Bridging the shortfalls of love: The Chinese market for sex products

Which demographics underlie the Chinese market for sex products?

In analyzing the post-1993 developments in the Chinese market for sex products worth several billion dollars, it is necessary to understand the social transformations that have driven the process. From domestic migration trends to new cultural concepts on sex, the Chinese consumers’ tastes for adult products are in essence a reflection of disruptions in the country’s old sexual patterns.

Chinese Valentines Day (七夕节)––set to take place on August 28 this year––celebrates the mythical reunion of the Cowherd (牛郎) and Weaver Girl (织女), cursed lovers who are permitted to meet just once each year. As tradition goes, the Cowherd and Weaver Girl, embodied by the stars Vega and Alastair, are trapped on opposite sides of the Milky Way (银河). On the seventh night of the seventh lunar month each year, however, they may meet each other by crossing a bridge formed by a flock of magpies flying across the Milky Way. The ancient story itself had originated more than 2,000 years ago; and yet, the tragedy of separation is far from antiquated. In fact, separation by distance has become increasingly relevant in the lives of many contemporary Chinese couples –– as well as the country’s burgeoning market for sex products.

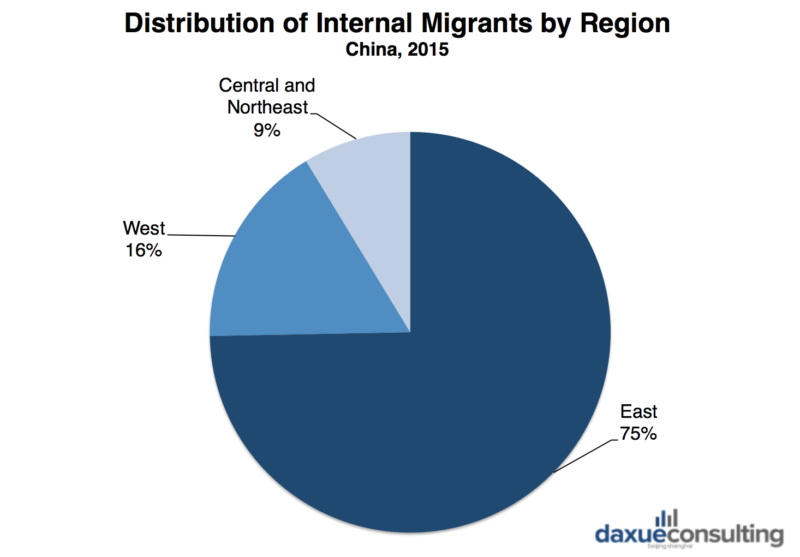

According to the 2016 Report on China’s Migrant Population Development (中国流动人口发展报告2016) issued by the National Health and Family Planning Commission of the People’s Republic of China, the country has had 247 million internal migrants in 2015, representing 18 percent of its total population.This group of migrants, at an average age of 29.3 years old, largely represents workers who have, in the search of economic opportunities, flocked to the country’s thriving eastern coast from western, central, and northeastern regions, the report showed. According to the research, approximately 75 percent of these migrants were found in the eastern region of China.The process, however, has also left 47 million married women living apart from their husbands,who have left their hometowns to earn a better wage, a Chinese market research institution found.

As of 2015, most of China’s internal migrants were located in the eastern region of the country. Source: Daxue Consulting with data from the National Health and Family Planning Commission of the People’s Republic of China.

Thus, in recent years, the country has witnessed rising demands for products that may serve as a solution for physically separated couples that wish to independently fulfill each partner’s sexual needs without engaging in extra-marital relationships.This demand, compounded by trends of gender imbalance, rising divorce rates, increasing preference for single lifestyles, and a newfound openness to sexuality have forged in China a prosperous market for diverse sex-related products including erotic apparel, generic sex toys and related content.

[ctt template=”2″ link=”wb87u” via=”yes” ]Sex industry expert Xiao-GuoRen claimed that contraceptives consume approximately a third of the overall market for sex-related products.[/ctt]In a recent collaboration with a lingerie brand for young women which operates numerous shops across mainland China and Hong Kong, Daxue Consulting has developed comprehensive marketing recommendations and e-commerce strategies for our client based on a survey of over 150 thousand millennial respondents across Hong Kong, Northern China, Southern China, Eastern and Western China.Thus, drawing upon our extensive experiences with clients in relevant fields, Daxue Consulting presents in the following article an exploration of the Chinese market for sex products, with detailed highlights on the high-performing sex doll and lingerie industries.

A brave new world: The overall market for adult products

Strange beginnings

As of year 2014, the Chinese market for sex-related products had exceeded a size of $5 billion, with a compound annual growth rate of 20 percent, CIRN, a Chinese market research institution, wrote in a 2015 report. Furthermore, the market may surpass $9 billion by 2020, according to the article. It must be noted, however, that the progression of the Chinese market for sex products in recent years was astonishing in view of the fact that, up until the year 1993, there had not been a single sex toy store in China, according to a 2016 article by China.org.cn (财经中国网), a Chinese news outlet.

Adam Eve Sex Shop (亚当夏娃), the first adult toy store in China. Source: money.2500sz.com (名城财富).

In 2003, however, the market began to grow explosively due to national law revisions alongside some unexpected effects of the SARS epidemic, the Chinese magazine Business (商界) wrote in 2013. On August 28, 2003, the China Food and Drug Administration (国家食品药品监督管理局) announced that sex aids such as masturbation tools were no longer classified as medical equipment, signaling a loosening of industry regulations. In the same year, the outbreak of SARS in China forced large numbers of civilians to remain at home in an effort to control the disease. In the monotony of life at home, however, adults had few choices of entertainment other than television programs and sexual intercourse, Business wrote in the article.

Thus, some sex toy retailers speculate that this phenomenon had contributed to the remarkable growth spurt of sex product sales in 2003, according to the report. In an interview with the magazine, for instance, one vendor recalled that her shop had experienced a 500 percent growth in revenue throughout 2003 compared to the previous year. In the wake of relaxed government policies alongside coincidences that first introduced Chinese adults to more active sex product consumption, the market for sex-related products has since established a significant presence in China and continues to offer new entrants a piece of the growing pie.

Looking beyond contraceptives

In a 2012 interview with the Chinese business magazine The Founder (创业家), sex industry expert Xiao-Guo Ren (任校国) claimed that contraceptives consume approximately a third of the overall market for sex-related products. Excluding contraceptives, however, executive manager De Lin (蔺德) of the adult toy e-commerce company Chunshuitang (春水堂) told the same publication that sex toys consisted 60 percent of the market, with erotic apparel and personal care products each consisting another 20 percent. Sex furniture, on the other hand, took up only a very small portion of the market.

#Condoms market on the rise in #China https://t.co/Caso7JHk0S @ONECondoms @ARJourdan pic.twitter.com/Y9sadyLpO0

— Daxue Consulting (@DaxueConsulting) June 16, 2017

Chinese natives in the lead

- AILV (爱侣)

As of 2014, AILV had enjoyed a sales revenue of $33.9 million, and a growth of 25 percent from the previous year, the new media publication TMTPOST wrote in an article. Nonetheless, the high costs associated with AILV’s acquisition of (桃阁), Lure (诱饵), Cyberskin+, and Climax had resulted in its loss of $11 million in 2013, $4.5 million in 2014, and $1.7 million in the first five months of 2015, the report added.

- Baile (百乐)

This company is mainly an original equipment manufacturer, and was estimated by The Founder to be roughly 60 to 70 percent the size of AILV up till 2012. According to Baile’s official website in August 2017, 95 percent of its products were exported, mainly to Europe and the Americas. Furthermore, the company has been granted patents in multiple countries and also owns the brand Pretty Love in Germany, according to the website.

- J.B Sex Toys (积美)

According to a 2012 report by The Founder, the company reaped an annual revenue of $10.5 million. 99 percent of J.B. Sex Toys’ operations consisted of original equipment manufacturing while domestic retail only composed of one percent, the article wrote.

- Shaki (夏奇)

A major player in the Chinese domestic market for sex toys and related products, Shaki has developed more than 1,500 products since 1995. It exports to Japan, alongside a number of countries in Europe and the Americas. Its main product categories include masturbation tools and erotic apparel.

Vibrators, such as this one by Baile (百乐), contribute to 13.3 percent of total sales revenue of sex-related products on Taobao (淘宝网), a Chinese market research institution revealed. Photo source: Amazon.cn.

Capturing the consumers

Regarding target customers, AILV stated on its website as of August 2017 that those aged between 15 and 49 consist of 56 percent of the overall population in China. At present, this group remains a large cohort within the country’s demographics, propping up the Chinese demand for sex-related products. Furthermore, women have also played a key role in the market. According to Health (快易捷健康频道), an online publication runby a Chinese e-pharmacy, 60 percent of all sex toy consumers were women as of 2012. In fact, most sex products available on the market have also been designed for women, the report added.

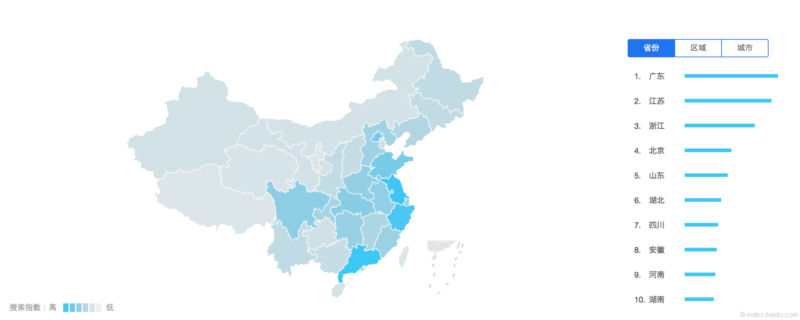

In addition, it may be noted that all three Chinese provinces which generated the largest number of searches on the keyword “adult product” (成人用品) using Baidu (百度), China’s largest search engine, are located in the east.This phenomenon implies that these provinces–– including Guangdong(广东), Jiangsu(江苏) and Zhejiang(浙江) –– may also hold the highest interest in consuming these products.

Between August 1 to August 20, 2017, the Chinese provinces which produced largest numbers of Baidu searches on the keyword “adult product” are, in order ––Guangdong, Jiangsu, Zhejiang, Beijing, Shandong, Hubei, Sichuan, Anhui, Henan, Hunan. Source: Baidu Index(百度指数).

Aside from these demographic trends, however, Chinese sex product consumers are characterized by a high concern for safety as well as distinct sensory preferences. In 2015, for instance, Global Times reported that Chinese consumers tend to prioritize the safety of sex toys above all other considerations. With regards to tastes, on the other hand, Chinese sex toy industry expert Wei-Guo Li (栗卫国) told the Chinese fashion publication Mangazine (名牌) in a 2006 interview that Chinese consumers tend to favor the colors pink, blue, purple, red, and sometimes nude tones as well. Furthermore, Li said that products exuding a light scent –– such as that of jasmine flowers –– are better suited to the Chinese market than strong-scented ones.

Without doubt, sensory research plays a key role in ensuring the successful entry of a product into the Chinese market. Thus, Daxue Consulting has provided sensory research for a wide variety of products ranging from food and beverages to cosmetics. For our clients, Daxue Consulting evaluate products in our sensory testing rooms in Shanghai, where participants drawn from target consumer groups provide vital insights to Chinese sensory preferences. Firms in need of such services may contact us for more information.

The ups and downs of adult industries

- A quest for brand names

Despite the cultural sensitivity and home ground advantage of Chinese firms in the country’s market for sex products, however, many of these businesses have been suffering due to severe competition amid very little differentiation. At its peak, the Chinese sex toy industry had occupied 95 percent of the global market, TMTPOST reported in 2015. Nonetheless, emerging from the market’s post-2003 boom, domestic sex toy providers in China were still largely ignorant of branding and its importance.

At the same time, the market has become very complex and crowded due to an inflow of entrants. As a result, TMTPOST wrote, business became difficult for companies as they failed to differentiate from one another. As of 2015, AILV was visibly continuing to suffer in its attempt to transition into a brand and channel operator, TMTPOST wrote. J.B. Sex Toys, as an original equipment manufacturer, was shaken by the rise of competitors in Southeast Asia. The founder of Xiaqi, on the other hand, had turned to another industry. It appeared that Baile has remained relatively stable, TMTPOST added, but is nonetheless needy of branding.

[ctt template=”2″ link=”3Mxo1″ via=”yes” ]In 2013, e-commerce giant Alibaba (阿里巴巴) revealed that more than 2,500 sex product companies have set up shop via its online platform.[/ctt]- A new chapter in Chinese sexuality

The good news, however, is that China has become an increasingly friendly environment for the adult toy industry. According to a 2017 article by Reuters reporter Adam Jourdan, increasing travel opportunities and exposure to foreign popular culture have introduced the Chinese population to new concepts regarding sex. Consequently, in 2013, gender and sexuality specialist Doctor Lucetta Kam (金晔路) from the Hong Kong Baptist University told South China Morning Post (南华早报) that the sex business in China has begun to shed its taboo quality as the country becomes increasingly “sex-positive”.

“Many of the sex-toy shops are run by the government,” Kam told South China Morning Post. “And there’s been an emergence of new sexual activities such as partner-swapping and group sex parties among both homosexual and heterosexual communities in China.” Indeed, in early 2013, another new practice found its entrance to the Chinese market for sex products when the nude model Xiao-Yu Zhang (张筱雨) introduced a sex toy made in the likeness of her own genitals. Up till then, China had never known a branded and celebrity-endorsed sex product in China.

Furthermore, a 2014 survey by the Chinese sex toy business JINGVO (净果) revealed that more than 75 percent of ten thousand participants polled expressed interest in purchasing sex toys, Global Times (环球时报) reported.

- The borders of legality

Nevertheless, one aspect of the Chinese market for sex products continues to lurk in the shadows. Whereas China has witnessed a flourishing adult toy industry over the past two decades, there yet exists no market for sexual content in Chinese media due to its criminal status.

“The Chinese government has adopted a zero-tolerance policy toward so-called sexual content,” Northwest University of Politics and Law (西北政法大学) Professor Chen-Ge Chu (褚宸舸) wrote in 2016. “For the state, these crimes run counter to Article 24 of the Chinese constitution, which asserts that ‘the state strengthens the building of socialist spiritual civilization.’”

As a result, the Chinese government has been known to regularly enforce pornography-cleanups. In 2005, for instance, 11 defendants responsible for operating a pornography site were sentenced to prison terms that lasted for as long as 12 years. Moreover, as of 2017, the National Office against Pornographic and Illegal Publications (反非法和违禁出版物司) had just conducted a fresh sweep, Xinhua News Agency (新华社) reported. In the latest round of sexual content cleanups, even Weibo (微博), one among China’s most influential social media, sustained a fine of $4,359, according to Xinhua.

Seeking companions: The market for sex dolls

A new found taste for substitute women

On the other hand, certain industries providing adult products have surged ahead. In the year 2013, more than 500 thousand sex dolls were sold around the world, Chinese news outlet That’s reported, adding that consumers in China had bought 85 percent of these dolls. To be more specific, Chinese male consumers consisted much of the market for sex dolls. In fact, dolls have become the best-selling sex-related product on Taobao (淘宝网), one of China’s largest e-commerce platforms, composing nearly 20 percent of the market’s sales revenue on the site, a Chinese market research institution reported in 2016.

[ctt template=”2″ link=”ok66i” via=”yes” ]In the year 2013, more than 500 thousand sex dolls were sold around the world,…consumers in China had bought 85 percent of these dolls.[/ctt]To a great extent, this phenomenon is a consequence of China’s gender imbalance. As of 2016, Chinese news outlet Yibada (易八达) reported that men have already outnumbered women by approximately 3 million in China.At the same time, a large number of Chinese men have also been unable to access sexual intercourse with their spouse due to work obligations away from their hometown. Instead of cheating on their wives with another women, South China Morning Post reported in 2015, some chose sex dolls as a stand-in.

Thus, given the combined occurrences of an uneven gender ratio alongside internal migration, it is little surprise that the country’s market for life-like sex dolls is projected to grow into the near future, as reported by That’s.

Standing tall amid the crowd

The market for sex dolls is considerably varied. According to Global Times, the three most popular models on Taobao fetched prices ranging between $23 to $92. In some specialized shops in Beijing, however, the government-owned news publication Can Kao Xiao Xi (参考消息) reported that a high-end sex doll may sell for up to $2,500.

According to a 2015 Beijing Today article, the most expensive dolls may be customized to the customer’s tastes –– from eye and skin color to breast size and vaginal depth. Moreover, they are made of soft and realistic thermoplastic elastomer. Nonetheless, a look at the distribution of sales volume among sex dolls available on Taobao suggests that shares within the product category is quite concentrated. According to a leading market research institution, the five most popular sex doll models on Taobao consumed 73.3 percent of all sales on the e-commerce platform. In fact, three out of these five dolls were products from a single brand –– Baile –– which took up at least 64 percent of the Toabao market for sex dolls.

Baile’s Bing Bing (冰冰) one among the brand’s bestselling sex dolls. Source: JD.COM (京东).

More than just a doll?

According to a 2015 article by That’s, middle-aged male customers holding white-collar jobs have been a key target for high-end sex doll providers. This group of consumers mainly uses the dolls as a means of remaining faithful to their wives while living away from home, Beijiing Today wrote in the same year. And when it comes to expensive products, clients commonly require seeing products in person instead of purchasing them online, according to the report. Consequently, it is unlikely that the high-end of the market for sex dolls will migrate online en masse anytime soon.

Aside from white-collar workers who merely seek sexual satisfaction in the absence of their wives, however, there are in fact a number of Chinese male consumers who consider sex dolls as their proper life partners, Yibada reported in 2016. According to these “friends of dolls”, who frequent online forums to share user reviews on dolls, the significance of these products is not just sexual, but also emotional, according to South China Morning Post. As reported by the French news outlet Agence France-Presse, this group had already numbered some 20 thousand as of 2015. Among sex-doll forums, according to Beijing Today in the same year, Zhongwa.net (中娃网) has been the most popular site, garnering over 290 thousand posts in its most visited section. On this site, the friends of dolls meet to share pictures and advise on their products. In addition, dolls with sweet voices and celebrity faces have emerged as the most popular in China, Beijing Today reported.

The homepage of Zhongwa.net (中娃网) which displays links to the site’s top posts and pictures of the market’s newest products. Source: Zhongwa.net

Going high-end: The market for lingerie

The fierce surge ahead

Lingerie, on the other hand, has also been a high-growth category within the Chinese market for sex-related products. As of 2016, a Chinese market research institution reported that erotic underwear was the adult product sold in the largest volumes on Taobao, excluding contraceptives. Furthermore, by the end of this year, according to a 2016 Reuters article, the Chinese market for women’s underwear is projected to reach $25 billion. In this case, the market would have gained a size double that of the United States’, the report wrote.

Moreover, by the year 2020, the women’s underwear market in China may have grown up to $33 billion, Reuters added. Over the past few years, however, the entry of competitors has also been fierce. By this year, Global Times reported, the number of lingerie makers in China has nearly tripled from the original 10 thousand already present in China back in 2010.

A foreign stronghold in the Chinese adult industry

According to a 2016 report by Chinese business news outlet Qianzhan.com (前瞻网), approximately 80 percent of China’s high-end lingerie market has been occupied by well-known foreign brands. Nonetheless, the Chinese market for lingerie remains largely composed of low-end domestic brands, Global Times wrote in 2017. At present, China’s low-end lingerie market is swamped by a considerable number of domestic firms. The five largest domestic lingerie firms in China composed a mere six percent of shares as of 2016, South China Morning Post reported, adding that none of the other three thousand manufacturers claim more than a three percent share.

Aggressive high fashion

- Victoria’s Secret (维多利亚的秘密)

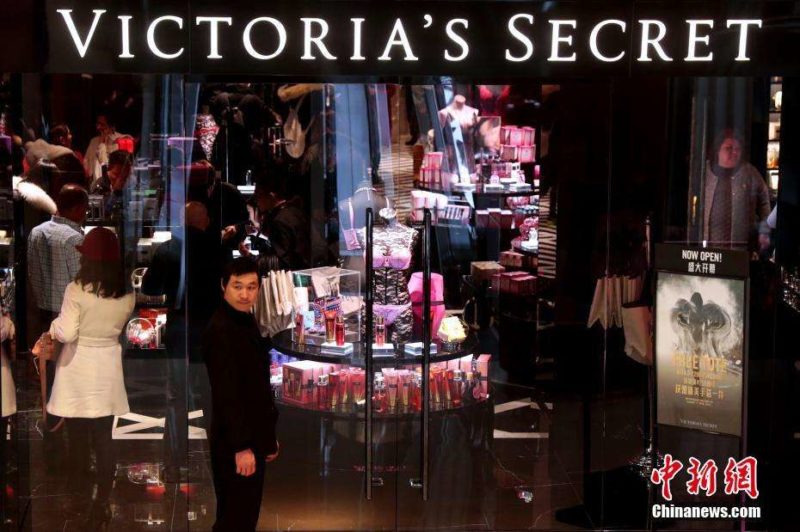

In 2017, the US lingerie brand Victoria’s Secret introduced its first lingerie store in China. According to South China Morning Post, the brand has carried forth an aggressive expansion since its 2015 arrival in China. Before the end of 2017, the report added, the brand plans to open its second lingerie-carrying location in China and unveil its annual fashion show in Shanghai.

In China, the Italian luxury lingerie brand La Perla carries bras priced around $300. As of 2016, the brand already operated eight stores in China, Reuters reported. Since last year, La Perla has been planning new locations in Chengdu and Chongqing as part of its gradual expansion beyond China’s major cities.

- Triumph (黛安芬)

In 2016, the German brand Triumph already owned one thousand stores in China. By the end of this year, the brand plans to have set foot in another 16 cities, according to Reuters.

China’s first Victoria’s Secret lingerie store is located in Xintiandi (新天地), one of Shanghai’s most affluent shopping and entertainment districts. Source: Chinanews.com (中新网)

Luxury in hush

In recent years, lingerie has drawn increasing attention from China’s fashion conscious female consumers, especially in the face of President Xi Jinping’s (习近平) disfavor of conspicuous spending, Reuters reported in 2016. Thus, instead of flaunting expensive accessories in public, many Chinese women have increasingly turned towards less showy items.With regards to tastes, on the other hand, brands may adapt themselves to the distinct traits that mark Chinese consumers in the lingerie market. According to Reuters, the Italian brand La Perla has noted that colors such as red and baby pink are unusually popular among Asian consumers compared to those in Europe and the United States.

Detouring the embarrassment

At present, however, some Chinese shoppers have yet to feel comfortable about purchasing sex-related products in physical stores. Thus, the rise of online retail in recent years has taken onto an increasing role in creating a customer-friendly environment, not to mention provide wider options and improved convenience.Thus, it may be unsurprising that, according to a 2014 JINGVO survey, 43 percent of respondents claimed to prefer shopping for sex toys online, Global Times reported. As of 2012, The Founder reported that offline retail accounted for 60 percent of sex product sales, whereas online sales represented 40 percent of the market. By 2016, however, research by Daxue Consulting revealed that the percentage of shares between offline and online sex product markets may already have flipped––with online sales composing 60 percent of all sales.

The prosperous online sex product market, however, has also grown considerably crowded. According to South China Morning Post in 2013, e-commerce giant Alibaba (阿里巴巴) revealed that more than 2,500 sex product companies have set up shop via its online platform. Of these firms, some 50 percent consisted of no more than 10 employees, the report wrote. Beyond Alibaba, however, a number of e-commerce services specialized in sex products have emerged over the past two decades. For instance, the online shop Chunshuitang, founded in 2003, has been a pioneer in e-commerce for sex products and continues to introduce fresh innovations.In 2013, the company released a series of smart devices, Technode reported. Among these products included smartphone-connected virtual reality masturbation devices.

In poor health, but still running

Gaping loopholes

Nonetheless, quality control and safety concerns remain an issue amid the high-growth sex product market. In 2013, a South China Morning Post article reported that despite China has long been one of the world’s leading producers of sex products, the country’s domestic retail market is flooded by unsafe products as high-quality ones have instead been exported.

Prior to 2012, the China Food and Drug Administration oversaw the production of sex-related goods. Since then, however, the management of different product categories have been placed under the responsibility of several government departments, making quality supervision more difficult, Global Times reported in 2015.As a result, the country has persistently struggled to keep sex products’ quality in check. According to Global Times as of 2015, investigations revealed that some vibrators have been made from industrial silicone, which is unsafe for human contact. These low quality products may easily be contaminated and cause inflammation as well as bacterial infections, the report wrote.

These low-quality products, however, are seldom reported by consumers, Business wrote in 2013. According to the article, a key reason is that most of these products were sold to China’s migrant population who were not bound to the locale of the transaction. Not to mention, many consumers may be too embarrassed to reveal their purchase of sex products by reporting them.

High-tech remedies for the lone?

Despite regulatory issues, however, business enthusiasm towards sex products continues to run high in China. In 2015, for instance, the Hong Kong-based company Leten (雷霆) launched a record-breaking initiative to crowdfund its new Leten Clover Smart (雷霆i智能) vibrators for women, China News Service (中国新闻网) reported. Placing a special emphasis on the products’ safe material, ergonomic design, and futuristic mobile-app features, the project swiftly garnered the interest of over five thousand donors and assembled more than $300 thousand of funding within three days, according to the report. No product in the sex toy category had previously rounded up a comparable amount of funding within such short duration, China News Service wrote.

In achieving record-breaking crowdfunding outcomes, Leten’s new product line signaled the coming of an innovative new age in sex products. The most highly publicized product in the series, known as the “intelligent husband” (智能老公), boasts a myriad of functions including voice control and multimedia interaction through the vibrator’s complementary mobile app. Not everyone is thrilled about the emergence of revolutionary sex products that may grant women independent sexual gratification, however. A few days after Leten launched its successful crowdfunding operation, male protestors appeared across multiple Chinese cities, bearing signs that read: “Boycott the ‘intelligent husband’” (抵制“智能老公”).

Leten’s Coco egg vibrator, a mobile-connected smart device also dubbed the “intelligent husband”. Source: Suning (苏宁).

Moreover, these men proclaimed their intention to “liberate” the country’s “remaining men” (剩男), who have been unable to find a romantic partner due to the country’s gender imbalance. Many netizens questioned the true purpose of this demonstration, some regarded the act as a piece of artistic expression while others speculated that it was nothing more than an advertisement shenanigan perpetrated by Leten itself, Chinese news outlet Cnjiwang.com (中国吉林网) reported.

Regardless of what the act truly was, however, there is no doubt that a good number of the country’s adults will, in fact, have to spend this year’s fast-approaching Chinese Valentines Day in the absence of a romantic partner. While China’s remaining men struggle to find love, some long-distance couples too may have no choice but to observe in envy as the Cowherd and Weaver Girl reunite over the night sky.

To learn more about the needs and preferences of the Chinese market for sex-related products, subscribe to our newsletter or contact our team at dx@daxueconsulting.com. We offer in-depth interviews and focus groups that construct insightful profiles on consumers across the country, and provide marketing strategy recommendations to our clients based on extensive experiences in China.