Chinese Art Market Report: China Exhibits its Global Art Ambition

Chinese Art Market. Each year, an increasing number of Chinese interact with the art world. China leads the Asian arts market and plays a major role on the international art scene. Foreign companies like Christie’s and Sotheby’s are making slow progress in China due to regulatory red tape, while several domestic auctions companies show strong performance. Wealthy investors are also warming up to the value of personal art collections.

Chinese art market overview: Chinese’ interest in art rekindled

Tradition and culture

Since ancient times, dozens of notable Chinese artists contributed greatly to their craft through innovation, meticulousness and sheer creativity. Some of the artists ‘compositions, like wash paintings and calligraphy, still confer prestige on the global market. In 2015, Chinese arts (including antiques, paintings, etc.) accounted for 32% of the value of all arts auctions worldwide.

In the past few years, Chinese lost interest in the arts due to the emphasis on economic development. Today’s improved conditions, however, are shifting society’s focus toward spiritual living. Chinese education has also begun to pay more attention to art. According to the graph below, the size of the domestic arts training market is expected to reach nearly ¥70 billion in 2017, with an average year on end growth of more than 20%.

Data source: 2016年中国艺术品拍卖行业市场现状及发展前景预测 (2016 Current Situation and Development Forecast of Chinese Arts Market Report) via Chyxx.com (中国产业信息网)

Art education

Over the last five years, universities and colleges in the UK have seen an increase of 158% in Chinese students enrolled in creative arts programs. Creative arts are a popular field of study for Chinese students studying abroad in the UK, second only to business. For Chinese students studying in Australia, creative arts are the fourth most popular field of study.

In urban primary schools, the Chinese government mandates that art is included in students’ core classes. Moreover, every student is required to acquire an instrument.

Besides, Chinese citizens are eager art patrons. There were 260 museums in Shanghai in 2012, a whopping increase from 385 in 2015. The number of museum visitors reached 69 billion in 2013 from 26 billion in 2012, which hints at a growing population of potential art consumers.

Photo credit: Vengki

Market size: The arts market in China decreased slightly in size overall, but the high-end arts market is booming

According to the TEFAF’s 2017 Art Market Report, the 2016 Chinese art market reached ¥57.4 ($8.3) billion in volume and accounted for an 18% share of the global market. Sales value for auctions decreased 2.6% to ¥43.6 ($6.3) billion in 2016.

After art sales peaked in 2011, the arts value in auction decreased rapidly due to the economic slowdown. Experts argue that Chinese consumers’ cautious spending contributed to the decline.

However, there have been some optimistic signs: the boom of high-end market. Even if the number of deals decreased in 2016, the sales value in fact increased. The number of arts in the high-end market (which sold for more than ¥50 million) grew by more than 200% because high-earning Chinese consumers are more willing to invest in and collect art as their incomes continue to soar.

Source: 2016年中国艺术品拍卖行业市场现状及发展前景预测 (2016 Current Situation and Development Forecast of Chinese Arts Market Report) via Chyxx.com (中国产业信息网)

Before the last quarter of 2016, there were more than 4019 galleries in China, with a year on end growth of 7%. In 2016, there were 259,948 items auctioned, with 114,079 of them successfully sold The total value of the deals reached equaled ¥28.2 billion. But the number of auctions and active auction organizers decreased by 3.5% and 9.1%, respectively.

Geography breakdown

In 2012, the arts training market in Beijing, Shanghai and Chengdu was worth ¥1.54 billion, ¥1.16 billion and ¥690 million, respectively. Each city ranked within the top three nationwide.

Additionally, the 10-day search index for the keyword “arts” on Baidu indicates that Guangdong, Beijing and Shanghai are the three cities with the highest market demand.

Regulation check: Foreign firms face steep obstacles to entry

Chinese government rolled out new policy called “Regulation For the Management of Arts Market” (《艺术品经营管理办法》) on March 15, 2016. The regulation streamlines the intermediate process of activities approval and enhances the management of arts retailers, which will accelerate the information symmetry in the arts market, rendering the market more orderly and attractive to consumers.

Auction certification still poses a huge challenge for foreign firm’s intent on entering the Chinese art market. The industry titan, Sothebys, works diligently to retain its permission to operate business independently. Christie’s, on the other hand, once bartered logo usage rights to Beijing YongLe Company (北京永乐拍卖) in exchange for certification. Now, the auction house operates as a sole corporation in Shanghai. Their business includes auctions, imports and exports, exhibitions and arts consulting, excepting the business of Chinese antiques. In return, their main shareholder donated the Chinese antique bronze heads of a rat and a rabbit (鼠首和兔首铜像) to the Chinese government. These two Chinese bronze animal sculptures, produced on the 18th Century, were stolen from the Beijing‘s Old Summer Palace (圆明园) by British and French.

Main players: Domestic auction companies dominate the market with strong financial support

The Arts market includes a primary market (galleries and exhibitions) and a secondary market (auction organizations). In 2011, the value of arts deals on auction was ¥96.8 billion; however, the transaction value on galleries and relevant exhibitions was only ¥35.1 billion, despite expectations of stronger performance. This is largely due to galleries’ lack of sufficient capital to compete with big auction companies.

Data source: 99 Arts News(99艺术新闻)

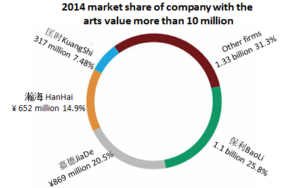

Main auction players: Local firms: Jiade (嘉德拍卖), Baoli (保利拍卖), Xiling (西泠印社拍卖), Yinshe Hanhai (翰海拍卖), Kuangshi (匡时拍卖).

Potential multinational competitors: 苏富比 (Sothebys), 佳士得(Christie’s).

Sothebys and Christie’s are still rookies in the mainland market, so local firms boast controlling shares of the market.

There are several firms seizing most of market share: “The Big Four”: Jiade, Baoli, Hanhai, Kuangshi cover more than 60% market share in high end market. And for total sales value, Xiling and Yinshe also rank third in 2014.

Consumer insights: Arts gradually become an investment option

Consumers are divided into three types: for consumption, for collection, for investment. The consumers with monetary background account for 50% of the private collection market.

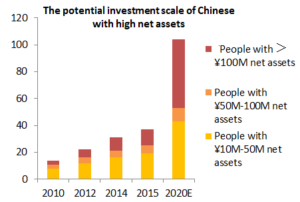

For investment purpose, some organizations, like monetary funds, are starting to view arts as an promising destination for their money. And more than 20% of Chinese high income individuals are willing to spend more than 1% of their assets on arts collection.

The main kind of arts is painting and calligraphy works in China. But gradually people transfer their focus from ancient arts to contemporary arts, from paintings to other types of collections.[2]

In the contemporary market, Chinese collectors moved away from young contemporary artists to embrace more experienced postwar artists, who were also their generational counterparts.

Chinese collectors of antiques also turned their interest to Old Master drawings and paintings, and distanced themselves from decorative objects.

Distribution: Digital arts market shows good conditions for develop

Recently, in global market, galleries are capturing share from auction companies as more and more customers turn to purchase high-end arts from them. In China, although the markets for galleries and exhibitions are still on the weak side, some of them have stood out, such as MadeIn Gallery (没顶画廊, in Shanghai), which is one of Artnet’s “2016’s Top 10 most creative galleries.” They are expected to have more market power toward auctions as the Chinese art market develops.

In addition to digital auction platforms like Taobao online auction (闲鱼拍卖) and ePailive (易拍全球), big players such as Christie’s and Sothebys also have their own digital sales channel and show strong potential for growth. This market volume is expected to increase to ¥75 billion in 2020 from ¥4.5 billion in 2014 with a CAGR of 60%.

Data source: 2016年中国艺术品拍卖行业市场现状及发展前景预测 (2016 Current Situation and Development Forecast of Chinese Arts Market Report) via Chyxx.com (中国产业信息网)

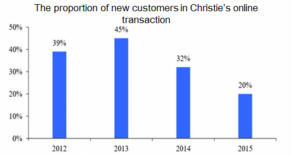

Every year, 30% of Christie’s digital transactions are conducted with new customers: More and more clients accept and choose this way for their purchase, which supports the point that digital arts auction will maintain high growth in the future.

Conclusion:

Arts have become more and more popular with an increasing number of arts museum visitors and students majoring in arts programs. The market is expected to grow constantly after the drop in 2011 with the development of Chinese economy. But foreign companies are still confused about how to enter this huge market. For selling channels, digital arts market shows a strong potential with the wide application of mobile system. In addition, although Chinese galleries are weak now compared with big auction firms, it is supposed to get more reputation and play a better role in Chinese art market.

To know more about Chinese art market, please don’t hesitate to contact us.

Stay Up To Date! Sign up for our Newsletter to Receive the Last Updates.