of time.

Prospect and Competitive Advantage in Online Catering Industry

As a newly developed e-commerce sector, food delivery in China has much potential to develop further. It is adapting the new 020 (online to offline) e-commerce business model, making the internet the front desk for offline transactions. In order to set up a sustainable brand, the site must have a standardized logistics system to support itself and to fulfill customers’ needs. This means to enter this business is not such an easy thing. As history reveals, sustainability and product advantage have always been the core competitiveness of a company.

If you have any questions or would like to discuss your online catering strategy, feel free to contact our project managers at dx@daxueconsulting.com.

Author: Valeriia Mikhailova

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes

![[Podcast] China paradigm episode #9: How to successfully run a restaurant in China](../wp-content/uploads/2018/11/Bonnefoy-Youtube-Cover-1-150x150.jpg)

Great post you wrote dear. I really appreciate your wisdom and command on your selected topic. In addition, I have a small business ideas for your visitors which is Snack Box Delivery . By doing Snack Box Delivery people can make a smart way of income as part time or full time.

Thank you

Best Regards,

Hitesh