Fashion Industry in China: Analysis of the world’s largest fashion market

Overview of the Fashion industry in China

China surpassed the US as the world’s biggest fashion market in 2019, according to McKinsey. The fashion industry in China has been flourishing and evolving over the past decade. Currently it is continuing to expand at an exponential rate. With the rapid urbanization and the increasing spending power of the population, markets for both high-tier and low-tier clothing are rapidly growing.

The fluctuation of Overseas Brands in Chinese Markets

Because of the improving living conditions of the middle-class in China, Chinese consumers have become highly brand conscious. In 2010, China’s fashion market was a $17.7 billion market where Louis Vuitton, Chanel, and Gucci remain the most desired luxury brands.

However, in recent years, traditional luxury brands are losing favor among Chinese consumers. Instead, the so-called “light luxury” brands have begun to gain favor. In 2014, luxury consumption in the mainland market by Chinese consumers dropped to 11% percent year-on-year to $25 billion. The government’s anti-graft campaign has formed a more economical and rational climate among the people. Yet, luxury purchases made by Chinese consumers in the global market remain powerful. Chinese people bought 76% of luxury products outside the country in places like duty free shops. Asides from luxury goods, fast fashion companies such as Zara and Uniqlo have maintained a good momentum and are still popular among the young population in China.

Mass fashion and luxury goods are the most promising areas

In terms of market segmentation, the fashion industry in China is most likely to achieve good development in the mass fashion and luxury goods. The mass fashion is mainly driven by competitors who stand out from the mid-market and have strong value propositions. Rapidly growing Chinese economy and the prosperity of the global tourism industry drove the growth of the luxury market.

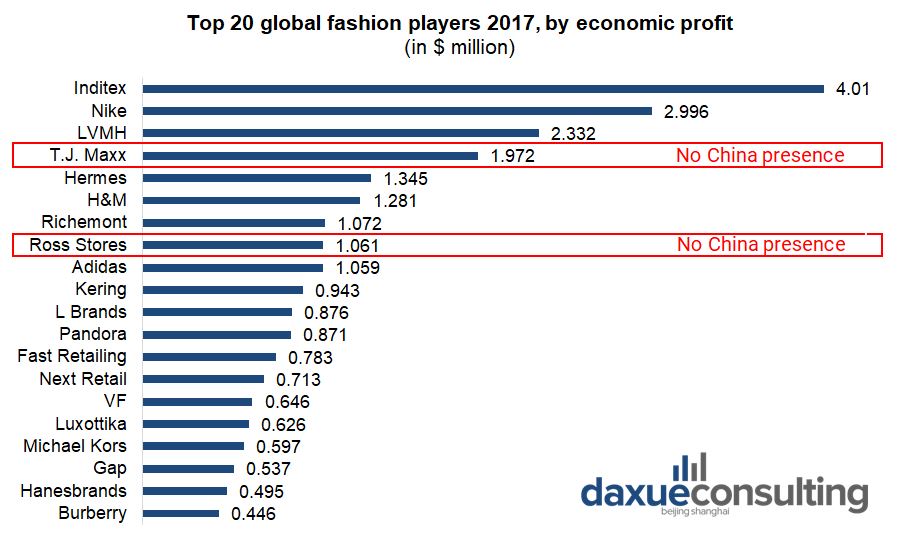

Of the top 20 global fashion companies, 18 have presence in China, which includes all the fast fashion and luxury brands. The only two players which do not have a China presence are the off-price stores, T.J. Maxx and Ross Stores, which rely on the business model of bulk purchasing name-band and luxury products and sell them at a high discount.

Data Source: McKinsey Global Fashion Index, ‘Top 20 players 2017’

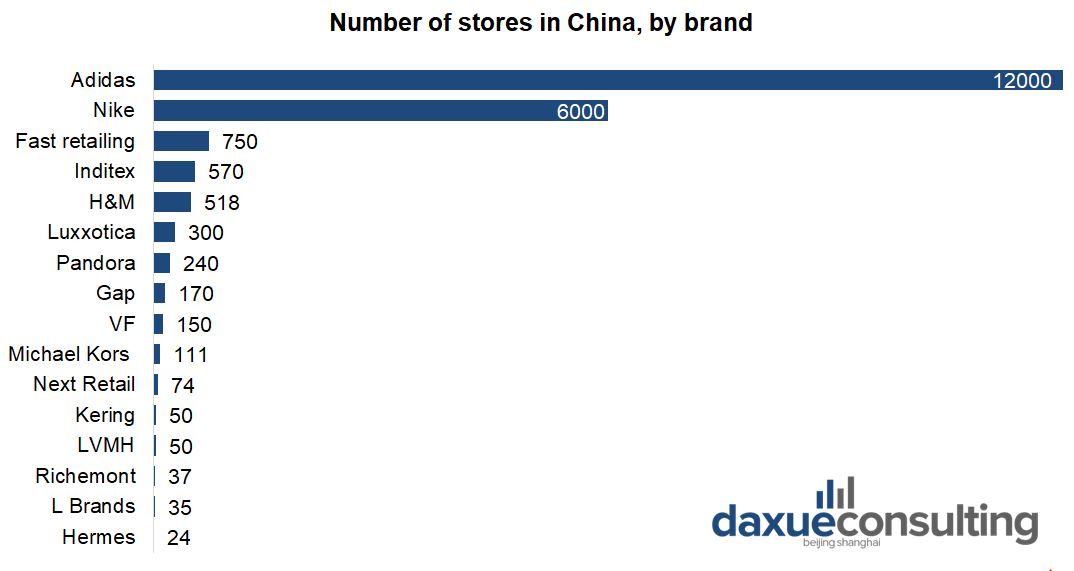

Data Source: Statista, official websites of brands, Number of apparel stores in China by brand

As we can see, mass market and such sportswear and activewear brands as Adidas and Nike lead in terms of number of stores in China. These brands have bigger target group in China, unlike the luxury brands (like Gucci and Hermes).

The top foreign off-price stores have not entered China

The challenges that off-price stores like TJ Maxx or Ross Stores would face in China are that as of 2020 Chinese luxury consumption habits are status-drive. Hence, luxury brands can get away at selling at a very high price in China. Additionally, Chinese can buy cheap products online, and have access to counterfeit luxury products for cheaper than discounted authentic luxury goods.

TJX, which operates TJMaxx, Marshalls, and Homegoods, makes 76% of its revenue in the United States, according to the company’s 2018 annual report. The remaining percentage is made primarily in Europe and Canada. As for Ross, it operates its more than 1,700 stores – Ross and dd’s DISCOUNTS – in the United States and the U.S. territory of Guam. These retailers buy unsold or excess inventory from brands and other retailers, meaning most of their supply chains start and end in the U.S.

However, a Chinese equivalent to TJ Maxx is being nurtured locally. Dadacang is quietly blooming in domestic third, fourth and fifth tier cities. This retail form covers clothing, beauty, home and other categories, which can simultaneously carry offline experience and online warehousing functions. Unlike TJ Maxx and Ross “Dadacang” has formed an online/offline model, which is easy to incentive distributors to participate.

On a similar note, the second-hand clothing market in China is growing a bit behind Japan and the west, but is starting to make-waves.

Domestic sales maintained rapid growth

In 2019, despite the impact of Sino-US trade frictions, fashion industry in China has generally maintained a steady development trend. The industry chain, value chain and ecology of the fashion industry have gradually improved.

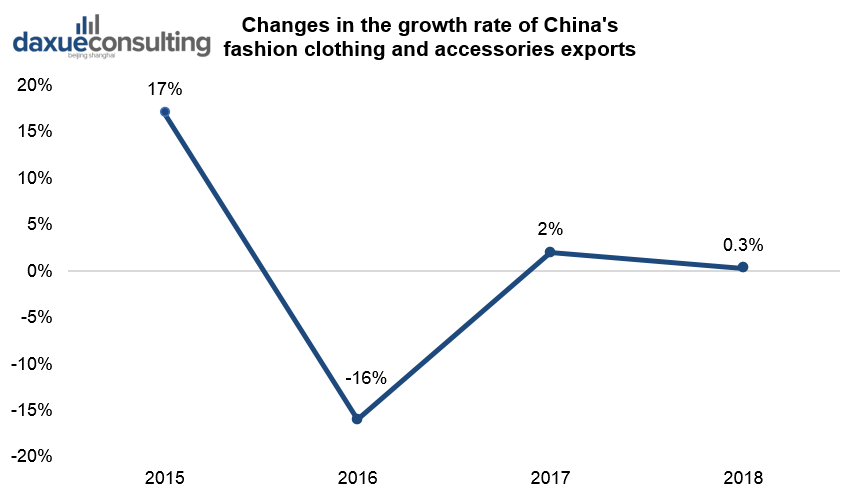

According to data from the National Bureau of Statistics, in 2018, fashion clothes industry completed a total of 23 billion pieces. Since 2018, China’s domestic fashion clothes market has maintained steady and rapid growth. According to estimates by the China Apparel Association, total fashion clothes sales in China reached 3.08 trillion yuan in 2018, an increase of 7.32% year-on-year. In 2018 exports of fashion clothes and accessories reached US$157 billion, an increase of 0.3% year-on-year.

Data Source: China Customs, ‘Changes in the growth rate of China’s fashion clothing and accessories exports’

The developing E-retail Markets in fashion Industry in China

Chinese e-commerce is dominated by a few domestic giants, including Alibaba, Tencent (in Chinese: 腾讯) and Baidu. Fashion is one of China’s biggest e-commerce category. Most of the apparel purchased online proceeds on Taobao. With the cheaper price and diverse designs, shopping online has become the first choice for most of the population. The development of e-commerce in the fashion industry has prompted the domino effect of instant celebrities on the social media. The fashion style they led has greatly influenced young people, resulting in some of them creating their own brand and starting to sell clothes on Taobao.

Thanks to the rise of e-retail, domestic designs can finally gain a foothold in the fashion markets. Alibaba as of lately launched a new platform called “Tmall Global” (in Chinese天猫). It is a channel covering the purchase of overseas products. As the e-retail markets have been growing and developing rapidly in China, the fashion industry will become more promising.

The penetration rate of the e-commerce fashion industry is high in China

China’s e-commerce industry has developed early and fast, and after many years has become one of the important retail channels. Statistics show that the domestic e-commerce retail scale has increased from 1.4 trillion yuan in 2013 to 5.5 trillion yuan in 2017. It had a year-on-year growth rate of 31%. Forecast shows that the scale of e-commerce retail will reach 10.1 trillion yuan by 2020.

The clothing category is unique from other categories. Compared to electronic products, it has a high degree of personalization. In 2011, the domestic fashion clothes e-commerce market scale was 203.5 billion yuan. In 2016, the market scale increased to 934.3 billion yuan. The year-on-year growth rate was 25%, and the 2011-2016 CAGR was 36%. The penetration rate of clothing e-commerce has also increased from 14% in 2011 to 37% in 2016.

Low price is the key factor driving e-commerce fashion in China

The penetration rate of e-commerce consumption in first-tier cities is significantly higher than that in low-tier cities. Due to the high degree of informatization, high-tier cities have a variety of accessible material supplies.

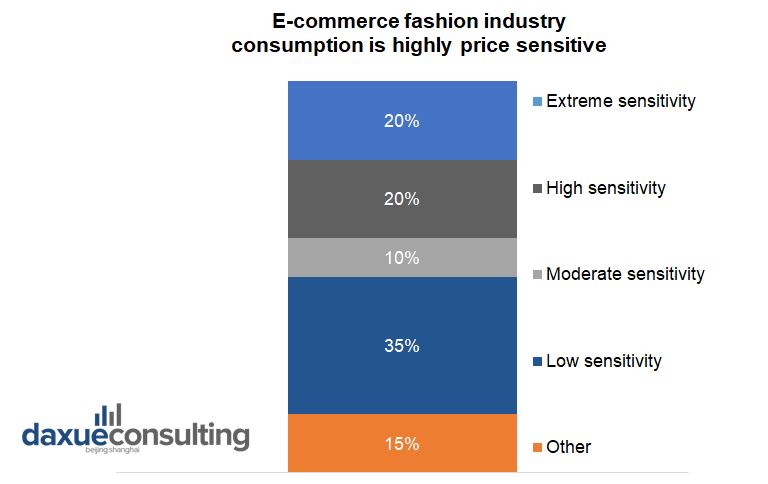

The advantage of e-commerce is that the price is relatively low. According to JD.com’s data, by 2016, the proportion of highly sensitive and extremely sensitive to price consumers in the e-commerce reached 40%. The price is still the priority in the e-commerce consumption.

Data Source: chyxx.com, Public data collation, ‘E-commerce fashion industry consumption is highly price sensitive’

Prospects of the fashion industry in China

More environmentally responsible brands

Currently in China more and more consumers are demanding ethical practices and responsible retailing. In fact, the country has a key position in shaping the new green trends in the global fashion market. The global fashion industry is growing, and a great deal of that growth comes from fashion market in China.

Examples of sustainable fashion brands in China

NEEMIC is a high fashion brand based in Beijing, seeking to address both ethical and environmental consciousness within their label. Their clothing is made from organic materials, eliminating all artificial products from agricultural production of fibers.

Fake Natoo is differentiating itself from competitors with its production techniques. Fake Natoo creates the clothing using discarded clothes or donated textiles, making this a truly sustainable line.

Shokay is a social enterprise that creates clothing using yak down through a partnership with Tibetan herders. Furthermore, they are actively contributing to the development of communities in western Tibet.

Data Source: Shokay, eco-friendly fashion brand in China

These companies stand out as excellent examples for green development in the industry. However, their ability to overcome rising costs in materials, labor, and transportation, while tackling more active regulation and shifting consumer sentiment, remains to be seen in the long run.

Fashion market in China is trying to target millennials

Chinese fashion companies have yet to figure out how to appeal to millennials as labor costs increase the pressure to adjust their brand strategy. The Chinese millennials are more about individualism unlike their predecessors. The new individualist consumer was the inspiration for the China’s biggest fashion fair in Shanghai in 2019.

“The transformation that our industry and overall economy is facing is as steep as a cliff,” said Zhao Weiguo, professor at the fashion department of Zhejiang Sci-Tech University. “This means that there is a wide gap between past and future and everyone faces the question of how to leap over it.”

While China’s technology sector has produced international heavyweights such as Huawei or Alibaba, an equivalent fashion brand hasn’t emerged yet. In China it’s key to understand the rapidly changing and diverse demands of consumers born after 1980. They have more and more influence by their western counterparts. The purchasing power of these groups, which currently consists of roughly 410 million people, will only grow. Working with the internet age and the millennials, Chinese fashion companies have a huge potential to uncover.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast