Tech Gadgets: The Poster Child of the Chinese Market for Alzheimer’s

Breaking down Challenges in the Chinese Market for Alzheimer’s Disease

The Chinese market for Alzheimer’s disease–a medical condition estimated to cost the country $1 trillion by 2050, according to a 2016 report published on EBioMedicine –has long been stuck in a jam of medical bottlenecks, adverse cultural norms, and a human resource deficit. Thanks to new government policies, however, innovative elderly care devices may be the industry to finally push the healthcare market in China to its full potential.

Alzheimer Disease International (ADI) reported that, as of 2015, 9.5 million people in China have been diagnosed with Alzheimer’s. Moreover, Peter Fuhrman of China First Capital, an investment bank, wrote that this figure may well account for just half of all cases of the disease in China, since cases regularly go undiagnosed.

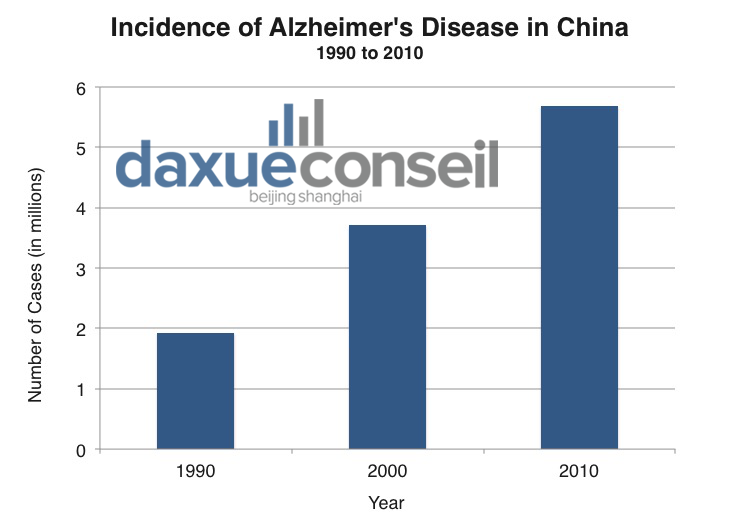

According to a 2013 report published on The Lancet , a medical journal, there were 1.93 million reported cases of Alzheimer’s in China in 1990, 3.71 million in 2000 and 5.69 million in 2010. Annually, another million or so cases of the disease have been diagnosed in recent years, potentially summing up to more than 45 million cases by 2050. Approximately half of all Alzheimer’s patients in the world will be found in China by 2050, Fuhrman reported, representing an enormous senior market in China.

Incidences of Alzheimer’s disease in China have steadily increased over the past years. Source: Daxue Consulting with data from The Lancet.

This prevalence of Alzheimer’s in China is, inevitably, a reflection of the country’s aging population. The rise of Alzheimer’s may also compound extant geriatric issues in China. In January 2017, the state-owned publication Chinadevelopment.com.cn (中国发展网) reported that China is bound to see its population above 65 years old increase from one hundred million in 2005 to 329 million in 2050. As of 2014, there were already 212 million people in China aged 60 and above––a number comparable to the total populations of Germany, France, and the UK combined––according to estimates by the Ministry of Civil Affairs of the People’s Republic of China (中华人民共和国民政部).

[ctt template=”2″ link=”5cA6W” via=”yes” ]As of 2014, there were already 212 million people in #China aged 60 and above. #seniors #nursinghome @DaxueConsulting http://bit.ly/2HZRMTA.[/ctt]Daxue Consulting has conducted comprehensive market research specific to the Alzheimer’s caregiving industry per the request of a client, recognizing a paucity of quality treatment centers in China, including nursing care facilities. Through extensive desk research, expert interviews and client surveys, we have identified key trends and strategies necessary to navigate the Chinese market for Alzheimer’s disease.The following article is an overview of industries pertaining to Alzheimer’s medication, caregiving needs, and technological solutions.

The Medical Industry: Sprouted, but Stunted

Craving drugs, but not treatment

In 2015, China Medical Economic Net (医药经济报) reported that the anti-Alzheimer’s drug market in China may be as large as $2.9 billion. Across a survey of sixteen cities in China, the report found that the Chinese pharmaceutical market for Alzheimer’s had grown 8.65 percent between 2014 and 2015. In fact, according to Daxue’s market research on China’s healthcare market, the demand for drugs in this category has been growing rapidly for the past ten years, and is expected to grow into the next five years.

Treatment centers dedicated to Alzheimer’s, on the other hand, have barely even begun in China as of 2017. The same industry is already worth $250 billion in the US, Fuhrman wrote. Furthermore, at “The Future Trends of Ageing 4.0” conference, China health services expert Olivier Milcamps said that there are currently less than two hundred treatment center beds in China dedicated to Alzheimer’s patients. The USA, on the other hand, already has more than 73 thousand beds in specialized treatment centers, according to Milcamps. Resultantly, China lags behind the USA and other developed nations with respect to resources for the treatment of chronic diseases, including Alzheimer’s.

A playground for domestic firms

According to China Medical Economic Net, in 2015, Oxiracetam (奥拉西坦) was the most popular anti-Alzheimer’s drug in the Chinese pharmaceutical market. Across a sample of sixteen Chinese cities in 2015, hospitals have purchased $163 million worth of the drug––a 7.84 percent increase from the previous year. Domestic providers of Oxiracetam occupy most of the market, with CSPC Pharmaceutical Group (石药集团有限公司) leading at a 35.30 percent share. It is followed by GuangDong Sencee Pharmaceutical (广东世信药业) and Harbin Medisan Pharmaceutical (哈尔滨三联药业) with a market share of 32.67 and 22.98 percent, respectively.

Oxiracetam, the most popular pharmaceutical for Alzheimer’s treatment in China. Photo Source: CSPC Pharmaceutical Group Limited. 石药集团有限公司(“石药集团”).

Vinpocetine (长春西汀) is also a popular treatment for Alzheimer’s in China. China Medical Economic Net reported that in the same sample of sixteen Chinese cities, hospitals purchased $68 million worth of the drug in 2015–1.29 percent more than they did the previous year. Concurrently, Henan Runhong Pharmaceutical (河南润弘制药股份有限公司) led the market for Vinpocetine, winning over 66.25 percent of the market. Hebei Shenyang Zhiying Pharmaceutical (河南润弘制药股份有限公司), with a 43.18 percent share; and Gedeon Richter Pharmaceutical (吉瑞医药有限公司), with a 21.98 percent share, were also major players in the market.

Alzheimer’s, a fact of life?

Although Alzheimer’s has become one of the most pressing healthcare issues in China, everyday Chinese still lack basic understanding of the condition. According to a 2014 report by Alzheimer’s Association, 80 percent of respondents to a quantitative study in China believed that Alzheimer’s symptoms are a natural reflection of the aging process. While many in the country know little concerning how to treat or prevent the disease, some even go as far as to discriminate against or abuse Alzheimer’s patients, the China Contemporary TCM Institute (当代中医药发展研究中心) stated on its website.

Oftentimes, the families of Alzheimer’s patients in China are unwilling to seek help during the early stages of the disease, when patients begin to display mild behavioral changes, Daxue Consulting Project Manager Yuwan Hu said. Traditional eldercare practices in Chinese society center on in-home treatment administered by close family members, according to Daxue’s research. As patients approach the later stages of the disease, however, they become increasingly aggressive. Only then do their families, powerless and unable to withstand more emotional damage, begin to seek the support of healthcare professionals.

According to Daxue Consulting Project Manager Yuwan Hu, a general lack of awareness regarding Alzheimer’s during the earlier stages has been a considerable hindrance to the disease’s care and medical services in China. Photo credit: Daxue Consulting.

The long wait for breakthroughs

Hopes for a cure at a standstill

At present, Alzheimer’s disease is considered to be irreversible, China Contemporary TCM Institute stated on its website. As recently as 2016, the American pharmaceutical Eli Lily and Company (礼来公司) announced that Solanezumab, its much-anticipated cure for Alzheimer’s disease, had failed a late-stage clinical trial. The company has invested $3 billion in Alzheimer’s research over the past 25 years, according to China National Radio (中央人民广播电台). Many speculate that the results for Solanezumab could trigger a “chill” on investments in Alzheimer’s research. Thus, although treatment options do exist for the disease, the pharmaceutical market for Alzheimer’s around the world is yet held back by setbacks in the search for a cure. But, as Daxue’s research revealed, treatment centers able to demonstrate the curative effects of their added value services and assets may be able to overcome this setback.

Treatment services, an uncharted territory

Fuhrman claims in his 2017 article that China severely lacks quality treatment centers for Alzheimer’s disease. He calls this shortage “one of the most significant market failures in China’s healthcare industry.” Most investments on geriatric care in China, across both the public and private sectors, have been dedicated to the construction of retirement communities, according to Fuhrman, adding that these infrastructures are of relatively low utility to elderly persons who may no longer be healthy and active. By comparison, assisted living in China for Alzheimer’s patients is an underdeveloped market segment.

“Universities should open postgraduate programs in cognitive disorders or Alzheimer’s disease,” said a China Aging Development Foundation (中国老龄事业发展基金会) spokesperson to China Daily (中国日报) in 2011. “And every comprehensive hospital should have an exclusive department that treats nothing but Alzheimer’s.”

The Senior Caregiving Industry: A Market Failure

China, unready to age

Patients with dementia, a category of brain disease encompassing Alzheimer’s, can live for as long as twenty years with the condition. About three years after diagnosis, though, patients begin to require around-the-clock care from Chinese geriatricians and other healthcare professionals. Despite the large number of Alzheimer’s patients in China, however, senior care services specific to the disease’s needs remain immature. Generic senior care facilities, on the other hand, have increased over the past few years.

Daxue concluded in its 2017 study on China’s urban eldercare market that the majority of treatment centers operate under business models focusing on tourism and leisure. The lack of a clear, specialized leader in the marketplace presents a window of opportunity for prospective entrants offering specialized care for dementia patients.

“Due to a lack of care offerings that specialize in Alzheimer’s disease for the mass market, much of Alzheimer’s-related care consumption in China is presently oriented towards ‘regular care’ instead of the more professional-oriented services,” Hu said.

As of March 2017, the U.S Department of State reported that the Chinese government’s 13th Five-Year Plan includes policies aimed at advancing China’ senior care system through the encouragement of private and overseas investment. China witnessed an explosive growth in the number of elderly care institutions nationwide. By 2015, that number was more than 116 thousand, representing a 23.4 percent year-on-year growth, the Ministry of Civil Affairs reported. Additionally, China is set to spend at least $1.54 trillion on senior care between 2016 to 2020, an increase of one percent year-on-year.

Alzheimer’s care, a rarity among nursing homes

The Alzheimer’s care market in China is mainly occupied by Orpea (欧葆庭). Orpea employs psychomotricity treatments that connect patients’ motor and cognitive skills, Fuhrman reported. Psychomotricity is an example of added value services that may help nursing homes and other eldercare facilities attract new customers, according to market research conducted by Daxue. The company’s facility in Nanjing, launched in 2016, has a total of 111 rooms and can hold up to 150 persons. At present, the facility provides long-term care (LTC) for about 40 seniors.

An Orpea facility in Nanjing. Photo Source: Js.ifen.com (凤凰网江苏频道)

An Orpea facility in Nanjing. Photo Source: Js.ifen.com (凤凰网江苏频道)

Aside from Orpea, Cascade Healthcare (凯健), Starcastle (星堡), and Cypress Garden Senior Living (雍柏荟) rank among the top ten foreign-owned senior care centers in China. At the same time, yet more foreign leaders of the senior caregiving industry have also set foot in the country. In 2014, for instance, the French Colisée Patrimoine Group (高利澤集團) entered into a joint venture with a Chinese business partner, the state-owned enterprise China Merchants Group (招商局集团), drawing plans to build more than 1000 nursing homes beds in China over the following five years. Meanwhile, the US-based Merrill Gardens (魅力花园) has also begun to operate their first project in Harbin.

A culture in transition

Nonetheless, it must be noted that nursing homes are a concept quite new to Chinese society, and have only just begun to gain acceptance in the country. Traditionally, Chinese citizens are required by law to take care of family elders. Altogether, the citizenry itself serves as an integral part of the country’s social security network, said the founder of China Senior Care Mark Spitalnik at a conference in June 2017. Chinese citizens may only enter the social welfare system on the condition that they have no family, no income, and no ability to work, Spitalnik added.

China’s elderly population could eclipse 300 million by 2050. Photo credit: Daxue Consulting.

This social welfare system based on China’s traditional culture of filial piety is a key reason why many families in the country refuse to send their elders to nursing homes. Instead, many elders were unnecessarily sent to hospitals. Over the years since he first entered the industry in China, however, Spitalnik believes the young and old alike increasingly see nursing homes as an acceptable form of geriatric care.

[ctt template=”2″ link=”Z_lF2″ via=”yes” ]At present, #China is short ten million #caregivers for the general #elderly population @DaxueConsulting http://bit.ly/2HZRMTA[/ctt]

Time, the only solution to the caregiving industry’s conundrum

China’s aging population has attracted numerous overseas elderly-care providers, but many of these businesses struggle to make a profit in the Chinese market. Many of these firms face considerable challenges along the lines of human resources, service affordability and consumer preferences, in addition to the complicated market entry process in China. Some elderly care providers, on the other hand, have found novel opportunities in the Chinese government’s focus on at-home caregiving and the concurrent rise of e-commerce.

Caregivers wanted

China lacks sufficient professionals experienced in senior care. At present, China is short ten million caregivers for the general elderly population—let alone the needs of those living with dementia, China Contemporary TCM Institute wrote on their website. Only 40 thousand out of the country’s over one million senior caregiving personnel met the industry’s professional standards set by China’s Ministry of Civil Affairs in 2015. More investment will not solve the shortage, said Spitalnik, adding that time is necessary to train truly professional personnel.

Flooded public nursing homes and the deserted private sector

China’s nursing homes are also in short supply. The Ministry of Civil Affairs reported that there were thirty spots available for every one thousand elderly Chinese citizens. Some 90 percent of China’s seniors must be cared for at home, as those with living family members are often denied access to nursing homes. At the same time, most of the country’s nursing facilities are incapable of meeting elderly dementia patients’ full needs, China Contemporary TCM Institute stated on their website.

Indeed, while there are some public nursing homes that admit dementia patients, the waitlist is excessively long for China’s millions of elderly persons with the disease. Furthermore, even as demand for spots in public institutions overwhelms the state-run system, private institutions, on the other hand, are only half full. The reason behind the phenomenon is that institutions receiving government subsidies are able to charge prices much lower than that of the private sector, which is constantly under pressure from rents, salaries, water and electricity bills among other costs, the Hong Kong Trade Development Council (香港贸易发展局) reported in 2015.

Furthermore, a report by China News Service (中国新闻社) in 2015 stated that while 51 percent of the country’s private nursing homes earned zero profits, another 40 percent are loss-making. Evidently, those in need of senior caregiving services were unwilling to pay the price offered by private institutions. According to Spitalnik, even though his own senior nursing home in Hangzhou, Cypress Garden Senior Living, has been fortunate enough to fill its facility with clients, he wondered if it is possible for the service to scale. A question key to the industry is whether or not the Chinese people may eventually be willing to pay a premium for quality senior caregiving, Spitalnik said.

The interior of Cypress Garden Senior Living’s facility in Hangzhou. Photo Source: Cypress Garden Senior Living (雍柏荟老年护养).

A bargain in process

A mismatch between incomes and prices is at the heart of private senior care providers’ struggles, and poses a challenge for market segmentation efforts in China. According to the South China Morning Post in 2016, the average urban Chinese citizen had an annual disposable income of $3,600 in 2012, but a nursing home bed costs $6,200 on average. As a result, nursing home beds are far from affordable for the average Chinese. Demand for senior caregiving may be surging in the country,but consumers’ purchasing power and the social security network cannot afford the service.

The story goes back to the 1990s, when the Chinese government canceled the state’s “cradle-to-grave” financial support for citizens as part of the nation’s transition to a market economy, The New York Times reported in 2011. China does not afford its elderly citizens the pension benefits and insurance schemes necessary to afford the fees nursing homes want to charge, Joseph Christian, a researcher at Harvard University’s Kennedy School, told CKGSB Knowledge, a publication by Cheung Kong Graduate School of Business (长江商学院), in 2014. The country’s existing health insurance program generally covers expenses made only at public institutions, the article wrote, adding that resources in the public system are already strained.

This issue of affordability may persist for some time. It will be challenging to earn money from China’s post-30s and post-40s generation, who grew old before becoming rich. Spitalnik, however, remains optimistic. In the long run, demographic and economic pressure will bring consumers to accept the necessary price of non-government LTC, Spitalnik said, adding that elderly care is a need-based product, and should not be as price-sensitive as choice-based products.

The future is at home

In the meantime, the Chinese government has other plans for senior caregiving. According to the government’s publicly endorsed “90-7-3” scheme, 90 percent of China’s elderly population will receive care at home, while the other 7 percent and 3 percent are served by community hospitals and nursing homes, respectively. In 2012, China Business Review reported that the government prefers reimbursement for in-home care,overthat for residential-based care, due to the belief that the latter is less cost-effective.

The government’s reimbursement scheme disadvantages the hospital market in China regard in its access to Alzheimer’s patients, but both foreign and domestic players have seen an opportunity within the in-home elderly care segment. In 2011, the US in-home elderly care provider Right at Home (慈爱嘉) began to set up services in China. Later in 2015, the US brand Home Instead (护明德) launched operations in Shenzhen. Domestically, Guangzhou Goodfield Investment Company (广州谷丰园投资有限公司) has also set up its own in-home care service Canhome (看护家), which provides services through a smartphone application.

The Canhome (看护家) mobile application is an O2O platform that facilitates in-home senior care service scheduling, monitoring, as well as payment. Source: Apple Store.

The technology industry: gearing up for old age

High demands for patient supervision

60 percent of all patients experience a “critical wandering incident”at least once during the development of Alzheimer’s, the science and technology publication Phys.org reported in 2009. For many families, the lack of monitoring is a key issue concerning elders who spend extended periods of time alone at home, founder of Hinounou Intelligent Robot Charles Bark said at a conference in June 2017. Meanwhile, patients’ medical conditions often also go unattended at home. As a result, remote monitoring devices have been one of the most promising opportunities for market segmentation in China within mobile health services.

In fact, the medical news publication Medical Design estimated in 2013 that the patient monitoring devices market in China is set to grow from $445 million to $714 million between 2012 and 2019, with a compounded annual growth rate of 7 percent. Moreover, within this market, chronic disease management solutions will contribute to over 90 percent of all revenues, according to a 2016 report published on the medical journal Aging and Disease.

A high-end segment unfulfilled

Within the domestic market, leaders in patient monitoring devices include Mindray (迈瑞), Biocare Bio-medical (邦健) and Yuwell (鱼跃). Presently, these companies mostly occupy the market’s mid to low-end, foreign brands may have more potential in the high-end market. Nonetheless, competition is fierce among these domestic brands, which continually improve their products.

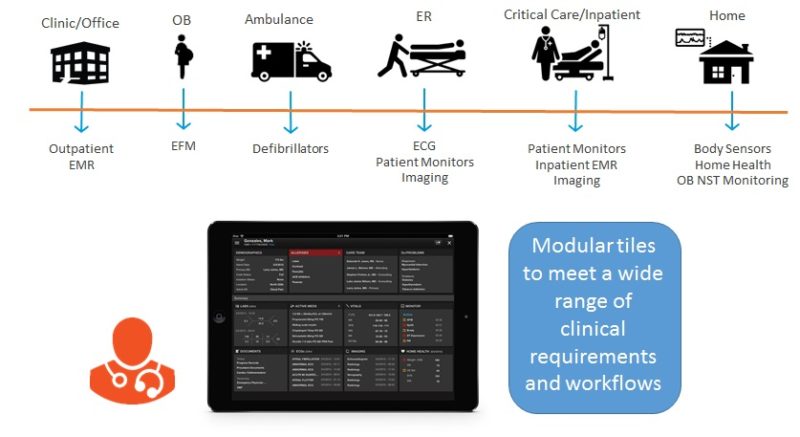

On the other hand, two foreign leaders that dominate most segments of the patient monitoring market, including Philips(飞利浦) and GE (GE 医疗) have both established a presence in China. The AirStrip ONE mobile platform supported by GE, for instance, allows medical personnel to access medical history and monitor patients anywhere.

The AirStrip ONE mobile platform gives medical practitioners increased ability to access their patients’ health conditions at all times. Source: GE Healthcare.

New gadgets for an old generation

A key concern for elderly healthcare devices, however, is that elderly persons are often unfamiliar with “geeky stuff”, according to Bark. For this reason, simplicity and convenience are crucial for a product to be implemented in the lives of seniors. In this case, innovations such as artificial intelligence voice communication may be helpful, Bark added. On the other hand, seniors in China have begun to use more electronic gadgets as they become increasingly well-adapted to technologies such as smartphone applications.

A more permanent issue, however, is that advanced Alzheimer’s patients have a tendency to remove unfamiliar objects attached to them, said George Mason University Assistant Professor Andrew Carle in 2009. In response to this problem, according to Carle, it is advisable for healthcare and monitoring device providers to integrate these products with everyday garments and conduct thorough sensory research in China prior to launching their devices in the market. After all, putting on clothing is one among the last ingrained habits retained by Alzheimer’s patients, Carle said.

Technology, riding on a wave of new policies

The hatching of a new industry

In 2013, the State Council of the People’s Republic of China (中华人民共和国国务院) began requirements for local governments to develop an elderly caregiving industry with a special focus on internet and technological applications, as opposed to traditional Chinese medicine (TCM) or mere physical therapy. According to the government’s plans, China will have constructed a smart health and elderly care industry by 2020, in collaboration with one hundred enterprises. At present, the Beijing Civil Affairs Bureau (北京市民政局) has already entered partnerships with 360 companies to provide cognitively impaired seniors with free GPS-tracking devices, the Hong Kong Trade Development Council reported in 2016.

Home caregiving devices will prove crucial to the Chinese government’s plan to provide at-home care to 90 percent of the country’s seniors. According to Spitalnik, the majority of China’s elderly population may not have access to high-end private caregiving. The government must take care of them, Spitalnik said––perhaps without human touch, but with technology. The availability for specialized home health equipment in China, however, is very low.

Opening the gates to innovation

In the meantime, new government regulations spell well for MedTech innovations, said Shanghai New summit Biopharma (上海新生源医药集团) Chief Marketing Officer Irénée Robin at a conference in June 2017. In May, the China Food and Drug Administration (国家食品药品监督管理总局) released new draft policies that may enable more extensive use of foreign data, simplify approval procedures, and speed up the overall product approval process. These regulatory changes are set to remove a major barrier for medical device providers in China.

Tech, the Way to Go in the Chinese Market for Alzheimer’s

Over the short term, the market for technological solutions to Alzheimer’s care may be considered the most promising among all three sectors related to the disease. On the medical front, the search for a pharmaceutical cure to Alzheimer’s has long suffered from one failure after another, thus disappointing investors. Meanwhile, treatment services are hindered by imperfect information among the Chinese population. Private caregiving services, on the other hand, seek prices too high to allow the business to scale. Not to mention, the training of professional caregivers for seniors––especially those afflicted with Alzheimer’s––requires time.

Technological solutions, including innovative systems and equipment, on the other hand, are set to benefit from government plans to expand in-home care alongside simplified medtech approval policies by the China Food and Drug Administration. Although other industries may have yet some while to wait before launching a full-scale expansion towards their industries’ full potential, the Chinese market for Alzheimer’s disease has given medtech the greenlight, meeting new entrants with state support.

Daxue Expertise: Elder Care Consumer Research

In 2017, Daxue Consulting conducted an extensive consumer research on the market for nursing homes and elder care services in China , in order to better understand the potential consumer’s touch points and their decision making journey when selecting medical and nursing services. Our consultant conducted eight in-depth interviews in China (IDIs) with experienced neurologists, key opinion leaders representing the local eldercare/medical care industry, and family members of senile dementia patients in a major first tier city to reveal critical factors considered by elderly patients and their family in choosing from the market’s offerings for senile dementia treatment. After creating interview guides, the qualitative interviews were conducted and translated in English by Daxue team. The responses were then synthesized on a Word document including main points of the interviews, details on interviewee and contact information, main figures, key comments..) and analyzed.

Analysts at Daxue concluded from their research that the nursing home/eldercare industry in that major Chinese city lacks a leading player specializing in the treatment of senile dementia, and that many of the firms that comprise the segment have achieved success through a business model centered on tourism and leisure—not healthcare.

The research also found that the scarcity of specialized industry contenders was compounded by market inefficiency: imperfect information on treatment options for dementia among elderly patients and their families hampers the growth of a dedicated industry. One trend that analysts found promising for players in the market was wearable healthcare tech, which is non-invasive and intuitive for patients, and reduces labor costs for firms.

Daxue concluded from its research that the local market for eldercare facilities is growing, fueled by increasing demand from a consumer base with more and more disposable income to spend on senile dementia treatment.

Do you represent a pharmaceutical company, healthcare provider, upmarket nursing home or assisted living company, or healthcare tech firm? Daxue Consulting’s expert analyses and robust understanding of China’s senior market can help your business develop a winning strategy today through our expertise and personalized solutions. Our qualitative research has shown that, as China’s market for Alzheimer’s grows, there are ample opportunities for companies looking to enter the market. Contact Daxue team by sending an email at dx@daxueconsulting.com.

![[Podcast] China Paradigm 38: How to start a dream driven elderly care business in China](../wp-content/uploads/2019/05/China-podcast-Elderly-care-business-China-150x150.jpg)

Dear Matthieu,

I read with much interest your wonderful report that gives a precise insight of aging care in China. We believe that traditional healthcare system is UNADAPTED to senior care because it is formatted to deliver treatment post-accident. We have done combine 12Y R&D in 4 countries to deliver LIFECARE based on AI preventative Innovative Wellness pack that includes DNA Testing, IoT robotics, insurance from AXA and Pingan launched in China at http://www.hinounou.com

Many thanks for mentioning us in your article.

Welcome to visit us anytime in Shanghai where we can demo our newest demo.