Nursing home in China (1/2)

With one-fifth of the world’s elderly living in China, the country having the largest absolute number of senior citizens in the world has become the center of attention in the world nursing home industry. This relatively untapped, unregulated and unsaturated infant industry in China is currently facing both great opportunities and risks.

The demographic situation enable the growth of nursing home market

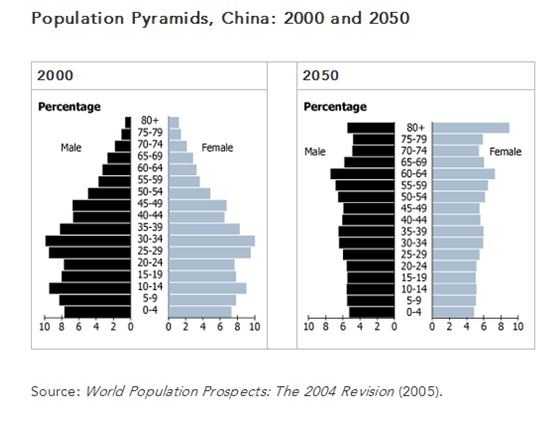

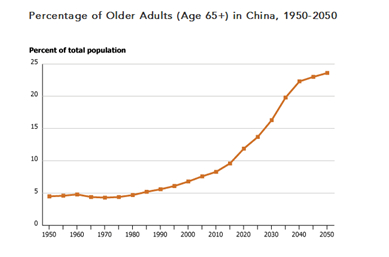

Demographically, China owns a rapidly aging population due to dramatic fertility decline and improved longevity over the past decades (see Figure 1 for China’s projected aging trend between 2000 and 2050). The one-child policy introduced in 1979 to control population also contributes to the change in the age composition of the population. The percentage of elderly in China is projected to triple from 8 percent to 24 percent between 2006 and 2050, to a total number of 322 million (see Figure 2).

Figure 1

In contrast to the growing elderly population, the working age population is shrinking. By the end of 2012, for every elderly person (aged 65 and above) there were nine working-age adults (ages 15 to 64); but by 2050, this ratio will be one elderly person per 2.5 working age adults.

Despite the question whether the working age population will be able to feed the aging burden, what remains for sure is that incapability of the young people to take care of the large elderly population will create a huge demand for the nursing home industry.

Overview of the nursing home market in China

By the end of 2012, there were nearly 45,000 nursing institutions for the aged and about 4,313,000 beds all over China; averagely, per thousand elderly people owned 22.24 beds, and the total number of beds only accounted for 2% of the number of elderly people, which was lower than the level of 5% to 7% in the developed countries. The difference between supply levels suggests a great potential for enormous industry growth yet also exposes many underlying problems.

The industry structure has long been skewed. Most of the well-facilitated and moderately-priced public nursing homes are only open to civil servants and family members of senior officials. The rest of the public nursing homes are usually poorly financed ones open to low-end clients in rural and urban areas. This leaves large urban middle-income population having to count on private nursing homes for a bed. However, the current proportion of private nursing homes is less than 20% in China. The proportion of private nursing homes and public nursing homes is 50/50 or 40/60 in the first-tier cities, such as Shanghai, Beijing and Guangzhou (and the waiting list are usually long). The private nursing institutions develop most rapidly in Tianjin and the proportion has reached more than 70%.

On the supply side, there is a lack of both physical and human capital.

While many foreign ventures and private investors in the private sector are running deficits, local governments also suffer losses by funding nursing homes. The government’s cut on tax and discounts on land, water, electricity, etc. only make the private sector skewed since private investors take the benefits and flock into the high-end market, competing with the well-facilitated public nursing homes. Also the relatively unregulated market has caused cautions in international investors.

On the other hand, the heavy workload, low pay and social stigma attached to the work create an empty talent pipeline. Among the 30, 0000 caregivers taking care of 2.6 million of people by the end of 2011, most of them had no formal qualifications and many were untrained rural middle-aged females entering urban areas following the floating population. Both foreign and domestic investors are looking to reduce the human capital shortage. However, to attract skilled caregivers with higher wages will lower profit margins and even add to the deficits of some nursing homes.

On the demand side, affordability of nursing homes is another big issue. Because of the fee-for-service and out-of-pocket payments norm, nursing home care is beyond the reach of many low and middle income families. Despite the new aged-care law that enforces children to financially support their elderly parents, the rising housing prices and the increasingly expensive education expenditures are depriving their ability to spare money for the elderly. At the end of the day, the elderly parents still need to pay for themselves with the average pension of 1900 Yuan per month for non-agriculture population and 1500 Yuan for all. In response to this, the government has also taken professional advices from experts and adopted the “subsidize-the-needy” policy in addition to funding nursing homes in recent years.

Other factors including saving habits of the elderly and the restriction of filial piety on their children are also constraints to industry expansion.

Thus, in the short-term, the basic industry structure of ‘nine-seven-three’ – 90 per cent of old people will live at home, seven per cent will get government care and three per cent will live in private facilities – will remain unchanged.

Amy Wang, Daxue Consulting, market research in China, contact us

http://usa.chinadaily.com.cn/china/2012-10/23/content_15837603.htm

Li, Xiaoshu. No Silver Bullet: Tapping China’s Elder-care Segment.

He, Dan. China Faces Shortage of Nursing Help.

Research and Development Trend of China Nursing Home Market, 2013.