China’s Mergers and Acquisitions (M&A) Market

Introduction to the market for mergers and acquisitions in China

With its emergence as a strong global economy, opportunities for mergers and acquisitions in China have increased in number and scale. However, financial, regulatory and cultural complexities surrounding Chinese transactions present unique challenges. Despite the overall global economic decline, M&A in certain sectors such as TMT and industrials remained active in 2019. The global factors impacting the future of the China’s M&A market are segmented into three scenarios.

These three scenarios include: The U.S. China trade tensions stabilizing through phased agreements. Second, China’s new foreign investment law and policy coming into play. Third, China’s planned new rules to open up certain heavily regulated industries such as automobiles and financial services. Therefore, the 2020 and 2021 the outlook for China’s M&A market be more active than in 2019, especially in those industries and particularly through inbound deals.

Looking deeper into 2020 and beyond, Chinese outbound transactions focused on strategic areas will continue to be a main driver for Chinese outbound M&A activity in the region. However, continued tensions between the U.S. and China in combination with the hurdles presented by national security reviews may dampen China’s interests in outbound activities to the U.S. and Europe. On the other hand, multinational companies in China will continue to review their domestic China market strategy and reevaluate their interests in forming partnerships with Chinese firms. As a result, this will drive support for steady deal activity. Furthermore, sponsors will remain active in Greater China with additional capital to deploy attractive valuations.

Legislation and Policy Changes in China’s M&A market

There is no single law or regulation specifically regulating M&A in China. An M&A deal may involve many laws and regulations. For example, PRC Company Law may be relevant when designing the corporate structure of the target company. PRC Securities Law and its supporting regulations may come into play in a public M&A transaction. Contract Law may govern when an asset purchase is part of the deal. Employment Law and Employment Contract Law may come into play when employees need to be transferred in the transaction. In addition, tax law is always relevant, and foreign exchange policy and regulation is important when payment of the deal needs to be made cross-border. Antitrust Law may be relevant if a deal meets a certain threshold triggering a regulatory requirement to make a filing.

The Foreign Investment Law, which took effect on January 1 2020, will replace a collection of decades old laws with a single, unified and streamlined legal and regulatory framework for foreign investment that is applicable nationwide. The Chinese national legislature passed the Foreign Investment Law with the aim of creating a better business environment for overseas investors. Inbound investment via M&A in China is expected to reach $1.5 trillion dollars over the next 10 years according to a report from Xinhua News.

The Foreign Investment Law seeks to protect the rights of foreign investors and their intellectual property, and clearly incentivizes them to invest in China. It also helps Chinese companies move up the value chain. The evolving nature of China’s consumer economy and the desire for Chinese industry to continue to move up the value chain are two particularly important drivers of economic opportunity. These factors are expected to boost inbound M&A transactions in the future.

Defining M&A: Types of Mergers and Deal Players

A merger is the process by which two or more companies merge together as one new company. Acquisition often refers to the process when a financially stronger company acquires over 50% of shares of another company and brings it into its own operation. Companies can also engage in a minority share, majority share, equal share and buyout scenario acquisition. The decision of which option to take is tied into a corporate’s strategy and growth plans. Additionally, it is important to consider acquisition structure, as each option offers varying degrees of control and various other trade offs. There are five types of mergers: horizontal, vertical, market-extension, product-extension, and conglomerate mergers.

Moreover, M&A acquirers fall under two broad categories. First are strategic investors, which are operating companies looking to buy other businesses in order to expand or defend market share and enhance profitability. The second are private equity investors (or financial buyers). Financial buyers are buyers that purchase minority stakes in start-ups, mid-growth enterprises and mature businesses using funds pooled from individual investors. Financial buyers typically aim to eventually sell out at a profit through exits such as initial public offerings (IPOs) or a sale to strategic investors.

Global M&A Market

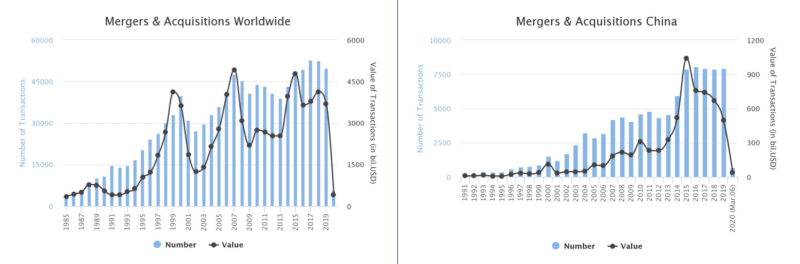

Global M&A made a strong showing in 2019. This came as stock markets reached all-time highs, private equity firms raised record funds, and companies searched for growth and other ways to address technological and economic disruptions. This was impressive given the fears of a potential recession, stock pull-backs in certain markets, increasing trade disputes, as well as heightened national security and competition concerns.

However, global M&A value in 2019 lagged behind 2018 numbers for much of the year. But, a surge of deals in Q4 2019 drove total M&A value to $3.9 trillion dollars, just 3% lower than 2018. This made 2019 the fourth biggest year for M&A since 1980. In particular, M&A value rose for deals in the United States and Japan, but fell for deals in Europe and the rest of Asia. Healthcare, technology, and energy were the most active sectors, accounting for about half the overall volume.

[Source: IMAA analysis, Worldwide M&A and Chinese M&A statistics]

In 2019, M&A involving Chinese targets totaled roughly $170 billion dollars, but represented only 5% of all global M&A volume. This is a small share compared to M&A involving U.S. targets, which made up more than half of global M&A volume in 2019. This makes China vastly underrepresented in the global M&A market in consideration of and relation to the sheer size of the Chinese economy. GDP in China was $15 trillion in 2019 compared to $22 trillion in the U.S. Also, 2019’s volume for deals involving Chinese targets was the lowest since 2014, which has been part of a downward trend over recent years following a peak in 2015.

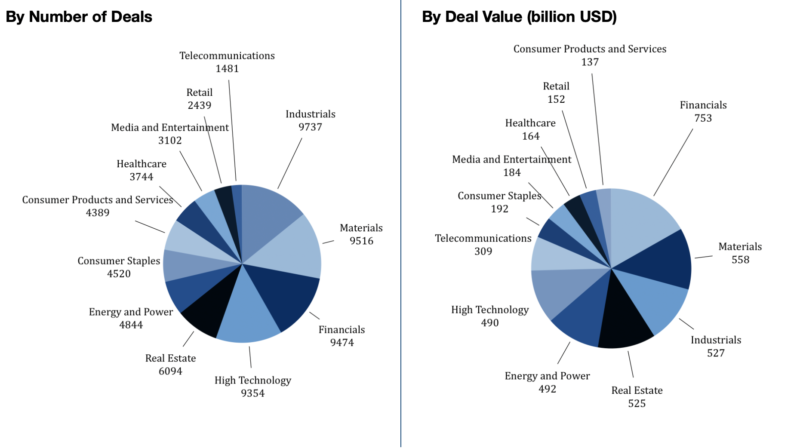

China’s M&A Market: Top Industries 2000-2016

From 2000-2016, China’s industry with the largest M&A activity in terms of transaction value has been the financial sector. Which has represented 16.8% of all deals with a total value of $753 billion dollars. The second most important industry by value is the materials sector with $558 billion dollars worth of transactions. The industrial industry reached the third rank with $527 billion of deals.

The industry with the largest number of transactions has been Industrials, which has represented 14.2% with a total number of over 9,737 transactions. The second most active acquirers are companies from Materials with more than 9,516 deals accounting for 13.8% of transactions. Lastly, Financials companies are the third most frequent industry in terms of consolidation with 13.8% of all deals.

[Source: IMAA analysis, Announced M&A in China and Hong Kong by Industries (2000-2016)]

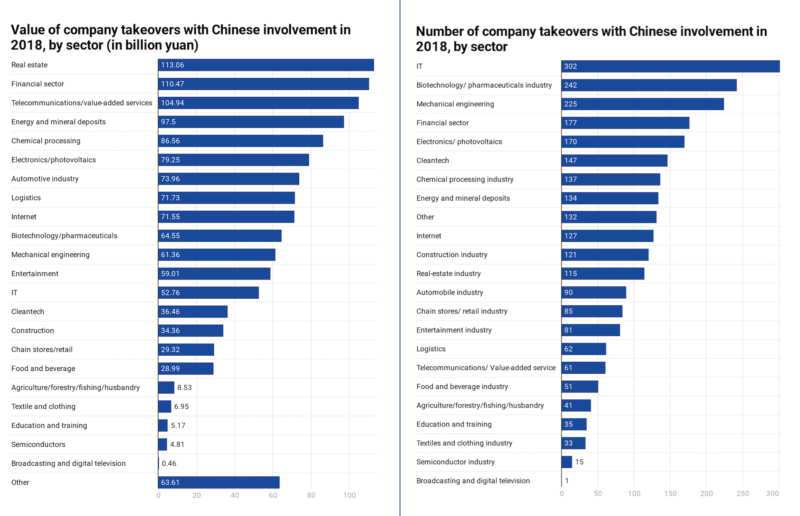

At the micro level, in 2018, 2,584 takeovers with Chinese participation took place. The leading five sectors of company takeovers with Chinese involvement based on the total M&A transaction values were real estate, financial telecommunications with value-added services, energy, mineral deposits, and chemical processing. The M&A transaction value amounted to around 113 billion yuan in the real estate sector. In terms of volume, the sectors with the largest amount of M&A company takeover transactions in China were the IT, biotechnology/pharmaceuticals, mechanical engineering, finance, and electronics sectors.

[Source: Statista, PEdaily.cn, Value and number of M&A transactions with Chinese involvement by sector]

Assessing China’s M&A Market

To measure China’s M&A market in its entirety, any assessment must include the added values of 1) domestic strategic buyers, 2) foreign strategic buyers, 3) private equity deals, 4) Hong Kong outbound, and 5) China mainland outbound.

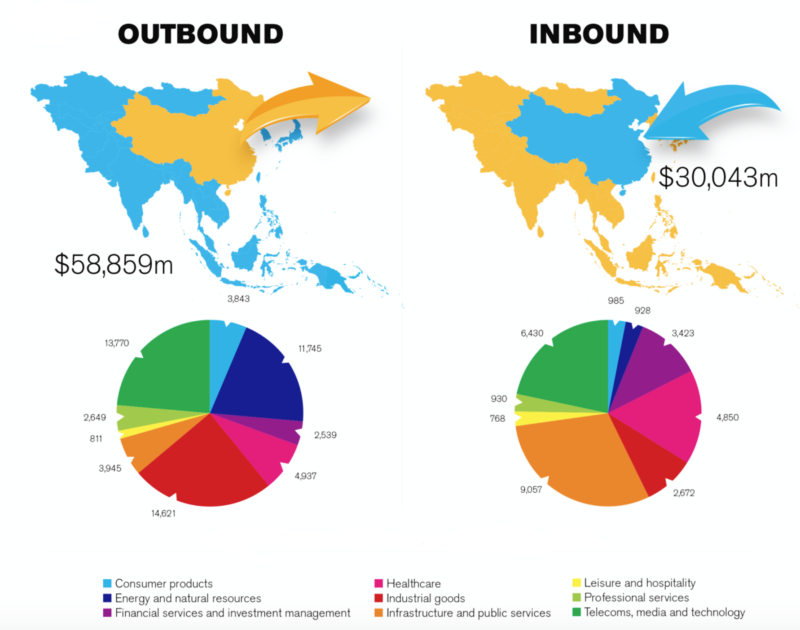

In recent years, the landscape of China’s M&A market has changed fundamentally. While the growth of inbound, outbound, and domestic M&A has been affected by global economic downswings and fluctuating Chinese growth, more and more Chinese companies will continue to seek opportunities through oversea Belt and Road M&A and domestic consolidation. China’s leading sectors for M&A in Belt and Road countries are oil and gas, diversified industrial products, financial services, TMT, power and utilities, consumer products, mining and metals.

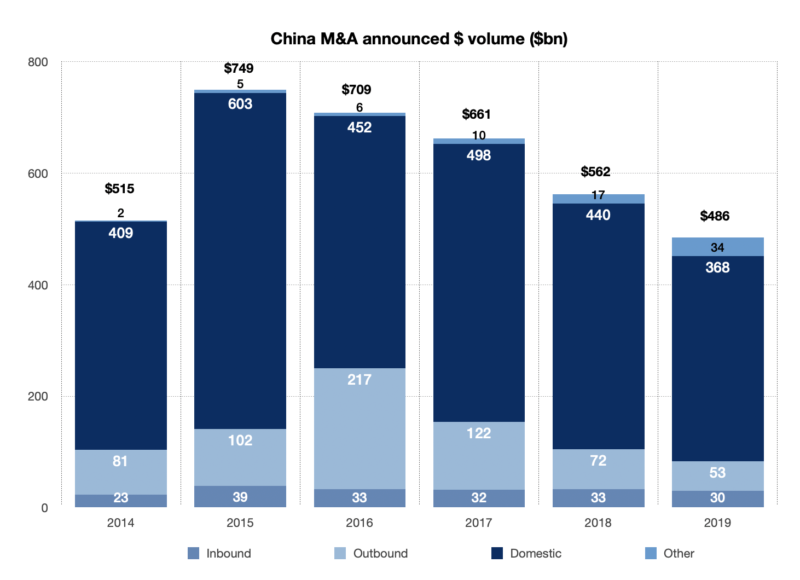

China’s M&A market experienced a slow start in the first half of 2019 but picked up considerably after June. Nonetheless, the market has slowed indefinitely. In particular, the principal drivers of the 14% decline in China’s M&A deal values were the domestic and outbound sectors. The drop in outbound M&A and private equity (PE) resulted in the lowest year for deal values since 2013. According to Dealogic, announced M&A deals in China amounted to $486 billion, as compared to $562 billion in 2018 and $661 billion in 2017. While inbound M&A remains stable ($30 billion in 2019, a slight decrease from $33 billion in 2018), both outbound deals ($53 billion in 2019 compared to $72 billion in 2018) and domestic deals ($368 billion in 2019 compared to $440 billion in 2018) saw a notable downturn.

[Source: JPMorgan, Dealogic, China M&A announced $ volume ($billion)]

Most M&A transactions of Chinese companies still take place in the domestic market. Roughly 80% of all Chinese M&A activity is domestic, involving both Chinese acquirers and Chinese targets. The expectation is that the bulk of M&A volume going forward will be accounted for by foreigners investing in, or acquiring, domestic companies. Also, by domestic companies merging with and acquiring each other. The key drivers here include rising purchasing power and private consumption, the government’s desire for foreign funds and expertise for SOEs as it fully opens sectors of the economy to foreign competition, and a more relaxed regulatory regime that, for example, has expanded the scope and geographical reach of wholly owned foreign enterprises (WOFEs).

The economically better developed regions such as China’s largest cities Beijing and Shanghai still lead the market. In 2018, 299 M&A transactions were completed in Beijing with a transaction value of around 207 billion yuan. In line with China’s economic reforms, foreign buyers will increase their activity in China’s M&A market in those sectors and areas favorable to making deals.

In China, especially those MNCs in consumer/retail and enterprise service sectors continued to explore strategic reviews and partnered with local players. Some of which were structured as a divestiture of a controlling stake. High-profile transactions in this category include Metro China’s partnership with Wumart, Carrefour’s partnership with Suning, and DHL’s sale of its supply chain business to SF Express. This is a continuation of a theme that has gained strong momentum since 2017, as companies such as McDonald’s, Yum! China, Heineken, and Salesforce partner with Chinese companies to strengthen their competitiveness in a fast-changing local market.

Outbound and Inbound M&A

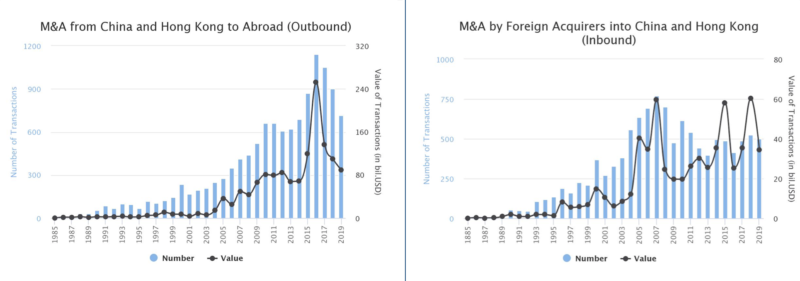

[Source: IMAA analysis, Dealogic, Announced M&A from China to abroad (outbound) and M&A by foreign acquirers into China (inbound)]

China was not a major player in global investment until the mid 2000s. Driven by policy loosening by Beijing and favorable global conditions, its outbound FDI (OFDI) grew from next to nothing to an average of almost $50 billion per year in the late 2000s. Easy money and loosening of Chinese policy in 2014 boosted flows to more than $200 billion in 2016, eliciting both enthusiasm about fresh capital and anxiety about economic and security risks.

Since 2016 China’s outbound investment has been on a downward trajectory. Outflows dropped precipitously in 2017 and 2018 after Beijing restricted “irrational” outflows. In addition to domestic regulators, Chinese investors also were confronted with greater regulatory and political scrutiny abroad, as economies tightened investment screening regimes due to concerns about China’s compatibility with their democratic market economies.

Global outbound direct investment dropped

In 2019 this downward trajectory continued with China’s global outbound foreign direct investment dropping back to 2014 levels. Official Chinese statistics show a modest decline in outbound FDI for the year: MOFCOM reports outbound FDI at $117 billion for January-December 2019, a decrease of 9.8% from the same period in 2018 in dollar terms. The global M&A component shows a deep drop, with newly announced 2019 deals at $50 billion, versus $80 billion in 2018, amounting to the lowest level in eight years.

Thus, China’s efforts to cut debt levels combined with the negative effects from the trade war have cut into outbound deal activity by Chinese firms. China’s outbound M&A fell back relatively to 2015 levels in value terms, with various factors combining to severely curtail large sized cross border transactions. However, there is still a good amount of smaller sized outbound transactions taking place with overall deal volumes holding up.

Chinese outbound M&A players are segmented by three categories: state owned enterprises (SOEs) , privately owned enterprises (POEs), and financial buyers.

POEs remained the most active overseas buyers in terms of volume although the overall value of those deals fell with considerably fewer mega deals. Mirroring the domestic scene, outbound deal values were strongest in the industrial and consumer sectors, but larger-sized high-tech deals took a significant hit due to the various sensitivities in this vertical. Furthermore, outbound M&A in the energy and power sectors, materials, and healthcare saw relative downturns in deal value.

Smaller outbound transactions less affected

However, in terms of deal volumes, outbound activity continues to be reasonably robust with smaller transactions being less affected. China’s strategy to acquire technology know how, IP, and brand strength to put to use in the Chinese market is continuing despite the headline declines in larger deals. Therefore, Chinese outbound M&A in the high technology, industrials, consumer, healthcare, financial, and materials sectors all carried out a high number of deal volumes.

Outbound M&A with Europe

In terms of geographies, the squeeze in outbound deal values is now evident in Europe with significant declines in the bigger markets of Germany ($6.5 billion in 2019 from $11 billion in 2018) and UK ($1.4 billion in 2019 from $4.5 billion in 2018). Chinese FDI in the European Union declined for a third straight year in 2019. The combined value of completed Chinese FDI transactions in the EU fell to EUR 11.7 billion, down 33% from 2018 levels (EUR 17.4 billion). This represents the lowest investment level since 2013 and a drop of 69% from the peak of EUR 37.3 billion in 2016.

But, this drop was not specific to the EU. Chinese global FDI fell in 2019 due largely to domestic variables which made it more difficult for Chinese firms to raise funding and get approval for overseas investments. The global decline also reflected a growing political and regulatory backlash against Chinese acquisitions, particularly in the U.S., but also in Europe.

Belt and Road countries and Latin America

Outbound activity to Belt and Road countries held up reasonably well in the context of the otherwise significant declines in deal values seen elsewhere. Furthermore, despite China’s outbound volume being down y-o-y, outbound activities remained active for investments into the Asia Pacific (outside China), Latin America, and EMEA. Consistent with China’s strategic needs, outbound investments in power and utilities, technology, and industrial sectors experienced strong momentum in 2019, with notable transactions including Three Gorges’ $3.6 billion cash acquisition of an 84% stake in Peruvian electric company Luz del Sur, Beijing Auto’s acquisition of a 5% stake in German automaker Daimler, and Jiangsu Shagang Steel Group’s $2.2 billion acquisition of London-based Global Switch Holdings.

In sum, the trade war between the U.S. and China along with a tightened CFIUS approval processes made Chinese buyers increasingly cautious when considering targets with significant business presence in the U.S. The expanded CFIUS jurisdiction that is expected to be implemented in 2020 will likely generate further headwinds for Chinese investment in the U.S., particularly for targets involved with advanced technologies, critical infrastructure, or sensitive personal data.

Added to the mix were national security reviews in Europe, which further drove the decline in outbound M&A from China. Thus, the uncertainty in M&A deals increasingly came from antitrust regulators across the globe. This trend makes early planning and engagement with the regulatory bodies in the cross-border deal making process a priority.

Concerning Chinese inbound M&A, while overall deal values and volumes posted marginal annual declines of 1% each, the M&A market avoided much deeper downtrends amid trade tensions with the U.S. and economic growth uncertainties domestically. Real estate, financial services and telecoms remain the sectors where M&A transactions with the largest deal values took place.

Dealmakers in the Chinese M&A market can expect to find opportunities in industries such as AI, advanced manufacturing, Fintech and healthcare. Particularly, the industrials and technology areas amongst other sectors are showing signs of robust growth. Moreover, on the regulatory front, China has begun a campaign to ease restrictions on foreign investment as it continues to open up the market. This could result in further inbound M&A, particularly from the U.S. should there be a thaw in trade negotiations currently taking place.

Important Considerations for Navigating China’s M&A Market

- Magnitude of investment

- How it varies across industries and locations

- How it compares to levels of greenfield FDI over time

- Horizontal (market access) versus vertical (integrating supply chains) transactions

- Mode of financing

- Diversifying transactions versus those in the same industry

- Patterns of control acquisition

- Strategic versus financially motivated transactions

Takeaway: What CEOs are saying?

According to the 2019 KPMP China CEO outlook survey results, 48% of CEOs in China believe that the most important strategy for achieving their growth objectives in the next three years are forming strategic alliances with third parties and conducting M&A transactions. In that same survey 56% of CEOs are reported to having a moderate M&A appetite, with 29% having a strong M&A appetite, and 15% having a low M&A appetite. Thus, in spite of the current global economic and investment climate, CEOs are still focusing on the opportunities in the Chinese M&A market.

The primary drivers for M&A among China’s CEOs ranked (in order) are: to reduce costs through synergies/economies of scale, to diversify the business, to transform the business model faster than organic growth, to increase market share, to on-board new digital technology/innovation, to take advantage of favorable valuations, to eliminate direct competitors, and to utilize cheap financing before interest rates rise.

Thus, in M&A consideration, it is important to assess the market value and proposition for each party in the deal, specifically what benefit a foreign stakeholder may bring to a Chinese enterprise. Concerning the benefits of M&A dealmaking with foreign MNCs, Chinese participant enterprises stated that expanding brand awareness, increasing market share, improving technology and productivity, increasing margins, and reducing costs were some of the benefits of engaging with oversea businesses in M&A deals. In addition, M&A benefits include: extending their upstream and downstream industrial chains, industrial transformation and upgrading, and cross-industry diversified operations. Thus, leading overseas businesses can reference these contributions from foreign MNCs to Chinese enterprises following the M&A deal to craft their own proposition.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast