Online luxury in China: how brands can leverage these channels | Daxue Consulting

The global luxury goods industry, which includes drinks, fashion, cosmetics, fragrances, watches, jewelry, luggage and handbags, has been on an upward climb for many years. Expected to make up to 40% of global luxury spending by 2024, Chinese consumers are becoming increasingly more important to luxury brands. In particular, with the rising purchasing power of China’s emerging middle class and further expansion of free trade zones, cross-border e-commerce businesses have become some of the most-used online shopping destinations in China. The rise in disposable income has elevated the consumer lifestyle in China and has shifted their individual preferences towards luxury goods. Moreover, the escalation in demand for luxury accessories and jewelry due to unique craftsmanship, refinement, quality, and brand name has further fueled the market. With its growing economic power and global influence, China has become the model for innovation within the industry and an attractive target for the international luxury market

Online Luxury Retail is Catching Up to Offline Retail

Commerce is changing in China at rates unseen in any other market. Possibly the biggest change in Chinese commerce is seen through the shifting attitudes and shopping behaviors of modern Chinese consumers. These shoppers are demanding the kind of convenience technology can provide, yet are also increasingly seeking meaningful ways to engage with brands in stores. Chinese consumers are becoming more selective in their luxury consumption choices, and at the same time luxury brands are making their products more experiential—both in stores and online.

Top luxury brand stores in China. Source: GartnerL2

Despite the e-commerce boom and the vast proliferation of online shopping, store-based retail still dominates the luxury goods market in China. Specifically, the world’s ten most valuable luxury brands all have their own stores in China, located mostly in the nation’s economically developed areas. Although offline channels remain the major source for luxury goods sales in China, the rapid digitalization within the retail industry has led to a momentum outburst in the luxury e-commerce segment.

For Luxury Brands, e-Commerce is a Must

With China’s rising rates of mobile usage, growth in e-commerce online spending, and disruptive millennial identities, luxury brands have recognized the need to adapt their image to these facets of change by launching their own online presences. From 2010 to 2016, the luxury goods e-commerce market size grew dramatically from 6.4 billion yuan to 57 billion yuan, thus showing the need for luxury companies to broadcast their brands via online platforms in order to drive future sales.

Retail Platforms Compete for the Attention of High and Mid-tier cities

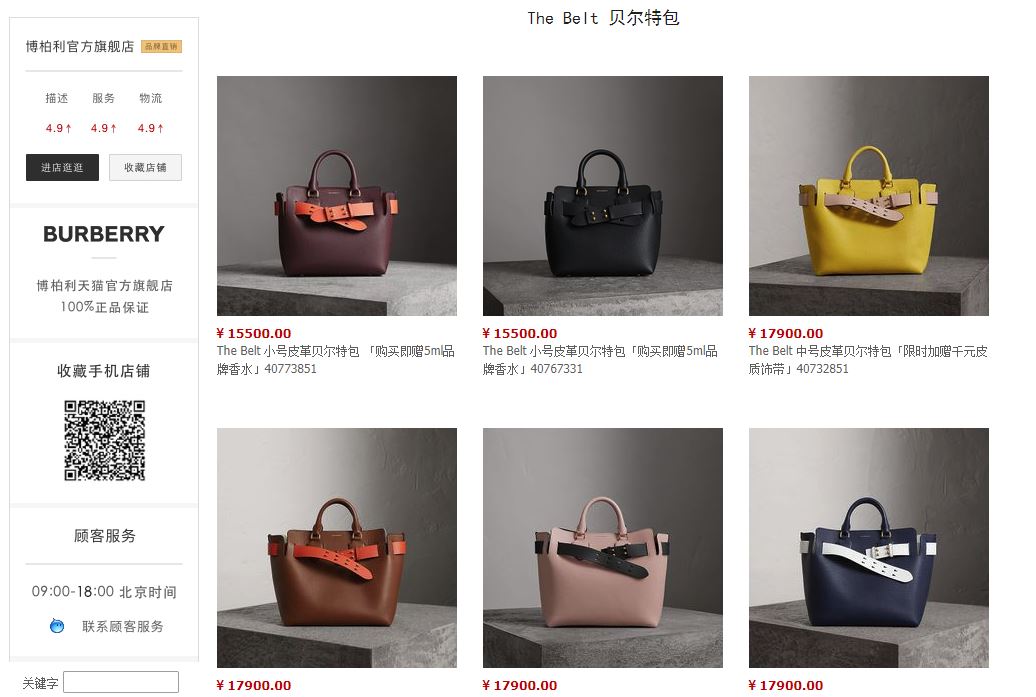

The combination of a growing e-commerce market in China and rising consumer spending on luxury goods has led Alibaba to launch its own luxury platform, Luxury Pavilion, on its business-to-consumer website, Tmall. Brands such as Burberry, Guerlain (LVMH), Hugo Boss, La Mer, Maserati and Zenith are some of the names set to be featured on Luxury Pavilion. Not to lose out to Alibaba, JD.com has also launched its dedicated luxury platform, Toplife in October 2017. Besides these two dominant players, there are several other popular luxury e-commerce sites and international brands that are represented throughout China, names such as Secoo, Mei.com, Net-a-Porter, Reebonz, and Farfetch are among the many. In 2016, Secoo Holdings Limited was the largest Chinese e-commerce platform for luxury goods, accounting for 25.3% of the online luxury market in China.

While also being offered in first-tier cities, JD.com has noted the rising incomes and luxury spending growth in mid-tier cities as a good impetus to launch their platform of influence towards mid-tier cities countrywide. In China, as a whole luxury goods consumption is forecasted to rise from 531 billion yuan in 2017 to 617 billion yuan in 2021, thus showing strong opportunities for growth in spending and sales for both Chinese shoppers and retailers. To gain a better understanding of China’s e-luxury landscape, here is an ecosystem map highlighting China’s online luxury architecture.

Millennials: Online and Offline Shopping can Coexist

Millennials have become the main force of consumption in China’s luxury market. In terms of discovering their style for buying certain luxury goods, the younger generations are more accustomed to searching for the latest fashion online. However, these consumers still make their purchases primarily at physical stores due to the innate nature of concern of getting something that doesn’t fit their style or is not authentic. More interestingly, however, is that their visits to physical stores are not solely for shopping per se, but rather to see, feel, and experience the product firsthand. This shows the expanding awareness of what luxury products are on the market and how it may fit their styles, in other words, these young consumers have already researched what they may want online before actually going to the stores to do what they couldn’t do online. This represents a successful ‘New Retail’ omnichannel business strategy where online and offline channels do not conflict with one another, but rather represent separate stages in the entire shopping experience that harmonize the process for both spenders and retailers. Hence, in order to appeal to this consumer group, brands need to consider how to create an unparalleled, innovative, and creatively attractive shopping experience vis-à-vis, a smooth integration of both online and offline mediums of sale.

Thus, marketing has become an important factor in online luxury distribution. With more smartphone users than any other country, 80% of Chinese luxury shoppers being on social media platforms. Mastering social media in China is vital for brands to connect with their consumers, increase their stake in the market, and make sales. China has simply become a blazing digital pathway for potential retailers. Luxury brands should capitalize on integrative branding, marketing, and sales offered through Chinese social media platforms such as WeChat, Weibo, Xiaohongshu, and Douyin. As a result, a new buzzword “social commerce” has arisen as social media marketers realize the potential power online marketing has on Chinese consumer purchasing decisions.

With regards to the millennial and non-millennial shopper, modern Chinese luxury consumers prefer products that better reflect their personality and tastes, their social status, and products that instil greater personal confidence. In combination with their social presences, this has led them to develop a greater awareness of luxury goods, where they now are looking for more unique and high-quality products that convey a brand’s heritage. Furthermore, these millennial shoppers are increasingly embracing unique and customized experiences when they shop. So what does this tell us about the Chinese online luxury market, and how will the market adapt to the shifting nature of customer preferences and the drive in technological adaptation?

Innovation in Chinese e-luxury: developing strong omni-channel presences

The first innovation we are witnessing in China is that physical luxury stores are striving to become a place where people can participate in the lifestyle instead of just selling and purchasing goods. In the store, consumers can authentically experience the surprises and pleasures of luxury goods such as wine, clothing and jewelry. Culturally, often luxury brand stores may be intimidating and seem non-welcoming to ordinary shoppers and high-end Chinese consumers regarding a lack of personal connection and communication between a potential foreign seller and guide as to what the buyer may be open to explore. Thus, it is important for luxury brands operating in China to consider the cultural implications and personalities of their consumers in order to better engage with them and improve their overall in-store experience. Doing this will enhance their reputation and attractiveness to engage with new demographics.

The second innovation that is slowly being implemented in stores and malls nationwide is the introduction of more “experiential” emerging technologies that achieve a “reality + virtual” luxury mix. In particular, using virtual reality technologies to break through the inventory restrictions and limits of personal experience in offline stores and online e-commerce UX. In this way, the application of virtual reality technology in stores synchronized with their online inventory of choices and mobile devices will allow customers to realize the most intuitive and personalized experience in order to increase the opportunities of subsequent sales.

Model example: Xiaohongshu 小红书, Temple Library JD

One of the more innovative luxury brand online distribution approaches today can be seen by Xiaohongshu. Its model innovates on 3 different paradigms and incorporates them into one ecosystem.

- Social network and Community engagement

- Integrating new Technologies

- Experiential – ‘Experiencing Luxury Retail’

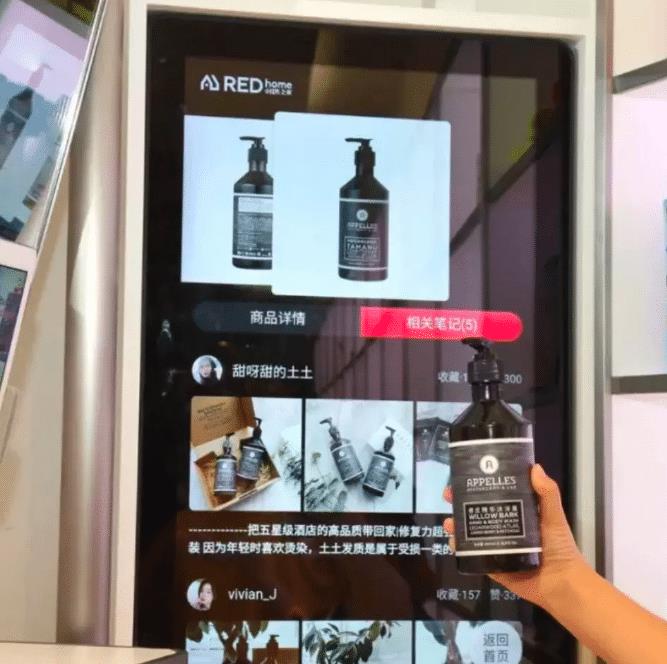

Xiaohongshu emphasizes that they are first and foremost a social platform with an added e-commerce component to respond to the needs and requests of its community. Xiaohongshu’s purpose in having an offline store is to provide an experiential place for its community to meet offline. In the era of the online influencer, China’s latest generation of fashionistas are keen to learn more about their favorite designers and thrive on feeling included as part of a community. This new interactive fashion phenomenon helps to satisfy these expectations, engaging consumers with playful technology and captivating immersive concepts. For brands looking to foster a deeper connection with Chinese millennials, an experiential approach is the key.

Constant exposure to new technologies and innovative social media campaigns have become an everyday part of Chinese consumers’ lives. Thus, physical shops need to adopt these technologies and integrate virtual activities into real life, in a way that is practical for the consumer. For example, beauty retailers including the Yves Saint Laurent store in Shanghai have added augmented reality screens that use facial recognition to enable

customers to virtually try on different makeup looks. By having a robust community along with the advantage of having a technologically sophisticated organization, by using data analytics, the store’s inventory does not include all items available on the Xiaohongshu platform; instead, it features only the most highly ranked products from its app. In this way, they use product reviews and preferences of its online community to curate the offline store’s inventory.

Xiaohongshu provides a window into the future of retail and shows how offline spaces can be designed to capture the attention of young Chinese consumers, integrating technology in a way that complements the behaviors of a brand’s target audience. Luxury companies have historically used customer experience, and more particularly in-store experience, to distinguish themselves from mainstream brands. Although global luxury companies have finally moved online, stores are still where customers connect with the brand through private shopping sessions, personalized styling, and top-notch customer service. Upgrading the in-store experience using newly available technologies is both an opportunity and a challenge for luxury brands which pride themselves on crafts and traditions.

Source: Jingdaily

Source: Jingdaily

The impact of China on the global luxury industry

Luxury in China has seen a rebound of growth in recent years. Specifically, the ongoing changes in China’s luxury e-commerce show that as the market evolves and consumers are becoming more sophisticated, retailers and brands alike have to change their business models to keep up with demand. Moreover, with the advent of the digital consumer and preference for online shopping, luxury brands that have historically focused on offline retail expansion by creating new stores cannot afford to neglect their online channels anymore. Lastly, because Chinese consumers are increasingly demanding a premium luxury experience, the inclusion of high tech in store applications and positive social media presences are becoming an ever more important component of the overall shopping experience. Thus, in order to thrive in a competitive and consolidating industry, luxury players will have to adopt omnichannel approaches that provide a positive and innovative customer experience both online and offline.

Author: Jeffrey Craig

Daxue Consulting can help your brand enter China’s luxury market

As it the luxury retail market is steadily growing, China has become a crucial stake for Western companies of all shapes and sizes. Understanding how to enter China market is the first step to successful development in China. Daxue Consulting provides all the customized tools to assist you in your China market entry.

Contact one of our project leaders at dx@daxueconsulting.com to plan your entry into China’s luxury goods market.