How the Chinese luxury market poised to become the largest in the world

According to Boston Consulting Group (BCG,) China will contribute 41% of global luxury consumption by 2025. The Chinese luxury market is now vital for many European brands. Since its explosion in the 1990s, the sector continues to grow and is poised to become the first in the world. Recent events like the coronavirus pandemic or technological improvement in digitalization shift the way we think about the luxury market in China.

The evolution of China’s luxury market

The 1990s, the beginning of Chinese luxury consumers

China has a long tradition of luxury craftmanship, such as painting or porcelain. An example of this is the art of painted landscapes called 山水 (shanshui,) which became popular during the Song dynasty. Since the Communist Era (1949), the economic elite went through difficult years due to opposition to the changes in ideology. However, Deng Xiaopping started liberalizing the economy in 1978 and in the 1990s, China therefore became one of the best place for foreign companies to relocate, causing a new economic elite to prosper. These wealthy communists have new needs, causing luxury demand to start to increase in the country. Up until now, the amount of Chinese luxury consumers continues to grow. Mr. Abtan, of the BCG, is convinced that the Chinese luxury market will continue to grow due to the “tsunami of the new middle class”.

The westernization of Chinese luxury consumption

The 1990s put China on the agenda of western luxury companies. They understood the potential of the Chinese luxury market. Many Western luxury brands opened their first Chinese store throughout the nineties, for instance Hermès in 1997, Cartier in 1992 and Chanel in 1999. Moreover, it is also during this decade that the private art market started to grow in China. The auction house “Duo Yunwan” was the first of the country in 1992 and some galleries also appeared around this time. The new economic elite had some demands which needed to be fulfilled but many luxury purchases were still made during trips in Europe. Thirty years later, there are many luxury shops and even flagship stores that symbolize the brand DNA.

Source: Behance – HERMES SHANGHAI By LEVI VAN VELUW

Millenials, the new cornerstone of luxury brands

Today, Millenials are the main Chinese luxury consumers. According to McKinsey insights, 43% of Chinese luxury consumers were born in the 1980s. This generation is accustomed to using social media platforms every day. Douyin or WeChat allows them to share content online. Also, the “generation Z”, born after the millennials is taking increasing parts. McKinsey shows that 28% of Chinese luxury buyers are born during the 1990s. They are used to going online to seek products and then to purchase the products in bricks and mortar stores. This is called ROPO: research online, purchase offline. These new generations force luxury brands to shift themselves because of the importance of social media platforms.

The modern Chinese luxury market

Market segmentation

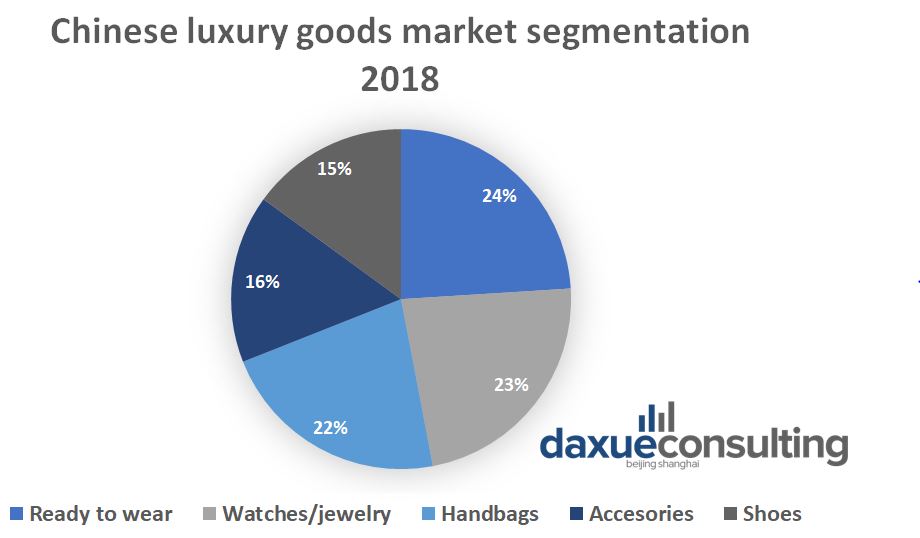

According to BCG, the Chinese luxury market grew by over 5% per year during the 2010s. It is currently the second biggest behind the US and is likely to become first in 2025. In 2018, it exceeded 110 billion dollars, 33% of the global market. Ready to wear products, handbags and jewelry are the most popular luxury goods.

Source: BCG 2019 reports – Chinese luxury market distribution in 2018

According to Agility & Research 2016 reports, the top 10 favorite luxury brands in China are: Chanel is first, followed by Dior and Hermès in the top 3. Louis Vuitton, Burberry, Versace, Giorgio Armani, Prada, Gucci and Montblanc make up the rest of the top ten. These brands hold a strong brand image. Not a single Chinese luxury brand is ranked.

Source: Agility & Research 2016 reports – Top 10 luxury brands in China

European luxury brands come first

The prestigious reputation of European luxury brands stimulates a strong demand in among the status-oriented Chinese consumers. Companies with an important brand image, thanks to their history or famous stars wearing it, will be more popular in the country. Chinese luxury consumers wearing popular luxury brands will increase their social status. Still, some Chinese luxury brands try to become prestigious. For instance, Shang Xia was created in 2008 by Jiang Qiong Er and was bought by Hermès in 2010. The luxury brand is independent and focuses on the Chinese traditional style in its product. So far, Chinese buyers are not that interested in the brand because it is not well-known worldwide, but it takes time to create a solid brand image.

Recent shifts in the Chinese luxury market

Digitalization

This is the new cornerstone of every luxury brand in China. According to Bain Consulting, luxury companies doubled their digital marketing budget from 35% in 2015 to 70% in 2018. Chinese Millenials are the main luxury customers. Due to their use of smartphones, they shape how brands should address them. Now, Luxury brands work with key opinion leaders (“KOL”) as advertisers. These influencers have influence and can make a brand gain notoriety. For instance, Cartier worked with the movie star Lu Han in 2016. They wanted to highlight men’s jewelry with the artist. KOLs are so popular that they can shift luxury trends in China. Moreover, luxury companies now present their new products online. During April 2020, Cartier showed its new watches on the online event: watches and wonders. Digitalization recently revolutionized the luxury industry and it can be an asset during unexpected crisis.

The challenge of selling alongside counterfeits

80% of counterfeit products come from China. According to European Union Intellectual Property Office, the luxury industry loses 60 billion euros annually. The impact is more than financial; brand image is also impacted. Also, it dwindles Chinese luxury trust in buying goods outside of official stores; online purchases are affected by this. In addition, it wipes out the possibility of a second-hand market for luxury goods. Some brands like Louis Vuitton are investing massively to tackle fake products. The company invested around 40 million euros. Attacking counterfeits is an investment to protect brand image.

COVID-19 is jeopardizing the luxury golden decade

The virus affected luxury companies regarding both demand and supply. First, shops were closed so Chinese luxury consumers could not buy luxury goods. There is a phenomenon of revenge purchase were people buy after the quarantine like in Guangzhou but it is difficult to estimate if it is going to be enough. Second, supply was affected because companies were not able to produce goods. The European factories were shut down. Still, European luxury brands remain solid in China. Their brand image continues to provide a good protection during unexpected events. As Alexis Karklins-Marchay, partner at Ernst & Young, noted: “In the eyes of Chinese luxury consumers, Prada, Chanel or Hermès are much more desirable, they are brands that don’t lose their character,”.

China has a long tradition of luxury. The 1990s however is the beginning of the luxury in contemporary China. Since this decade, the Chinese luxury market has grown rapidly every year. The country is vital for some companies like Longines, which conducts more than 80% of its activities there. Digitalization forces luxury companies to rethink their strategies. Even if the coronavirus momentarily damages the luxury industry, the brand image of European luxury brands is strong enough to recover and to bypass it. Nevertheless, it is never a viable strategy to focus only on one country’s market.

Author: Enzio Cacciotto

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast