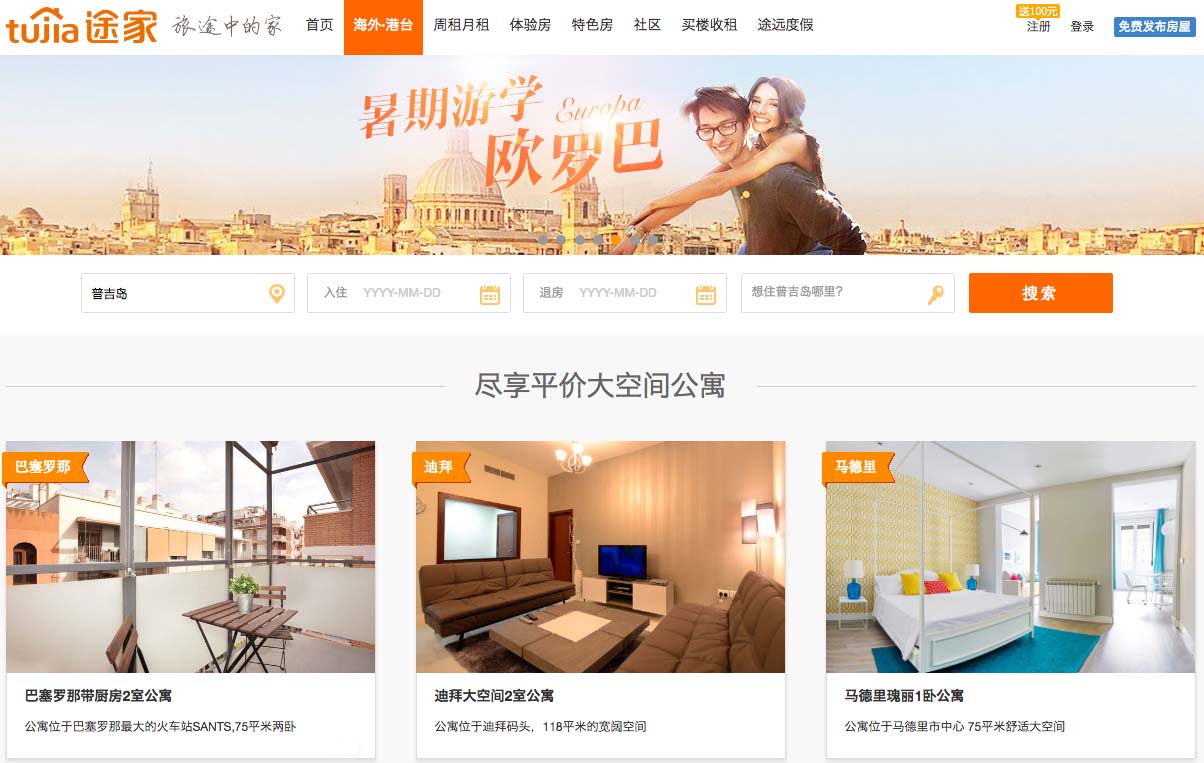

Tujia leverages local knowledge and beats Airbnb with tailor-made services

http://international.tujia.com/

To know more about the digital home-sharing industry, contact us at dx@daxueconsulting.com

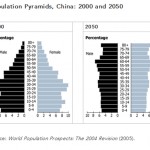

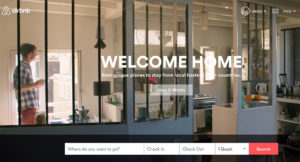

In recent years, hotels and hostels all over the world have been losing out to Airbnb, serving as a platform through which users can book a place to live. As the people renting out places to live are usually normal citizens, that are not involved in a professional hotel or B&B industry, the spread of localities is usually greater than that of hotels and hostels. Furthermore, and perhaps more importantly, it is often cheaper as well. Hence the online home-rental service industry has had significant growth in recent years. However, in China, Airbnb is facing competition from Tujia, which has been termed ‘China’s Airbnb’. Tujia means “home on a journey”. It was valued at more than $1 billion in its most recent fundraising round last year. Tujia recently teamed up with Mayi, which will enable Tujia to “build a home-sharing ecosystem faster and more efficiently,” said Tujia co-founder and Chief Technology Officer Melissa Yang. It is even setting up branches overseas in Asia, with Thailand and Taiwan being priorities. In order to capture market shares from Airbnb, Tujia must have a different business model or booking system to capture market share. In this article, an analysis of the key differences between Tujia and Airbnb will be provided.

What are the key differences between Tujia and Airbnb?

In a recent interview, CFO Melissa Yang expanded on the commonalities of – and differences between – Tujia and Airbnb. She claimed that similar to Airbnb, Tujia is a sharing platform to connect travelers with homeowners. It provided alternative accommodations for travelers. But Ms. Yang also claimed that they were actually quite a difference in a few ways, due to the cultural differences between the West and China. “First, I would like to outline a couple of things specific to China. My husband and I traveled a lot in the U.S. and Europe. So it’s common [when staying in a rented home, too] take out the trash when we leave. However, in China, let’s say somebody booked a villa for about $100 U.S. a night, and you ask him, “By the way when you leave, please take out the trash,” this person, most people, would not like to do it. Second, there is a trust issue in China. It’s getting better, but it’s still an issue.”

As Chinese travelers are not accustomed to the “do it yourself” traveling, Tujia takes a different approach to Airbnb. It capitalizes on service, as

http://guytorelli.com/will-airbnb-challenge-the-apartment-market/

Chinese travelers value this aspect more than Western travelers. For this reason, all of the listings on its website provides high-quality services. Moreover, Tujia only picks properties, such as villas in Thailand, that will fulfill the expectations of Chinese travelers, who usually travel in family groups and like their rentals to include kitchens. Tujia also targets business people who need high-class furnishings for meetings, parties, and holidays. Hence Tujia solely focuses on high-end properties. This differs from Airbnb, which has a broader range of clientele. According to Campaign Asia Magazine, “the Chinese home-rental firm, which is often described as an equivalent of Airbnb, actually tends to focus more on high-end properties rather than bargain accommodations, and also offers services Airbnb does not, such as inspection and cleaning of properties.

”From the beginning, Tujia managed the properties itself. It has people inspecting each property to make sure that all the photos are authentic. Hence, unlike Airbnb, which only serves as a platform to connect property owners with travelers, Tujia also manages the properties listed on their website and works closely with Chinese real estate developers to rent out unsold inventory. In this manner, Tujia effectively obtains access to apartment resources in the Chinese market. In order to list one’s property with Tujia, property owners are required to have at least 10 apartments or 30 rooms. It charges 1000 CNY (USD 16000) as a deposit and 6% of the rental income for using its brand and services. It also connects prospective customers who are interested in buying property as an investment. By verifying the authenticity of the photos and inspecting the properties, Tujia is able to build trust between customers and property owners and promises refunds in the event of fraud.

There are also political and economic conditions that work in Tujia’s favor. Firstly, with respect to financing, Tujia receives a lot of funding and financial support from the government, as Tujia closely collaborates with it. Secondly, Airbnb’s app, which must be purchased through the Google Play store on androids, cannot be downloaded in China as the Google Play store is blocked in China. Hence structural factors contribute to Tujia capturing market share from Airbnb.

In conclusion, Tujia is capturing market share from Airbnb’s high-end customers. However, Tujia has a significantly different business model and different value offerings compared to Airbnb, which allows it to distinguish its services from those of the established online home-rental service provider. It offers to tailored services to high-end customers, manages its own properties, and connects actors in the real-estate market. Hence, Ms. Yang’s words ring true: “We’re not the ‘Airbnb of China”.