The Coffee shop market in China

China’s coffee culture has been rapidly growing since 2000. Though China is far from being the largest coffee market, many believe that it will soon surpass many European countries and Japan. The size of the coffee shop market in China has doubled since 2013, which achieves an annual compound growth rate of 18%. According to Zhu Danpeng (朱丹蓬), a researcher from the China Brand Research Institute, the current coffee market in China is dynamic yet not fully saturated. The coffee market in China opens to different brands targeting different customers; whoever has a special strength would benefit from the Chinese market. Though deeply influenced by the thousand-year-tea-drinking culture, Chinese are more and more open to the western lifestyle. It is a part of the overall expansion of western diet and way of life in China.

Coffee shop market in China: Growing Competition Threats Starbucks’ Supremacy

Nestlé in China

The very first foreign brand coming to China was Nestlé (雀巢), which has an occupation rate of 28.5% in 2019, ranked first in the instant coffee market in China. Some researchers see Nestlé entering China as the beginning of the coffee market in China.

Starbucks in China

In 1999, Starbucks China opened its first store in the World Trade Building in Beijing. Before the entering of Starbucks in China, most of the Chinese consumers only knew about instant coffee but had no idea about coffee culture. Starbucks China contributed to the popularization of coffee culture. Nowadays, Starbucks has opened over 4,100 stores in 168 cities in mainland China. As of January 2019, China is already the second-largest market after the US for Starbucks in the world.

Unlike Nestlé, Starbucks targets middle and high-income consumers. Its pricing is comparatively much higher than in the US, which caused criticism by CCTV (China Central Television) in 2013.

Starbucks vs. Luckin Coffee

Luckin Coffee is a domestic start-up coffee chain founded in October 2017 in Beijing. The brand opened stores at a fire pace. By the end of 2019, it manages 4,507 locations in China and surpasses the number of Starbucks stores.

The competition from the homegrown coffee shop, Luckin Coffee is catching up with Starbucks at a fast pace in the coffee shop market in China. Luckin Coffee is threatening Starbucks’ supremacy for several reasons. One of them is the opening of a “Relax” Luckin Coffee outlet inside of the Forbidden City, where Starbucks was evicted in 2017 amid protests of western invasion. Luckin Coffee claimed to sue Starbucks in China for monopolistic behaviours as its publicity stunt. Meanwhile, price competition raises a nightmare for Starbucks. Luckin Coffee’s pricing is 20% lower than Starbucks in China. Also, it provides discount coupons on many platforms, such as Meituan (美团) and Dazhong Dianping (大众点评).

Starbucks Reserve Roastery vs. Specialty Cafés in the Coffee Market in China

Other than Luckin Coffee, some small, independent start-ups are stealing the market from Starbucks as well. With the popularization of coffee culture, the coffee brewed by automatic coffee machines is not able to meet their needs anymore. Consumers in the taste pursue personalized. More coffee consumers in China are enthusiastic about hand drip, ice drip, siphon and other high-quality coffee. To meet the consumer needs, the coffee shops in China develop towards the direction of specialty cafés. Shanghai is the representation of regions embraces the considerable coffee culture.

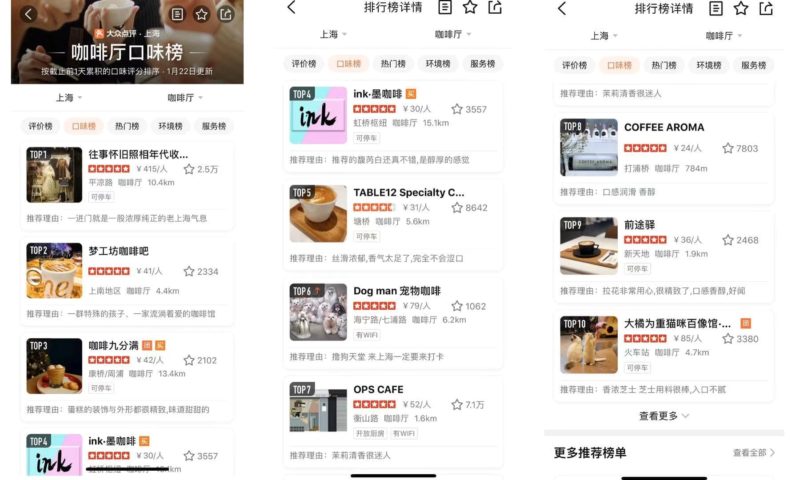

[Source: Dazhongdianping ‘coffee shop ranking in Shanghai’]

Coffee shops ranked top ten on the list of the top taste of coffee shops in Shanghai are all specialty cafés and roasters. To compete with these upscale coffee shops in China, Starbucks launched a Starbucks Reserve Roastery in Shanghai, which is the first Starbucks Reserve Roastery in Asia. It ranked first on the list of the most popular coffee shops in Shanghai.

[Source: Dazhongdianping ‘Starbucks Reserve Roastery in Shanghai’]

Starbucks Reserve Roastery in Shanghai includes a cold brew coffee bar, high-end Princi bakery, bakery counter, full liquor bar and additional brew station, coffee bar and roaster.

[Source: Barrett ‘Shanghai, China: Starbucks Reserve Roastery coffee bar’]

This Starbucks Reserve Roastery is a prime coffee shop to show Starbucks, as an international coffee chain, still focuses on the coffee craft and to win back the hearts of the coffee consumers in China. The Starbucks Reserve Roastery in Shanghai currently provides seven types of brewing methods, including MODBAR precise self-controlled brewing, hand-pour, French pressure, Siphon, Cold Brew, expresso and CLOVER. It can serve a total of more than 100 types of drinks. Additionally, it offers and sells freshly brewed coffee beans, which are not available at traditional Starbucks. As the result shows on Dazhongdianping, Starbucks Reserve Roastery in Shanghai has succeeded in both sales and reputation.

[Source: Weibo ‘Starbucks Reserve Roastery in Shanghai’]

On the other hand, Starbucks still dominates the coffee shop market in China, especially in non-metropolis area. Carol Liu, the co-founder of Big Sur coffee in Shanghai, says the coffee market is not mature in non-metropolis areas. Consumers could not appreciate good quality coffee but were profoundly affected by brand names. Most of them still put Starbucks as their first choice for coffee. Big Sur used to have another coffee shop in Hefei, Anhui Province. Although the salaries and rent are relatively cheaper in Heifei, the Big Sur coffee shop in Hefei still closed.

Key strategies to enter the coffee shop market in China

Compared with more than 4.2 kg of annual coffee consumption for an average American, the average annual coffee consumption in China is 0.09 kg per person. Coffee consumption in China is far too small to be considered a mature market. Even compared to its Asian neighbor Japan, who, like China, has a long history of tea culture , the Chinese per capita coffee consumption is much smaller. Therefore, many other foreign brands are eying this untapped potential coffee market in China. In 2019, Tim Hortons, a Canadian coffee shop brand opened its first coffee shop in Shanghai and projects to launch more than 1,500 coffee shops in China in ten years.

Some key strategies that foreign companies should bear in mind:

Coffee is a social event

Firstly, according to market research in China, Chinese consumers consider having coffee in a coffee shop as a social event; seldom people drink coffee alone, or on the road, they prefer to have coffee in a comfortable environment with friends. Thus, installing a coffee shop needs a more spacious and comfortable environment. Tim Hortons, which has a fast-food-like seating in its domestic market, has adapted with comfortable and aesthetic coffee shops in China.

Must have sweet and fun options

Secondly, coffee without sugar, such as black coffee, Espresso and Americanos are not popular among coffee consumers in China. Starbucks adds fruity taste Frappuccino and other sweet drinks to adapt to the taste of Chinese consumers. New entrants should not be in a rut. Innovation and localization are both necessary elements in the coffee shop market in China.

Espresso over drip coffee

A majority of coffee consumption is espresso drinks. In fact, very few Chinese coffee drinkers order brewed coffee. Even shops like Starbucks in China, often do not have it prepared and will offer an Americano instead. Chinese consumers will expect a menu of drinks made with espresso, like lattes, cappuccinos, affogatos and americanos. However, in tier-1 cities like Shanghai and Beijing, some coffee shops are expanding to include drip coffee for a higher price.

Need a competitive pricing strategy

Lastly, if companies want to launch a business in small cities where the coffee culture is not mature, the pricing strategy is essential. Coffee prices in China are much higher than in the US, and coffee shops must maintain a balance between being unaffordable and being perceived as low quality. However, young white-collar workers in Beijing and Shanghai consume 100 to 150 cups annually. If companies want to enter the coffee shop market in metropolises, they need distinctions other than pricing to compete.

Do the market research necessary to get the most out of China’s coffee market: Contact our project leader at dx@daxueconsulting.com

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes