A guide to the non-life insurance market in China | daxue consulting

Non-life insurance market in China

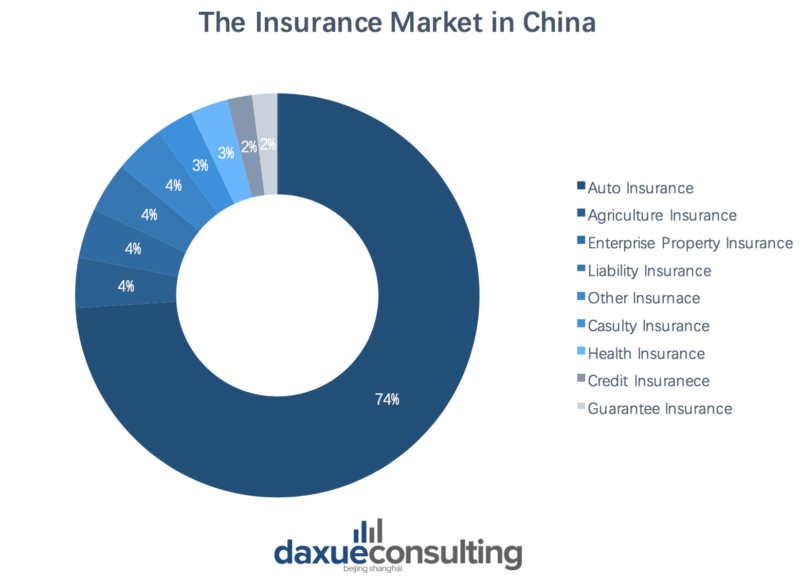

Following economic growth and the accumulation of wealth comes the need to protect ones belongings. Many segments of the non-life insurance market in China are growing and creating opportunities for both foreign and domestic companies.

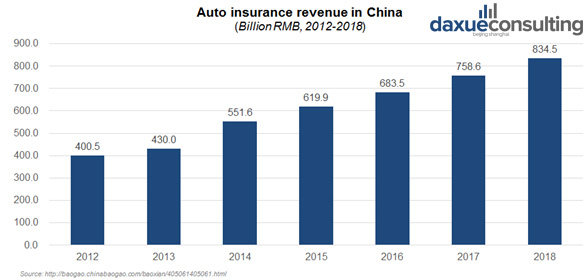

The auto insurance market in China: Following China’s car boom

China’s auto insurance market can be segmented into two types: Compulsory liability insurance for traffic accidents and commercial motor insurance. The auto insurance market in China had a total revenue of 834.5 billion RMB in 2018 and it still has a lot of room to grow.

The fast development of the auto insurance market in China is driven by several factors. First, there is a huge vehicle market fueling the need for auto insurance. Secondly, the awareness of road safety is increasing with the help of multi-agency education and publicity. Another driver is policy support from the Chinese government, to regulate the auto insurance market and support the developing of new business models. Last but not least, online insurance platforms are becoming more popular as internet use in China becomes more widespread.

The liability insurance market in China: Charged with potential

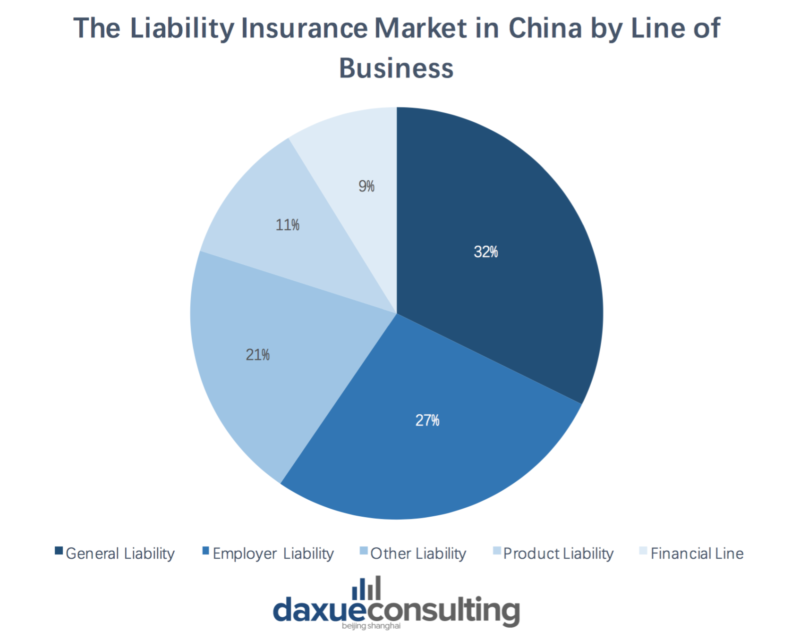

In 1980, liability insurance was first introduced in China and segmented as follows: general liability insurance, product liability insurance, public liability insurance, employer’s liability insurance. The liability insurance market in China is developing slowly; its total premiums were 59.1 billion RMB in 2018. The premiums were considerably lower than western countries (such as USA and England) and only accounted for 5.03% of total non-life insurance market in China. What incidents that liability insurance in China covers tend to happen in high frequencies and have low premium payment, one example is the refund of online purchases. This increases the operating costs of insurance companies. However, the market has huge potential due to the development in regulation, product innovation and e-commerce platforms.

Large domestic brands are dominating China’s liability insurance market, the top three insurance companies in China are (PICC, Ping An and CPIC) which occupy over 60% of the liability insurance market in China during the last three years.

The travel insurance market in China: Strong demands from the growing tourism industry

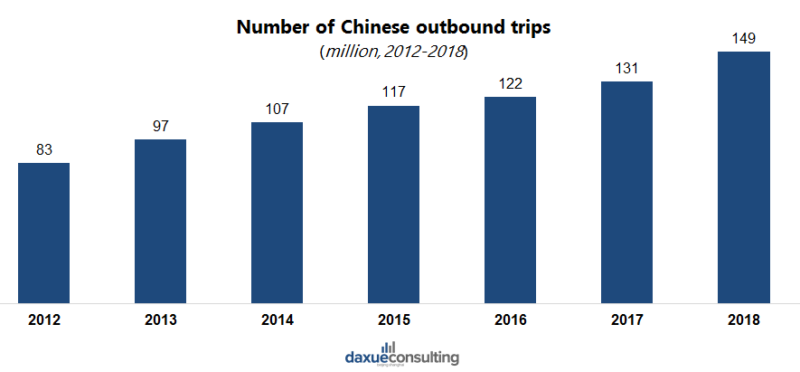

China is one of the largest tourism markets for both inbound and outbound tourists. In order to avoid prepare for risks and escort the development of the tourism industry, tourism insurance is an essential. The travel insurance market in China has a large variety of products covering a variety of services including such as destinations, travel agencies, guides, tickets, transportation, hotels, etc.

Among the Chinese tourists, elderly and children have stronger needs of travel insurance since they are more vulnerable than adults. Tourism is one of the most popular leisure activities for the Chinese senior citizens, in fact, seniors make up more than 20% of China’s tourists every year. However, there aren’t many travel insurance products targeting seniors, single insurance products are unable to adapt to the diverse needs of consumers. The main sales channels of travel insurance in China are travel agencies, the Internet and from travel APPs, but many Chinese tourists prefer to travel independently and some of them show less trust in travel insurance purchased online. Insurance companies need to develop more distribution channels for travel insurance in order to reach the diverse Chinese consumer base.

The agricultural insurance market in China: Thriving with government support

In China, agricultural insurance is highly supported by the Chinese government since it is the basic industry for national economic construction and development. Currently, China’s agricultural insurance covers 211 crop varieties in all provinces of the country. In addition to farming, it also involves forestry, poultry and fishing. In 2018, the total premiums of agricultural insurance were around 57.2 billion RMB with 19.54% year-on-year growth. The main types of agricultural insurance in China are policy-supported agricultural insurance (政策性农险) and commercial agricultural insurance (商业性农险). The government subsidizes the policy-supported agricultural insurance in China, it covers most kinds of crops but the payment of claims is relatively low. Commercial agricultural insurance mostly targets crops with high economic value. Agricultural insurance is playing an important role in improving the capable of disaster resistance, increasing the income of farmers and agricultural production safety.

China’s huge agricultural market and policy support are the main drivers of agricultural insurance. The central and local governments are both increasing their financial subsidies for agricultural insurance. More insurance institutions started to develop new types of agricultural insurance to attract Chinese farmers.

The property insurance market in China: Great potential but lack of publicity

The property insurance market in China includes house, CPI, home decoration, furniture, household appliances, water pipes, etc. Between 2008 and 2017, home insurance premiums grew by an annual average of 19%, close to the annual growth of 17% for the non-life industry in China as a whole. However, home insurance accounted for just 0.64% of total non-life premium income in 2017. There are several reasons making the property insurance market in China unknown. First, insurance companies have not created enough publicity for property insurance. Many citizens are not familiar with home property insurance and worry about being deceived. Secondly, insurance companies place too much emphasis on premiums and ignore the quality of services. Besides, the small product range of home property insurance is difficult to meet the market demand.

However, the property insurance market in China still has great potential of growth. Along with the increasing income of the Chinese citizens and their family assets, personal property and safety is becoming more important for most consumers. The rise of Internet and social networking make insurance companies have new channels for promotion and sales.

The credit insurance market in China: Growing with global trade

Credit insurance is puts the insurer liable for the economic loss suffered from failed contracts or failing to pay off debt. Credit insurance in China can protect companies from the risks of trade such as customers failing to pay. In 2018, China’s credit insurance premium income was approximately 24.25 billion yuan.

The products in China’s credit insurance market include: General commercial insurance, sales credit insurance, loan credit insurance, short term credit insurance, export credit insurance and more.

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes