Chinese Labour market: The Electronics Industry

Chinese Labour Market – Electronics Industry

Overview of the Labour Market

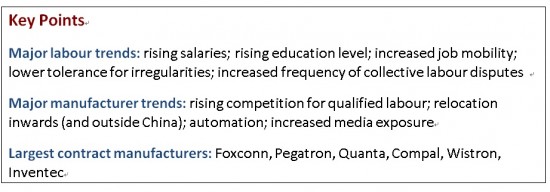

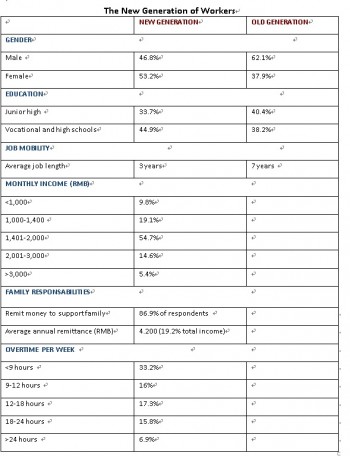

The comparative advantage of nations is constantly shifting, and Chinese labour market is a perfect illustration. Once the world’s electronics manufacturing hub, rising labour costs in recent years have challenged China’s image as the ideal destination for cheap and docile labour. The main issue is a demographic one: A shrinking working population (ageing overall population) and a rising labour demand means that workers are in a stronger bargaining position than before (see graphs on the left). Not only is the new generation of workers smaller, it is also more educated with even the literacy, numeracy, and educational attainment of unskilled Chinese employees drastically improving. This new group of workers has a far lower tolerance for low salaries, overtime, and poor working conditions (see appendix for details). In addition to the demographic reality, rising inflation, increases in the minimum wage, rising labour unrest, and pressure from consumers (media coverage) have all exerted an upward pressure on salaries in China’s manufacturing industries (see graph below).A minimum wage has been implemented since January 2008, which means that now electronics companies are accountable for the wage level in their factories.

The minimum wage is not fixed nationally; it varies from one region to another and is currently much lower inland than in China’s coastal cities. Coastal regions, where the competition for skilled labour is greatest, have witnessed the highest growth in salaries. In March 2010, Fujian province announced its intension to raise its minimum wage by an average of 24.5% to RMB 900, while in April that year, Zhejiang province increased it to RMB 1,100 (highest in the country). Moreover, according to Standard Chartered, manufacturers in the densely populated Pearl River Delta region have seen wages go up by 7.6% in 2012, and by 9.2% in 2013.On top of installing a minimum wage, the government enacted in January 2008 a new Employment Contract Law. The new law improves the legal status of workers, by guaranteeing workers basic rights, including the right to have a signed labor contract, to work in a safe environment, and to be paid on time. The law also aims to limit overtime work, and makes it much more difficult to layoff workers. Generally, the law holds companies accountable for their workers’ welfare, which means higher costs for them on top of the lower supply of cheap labour. Through its recent intervention on the labour market, the central government hopes to decrease the frequency of labour unrest incidents.

Overview of the Main Manufacturers and their issues

In the electronics sector, manufacturers work on tight deadlines and make thin profit margins. 1.6% of an iPhone’s sale price, for example, goes to the manufacturers in China; a fraction of which then goes to labour. Manufacturers have to keep costs (and therefore salaries) as close to zero as possible in order to make profit. Foxconn, based in Taiwan, is by far the biggest contract manufacturer in China at the moment. In fact, Foxconn is the second biggest private employer in the world after Wal-Mart, employing 1.4 million workers in China alone in 2013. Foxconn’s biggest customers are Apple and Samsung, but it also supplies HP, Dell, Sony, Intel, Microsoft, amongst others. On top of Foxconn, Apple in China works with Quanta Computer and Pegatron (both Taiwanese) to manufacturer and assembles its products. Another defining factor of the electronics sector is high turnover rates, and most of the labour stays at Foxconn for less than a year. In its Shenzhen factory alone, 24,000 workers quit every month. Indeed, many of the workers in electronics plants are migrant workers looking for a temporary way to earn money, with students and especially “interns” also constituting a significant source of labour (15% of labour force at peak times).

In the production plants run by Foxconn, amongst others, production intensifies sharply at certain parts of the year (unpaid/unplanned overtime), whichhas led to tough working conditions and tension in the factory (see chart below). One-hundred-hour workweeks are not uncommon during peak times (typically around 50 hours, along the lines of the national regulation of49 hours/week). The average salary at Foxconn plants is $1-2/hour, depending on the location. Tensionsat Foxconn factories have led to labour unrest, highly mediatised due to Apple’s particular notoriety around the world. Examples of recent unrest includea riot that broke out in September 2012 at Foxconn’sTaiyuan’s plant, followed by a general strike at its Zhengzhou factory. In early 2012, 150 workers at Foxconn’s Wuhan planthad already threatened collective suicide. Generally, the number of collective labourincidents is on the rise (180,000 in 2010), as labour is increasingly organized and the new generation of workers is more self-aware. Unsafe working conditions at Apple manufacturers have also received media attention recently, with an explosion at its Chengdu plant (2011) and at its Riteng factory, and the poisoning of 140 workers at an Apple supplier (Wintek), revealing significant issues in this area.

Yet Apple’s competitors use similar factories with similar working conditions, and so the situation in Chinese plants is no immediate threat for Apple in terms of loss of market share. Samsung, for instance, is one foreign company that has also know its fair share of controversies in China in recent years (underage labour, unpaid overtime, forced labour, etc.).Apple has sought under Tim Cook’s leadership to improve its reputation by addressing some labour issues in China, and in particular by joining the Fair Labor Association (FLA) in 2011. Apple now publishes its listof suppliers, regularly conducts supplier audits, and undertakes punitive and reparative action in the event of problems. Furthermore, although Chinese manufacturers receive far less media attention, the working conditions in their factories are fairly similar to that of foreign competitors. Lenovo and Xiaomi, just like Apple and Samsung, use contract manufacturers such as Foxconn, Compal and Inventec. In March 2014, more than 1,000 employees working for Lenovo contractors went on strike to demand higher pay and more days off. Similarly, evidence shows that Huawei factories are subject to labour unrest problems, with production staff complaining of work pressure, a strict management environment, and low salaries.Because of increased costs, most local factories have taken savings measures such as layoffs, increased working hoursand overtime, etc.

Geographic trends

Up until recently, manufacturers have strived to locate in china’s eastern and southern provinces, in search of skilled labour.Nowadays, however, the increasing wages and labour incidents in these regions have led foreign and domestic electronics manufacturers to change their strategy, and they are now considering threemain options:automation (e.g. Foxconn, Quanta, and Pegatronor), a move further inland, and the relocation to other Southeast Asian countries with cheaper labour forces. According to a 2013 survey by Standard Chartered of over 300 hundred manufacturers,30% of respondents expressed their intension to move to other parts of China, and 9% claimed they would relocate outside of China (e.g. Cambodia, Bangladesh, Vietnam). The previous year, these figures were only 13% and 4%, respectively.Foxconn, for one, is heavily expanding towards inland China (e.g. Henan, Hubei, and Sichuan). More precisely, its strategy is to move away from large factories on the coast (one of its factory in Shenzhen hires 300,000 workers) producing all kinds of electronics, and towards smaller specialised factories (e.g. iPads in Chengdu, iPhones in Zhengzhou, etc.).This advantage is expected to be only temporary, however, and soon the situation there will catch up with the east with labour prices already starting to rise. Indeed, in 2013, salaries increased by 21% in Chongqing, 32% in Taiyuan, and 41% in Chengdu. The majority of semiconductor suppliers have not yet relocated inland, as they need a more qualified workforce than basic electronics assembly plants. In addition, although large manufacturers like Foxconn are likely to attract component manufacturers to their locations, smaller ones are more likely to be dependent on the developed ecosystems on the coast (e.g. lowers transport costs). This partly explains why the number of electronics manufacturing plants is remaining higher in coastal areas (see map above). Foxconnalso drastically reduced its labour employment this year, choosing instead to install robots on its factory floors. Relocation overseas is still not widely operated, on the other hand, as there are still many advantages linked to being close to China’s booming markets at the moment.

More about Chinese Labour Market:

http://www.economist.com/node/16693397

http://www.voxeu.org/article/china-s-unemployment-and-labour-shortage

Follow us on our Social Media, here is our latest post about the Consumer Electronics in China:

#China’s rise in #consumerelectronics in recent years has been amazing. Read more at https://t.co/30y0wTLlhA pic.twitter.com/BYJbDiLNAb

— Daxue Consulting (@DaxueConsulting) December 11, 2015